Hiroshi Watanabe

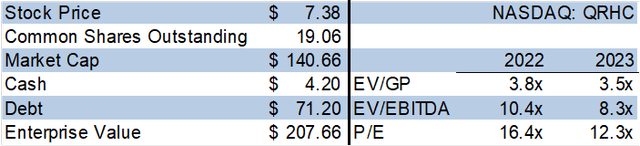

Financial Profile (Pinnacle internal estimates)

Description

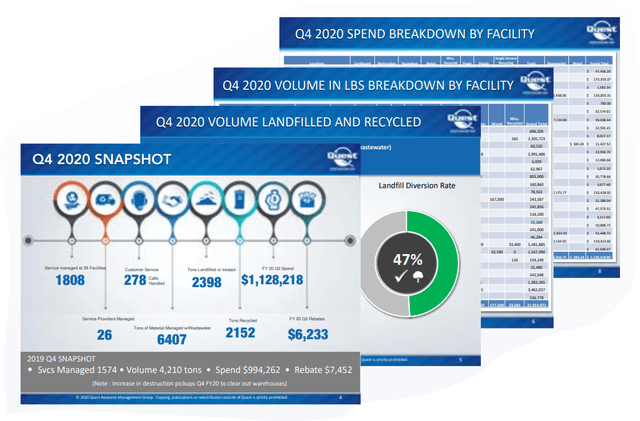

Quest Resource Holding Corp. (NASDAQ:QRHC) is an asset-light value-added waste and recycling services provider that fundamentally transformed its business from 2016 to 2020 after CEO Ray Hatch joined the company. Hatch inherited a company that grew revenues for the sake of growing revenues with little focus on gross margin or profitability. Quest had millions of dollars of negative gross margin contractual revenue. Hatch took on the multi-year task of eliminating negative gross margin revenue and positioned the company to grow.

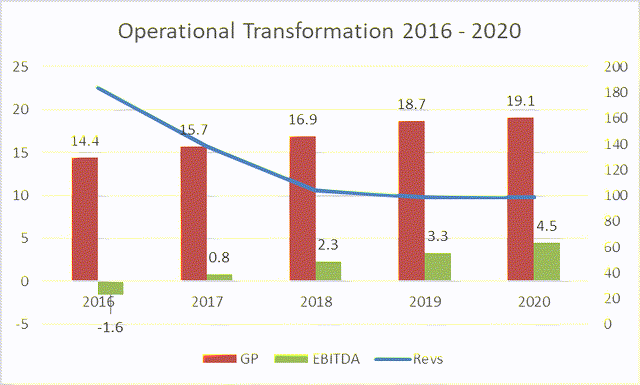

Quest’s revenue shrank from $183 million in 2016 to $99 million in 2020, but Quest’s gross profit increased from $14.4 million to $19.1 million, and its EBITDA increased from -$1.6 million to $4.5 million over the same time. I cannot remember another company that reduced revenue by 45%, grew gross profit 30%, and grew EBITDA dollars more than gross profit dollars while becoming profitable. This is an accomplishment that few companies could achieve, and this transformation speaks to the quality of this management team.

Operational Turnaround (Pinnacle)

The chart above clearly depicts the transformation that Quest achieved during CEO Hatch’s first four years at Quest. Investors that believed in Quest’s operational turnaround during the 2016-2020 transition period have been rewarded.

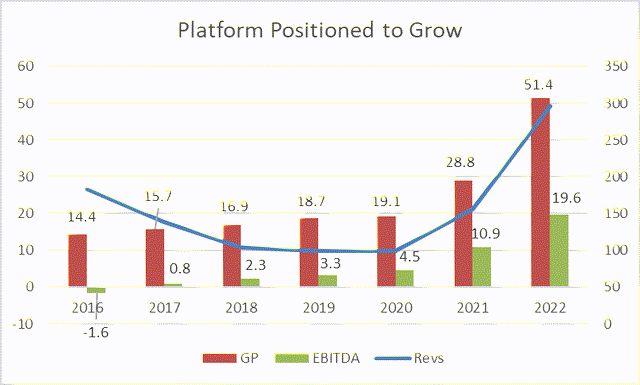

Platform Positioned to Grow (Pinnacle)

Quest began growing organically in Q4’20, grew ~25% organically in 2021, and continues to grow organically 20%+ in 2022. Quest embarked on an acquisition strategy that has driven further growth and resulted in operational synergies that started to meaningfully contribute to profitability in Q2’22. Shares are extremely undervalued at 7x our 2024 EBITDA estimate, and we see similar business models with >20% aROIC trading at 20x EBITDA or more. We think Quest can generate 20% of its market cap in free cash over the next two years. We see 198% upside to $22/share over 2 years, and we think Quest’s business could increase 5-10x in 10 years.

Business Overview

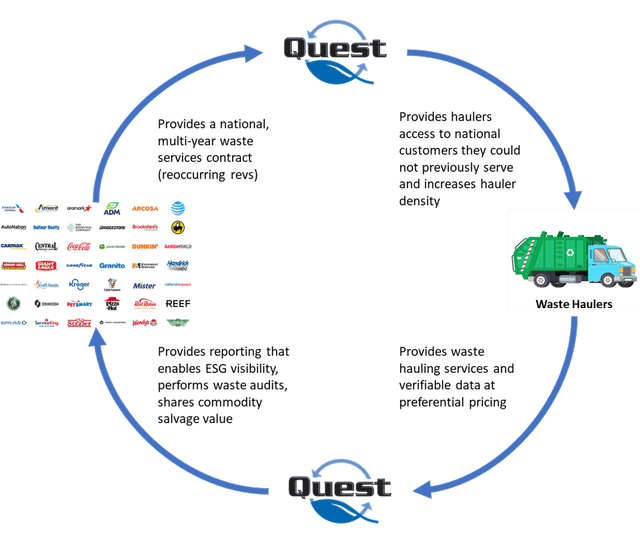

Quest is an asset-light value-added recycling services provider that services large national customers like John Deere (DE), Bridgestone (5108-TKS), JPMorgan (JPM), Kroger (KR), Archer Daniels Midland (ADM), Trinity Industries (TRN), Mister Car Wash (MCW), Buffalo Wild Wings, PetSmart, Hendrick Automotive Group, and many more. Quest aims to help customers achieve meaningful landfill diversion (some customers achieve 80%+ landfill diversion). Quest helps national customers meet internally mandated and/or externally regulated ESG goals. Hendrick Automotive Group, a Quest customer, recycled over 27,000,000 pounds of waste in 2020 and accomplish internal ESG goals. Externally legislated ESG regulations can be illustrated by California’s enforcement of a new law (SB 1383) to reduce disposal of food and other organic waste in landfills. SB 1383 requires that California businesses maintain records of type, frequency, and pounds of food recovered each month. Quest collects data, processes information, and prepares verifiable reports for customers regulatory filing requirements like what is required from California SB 1383. Quest’s reporting allows its customers to redeploy employees to other tasks. Importantly, I believe that Quest helps its customers divert waste away from the landfill at potentially no incremental cost versus the incumbent solution. I like investing in companies that help customers solve a problem at no incremental cost to the customer.

An important question is “how does Quest divert waste away from the landfill at no incremental cost to the customer?” Quest performs waste audits to understand exactly what customers are throwing away; often customers are not aware of all their specific waste streams. Quest identifies all a customer’s waste streams and provides a customized solution for each waste stream. Quest will also help right-size a customer’s waste collections. A customer may have an 8-yard dumpster picked up three times a week, but Quest may identify that a customer location only needs a 6-yard dumpster picked up twice a week. This reduction in service frequency and dumpster size can result in cost savings. Finally, Quest helps its customers by selling its recyclable waste streams to the appropriate party, and the customer recovers the salvage value of the commodity minus Quest’s service cost.

After winning a national contract with a customer, Quest uses its network of 3,500 independent waste hauler partners to efficiently service customer locations in every zip code of the US. Quest does not own any waste hauling trucks. The most expensive thing that a waste hauler can haul is air/spare capacity because of an inability to win business. Increasing a waste hauler’s utilization from 65% to 100% of capacity has high incremental margins. A small hauler may drive past Kroger every day, but that small hauler is not able to compete for Kroger’s business because the contract is awarded nationally. Quest affords haulers the opportunity to win business that haulers did not have an opportunity to win. Further, Quest is helping haulers improve route density, which is the most profitable revenue a hauler can add. Quest’s waste hauler partners are willing to give Quest attractive pricing to access large customers that can drive high incremental margins.

Quest effectively earns the difference between what customers pay to Quest and what Quest pays to waste haulers. Quest’s reported gross profit is the difference between customer payments and hauler costs; I look at Quest’s gross profit as net revenue. Quest’s contracts are generally structured to protect Quest’s gross profit dollars, so inflation is not a meaningful beneficiary or detractor to gross profit dollars as illustrated by Q2’22 results. Said differently, Quest’s gross profit does not take meaningful commodity price risk. CEO Hatch recently noted that 90-95% of gross profit is contractual and recurring. Historically, approximately 50% of Quest’s incremental gross profit has converted to EBITDA. I think investors would ascribe a very big multiple to Quest were they to view QRHC’s gross profit as net revenue. Quest’s financial profile looks like a company growing net revenue (which is 90-95% recurring) 20% organically with 50% of incremental net revenue falling to EBITDA and converting a material amount of EBITDA to FCF (which has historically been the case prior to 2022’s outsized growth).

Investment Thesis

1. Organic Growth

QRHC grew organically for the first time under CEO Hatch’s leadership in Q4’20. CEO Hatch is quick to deflect praise away from himself and towards his team. VP of Sales and Business Development Stephen Coskery joined Quest in October 2020. Quest has disclosed the following customer wins since Coskery joined Quest: one 7-figure expansion with an existing customer in Q4’20, two 7-figure revenue wins in Q1’21, one 8-figure revenue win in Q1’21, one 7-figure revenue expansion in Q2’21, one mid 7-figure revenue win in Q3’21, and one major expansion with a financial services customer in Q1’22. These seven disclosed customer wins/expansions demonstrate that Quest has figured out how to present itself to prospective customers in a way that is resonating and resulting in new business.

CEO Hatch said the following at an investor conference on November 18, 2021:

We have got a sales team that I am very proud of now. For a little over a year, we have had our sales VP, we have a sales process that is very consistent and is working. But, the most important thing is we are identifying the right customer at the front of the pipeline, the funnel, which makes [our] conversion rate much higher as [we] move through the [funnel].

Quest’s ability to win new business has been, in part, dependent on Quest’s ability to provide good service to customers. COO Dave Sweitzer joined Quest shortly after CEO Hatch and was instrumental in Quest’s operational turnaround. Hatch and Sweitzer worked together in the past, and recently added another former colleague, VP of Operations Jim Bentley, to bring the band back together. Bentley is Six Sigma certified and has worked in the waste industry for 30 years. Quest’s ability to expand from very modest new customer growth to onboarding seven material customer wins simultaneously has been a result of Quest’s strong operational capabilities.

Sales and operational execution aside, why is Quest winning profitable business more easily than ever before? Good question. Waste spend was likely not one of the most important corporate initiatives for many companies because it is generally a small financial line item. Further, mishandling waste carries substantial regulatory risk if not handled appropriately. So, companies may have had a “if it isn’t broke, don’t fix it” attitude. However, this trend seems to be changing. Quest is benefitting from increased ESG adoption and increased regulatory scrutiny. Companies are more frequently pressured by shareholders to produce sustainability reports which typically include landfill diversion as a key metric. Bridgestone, the world’s largest tire manufacturer and a Quest customer, announced its E8 Sustainability Plan in March 2022 to become a sustainable solutions company. John Deere, another Quest customer, issued a $600 million sustainability linked note (“SLN”) in April 2022 that penalizes Deere by increasing the interest rate if Deere does not achieve its “sustainability performance target” of reducing Greenhouse Gas Emissions by 20% by 2026. Green bonds and SLNs are generally issued at lower yields than traditional debt since the issuer is assuming an additional obligation (an ESG initiative). A recent WSJ article states “investors are paying nearly a record premium for shares of companies with the best ESG scores over the ones with the worst ratings” according to Bank of America research. Sustainability and ESG initiatives are providing economic incentives to companies, and Quest is a direct beneficiary of this trend.

Government environmental regulation is also a positive driver. The Inflation Reduction Act (“IRA”) has been hailed by many as America’s greatest ever step to confront climate change. The Department of Energy says the Inflation Reduction Act’s Advanced Industrial Facilities Deployment Program plays a significant role in supporting “emissions abatement at industrial facilities and within manufacturing and recycling processes” among other incentives that could drive business to Quest. The pursuit of a Closed-Loop recycling system, a system in which waste is repurposed into a future product, is receiving major federal support through the IRA. Focus on Closed-Loop recycling could drive more demand for Quest’s services which help customers understand and recycle their waste streams.

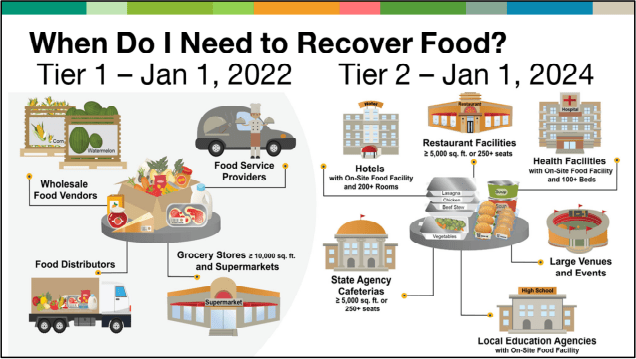

States continue to introduce new regulations like California’s organic waste regulation SB 1383. SB 1383 requires that California businesses maintain records of type, frequency, and pounds of food recovered each month. The infographic below explains SB 1383 implementation.

SB 1383 implementation (Recycling & Waste Reduction Commission)

I am most excited about tier 2 generators (January 2024 implementation) because it contains some very large businesses. Marriott (5,700 locations), Hilton (5,500 locations), major restaurant chains, and hospitals are exciting opportunities. Marriott filed its SERVE 360 report in September 2021 and highlighted goals to reduce waste to landfill by 45% and reduce food waste by 50% by 2025. Hilton wants to cut waste by 50% by 2030. Many other states have introduced food waste legislation or tax incentives including: Arizona, Colorado, Iowa, Kentucky, Massachusetts, Missouri, Oregon, South Carolina, Vermont, Virginia, Maryland, and New Jersey. I speculate that companies like Marriott will look for service providers to manage additional waste streams that help Marriott reach its national ESG goals. Quest has an opportunity to win business with large potential customers that could drive a massive acceleration in revenue. Simply put, QRHC is a huge beneficiary of legislation forcing landfill diversion.

Reshoring efforts to protect America’s supply chain will also benefit Quest. President Trump’s protectionist push to bring jobs back to America began a 6-year trend of reshoring. COVID, legislation from the Biden administration, and macro-economic uncertainty all accelerated the localization of supply chains. Executive Order 14017, America’s Supply Chains, was signed into law by President Biden in February 2021 with the goal of “strengthening critical supply chains and revitalizing the U.S. industrial base.” US industrials are generally benefitting from E.O. 14017 with the Biden administration focusing on battery electric vehicles and semiconductors. The Bipartisan Infrastructure Law is funding initiatives to make more batteries and components in America. The CHIPS And Science Act of 2022 appropriates $54.2 billion for subsidies to build semiconductor chip plants in the US. Many pieces of government legislation are incentivizing US manufacturing, and companies are responding accordingly. UBS Evidence Labs highlighted that 1181 companies have disclosed supply chain investments in the US from Q1’21 to Q2’22. Any incremental manufacturing performed in the US will result in incremental waste products that could be managed and recycled by Quest. Quest has a rolodex of reference customers and is well positioned to win business with customers reshoring manufacturing.

Quest further benefits from landfill owners increasing tipping fees. Tipping fees generate most of a landfill’s revenue and are paid by anyone who disposes of waste in a landfill. Increasing tipping fees makes it easier for Quest to offer an alternative solution at no additional cost to customers disposing of waste in the landfill. “Landfill parity” is the goal for Quest. Quest has a very good chance of winning a new customer if Quest can find a way to offer a customer a recycling/landfill diversion solution at parity to landfill cost. NIMBY (aka “not in my backyard”) is a common response to permitting efforts for new landfills, transfer stations, recycling centers or composting facilities which makes growth by facility expansion more challenging. This community response to landfills should generally benefit landfill owners’ ability to continue to increase tipping fees over time. Increasing tipping fees should sound like music to Quest shareholders’ ears. Further, commodity price appreciation in materials like scrap metal has generally helped Quest achieve landfill parity and recover a greater salvage value for previously landfilled material.

Additionally, the amount and type of waste streams managed is highly important. Quest has said that it manages over 100 different waste streams. Quest manages potentially the most comprehensive list of waste streams/services in the industry including hazardous waste. CEO Hatch said at a recent conference presentation that he believes that nobody else handles all these services.

Quest’s Managed Waste Streams (Quest Resource Holding Corp.)

Importantly, more complicated waste streams like hazardous waste generate higher margins for Quest and have higher competitive barriers. Imagine that you are a Fortune 500 company submitting an RFP for 10 different waste streams, and only one bidder can support all 10 waste streams. Ideally, the Fortune 500 company would be able to identify one (rather than several) recycling services provider that can handle every waste stream to simplify management of a relatively small operating line item. Quest has experience meeting large, diverse waste stream needs. The breadth of recycling services offered is an important differentiating factor that investors should not overlook.

Quest launched several exciting new services, like Quest Proganics.

Quest Proganics (Quest Resource Holding Corp)

Quest Proganics differentiating factors are Quest’s ability to provide a single collection process, recycle all non-organic waste, and turn organic materials into compost, biofuel, or animal feed. Quest Proganics has been adopted by Dillons, a Kroger subsidiary with 65 stores, to take organic waste and turn it into compost to give to residents at its annual Earth Day celebration. Grocery stores and food distributors with California locations could adopt Quest Proganics as a part of SB 1383. On Quest’s August 15 Q2’22 earnings call, CEO Hatch said the following:

I think the best opportunity is probably – they are all great opportunities, but food waste just seems to be – it has a lot of momentum, it is a huge generator of landfill filling material, and the vast majority of that organic waste does not need to go there. And so, we are working very hard to expand that part of our business along with everything else.

Quest often expands the breadth of services managed for a client after starting a relationship with a customer. Quest “lands and expands” by adding new services or serving additional locations. Quest’s asset light business model allows it to add additional services to its portfolio and meet customer needs with a minimal dollar investment. For example, Quest had not offered grease trap cleaning at restaurants, but Quest identified a need at one customer. Quest sourced a network of service providers to clean grease traps, and Quest was able to capture additional gross profit dollars by meeting this customer need. Quest can offer this service to other restaurant customers after building it out. Sometimes, Quest will win business from a customer for one specific location or region. Over time, Quest has been able to expand to perform waste and recycling services for that customer’s other locations.

Further, Quest has been able to cross-sell services from acquired companies to Quest’s customers. Quest’s largest acquisition to date is RWS. RWS had a network of vendors to refurbish or recycle pallets, and Quest did not previously offer pallet waste recycling as a service. Quest announced on its Q1’22 earnings call that an existing Quest customer adopted pallet service to its program, which will add $1 million in incremental revenue once fully integrated. Quest is also seeing an opportunity to cross-sell Quest’s broad portfolio of services into its acquired company’s customers. InStream was acquired in December 2021 at the same time as RWS. On Quest’s Q1’22 earnings call, CEO Hatch said:

There is a tremendous amount of opportunity for us to sell services that we provide that [RWS and InStream] never provided. InStream maybe even more so because they are narrower in their offering.

Quest provides differentiated value-add data and reporting. This is by far the most underappreciated part of Quest’s value proposition. Most companies have a decentralized waste management solution, and therefore they do not have any visibility into their waste spend or waste streams. Quest centralizes waste service management for its customers. For example, a company with 1000 stores nationally may have 1000 disparate decision makers managing waste for each store. Under Quest’s management, this customer could get: 1) cost savings by leveraging its scale with service providers, 2) data on each store’s waste spend, 3) visibility into what waste streams are coming out of each store, and 4) detail on how much of each waste stream is produced. Quest puts this information in its data portal and enables its customers to have visibility into each store’s waste spend by waste stream. Importantly, Quest is uniquely positioned to give its customers visibility into their waste streams. Quest is collecting data from waste hauler partners for every waste stream a customer produces, but other waste service companies may only manage 3-4 waste streams, and therefore will only give visibility into those 3-4 waste streams. Therefore, asset heavy competitors would need to broaden their service offering and dramatically restructure how they serve customers to effectively compete with Quest’s data offering. Technology companies that may try to address this customer demand are disadvantaged versus Quest because they don’t manage waste and cannot respond to industry standard RFPs. The result is a very evangelical and unnatural sales process. Quest’s core business of managing customer waste streams allowed it to create a competitively differentiated value-stream to customers that is uniquely protected by its breadth of waste streams.

Quest also performs quarterly business reviews with each client to go over waste and recycling reports generated by Quest. Quest’s reports provide customers with verifiable reports for regulatory filing obligations and ESG/sustainability reporting. Quest is providing customers with substantial time savings while also reducing customer risk by ensuring that data is correct, collected, and processed into easy to navigate reports. Quest can provide granular data by location or company-wide visibility into pounds of waste produced by waste stream, dollar spend by waste stream, landfill diversion rate, carbon and greenhouse gas emission reduction, number of service providers managed, customer service calls handled, and more.

Data and Reporting (Quest Resource Holding Corp)

CEO Hatch made the following statement about its data and reporting on the Q4’21 earnings call:

By collecting better, cleaner, and more accurate data in our data warehouse, we are able to give customers cleaner, [timelier], and accurate data as well. So, we really feel our current technology differentiator is data. I mean, the market seems to be accepting that. Customers are looking for it. A lot of our competitors are giving out data, but it’s a point in time. It is static. It is not a live document like our stuff is, and I do not think it is as useful. And so, our goal is to make sure that we are giving our customers very useful information because their reporting requirements are doing nothing but growing.

Quest’s data and reporting is more like a near real-time business intelligence and analytics platform that could eventually be worth Quest’s current market cap. Quest is at the early stages of monetizing this service.

To summarize Quest’s organic drivers, 1) Quest’s salesforce is better organized today to execute on opportunities. 2) Companies are more focused on sustainability and landfill diversion due to the proliferation of ESG. 3) Federal and state environmental regulation is forcing increased attention on landfill diversion. 4) Reshoring manufacturing will result in additional waste produced that could be recycled. 5) Landfills are generally increasing tipping fees, which makes it easier for Quest to compete, and tipping fees are likely to continue increasing over time due to a lack of new landfills permitted in attractive geographies. 6) Commodity price inflation has increased the salvage value of some waste streams. 7) Quest’s new waste services are attracting new customers. 8) Quest is having success cross-selling services to customers of recently acquired businesses and vice versa. 9) Quest’s ability to centralize waste management and provide actionable near real time data and reporting for internal analysis and external reporting is providing better business visibility.

Investors often talk about tailwinds supporting a company’s business. I am not sure what to call nine tailwinds all blowing at the same time. A Category 5 hurricane wind? Many factors are helping Quest compete more effectively against landfill.

2. Acquisitions

Quest has completed three material acquisitions (Green Remedies, RWS, and InStream) in addition to several small waste brokerage companies over the prior three years. Generally, Quest’s acquisitions allow for revenue synergies (i.e., cross selling different services to customers) and cost synergies (i.e., consolidating waste haulers onto Quest’s rate card).

Green Remedies – $16.2 million cash and stock M&A in October 2020

Quest’s first material acquisition was Green Remedies for 5.78x TTM EBITDA to start building Quest’s multifamily business. Management’s acumen can be seen in the structuring of the Green Remedies acquisition. 66.9% of the acquisition was paid in cash, 16.5% was paid with a five-year seller note bearing 3% interest, and 16.5% was paid in Quest’s option of cash or stock to be paid in equal amounts at the 1st and 2nd anniversary of the acquisition. Therefore, Quest was able to use Green Remedies cash flow and EBITDA to help pay for the acquisition of Green Remedies. QRHC closed at $1.96/share the day before Quest announced the Green Remedies acquisition, and Quest was able to use stock valued at $6.14/share to pay for part of the acquisition on the 1st anniversary. Investors in QRHC are investing in an astute management team that is extremely literate in deal structuring relative to other ~$100 million market cap companies.

Green Remedies provides waste management services to multifamily buildings. Quest did not previously have a multifamily business, and Green Remedies provided a platform for Quest to build around. Under Quest’s leadership, Green Remedies has the potential to win institutionally managed multifamily commercial real estate portfolios of multifamily buildings.

InStream – $11 million cash M&A in December 2021

InStream sounded like a mini-Quest to me. InStream serves customers in the industrial end market. Quest discloses that it serves Deere, ADM, Trinity Industries, and other industrial customers. Scrap metal can be a big waste stream at industrial companies. Increased scrap tonnage managed by Quest should allow Quest to have more leverage in pricing negotiations and capture better scrap prices. Importantly, Quest’s gross profit is not subject to commodity price risk; commodity price risk is born by the customer. Quest has an inherent margin expansion opportunity as Quest scales because Quest may be able to retain some of the margin captured by leveraging the size of its managed waste streams. Any retained margin captured due to Quest’s scale should have nearly 100% flow through to EBITDA. This is a durable and long term opportunity that could contribute to Quest’s cash flows for years as it scales.

RWS – $33 million cash M&A in December 2021

RWS is Quest’s most material acquisition to date. RWS generated $50 million in revenue in 2021 and was modestly profitable. RWS was owned by Atar Capital, an LA based PE firm, and gave QRHC the opportunity to enter the commercial property management market. RWS’s CEO Anthony Dilenno highlighted Quest’s data and reporting capability at the time of the merger by stating:

Quest has a unique and differentiated data reporting capability that is in demand from our customers who are looking to increase visibility into their operations and to improve and simplify sustainability reporting.

Quest highlighted that it expected to generate $5.5 million in annual EBITDA pro forma for synergies from the combination of the RWS and InStream acquisitions. Note that Quest paid 8x pro forma EBITDA for RWS and Instream ($44m / $5.5m EBITDA = 8x). I assumed that Quest would take 12-18 months to realize those synergies, but I think Quest achieved $5.5 million of EBITDA already (less than seven months into integration). Quest’s Q2’2022 10-Q discloses that Quest’s acquisitions completed after June 30, 2021 generated $1.3 million of GAAP Operating Income in Q2’22, which is an annualized $5.2 million of GAAP Operating Income. RWS had $650,000 in Depreciation and Amortization in 2020. Therefore, QRHC has probably already achieved its goal of generating an annualized $5.5 million of EBITDA from RWS and Instream. Quest likely paid less than 8x EBITDA for these two acquisitions that added new verticals and waste streams to Quest’s portfolio.

Acquisition summary

Quest plans to make additional acquisitions. Management is shrewd in their ability to structure deals, pay attractive multiples, and find strategic assets with clear revenue and cost synergies. I am in favor of Quest continuing its acquisition strategy. Quest is building a platform that will be an attractive target to strategic investors searching for a cornerstone asset.

3. Management: Chairman Dan Friedberg and CEO Ray Hatch

Dan Friedberg, QRHC’s Chairman of the Board, joined in April 2019. Friedberg was an early partner at Bain, where he founded Bain’s Toronto and New York offices in 1989 and 2000, respectively. Following his time at Bain, Friedberg started a hedge fund that averaged a 20% net return over 10 years. Since becoming Chairman, Friedberg purchased 2,828,000 shares of QRHC through his company, Hampstead Park Capital Management. Mr. Friedberg’s time investment, financial investment, and leadership have helped transform Quest.

Ray Hatch, QRHC’s CEO, joined in 2016. Hatch inherited a company that was marked by unprofitable revenue growth. Hatch earned credibility in our book during QRHC’s transformation from 2016 to 2020. Hatch has extensive experience in waste management; he served as an SVP at Oakleaf Waste Management and COO at Greenleaf Compaction, both companies are now subsidiaries of Waste Management.

CFO Laurie Latham was valuable during Quest’s transformation, but she retired on August 31, 2022. Glenn Culpepper, Member of Quest’s Board of Directors and former CFO of Republic Services, is leading the search for Laurie’s replacement. Laurie has committed to continue working with Quest during the transition period. We are confident that QRHC will find a competent CFO to take Quest to the next level.

Quest has built a roster of waste industry veterans (i.e., COO Sweitzer and VP of Operations Bentley) and paired them with non-waste industry specialists (i.e., VP Sales Coskery, VP of Strategy Reynolds, and VP of Corporate Development Sa) to institutionalize and differentiate Quest from peers. Quest’s leadership is far superior to the average $100 million market cap company that I research.

4. Deleveraging

When we invested 3.5 years ago, approximately 50% of incremental gross profit dollars fell to EBITDA, and ~65% of EBITDA converted to FCF. Quest’s acceleration from flat organic growth to 20%+ organic growth has caused working capital uses since 2H’20. Further, Quest’s acquisition strategy increased Quest’s debt load, subsequently increasing Quest’s interest expense. Therefore, Quest has recently not displayed its historical level of FCF conversion, but I think this is a temporary phenomenon.

CFO Laurie Latham made the following statement on Quest’s August 15 Q2’2022 earnings call:

We have had several new customers that have ramped quickly during the first half of the year. In particular, our industrial customers were onboarded with extended payment terms. Since the end of the quarter, we have been able to transition those terms to a more typical payment schedule which, we expect, will cycle through during the fourth quarter. As such, we expect to generate positive cash flow from operations during the second half of the year.

Quest’s focus on working capital management is another datapoint that should give investors confidence. In my experience, few small cap growth companies 1) focus on generating free cash flow, and 2) would consider approaching large cap customers to ask for better payment terms ~12 months into a new relationship. To me, this says two things: 1) Quest’s customers view Quest as a partner, and 2) Quest is providing a service that is differentiated from competitors.

Quest has $71.2 million in gross debt, $4.2 million in cash, and $67.0 million in net debt. Therefore, Quest is approximately 3.3x levered on a total net debt/2022 EBITDA basis. Some investors have an aversion to small cap companies with a heavy amount of debt because of scar tissue from prior investments. I would argue that Quest’s business model could handle more leverage because Quest’s customers generally contract for 3 years in evergreen contracts that auto-renew. Further, Quest generally grows gross profit and EBITDA dollars with its customers every year by adding additional waste streams and customer locations.

Quest has historically converted approximately 50% of incremental gross profit dollars to EBITDA. We are forecasting similar levels of EBITDA conversion in the future. However, Quest recently discussed its investment in data, reporting, and technology to increase its scalability. CEO Hatch said:

We will be able to drop in a whole lot more revenue with little-to-no additional SG&A. Right now, we have a significant project going to continue to grow and enhance EBITDA margin and leverage our cost structure to enable us to be even more competitive.

Quest’s investment to position itself as a scalable platform is a pivotal moment in the company’s history. I think incremental gross profit dollars could have higher than a 50% contribution margin to EBITDA after this project is completed, but we have not modeled for that possibility.

We expect that Quest will return to converting approximately 50% of EBITDA to FCF over several quarters. Quest converted ~65% of EBITDA to FCF prior to the pandemic; our assumption for modestly lower FCF conversion contemplates higher growth rates than pre-pandemic periods, larger interest expense, and Quest exhausting its NOLs in 2024. Therefore, we assume that Quest’s leverage will decrease to less than 2x levered by the end of 2024 absent additional acquisitions.

5. Discovery

Quest also has three discovery catalysts that could prove timely:

1. Rubicon’s SPAC IPO

The recent SPAC IPO of Rubicon Technologies (RBT) will drive investor awareness. At a minimum, investors performing due diligence on Rubicon will discover Quest as a comp, and more eyeballs will look at Quest’s fundamentals, which are very favorable.

Rubicon is an asset-light waste services company that helps customers drive landfill diversion, and Rubicon discloses that its customers achieve a ~30% landfill diversion rate (3x higher than industry average). Rubicon has a high-quality customer list that includes Starbucks, Walmart, Best Buy, Amazon, Chipotle, Dollar General, Wegmans, and others.

At a high level, Rubicon’s business is very similar to Quest’s. Both companies contract nationally at the enterprise level for various waste streams. Both companies contract with a network of independent waste hauler partners to collect waste. Both companies principally generate gross profit dollars by capturing the difference between customer receipts and payments to waste haulers. Essentially, both companies built a marketplace platform that is dependent on chunky, enterprise-level customer wins on the demand side that attract independent waste haulers on the supply side. Rubicon markets two additional services (Rubicon SmartCities and Rubicon Premier) that are higher margin recurring software services, but I estimate these two products combine to generate less than 5% of revenue (although not disclosed) today.

Rubicon’s SPAC merger deck forecasted $77 million of adjusted gross profit in 2022 (including $10m of acquired GP), which I think equates to ~$50 million of GAAP gross profit (or $40 million GAAP GP excluding acquisitions). Rubicon backs out platform support costs in its adjusted gross profit calculation. Rubicon is not yet profitable on an aEBITDA basis, so I will focus on comping on gross profit. I expect that Quest will generate $53 million of GAAP gross profit in 2022. Rubicon is generating materially more revenue ($657m guidance ex-future acquisitions vs $295m) in 2022, but Quest is generating materially more GAAP gross profit ($53m vs ~$40m ex-future acquisitions) and aEBITDA (+$20m vs appx -$45m).

We believe that Rubicon’s total share count is 164,977,882 based on August 19, 2022 8k exhibit 99.4 Note 2 (O). Therefore, Rubicon has a $825 million market cap, $45 million of net debt, and a $870 million enterprise value with RBT at $5.00. We estimate that RBT is trading for 12.5x our 2023 GAAP gross profit estimate absent any additional acquisitions. Quest is currently trading for 3.6x 2023 GAAP gross profit. A ~9-turn discount to Rubicon is unreasonable to me; other investors researching these two companies will come to the same conclusion.

Someone could argue that Rubicon deserves a gross profit premium to Quest based on the ability to generate more material software sales. However, QRHC currently has higher gross margins, is profitable, and has grown faster than Rubicon organically over the prior 2 years. I would argue that QRHC could reasonably trade in-line with Rubicon. Assuming RBT’s maintains its multiple, a 12.5x GAAP gross profit multiple on QRHC would equate to a $31 share price for QRHC today. We continue to underwrite QRHC based on 20x EBITDA, but I think these companies could legitimately trade off gross profit (like real estate brokerages). Customers are contracted for multiple years, Quest’s gross profit is 90-95% recurring, volumes are somewhat visible, and some investors may view these stocks as SaaS-like or at least highly repeatable and visible.

2. Other Publishing Analysts

Quest has an attractive high level “story”, its business is trending positively, and it has some leverage on its balance sheet. Typically, this set up has attracted investment bank research coverage. Any additional coverage could help drive investor awareness and share price appreciation.

3. Sustainability ETF inclusion

ESG ratings firms like ISS and MSCI have not yet rated Quest. Quest could rate very highly on the “E” in ESG and would need to make investments and additional disclosures to rate highly on the “S” and “G.” Zero sustainability ETFs own QRHC today, and QRHC could appeal to $2.5 trillion of global sustainable fund assets were Quest to pursue a formal ESG rating.

Competition

The waste and recycling market is enormous, and the North American market is headlined by Waste Management (WM), Republic Services (RSG), and Waste Connections (WCN). WM, RSG, and WCN are commonly referred to as the “Big 3.” The Big 3 collectively generate $40 billion of annual revenue, and Allied Market Research estimates that non-Big-3 haulers in North American generate $177 billion annually. It is fair to say that this is a fragmented industry.

The Big 3 own and operate landfills. Landfill owners get compensated by volume taken to the landfill, and incremental margins on volumes taken to the landfill are extremely high (65%+ EBITDA margins). The Big 3 all have recycling services, but they are generally subject to the prisoner’s dilemma in that the landfill is drastically more profitable than recycling. From an economic perspective, the Big 3 are negatively incented to divert waste away from the landfill.

A recent expert interview with a former District Manager at Waste Management that has 30 years of experience in the waste industry touched on an interesting point. The former District Manager at WM said:

1) Landfill is the most profitable business line, 2) volume drives profitability, and 3) many commodities pass through a MRF (materials recovery facility) but ultimately go to the landfill to optimize profit. A ton of waste in a landfill generates 45-70% EBITDA margins vs paying a $95/ton tipping fee at a MRF that reduces the amount of waste going to landfill.

The basic implication is that landfill operators want to push as much waste to the landfill as possible.

Waste Management recently disclosed that 90% of its emissions come from its landfills at a Feb 24, 2022 ESG conference. WM is looking at strategies to collect gas produced from its landfills to reduce emissions. WM is investing in gas collection infrastructure and renewable natural gas infrastructure, and using natural gas produced by its landfills to power its fleet of compressed natural gas vehicles. Waste Management seems rightly focused (from an economic perspective) on continuing to drive waste to the landfill and reducing emissions from its landfill. This solution is not addressing corporate America’s desire to divert waste away from the landfill.

Rubicon is the only public asset-light peer. Many smaller private companies also serve the waste and recycling market including Keter, RTS, Compology, and many more. There is plenty of market share for each of these companies to grow for years before they begin to materially impede on the Big 3.

I previously addressed Quest’s breadth of waste streams managed, which we believe is the broadest in the industry. Quest is the one stop shop for large national companies managing recycling waste streams. After picking up waste materials, Quest’s data warehouse reflects when waste was collected, what waste was collected, how much waste was collected, and where the waste was sent. Quest collects this data, compiles it into comprehensive reports for customers to use for internal analysis (i.e., waste volume trends), internal ESG reporting, or external regulatory reporting. I do not have a clear understanding of Quest’s private peers’ ability to provide similar quality of reporting, but I do not see an obvious hole in the data and reporting that Quest provides to customers.

Shareholders/Insider Buying

Quest has a relatively concentrated shareholder base. Chairman Dan Friedberg owns 14.8% of QRHC followed by Wynnefield (13.5% owners), and Pinnacle Family Office (13.1% owners). These three entities own ~41.5% of QRHC and seem to be long term in nature given their current duration of ownership. Wynnefield was buying stock through mid-July as low as $3.85. Pinnacle was buying stock in May in the $4s. As greater than 10% shareholders, Wynnefield and Pinnacle are subject to the Short-Swing Profit rule; neither of those shareholders can sell any stock for a gain for 6 months from their most recent purchase without forfeiting those profits to the company.

Chairman Dan Friedberg implemented a 10b5 plan to buy stock that became effective June 20, 2022 and expires on September 30, 2022. Chairman Friedberg filed Form 4s reporting purchases on 16 different trading days between mid-June and July 26.

CEO Ray Hatch made an open market purchase on June 15, 2022. Prior open market purchases from Hatch were timely: March 23, 2021 at $3.90, November 18, 2018 at $1.50, and August 22, 2017 at $1.54. Hatch’s purchases have historically led to 50%+ returns over the next 6 months.

Valuation

Quest is still the cheapest growth stock that I know even after the recent move higher. Companies that trade for relative discounts to comps are often experiencing some sort of degradation in their businesses or have impaired business models. I believe that Quest’s fundamentally sound business is strengthening, and an increasing focus on landfill diversion is a potential multi-decade industry tailwind. QRHC’s peers trade for 50-200% more than Quest based on EV/EBITDA, P/E, PEG or FCF Yield. QRHC should screen well for growth, GARP, and value investors.

The Case for Growth Investors

Quest is serving a $200 billion fragmented market searching for a solution to an emerging social issue: landfill diversion. Quest has spent the past 5 years positioning itself for growth just in time for a potential multi-decade increase in demand in landfill diversion. Absent a deep recession, I think that Quest’s revenue could maintain double-digit revenue and gross profit growth rates. Quest trades at a massive 8-turn discount on EV/2023 gross profit (11.5x vs 3.6x) to what I consider Quest’s best peers.

The Case for GARP Investors

Quest is growing revenues organically ~25% and delivering strong operating leverage. QRHC is trading for 9.5x EV/2023 EBITDA, 14.5x 2023 adjusted EPS, and has a 1.1x 2023 PEG ratio based on consensus estimates. Gross profit and EBITDA growth is sustainable, and there is a clear case for multiple expansion.

The Case for Value Investors

QRHC is trading for an estimated 10% 2024 FCF yield. Approximately 50% of incremental gross profit falls to EBITDA, and I estimate that ~50% of EBITDA will convert to FCF in the future. QRHC could add $25 million in free cash flow by the end of 2024, which would equal ~20% of its current market cap.

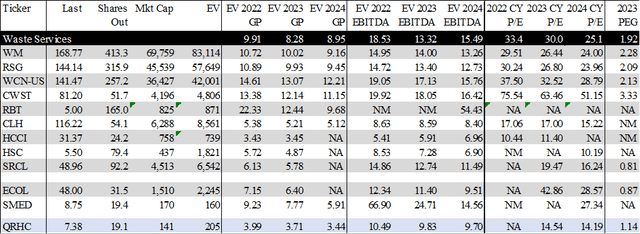

Comps

I compiled two comp sets to evaluate Quest’s valuation. I examined GAAP gross profit instead of revenue because I view Quest’s gross profit as its net revenue.

Waste Service Companies

Waste Services Comps (Pinnacle)

Waste service comps trade for a 124%, 35%, 106%, and 68% premium to QRHC on consensus EV/2023 Gross Profit, EV/2023 EBITDA, Price to 2023 EPS, and 2023 PEG, respectively. This comp set trades for 8.3x, 13.3x, 30x, and 1.92x consensus 2023 EV/GP, EV/EBITDA, EPS, and PEG, respectively. I find this comp set interesting, but not necessarily instructive. There are few similarities between QRHC and WM’s business models. I don’t like comping asset-light companies with asset-heavy companies. QRHC’s business is superior to HCCI and CLH given their sensitivity to oil prices, and Quest’s lack of commodity price risk. However, QRHC could approximately double to trade in line with waste service peers. ECOL and SMED were recently acquired at 12.8x and 67x 2022 EBITDA estimates.

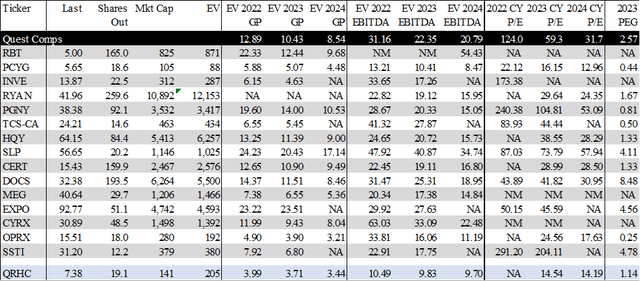

Value-added Enterprise Business Solution companies (my preferred comp set)

I look for other businesses that share similar characteristics rather than limiting myself to an industry. Quest is a 1) small cap, 2) asset-light company, 3) that has multi-year contractual customer relationships with high renewal rates, 4) focuses on an enterprise level sale, and 5) has high incremental contribution margins. This comp set generally reflects those five qualifiers, therefore I believe this to be the best comp set from which to value QRHC.

Quest Business Model Comps (Pinnacle)

Value-added enterprise business solution comps trade for a 181%, 127%, 308%, and 126% premium to QRHC on EV/2023 GP, EV/2023 EBITDA, Price to 2023 EPS, and 2023 PEG, respectively. Our internal estimates for Quest’s future performance make Quest even cheaper relative to this comp set. This comp set trades for 10.4x, 22.3x, 59x, and 2.57x consensus 2023 EV/GP, EV/EBITDA, EPS, and PEG, respectively.

Some investors will look at my comp list and argue that comps must be in the same industry, and I respect that criticism. I would push back that I have always attempted to comp businesses by most similar business model, and then I’ve applied a premium or discount based on the industry. My $22 price target is based on an average of 8x Pinnacle’s internal 2024 gross profit, 20x 2024 EBITDA, 25x 2024 aEPS, 1.25x PEG, and a 3% 2024 FCF yield. Multiples used for my price target are all discounts to the average multiple in my preferred comp set, and a massive discount to Rubicon, Quest’s closest comp. My $22 price target yields a 2-year 72.7% IRR. Investors can apply a larger multiple-discount and still find QRHC very attractive.

Conclusion

My best investments have always offered a differentiated service that addresses a growing market need and traded at attractive absolute valuations. Quest fits that bill as it is trading for ~9.5x 2023 consensus EBITDA expectations while growing 20%+ and benefiting from structural tailwinds. I also love businesses that present a win-win solution for the ecosystem. Quest’s customers win by meeting ESG goals at no incremental cost. Quest’s waste haulers win by gaining access to business they otherwise couldn’t serve. I expect to own QRHC for many more years.

The management team has taken drastic steps to shed unprofitable revenue, position the company to grow, and make strategic investments that are synergistic. Quest’s business is as healthy as it has ever been, and the company is in the right place at the right time as investors focus on sustainability and ESG themes. Quest is one of the most obvious and direct ways to invest in an ESG pure play at below average multiples. Further, Quest’s data and reporting capabilities are underappreciated and provide business visibility and verifiable waste reports that can be used to meet internal and external ESG reporting requirements.

Quest’s financial metrics offer a rare combination of growth and value that should appeal to a broad set of investors. Finally, we love asset light businesses because they have the potential to generate a ton of cash, and Quest could generate 20% of its market cap in free cash flow over the next two years. I want to own Quest as the stock goes through discovery, and QRHC is better appreciated.

Be the first to comment