Michael Vi

Introduction

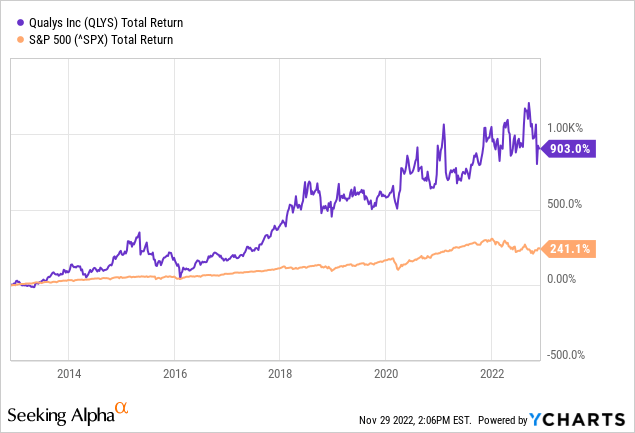

Don’t be fooled by the chart, it’s real. Qualys (NASDAQ:QLYS) has performed quite well over the past decade, averaging 26% per year versus the S&P500’s return of “only” 13%.

Looking at those returns, many people assume the stock is overvalued. But that is not the case with Qualys. Qualys shares are favorably valued compared to competitors.

Qualys’ free cash flow (“FCF”) yield is 41% and has been stable and growing strongly in recent years. 12 analysts have upgraded the stock and earnings per share are expected to grow 12% annually over the next few years. Let’s dig deeper into this GARP stock.

Company Overview

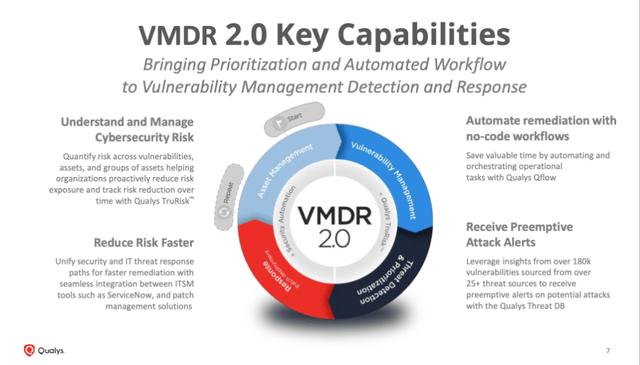

VMDR 2.0 Key Capabilities (Qualys’ 3Q22 Investor Presentation)

Qualys introduced its Vulnerability Management (VM) cloud solution in 2000, one year after the company was founded. Over the years, the package has expanded to include multiple cloud solutions to help customers with IT, security and compliance requirements. The complete suite of cloud solutions includes:

- IT Security: Vulnerability Management (VM), Vulnerability Management, Detection and Response (VMDR), Threat Protection (TP), Continuous Monitoring (CM), Patch Management (PM), Multi-Vector Endpoint Detection and Response (EDR), Certificate Assessment (CRA), SaaS Detection and Response (SaaSDR), Secure Enterprise Mobility (SEM);

- Compliance: Policy Compliance (PC), Security Configuration Assessment (SCA), PCI Compliance (PCI), File Integrity Monitoring (FIM), Security Assessment Questionnaire (SAQ), Out of-Band Configuration Assessment (OCA);

- Web Application Security: Web Application Scanning (WAS), Web Application Firewall (WAF);

- Asset Management: Global Asset View (GAV), Cybersecurity Asset Management (CSAM),

Certificate Inventory (CRI); and

- Cloud/Container Security: Cloud Inventory (CI), Cloud Security Assessment (CSA), Container Security (CS).

Although most revenue comes from cloud solutions, the company also offers solutions through a software-as-a-service (“SaaS”) model with renewable annual subscriptions. Customers pay a fee to access each of the cloud solutions.

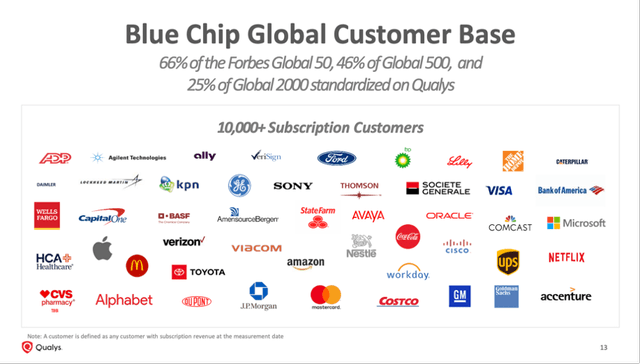

Qualys is experiencing revenue growth from existing customers through renewal and purchase of additional subscriptions, as well as the addition of new customers. More than 10,000 customers worldwide use the Qualys Cloud Platform, and no single customer accounts for more than 10% of total revenue.

Revenue is generated from internal sales to enterprises and government agencies, as well as external sales through channel partners such as Accenture (ACN), BT Managed Security, Cognizant Technology Solutions (CTSH), Deutsche Telekom (OTCQX:DTEGY) , DXC Technology (DXC), Fujitsu, Hindustan Computers Limited (HCL) Technologies, International Business Machines (IBM), Infosys (INFY), Nippon Telegraph and Telephone Corporation (NTT), Optiv, SecureWorks, Tata Communications, Verizon (VZ), Wipro (WIT) and TD SYNNEX Corporation (SNX) (TD SYNNEX).

Qualys has also established strategic partnerships with leading cloud providers such as Amazon Web Services (AMZN), Microsoft Azure (MSFT), and the Google Cloud Platform (GOOGL)(GOOG). About 41% of revenue was generated by channel partners.

Blue chip customer base (Qualys 3Q22 Investor Presentation)

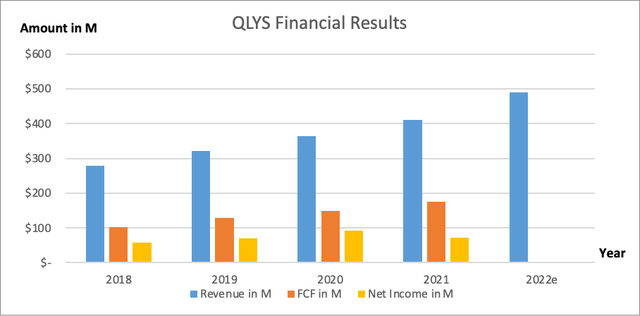

41% Free Cash Flow Margin

Qualys is a true free cash flow margin cow. The 2021 free cash flow margin was a strong 41%. Free cash flow has increased at an average annual rate of 30% over the past 5 years. Its strong growth is due to their cost control and revenue growth. Revenue increased an average of 16% per year over the same period. Net income decreased slightly in 2021 compared to 2020. Over the same five-year period, net income grew at the same annual average as free cash flow growth.

Qualys Financial Results (SEC and Author’s own graphical representation)

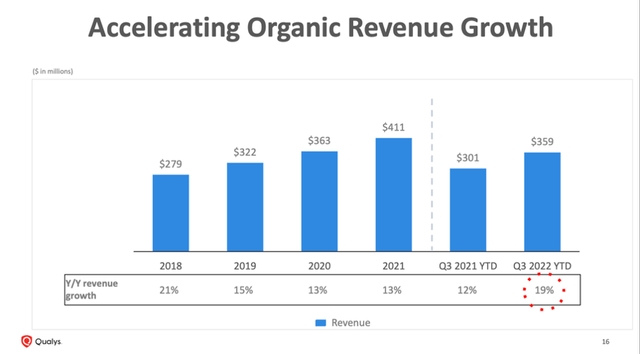

Looking at the most recent quarterly figures, we see strong revenue increase of a whopping 19% year-on-year. Current customers are satisfied with the Qualys Cloud Platform, as current customers are spending 26% more than in the same period last year. Adjusted EBITDA margin remains stable at 46%. Free cash flow margin also remains stable at 40%.

Accelerating organic growth (3Q22 investor presentation)

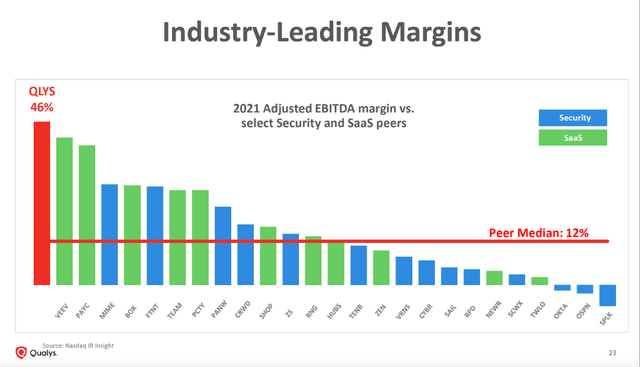

Adjusted EBITDA margins are excellent. Peers in the same sector such as Veeva (VEEV), Paycom Software (PAYC) and others have excellent operating margins, but Qualys outperforms the peer group.

Industry leading margins (3Q22 investor presentation)

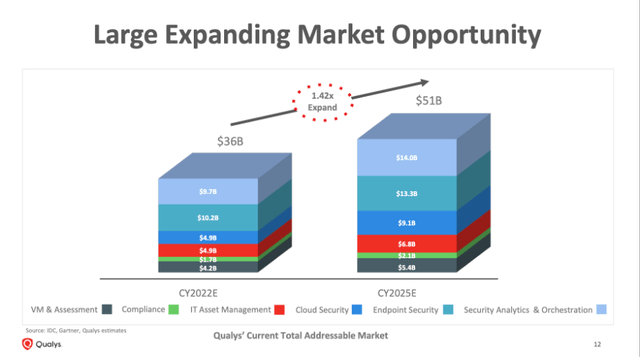

Qualys sees strong growth in their cloud solutions and expects the market to grow 1.42x from CY2022E to CY2025E, representing a CAGR of 12.3%. Qualys does business in a high-growth market and is still a small player, allowing Qualys to capture a large market share.

Large expanding market opportunity (3Q22 investor presentation)

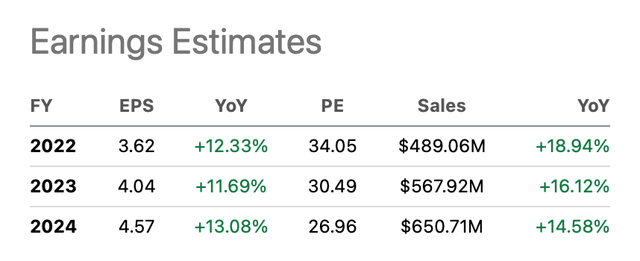

Qualys raises revenue and earnings estimates for fiscal 2022. For fiscal 2022, revenue is expected to be $489 million, a 19% year-over-year growth. Adjusted earnings per share are expected to be $3.62, a 12% year-over-year growth.

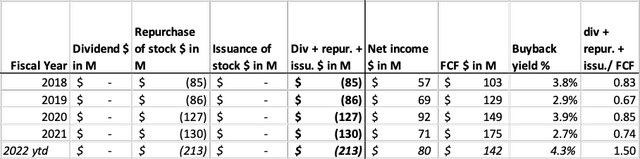

4.3% YTD Buyback Yield

Qualys rewards shareholders with a share buyback package. The high repurchase yield of 4.3% this year has propelled the share price. Comparing share repurchases to free cash flow, Qualys has given more cash to shareholders this year than free cash flow. With the large amount of cash on its balance sheet of over $194M, and no debt, the company has enough liquidity to do business, make corporate acquisitions or return cash to shareholders.

Cash flow highlights (SEC and author’s own calculations)

EV/FCF Looks Favorable Compared To Competitors

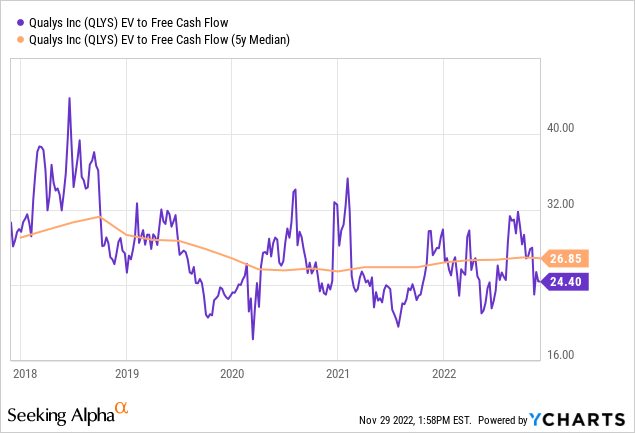

The high net cash position of $194M can be factored into the stock’s valuation. Since Qualys’ FCF margin is over 41% and growing stably, the EV to FCF is an suitable chart to chart the stock valuation.

The EV to Free Cash Flow chart shows that the share’s valuation is favorable on average. There is a small discount to the current share price.

In general, an EV to FCF ratio of 24 means the stock is expensively valued. Still, the outlook for Qualys is favorable, as 12 analysts have revised the stock upward.

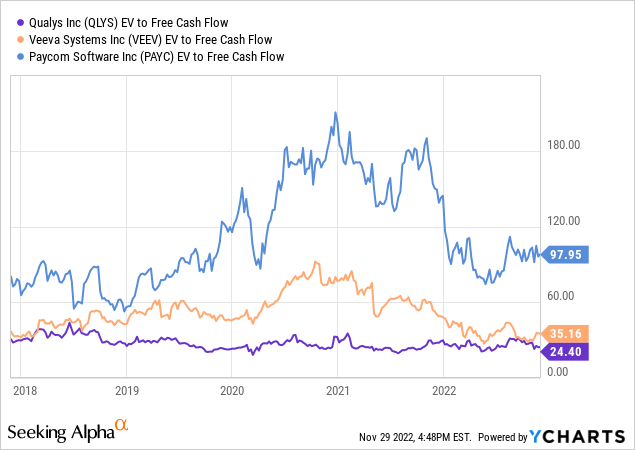

Looking at industry peers like Veeva and Paycom, Qualys’ valuation is very attractive. The adjusted EBITDA of these companies are 40+%, making them all strong cash generating companies.

12 analysts cover Qualys and expect revenue growth averaging 15% per year through fiscal 2024. Earnings per share are expected to rise to $4.57 in the same fiscal year. The forward P/E ratio is 27, which is expensive on average. But given the stable growth in their free cash flows and earnings, a premium on the share price is expected.

Earnings estimates (Seeking Alpha QLYS ticker page)

Key Takeaways

- With 41% free cash flow margin, Qualys is a free cash flow margin cow. Free cash flow increased by an average of 30% annually over the past 5 years.

- Recent quarterly figures show strong year-on-year sales growth of 19%. Current customers spent 26% more than in the same period last year. Adjusted EBITDA margin came in strong at 46%.

- Qualys is in a fast-growing market. The market is expected to grow 1.42x from CY2022e to CY2025e, representing a CAGR of 12.3%.

- Revenue and earnings estimates for fiscal year 2022 have been increased. Revenues for 2022 are expected to increase 19% year-on-year and adjusted earnings per share are expected to increase 12% year-on-year.

- The tax-efficient share buyback will provide an upward price reaction. The current buyback yield of 4.3% ytd is high. The high FCF return will be returned to shareholders.

- The EV to FCF ratio appears in line with the 5-year average, but is considered on the high side. Compared to close competitors with adjusted EBITDA margins of 40+%, Qualys appears favorably valued.

- Increased guidance, favorable secular market trend and favorable valuation compared to competitors make this stock a buy.

Be the first to comment