Sundry Photography

From our previous analysis of Qualcomm Incorporated’s (NASDAQ:QCOM) IoT segment, we analyzed the company’s planned expansion into the Arm PC CPU market supported by its acquisition of Nuvia and projected its revenue opportunities based on the share of our ARM CPU market forecasts.

This time for its IoT segment, we looked into the company’s Wi-Fi products as it recently launched its Wi-Fi 7 gen product in 2022. Within the Wi-Fi market, we examined its competitors including Broadcom and MediaTek. To determine whether Qualcomm could maintain its competitive position based on its product performance, we analyzed its Wi-Fi 7 chip specifications against competitors such as Broadcom (AVGO) and MediaTek (OTCPK:MDTKF).

To determine the market opportunity for Wi-Fi 7, we analyzed the evolution of Wi-Fi technologies in the past since 2003 and forecasted the future market growth rate driven by Wi-Fi 7 based on ASP growth, which we obtained based on the average difference between 12 Wi-Fi 5 and 6 chips, and unit shipment growth.

Finally, Qualcomm had also announced its partnership with AMD (AMD) for Wi-Fi 7 with Ryzen CPU-based systems. We determined whether it could provide revenue opportunities to Qualcomm based on its market share in the CPU market and the average prices of Wi-Fi chips.

Qualcomm’s Comprehensive Wi-Fi Chipset Integration and Features

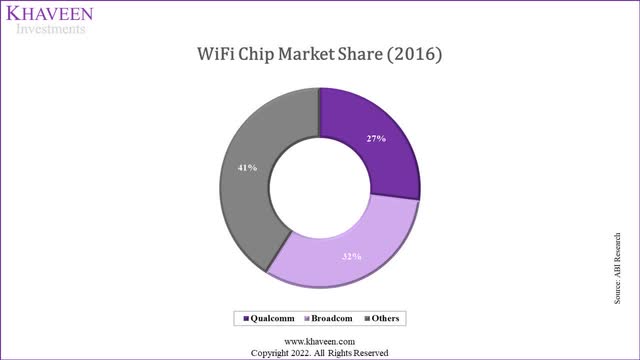

According to ABI Research, both Qualcomm and Broadcom dominated the Wi-Fi chipset market with a combined share of 59% in 2016. However, while we are unable to obtain up-to-date market share data due to limited revenue breakdown by these companies, All The Research stated that Qualcomm had overtaken Broadcom as the market leader following Broadcom’s exit of its Wi-Fi chipset business in 2020.

According to Grand View Research, Wi-Fi 7’s IEEE standard name is 802.11be and operates on a wide range of radio frequencies (2.4GHz, 5GHz, and 6GHz). Furthermore, Wi-Fi 7 offers:

wireless interface capacity up to 33Gbps and a threshold over 10Gbps throughputs.

In February, Qualcomm introduced the FastConnect 7800, its subsystem for Wi-Fi 7. According to Light Reading, Broadcom is:

currently sampling its Wi-Fi 7 chips to early access partners across the retail, enterprise, smartphone, service provider and carrier segments.

Also, the company estimates a nine to 12-month product cycle from when it starts sampling its Wi-Fi solutions. We compared the announced Wi-Fi 7 chipsets by Qualcomm, Broadcom and MediaTek for mobile applications in the table below to determine whether Qualcomm has a performance advantage over Broadcom.

|

Wi-Fi 7 Chips |

Qualcomm FastConnect 7800 |

Broadcom BCM43740 |

MediaTek Filogic 380 |

|

Peak Speed |

5.8Gbps |

11.5 Gbps |

6.5Gbps |

|

Streams |

4 |

4 |

2 |

|

Spectrum Support |

5GHz, 6GHz, as well as 2.4GHz |

5GHz, 6GHz, as well as 2.4GHz |

5GHz, 6GHz, as well as 2.4GHz |

|

Modulation |

4K QAM |

4K-QAM |

4K-QAM |

|

Multi-Link |

Yes |

Yes |

Yes |

|

Bluetooth |

Yes |

Yes |

Yes |

|

Advanced Dual Bluetooth |

Yes |

N/A |

N/A |

|

Snapdragon Sound Technology Support |

Yes |

N/A |

N/A |

|

LE Audio |

Yes |

N/A |

N/A |

|

Qualcomm® aptX™ audio playback support |

Yes |

N/A |

N/A |

|

Security Support |

17 |

5 |

N/A |

Source: Qualcomm, Broadcom, MediaTek, Khaveen Investments

Based on the table above, Qualcomm’s FastConnect 7800 and Broadcom’s BCM43740 chips are nearly similar in all aspects except their peak speed or physical layer (PHY) rate, which refers to:

the maximum speed that data can move across a wireless link between a wireless client and a wireless router” – according to Netgear.

Qualcomm’s product has the lowest peak speed (5.8Gbps) among Broadcom and MediaTek. Broadcom has the highest peak speed of 11.5 Gbps and uses a quad-stream (4×4) setup similar to Qualcomm compared to MediaTek which is dual-stream. When multiple antennae are used, the spatial streaming multiplexing technique is used to transmit and receive signals simultaneously. Having a higher number of spatial streams provide benefits including achieving higher data rates and higher aggregate performance. Though, Qualcomm is similar to Broadcom and MediaTek with similar spectrum support (Wi-Fi frequency bands) and 4K-QAM modulation support, which uses both:

amplitude and phase components to provide a form of modulation that can provide high levels of spectrum usage efficiency,

resulting in higher peak rates. Additionally, all 3 products offer Bluetooth integration and multi-link support (utilizing multiple channels for higher bandwidth).

However, compared to Broadcom and MediaTek, Qualcomm’s FastConnect product has a higher level of integration and advanced features including advanced dual Bluetooth support, which allows sending media audio to two devices simultaneously. It also features integration with Snapdragon Sound Technology which is:

designed to deliver super wideband 32kHz voice quality for richer, clearer calls with greater intelligibility than standard Bluetooth” – according to Qualcomm.

Moreover, it also supports LE Audio, enhancing the performance of Bluetooth audio, as well as Qualcomm’s aptX audio playback support for high-resolution audio, supporting 24-bit music quality over Bluetooth. Lastly, Qualcomm has 17 wireless security support such as WPA3, WPA2 and TKIP.

According to Anshel Sag from Moor Insights & Strategy, a point of differentiation will be cost and time to market which has yet to be disclosed by the companies in early technology claims but expect equipment vendors to unlikely to switch from Qualcomm and Broadcom.

How they aggregate and switch will be a differentiator, and what kind of power levels are required. – Anshel Sag, Analyst at Moor Insights & Strategy

Despite the greater product performance (peak speed) of Qualcomm’s competitors with higher peak speeds, we believe Qualcomm has an advantage over Broadcom and MediaTek in terms of the level of integration and features supported with its FastConnect 7800 including dual Bluetooth, Snapdragon Sound Technology Support, LE Audio, Qualcomm aptX audio playback support as well as stronger Wifi security support. Overall, we believe Qualcomm to have the advantage over Broadcom and MediaTek in Wi-Fi 7 as we analyzed it to be better than these companies in 5 out of the 11 metrics compared. We believe that this bodes well for Qualcomm to maintain its market share leadership in the Wi-Fi market.

Forecasted Market Growth of 14.3% on Average with the Evolution of Wi-Fi Technology

According to Grand View Research, the Wi-Fi chipset market is valued at $12.29 bln in 2021 and was forecasted to grow at a CAGR of 17.3% through 2030 driven by the growing need for “enhanced network, low latency, and bandwidth communications across enterprises.”

|

Wi-Fi |

Year Introduced |

Gap (Years) |

Mobile Networks |

Year Introduced |

Gap (Years) |

|

Wi-Fi 3 |

2003 |

||||

|

Wi-Fi 4 |

2009 |

6 |

2G |

1993 |

|

|

Wi-Fi 5 |

2014 |

5 |

3G |

2001 |

8 |

|

Wi-Fi 6 |

2019 |

5 |

4G |

2009 |

8 |

|

Wi-Fi 7 |

2023F |

4 |

5G |

2018 |

9 |

Source: Rantcell, CNET, How-To-Geek, Khaveen Investments

Based on the table above, we compiled the year of introduction of Wi-Fi technologies and mobile networks and calculated the average period between the years of introduction for each standard. We found that the average period for next-gen Wi-Fi technologies is between 5 to 6 years which is shorter compared to the transition between mobile networks of between 8 to 9 years. However, with Wi-Fi 7 expected to be launched in 2023, this would translate to a period of 4 years from Wi-Fi 6.

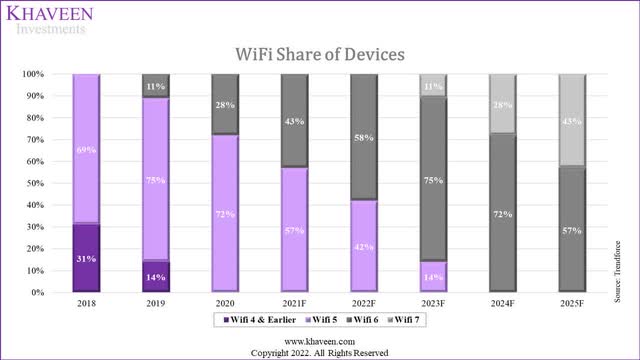

Trendforce, Khaveen Investments

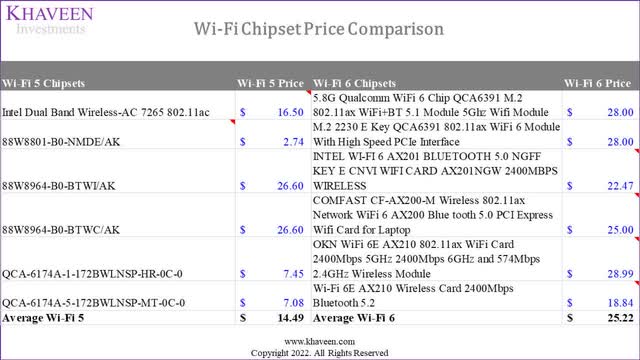

Based on the forecast by Trendforce, the share of Wi-Fi 6 devices was estimated to have increased to 43% in 2021. However, in terms of value, the Wi-Fi 6 segment accounted for the largest share of more than 80.0% in 2021 according to Grand View Research, which indicates higher pricing for Wi-Fi 6 compared to Wi-Fi 5. We further examined this by comparing the average prices of 6 Wi-Fi 5 and Wi-Fi 6 chips each. Also, we further extended the forecast of the Wi-Fi share of devices through 2025 by Trendforce.

As seen above, the average price of Wi-Fi 6 chipsets is higher than Wi-Fi 5 by 74% based on price data of chips collected from various online sites. Then, we projected the growth of the Wi-Fi chipset market based on ASP and unit shipment growth. We assumed the ASP growth factor to be 1.74 based on our obtained average price difference and forecasted the shipment growth based on the long-term PC market forecast CAGR of 3.3%.

|

Wi-Fi Revenue Growth Projections |

2022F |

2023F |

2024F |

2025F |

|

Share of Wi-Fi 7 |

0% |

11% |

28% |

43% |

|

Share of non-Wi-Fi 7 |

100% |

89% |

72% |

57% |

|

Wi-Fi 7 Share Increase |

11% |

17% |

15% |

|

|

Wi-Fi 7 ASP Increase Factor |

1.74 |

1.74 |

1.74 |

|

|

ASP Increase Projections |

8.1% |

12.6% |

11.1% |

|

|

Shipment Growth |

3.30% |

3.30% |

3.30% |

|

|

Total Wi-Fi Growth |

11.7% |

16.3% |

14.8% |

Source: Trendforce, IDC, Khaveen Investments

All in all, we expect the growth of the Wi-Fi market to be driven by the transition towards next-gen Wi-Fi technologies with the upcoming Wi-Fi 7. We projected the growth of the Wi-Fi market based on ASP and unit shipment growth with a 3-year forward average of 14.3% which we expect to benefit Qualcomm’s IoT segment growth.

Partnership with AMD To Provide $914 mln In Revenue Opportunities by 2025

In May 2022, Qualcomm announced a partnership with AMD:

to optimize the Qualcomm® FastConnect™ connectivity system for AMD Ryzen™ processor-based computing platforms, starting with AMD Ryzen™ PRO 6000 Series processors and the Qualcomm® FastConnect™ 6900 system.

The company stated that with FastConnect 6900, AMD Ryzen-powered business laptops feature WiFi 6 and 6E connectivity. PC makers such as Lenovo (OTCPK:LNVGY) and HP (HPQ), (23.6% and 20.5% market share) were stated as examples of customers using the Ryzen CPUs with Qualcomm FastConnect.

Our enterprise customers demand the advanced manageability and superior Wi-Fi connectivity AMD Ryzen™ PRO 6000 Series processors with FastConnect 6900 offer, – Tom Butler, executive director, IDG Commercial Portfolio at Lenovo.

However, previously in 2021, AMD also announced that it was entering a collaboration with MediaTek to co-engineer Wi-Fi chipsets with MediaTek with its AMD RZ600 Series Wi-Fi 6E modules containing MediaTek’s new Filogic 330P chipset to power AMD Ryzen-series laptop and desktop PCs in 2022.

Therefore, we estimated the revenue opportunity for Qualcomm with its partnership with AMD for Wi-Fi chipsets. Firstly, we estimated the number of Wi-Fi chipset shipments for Qualcomm leveraging its AMD partnership based on the average of our previous forecast of AMD’s market in desktop and laptop markets with the PC market shipments and share of x86 PCs from our previous analysis on Qualcomm. We based our forecast on the PC market growth by IDC which is expected to decline by 8.2% in 2022 but with a long-term CAGR of 3.3%. Then, we obtained the revenue opportunity by multiplying its shipments with Qualcomm’s market share of Wi-Fi chips (27%) and calculating the average price of a total of 6 Wi-Fi 6 chipsets at $25.20.

|

Qualcomm Revenue Opportunity |

2021 |

2022F |

2023F |

2024F |

2025F |

|

PC Shipments (‘mln’) (‘a’) |

342.00 |

313.96 |

324.32 |

335.67 |

347.42 |

|

ARM CPU Share |

7.00% |

9.00% |

11.70% |

15.10% |

19.50% |

|

x86 CPU Share (‘b’) |

93.00% |

91.00% |

88.30% |

84.90% |

80.50% |

|

AMD x86 market share (‘c’) |

35.0% |

35.1% |

35.2% |

35.4% |

35.5% |

|

Qualcomm Wi-Fi share (‘d’) |

27% |

27% |

27% |

27% |

27% |

|

Average Wi-Fi chipset price ($) (‘e’) |

25.2 |

25.2 |

27.3 |

30.7 |

34.1 |

|

ASP Growth % |

– |

– |

8.1% |

12.6% |

11.1% |

|

Revenue Opportunity (‘f’) |

– |

– |

742.6 |

835.0 |

913.7 |

*f = a x b x c x d x e

Source: Qualcomm, IDC, ABI Research, Khaveen Investments

Therefore, we believe the partnership with AMD could benefit Qualcomm as it strengthens its position in the CPU market. Based on the table above, we estimated a revenue opportunity of $913.7 mln for Qualcomm by 2025 with its partnership for Wi-Fi chipsets.

|

Qualcomm Wi-Fi Revenue Forecast ($ mln) |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Wi-Fi Revenue |

632 |

741 |

828 |

963 |

1,105 |

|

Growth % |

17.30% |

11.71% |

16.29% |

14.76% |

|

|

AMD Partnership |

742.6 |

835.0 |

913.7 |

||

|

Total Estimated Wi-Fi Revenue |

632 |

741 |

1,571 |

1,798 |

2,019 |

|

Growth % |

17.30% |

111.87% |

14.47% |

12.29% |

Source: Qualcomm, ABI Research, Khaveen Investments

To forecast Qualcomm’s total Wi-Fi revenue growth, we first estimated its Wi-Fi revenue from the company’s investor presentation slides which are around 12.5% based on its revenue breakdown for its IoT segment. We based our forecast in 2022 on the market forecasted CAGR of 17.3% and forecasted its growth beyond 2023 on our projections of the Wi-Fi market driven by the shift to Wi-Fi 7 from the point above. Additionally, we accounted for the estimated revenue opportunity with the AMD partnership to derive the total Wi-Fi revenue growth for the company at a 3-year forward average of 46.2% until 2025.

Risk: Competition Within Wi-Fi Market

According to IDC, besides Qualcomm and Broadcom, other companies such as MediaTek and Intel (INTC) will have Wi-Fi 7 chipsets and expects ON Semiconductor (ON) and Renesas (OTCPK:RNECY) to join in too. Thus, we expect the company could face increasing competitive threats if more companies develop and launch Wi-Fi 7 chipsets to compete against the company. This could affect Qualcomm’s revenue growth and market share. However, as mentioned, we believe Qualcomm has a comprehensive Wi-Fi 7 product with various integration and advanced features supported. Also, the IDC noted that “Broadcom and Qualcomm have been the most aggressive and target both clients and access points,”. Thus, we expect Qualcomm to remain competitive in the Wi-Fi chipset market and could capitalize on the upcoming Wi-Fi 7 transition.

Valuation

We updated our revenue projections from our previous analysis of the company with an estimate of the company’s Wi-Fi revenue and revenue opportunity with its AMD partnership. For its other IoT segment revenue, we continued to base its growth on the market forecast CAGR of 14.9% but tapered down by 2% per year as a conservative estimate. This resulted in an increase in our revenue projection at a 5-year forward growth average of 15.9% compared to 15.5% previously.

|

Revenue Forecast ($ mln) |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Handset |

10,461 |

16,830 |

24,614 |

25,128 |

28,011 |

30,757 |

|

Growth % |

6.82% |

60.88% |

46.25% |

2.09% |

11.48% |

9.80% |

|

Total Estimated Wi-Fi Revenue |

632 |

741 |

1,571 |

1,798 |

2,019 |

|

|

Growth % |

17.30% |

111.87% |

14.47% |

12.29% |

||

|

Other IoT |

4,424 |

5,083 |

5,739 |

6,364 |

6,931 |

|

|

Growth % |

14.90% |

12.90% |

10.90% |

8.90% |

||

|

Total IoT |

3,026 |

5,056 |

5,825 |

7,310 |

8,162 |

8,950 |

|

Growth (%) |

10.92% |

67.09% |

15.20% |

25.50% |

11.67% |

9.65% |

|

RFFE |

2,362 |

4,158 |

4,524 |

4,850 |

5,184 |

5,366 |

|

Growth (%) |

59.81% |

76.04% |

8.80% |

7.20% |

6.90% |

3.50% |

|

Automotive |

644 |

975 |

1,393 |

1,991 |

2,845 |

4,065 |

|

Growth (%) |

0.63% |

51.40% |

42.90% |

42.90% |

42.90% |

42.90% |

|

QTL |

5,028 |

6,320 |

6,920 |

7,368 |

8,014 |

8,715 |

|

Growth % |

9.52% |

25.70% |

9.50% |

6.47% |

8.76% |

8.76% |

|

QSI |

36 |

45 |

57 |

71 |

90 |

113 |

|

Growth (%) |

-76.3% |

25.0% |

25.92% |

25.92% |

25.92% |

25.92% |

|

Arm CPU Revenue |

487 |

1,170 |

2,380 |

3,798 |

||

|

Growth (%) |

140.49% |

103.36% |

59.61% |

|||

|

Reconciling Items |

1,974 |

182 |

182 |

182 |

182 |

182 |

|

Total |

23,531 |

33,566 |

44,001 |

48,070 |

54,868 |

61,947 |

|

Growth (%) |

-3.06% |

42.65% |

31.09% |

9.25% |

14.14% |

12.90% |

Source: Qualcomm, Khaveen Investments

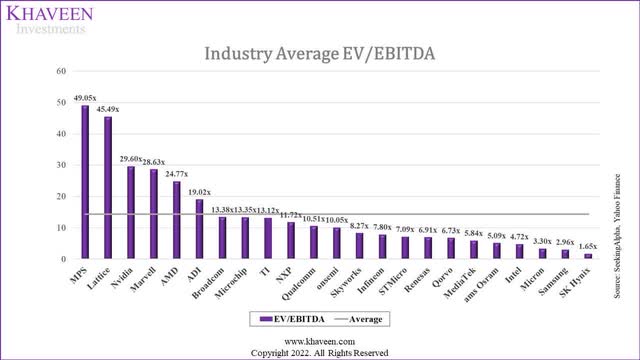

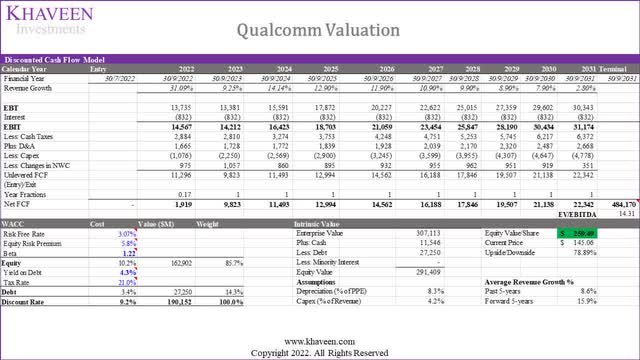

We continued to value the company with a DCF analysis as we expect it to continue generating positive FCFs. We updated the average chipmaker EV/EBITDA which declined to 14.31x.

Seeking Alpha, Yahoo Finance, Khaveen Investments

Based on a discount rate of (9.2%), our model shows its shares are undervalued by 78.9%.

Verdict

To conclude, we analyzed Qualcomm following its recent announcement of its new Wi-Fi 7 products which we determined that while it lags behind competitors such as Broadcom and MediaTek in terms of performance with lower peak speeds, Qualcomm’s product has a higher level of integration and advanced feature support which we believe is its benefit. Moreover, we expect Qualcomm to benefit from the Wi-Fi chipset market growth and forecasted its growth based on the ASP and unit shipment growth at a total 3-year forward average growth of 14.3%. Finally, we believe the company’s partnership with AMD for Wi-Fi chipsets could be positive for the company with an estimated revenue opportunity reaching $914 mln by 2025. Overall, we rate the company as a Strong Buy with a target price of $259.49 which is lower compared to our previous analysis despite a higher revenue growth due to a lower EV/EBITDA average for our terminal value.

Be the first to comment