Justin Sullivan

Investment thesis

We believe Coca-Cola is still overvalued. Future growth of financial results is severely limited, in the medium term the company shall experience problems with inflation and consumer activity typical for the sector, and the dividend yield it can offer to shareholders is not enough to raise its target price.

Q2 2022 results are strong, but there are negative indicators

Q2 2022 was quite positive for Coca-Cola – the company reported revenue and EPS higher than analysts’ consensus estimates. Management raised its expectations for 2022 operating results and noted that the company had no serious problems.

Nevertheless, due to some negative indicators, we believe that positive Q2 2022 report is not a reason to set high expectations for the whole year.

There are 3 main drivers of Coca-Cola’s organic revenue:

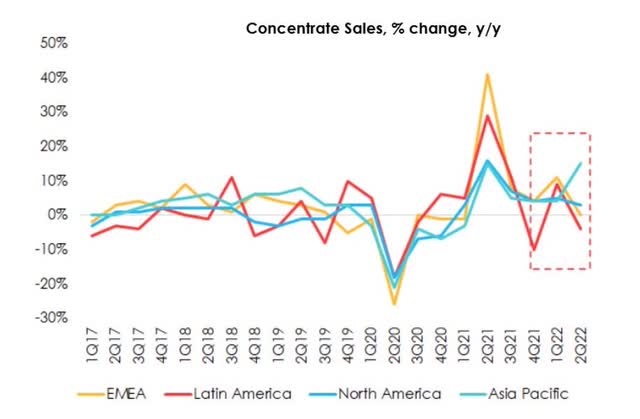

- Concentrate Sales – change in the sales volume of concentrated products (including sales to bottling partners).

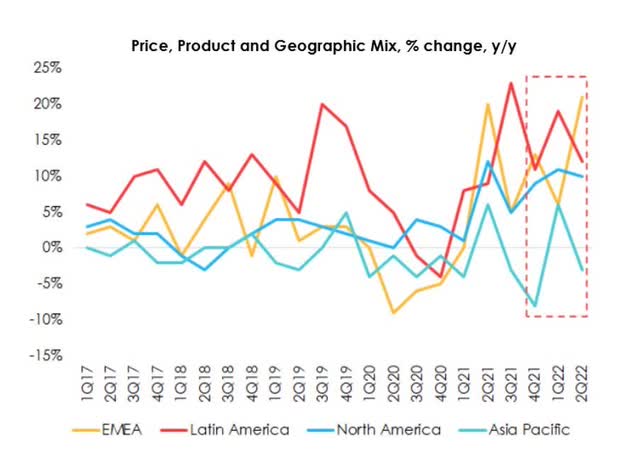

- Price Product & Geographic Mix – change in retail prices, given the difference in geographic distribution and the revenue structure by product.

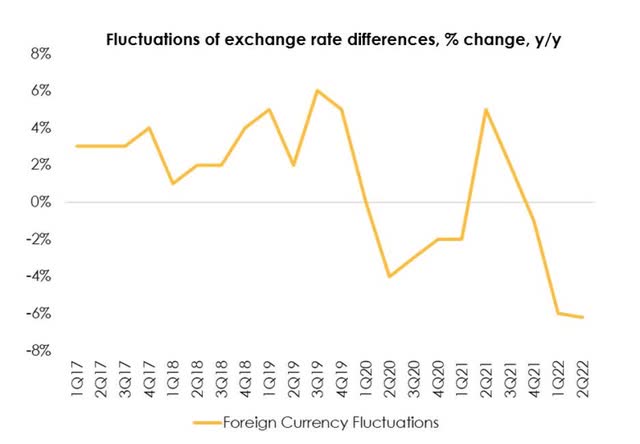

- Foreign Currency Fluctuations – the effect of exchange rate differences on the company’s revenue.

In Q2, the group’s net operating revenues growth was 12.56% y/y, according to our estimates, which is a relatively high indicator. However, if we take a closer look at the structure of revenue growth, the main driver in almost all business segments is price, product and geographic mix (PP&G Mix). The volume of concentrated products sales in the main regions decreased, except for the Asian region and Bottling Investment Group.

Pricing policy of Coca-Cola remains favorable for value creation – the company reacts quickly to changes in the inflationary environment and raises prices at a high rate. Therefore, we expect the high growth of PP&G Mix to persist during the year, although it shall be slightly adjusted to reflect the subsiding overall inflation.

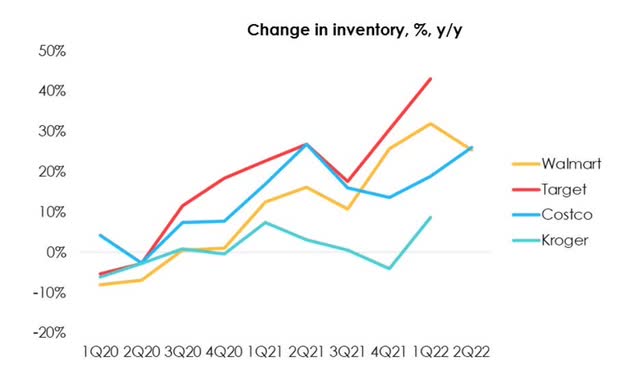

Nevertheless, the decline in volume is a bit alarming. The situation among major retailers, which are the main distributors for the food and beverage manufacturers, is also an important factor.

As of the end of H1 2022, we observed significant inventory growth of large grocery retailers (Walmart, Costco, Kroger) due to cost-based accounting policy and better merchandising.

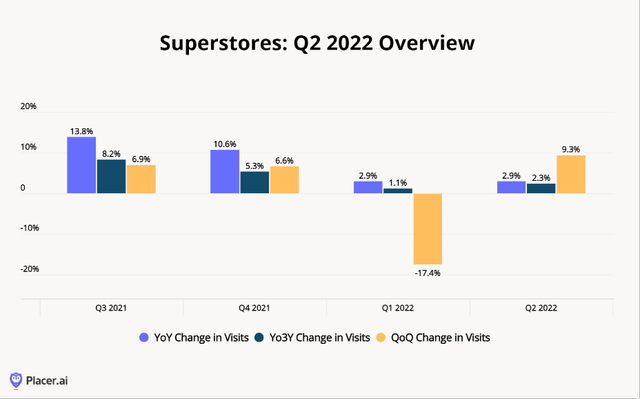

Placer.ai data shows that traffic at supermarkets grew by ~2.9% y/y in H1 2022, poorly correlating with growth of supermarkets’ working capital. In our previous article, we have stated our expectation of lower household mobility and, as a consequence, lower traffic at supermarkets in H2 2022.

Given declining mobility, the merchandising policy in stores (further replenishment of already heavily increased inventories) is not reasonable. While working capital cycles of products such as soft drinks shall remain short, we expect further conservative decline in concentrate sales growth this year.

Another key factor for Coca-Cola, as for any multinational business, remains the impact of foreign exchange rates. Strong appreciation of the dollar against other currencies negatively affects the company’s organic revenue. With the Fed set to keep increasing rates, we believe the impact of strong negative exchange rate differences shall amount to -5% / -6% (% change, y/y) and remain at least till the end of the year. During the last call, the management provided expectations of ~6% negative impact of foreign exchange differences on the company’s revenue in 2022.

Income statement of Coca-Cola looks positive at first glance, but organic growth is largely driven by price increase rather than sales volume. Since we expect population mobility to keep declining, income of Coca-Cola in the H2 is likely to be slightly below expectations of analysts if large supermarkets replenish stocks less frequently. While our original revenue forecast is virtually unchanged given the new data, the ongoing decrease of concentrate sales shall be a warning sign for investors.

Moreover, inflation continues to negatively affect the company’s margin. According to the management, the company hedges most of its costs through floating arrangements with suppliers, but in Q2 the company’s gross margin fell to a record 57.4%, 10 bp lower than in Q2 2020. Given the drop of sales volume, we expect the downward trend in gross margin relative to historical levels to be quite prolonged (till late 2023-early 2024).

Coca-Cola’s long-term prospects

Coca-Cola, as a value benchmark company, has largely exhausted its organic growth potential, the product line is already very broad, and according to various estimates, its share in the U.S. soft drinks market is above 40%. We assume that the situation in other regions is similar, so it shall be quite difficult for the company to grow above the market rate.

The company’s potential is partly offset by its M&A activity. The acquisition of the controlling interest of BodyArmor in November 2021 is a bright example of a business entering new narrow beverage markets (in particular, isotonics) with no need to create anything from scratch.

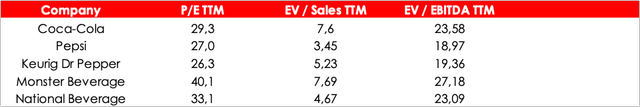

However, the beverage market remains quite expensive, so we do not expect the company to significantly outpace competitors through acquisitions of new brands. The cost of the most recent BodyArmor acquisition was ~$8 bln because Coca-Cola had a non-controlling interest of $2.6 bln prior to acquiring the controlling stake for $5.6 bln. Based on the rough estimate of 2021 annual revenue of isotonic drinks manufacturer ($1.4 bln), it gives a valuation of 5.7x EV/S.

Further growth of Coca-Cola’s revenue and EBITDA is driven by price indexation based on future inflation expectations and conservative increase in sales volume. Our expectations for the company’s long-term revenue growth remain at ~5% y/y. Coca-Cola is a large value company, and we do not expect it to give great surprise to shareholders.

Buy to get dividend

Coca-Cola has always paid decent dividends and is a kind of perpetual bond with certain operational risks.

We expect Coca-Cola to raise its quarterly dividend by 2 cents again in 2023, which corresponds to 4.76% increase y/y, payout ratio – 82%.

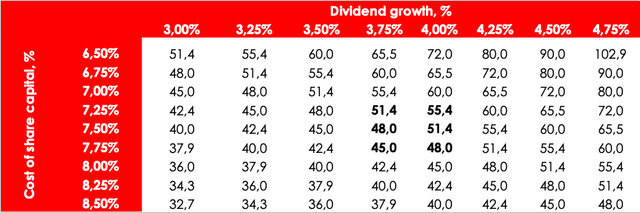

To maintain long-term dividend growth at current levels, Coca-Cola shall start increasing the dividend by 3 cents per quarter instead of 2. We believe this is unlikely over a 5-year horizon, so we assume an average long-term dividend growth to be between 3.75 and 4%.

FTM dividends at current market value give 2.80% yield, which correlates with the 10-year bonds yield. Therefore, based on the dividend valuation method, Coca-Cola looks quite expensive.

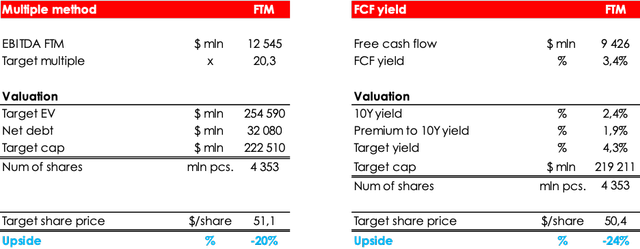

Valuation

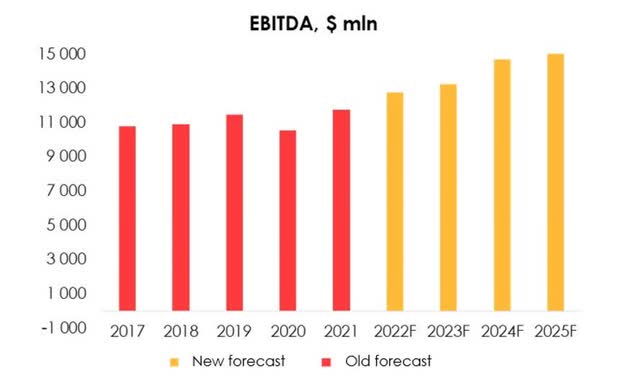

According to our forecast, the average rate of the company’s EBITDA growth shall be 8% over the next 4 years, outpacing revenue growth. It shall be supported by recovery of the company’s gross margin (as inflationary pressure subsides) and a slight decrease in advertising expenses as a total % of revenue.

Based on our forecast, the company’s stock fair value is $50.7/share, so we consider it to be overvalued and maintain SELL rating. Downside – 20%.

The conclusion

We maintain our view on Coca-Cola as overvalued stock. Although the company has a strong market position and high pricing power, moderate growth rate of future financial results does not imply an increase of the target multiple and fair stock value.

We believe that Coca-Cola is now trading with an unjustified premium (~20% of its fair value). The valuation of the company using the dividend method also does not imply significant revision of the target price, so we maintain SELL status. Nevertheless, we do not recommend investors to open short positions due to low volatility of the company’s shares. We recommend those who want to buy it in the portfolio to wait for more favorable market prices.

To manage the position, we recommend paying attention to Coca-Cola’s financial statements and industry surveys (e.g., Placer or Nielsen).

Be the first to comment