Win McNamee

Golden Age Of Merger Arb

This is the best opportunity in the best opportunity set in years for merger arbitrage. If you focus on just one, it should be this. If you want a basket of opportunities, here they are:

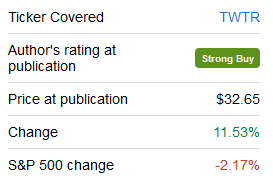

For a background description of the Twitter saga before the suit was filed, please see Elon Musk’s Twitter Options And Yours. I maintain my view of Twitter:

SA

But despite holding onto that view, it is worth updating now that so much has happened. Following Musk’s purported termination but before Twitter filed their suit, my firm sent this letter to Twitter’s board of directors:

|

Rangeley Capital Partners, LP, together with its affiliates (“Rangeley”) is a beneficial owner of Twitter. In addition to owning a substantial stake in Twitter, our firm’s principals are passionate Twitter users. We care deeply about Twitter and our ownership stake in Twitter represents one of our firm’s largest and highest conviction holdings, representing roughly 10% of our firm’s assets. The crux of our thesis is simple: Mr. Musk and Twitter signed a contract, and we think the law is overwhelmingly on Twitter’s side in the Delaware court in enforcing the contract. Mr. Musk’s antics around the deal have been ridiculous and we sympathize with the board’s awkward position – almost from the moment the ink on the deal was dry, Mr. Musk has been in continuous breach of the contract by disparaging Twitter or attempting to place the deal on “hold.” Our largest concern throughout this drama has been that the board would back down from the pending legal fight with Musk. Given that worry, we were thrilled to see the continued communication from Twitter’s board that it is committed to closing the transaction on terms and are prepared to enforce the contract. The primary purpose of this letter is to encourage the board to continue to pursue every legal avenue available to force Mr. Musk to close the deal. If that means a protracted legal battle, you have our support to pursue one, and, based on our talks, we are confident the vast majority of other shareholders would support a legal fight as well. As we get closer to the court date, there will likely be some type of mediation with Mr. Musk to see if this case can be resolved without going to court. While we’d be open to avoiding the uncertainty of the courtroom, we strongly believe Twitter would prevail in court in seeking to enforce the merger agreement on the current terms. However, if the board were to explore settlement options with Mr. Musk, we would strongly favor a token price cut over damages. If the board chooses to settle for damages, we think an appropriate check size would need to be significantly greater than $20 billion to account for the magnitude of what is contractually owed and the damage Mr. Musk has inflicted on the company in this process. A payment for damages would be a tax drag on Twitter and would also partially need to account for Musk’s own 10% holding (as his ownership would let him benefit from 10% of any damage payment). If the board chooses to negotiate a token price cut, we don’t see how anything in excess of a 2-3% reduction would be reasonable based on precedent and the facts and circumstances of this case as we understand them. One last point: we’ve seen a lot of bad takes on the acquisition saga in the public discourse. For example, we saw a former board member suggest Twitter should just “let the whole ugly episode blow over.” Others have argued that “Elon owning Twitter is bad for the public sphere, and employees don’t want to work for him. The board should take whatever fee they can get and remain independent.” We strongly disagree. The board represents owners, and the best thing for shareholders is to aggressively pursue legal action against Mr. Musk to compel him to close. Anything less would be a tacit admission that Musk’s claims about the company’s false reporting are true. We’d also note that this is in the board’s best interest: the current drama with Mr. Musk will be cited as a precedent and taught for decades to come. This case will be the first thing mentioned when recapping the career of each director and will be the first thing shareholders use when considering Twitter’s board members as potential future executives / board members at other companies. It is clear the facts are overwhelmingly on Twitter’s side to enforce the agreement. We are heartened by the board’s serious and professional initial response to Mr. Musk’s childish antics and meritless attempt to terminate the deal. Any potential price cuts or settlements should be negotiated from a position of extreme strength on Twitter’s side – the best outcome for shareholders would be that Mr. Musk is the owner of the company when this process ultimately concludes. If you have questions or would like to discuss our perspective in more detail we would be happy to do so at your convenience. |

We are gratified and relieved to see their vigorous defense of the merger contract. The fact that they are so lightly invested in the company’s stock, a fact that I normally dislike, might actually serve our interests. They don’t have to worry about a big downside if they fight and instead are more motivated to avoid shareholder liability. The best way to do so is to fight and win in Delaware (or reach a conclusion vanishingly similar to a court win). Now that we know Twitter is going to fight, we’re going to find out if the rule of law will prevail.

Who?

Tesla’s (TSLA) Elon Musk is as curious as any of us about the key question in the Twitter (NYSE:TWTR) takeover saga: is he above the law? This isn’t a rhetorical question or a pointed one; it is the literal topic in question with the answer to be determined. So far, my answer is “maybe”. Evidence related to past brushes with the SEC and others indicate that there is a real possibility that the answer is “yes”. But we are going to find out and the future of Twitter and Tesla hang in the balance as we approach an epic showdown on the rule of law.

What?

I prefer to focus on situations no one else is looking at. This one is top of the fold in every newspaper. And yet, there could still be opportunities because so much of the analysis has been so terrible. Musk supporters and detractors largely talk past one another in a low quality debate (see this or any comment section for talking past each other). We ask different questions and reach different answers. Is this about contracts or personalities? Should we focus on memes or precedents? What is the time horizon – the next day’s voting machine or the weighing machine of the deal’s outcome? My interest is in the contract, the precedents, and outcome. For Musk fanatics captivated by his personality, memes, and short-term market hot takes, this will be foreign; we’re both speaking of the same subject but practically speaking in different languages.

When?

Possibly soon. Twitter is pushing for trial in September which is reasonable considering the October walk date.

Where?

This case is heading to Delaware where the vast majority of US corporations are incorporated. Elon may think that this is a joke, but Delaware Chancellors will probably disagree.

Why?

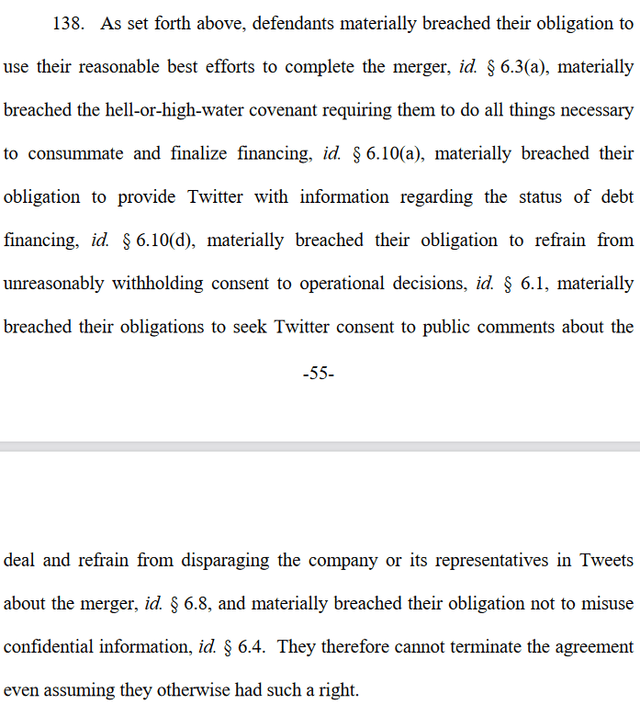

According to Twitter’s complaint:

Having mounted a public spectacle to put Twitter in play, and having proposed and then signed a seller-friendly merger agreement, Musk apparently believes that he – unlike every other party subject to Delaware contract law – is free to change his mind, trash the company, disrupt its operations, destroy stockholder value, and walk away. This repudiation follows a long list of material contractual breaches by Musk that have cast a pall over Twitter and its business.

If the court says this is okay under contract law, then anything is okay. Merging parties should save themselves the bother of writing down their commitment. Relevant recent precedent indicates that it won’t be okay. Just last year Kathaleen McCormick directed a buyer to specifically perform its contractual obligation to close their deal in Snow Phipps Group, LLC v. KCake Acquisition, Inc. The Delaware court generally and McCormick particularly cares about deal certainty and protecting Delaware’s preeminent position as the place where companies go for M&A contract enforcement. She’s more of a contract minutiae person than a Twitter meme person. In Snow Phipps, she carefully reviewed the material adverse change clause and the ordinary course clause. She determined that the contract was in force despite a fact pattern that was a far closer call than it is with Twitter. Leo Strine, formerly of the Delaware court and now of Twitter’s law firm Wachtell Lipton, is the top expert on both merger agreement sections. Material adverse changes such as occurred in Akorn, have to be very clear, where the duration and magnitude of the problems are not even close calls. In that case, said Strine “the seller just sucked” (not the formal decision; his description after retiring from the court). He made similar points on the normal course – you can’t as a seller make a profound change in strategic direction on your own. As an example, you can’t strip assets with a surprise special dividend between signing and closing. But you can fire a few people. These provisions are designed to allocate real risks between buyer and seller, not hand out free options to remorseful buyers.

There is a particular aspect of McCormick resolving all issues in favor of the seller worth focusing on here. She said that there was not material adverse effect. The carve outs protected the seller. There was no ordinary course breach. But most crucially, she said that the buyer’s failure to live up to their efforts duties to obtain debt financing led her to order specific performance of all defendants. The prevention doctrine provides that the non-occurrence of a condition of a duty is excused when a party’s breach by nonperformance materially contributes to that non-occurrence. She could cut and paste each of these findings from Snow Phipps into her findings in Twitter v Musk but with a more egregious fact pattern and an easier call.

Kramer Levin hit on four major implications all of which could be relevant to Twitter:

- A court is unlikely to find an MAE absent a reasonably expected sustained effect on the seller. A steep but transitory decline in sales and/or profitability alone will generally not be enough to establish an MAE. If it is unclear whether a decline in sales and/or profits prior to closing will be prolonged or temporary, buyers should consider that it may be difficult as a practical matter to prove an MAE if, by the time of trial, seller’s financial performance has begun to recover.

- Courts will examine not only the litigation record, but also the process that created that record. In Snow Phipps, the court had visibility into when buyer brought in litigation counsel, and drew the inference that buyer’s subsequent aggressive demands of lenders and pessimistic projections regarding seller’s business were driven by a desire to get out of the deal. Deal participants should be mindful that at trial any pre-closing shift to a litigation posture may become apparent and taken into account by a court in considering whether a party genuinely tried to satisfy its obligations under the purchase agreement.

- The Court of Chancery may apply the prevention doctrine to conditions for the remedy of specific performance and order buyer to perform absent the satisfaction of those conditions if the buyer prevented them from occurring by breaching other obligations under the purchase agreement – even if buyer did not act in bad faith. The purchase agreement in Snow Phipps expressly made specific performance available “if and only if … the full proceeds of the Debt Financing have been funded to Buyer,” and the court determined that buyer prevented that condition from occurring by failing to undertake reasonable best efforts to obtain debt financing, as buyer was obligated to do under the purchase agreement.

- The court may have applied the prevention doctrine in part to prevent an unsatisfactory result when specific performance is unavailable because it is simply impossible to litigate fast enough to save a deal. As we previously reported, Chancellor McCormick denied seller’s motion to expedite in April 2020 because a trial within a month would be unusual under the best of circumstances and a potential public health concern in light of the COVID-19 pandemic. By using the prevention doctrine to save a specific performance remedy, the court provided seller with a meaningful remedy and prevented a breaching buyer from capitalizing on the limits of expedited litigation.

Caveat

Anything could happen. We can look to the contract, the precedents, and the probability-weighted outcomes, but nothing quite like this has ever happened before.

Conclusion

Here’s where the silly phase of the Twitter saga ends.

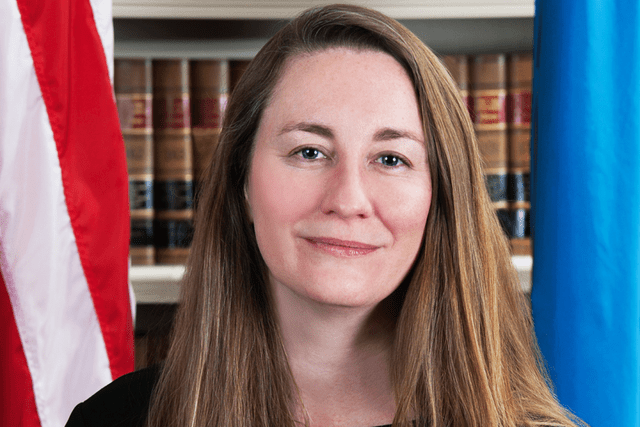

Chanellor Kathaleen McCormick (Delaware Court of Chancery)

Based on the evidence and initial legal filings, Twitter will win in Delaware. They are asking for specific performance, which they will probably get. However, there is another option. Chancellor Kathaleen McCormick could, in effect, rule from the bench. Twitter is asking for a September trial which is reasonable under the circumstances. That would allow for a decision before the October walk date. But instead of waiting to rule in a lengthy decision, she could simply say that there has not been a termination on two grounds that are so clear that they need no further examination. First, the purported issues are curable and therefore not termination events. Secondly, and this is the most important point of Twitter’s case, Elon Musk’s constant merger agreement violations – violations that require no further discovery or debate as they are by their nature right in the open – prevent him from terminating. As Twitter described in their complaint:

That isn’t just enough to win in a lengthy decision sometime in early 2023; it is enough for a judge to essentially decide from the bench. It could allow the parties to reconcile to close by the walk date. Happily the spread is so wide that its attractiveness isn’t all that time-sensitive. $54.20 a year from now is a great outcome for TWTR longs, but this just emphasizes that there are ways that this could go much faster. Whatever the ultimate outcome, the direction could be far clearer and cheerier by the fourth quarter of this year, which is variant with the market’s perception of both the likely timeline and outcome.

The $17.27 net spread offers an 82% IRR if the deal closes by the second quarter of 2023. Oh, and if Musk blows up both his debt and external equity financing for this deal, he’ll have to sell the maximal number of Tesla (TSLA) shares, so they could come under significant pressure.

TL; DR

Buy TWTR.

Be the first to comment