CHUNYIP WONG

Exxon Mobil (NYSE:XOM) is an American multination oil and gas company back up to an almost $400 billion market capitalization. The company now has a dividend yield of almost 4% and numerous other avenues to generate shareholder returns. As we’ll see throughout this article, cash flow is king, and Exxon Mobil’s cash flow will enable dramatic increases in shareholder rewards.

The Market

Exxon Mobil is focused on outperformance as the company continues to operate in a difficult market.

Exxon Mobil Investor Presentation

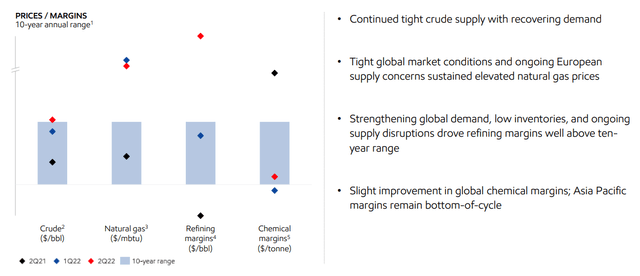

The company had strong margins in the most recent quarter. The company had upper end margins for crude and middle-end margins in the chemical markets. It saw margins substantially above the 10-year range for both natural gas and refining. The continued strength in the markets will enable additional cash flow.

The market remains volatile. The Ukraine-Russia conflict continues putting pressure on prices. Europe continues to attempt to drastically move demand away from Russia as a result. Countries continue to develop in Asia and Africa increasing their demand for energy. Supply investment remains low as the long-term demand remains in question.

A volatile market and how that plays out for Exxon Mobil remains to be seen. However, the company has some of the strongest assets and lowest breakeven in the industry.

Exxon Mobil’s Paid Out Investments

Exxon Mobil took advantage of massive investments during a difficult time period.

Exxon Mobil Investor Presentation

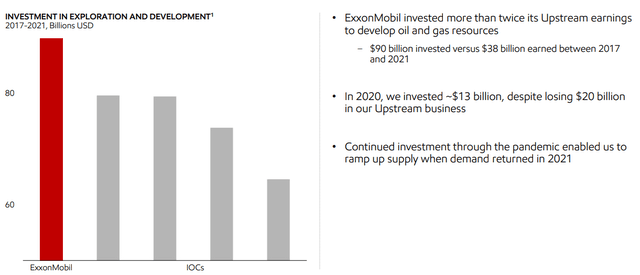

Exxon Mobil spent almost $100 billion between 2017 to 2021 or more than double its upstream earnings as the company worked to develop a massive portfolio of assets such as Guyana. For example, in 2020 despite losing $20 billion, the company invested $13 billion. In the same way Chevron invested massively before the mid-2014 crash.

That massive investment means that now that prices are incredibly high, the company stands to generate incredibly high returns. Substantially higher returns than the majority of the companies peers which didn’t invest the same way.

Exxon Mobil 2Q 2022 Results

Exxon Mobil generated incredibly strong 2Q 2022 results on the basis of a profitable market.

Exxon Mobil Investor Presentation

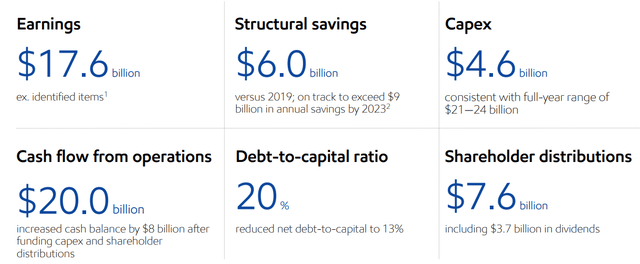

Exxon Mobil generated strong 2Q 2022 results on the back of a blockbuster quarter. The company had $20 billion in CFO and $17.6 billion in earnings. Even with a full year expected capital investment at a midpoint of $22.5 billion, the company’s FCF for the quarter was still above $15 billion, or $60 billion annualized.

That’s a FCF yield of almost 16% for 2022 that’s expected. The company distributed $7.6 billion in shareholder distributions, or an almost 8% annualized yield which included $3.7 billion in dividends and almost $4 billion in share buybacks. However, even that and capital spending, it still added $8 billion to the cash position.

These incredibly strong results mean that concerns about the company’s debts are long behind it.

Exxon Mobil Outlook

Exxon Mobil has the ability to generate even stronger earnings in the coming quarters.

Exxon Mobil Investor Presentation

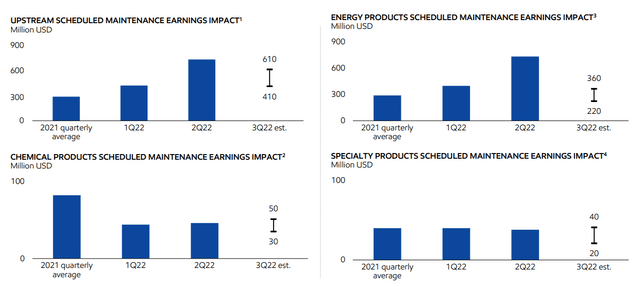

Exxon Mobil had volatile expenses in the 2Q 2022, however, many of these expenses are expected to come down in the upcoming quarters. At the same time, so far prices have remained strong. That’ll enable the company to increase earnings in the upcoming quarters versus prior quarters. The reduction in maintenance alone is expected to save the company $1 billion.

The company expects 3Q 2022 volume to remain flat as a result of divestments. However, the company has recently found 2 new discoveries in Guyana and hundreds of thousands of barrels in production will come up in the next several years. The company’s outlook will continue to enable growing production.

Exxon Mobil Shareholder Return Potential

Exxon Mobil has the ability to generate massive shareholder rewards.

The company has the ability to continue its dividend with an annualized yield of almost 4%. At the same time, the company’s share buyback rate is almost 5%. We would like to see the company accelerate its share repurchases and continue to invest in its business before increasing its dividend further. Paying down debt to save on interest would also be prudent.

At the same time, the company hasn’t made any big investments in a substantial amount of time. Plenty of other companies remain cheap and this would be a good time for the company to make a substantial investment. Regardless of how the company spends the money, we expect high-single digit direct shareholder returns.

The company’s massive cash flow generation in a volatile market helps to highlight how the company is a valuable investment.

Thesis Risk

Exxon Mobil is an integrated oil producer meaning that it benefits from not only high oil prices but also from higher downstream prices. The company saw that with the recent strength in downstream prices. The company’s largest risk is pricing weakness especially in upstream crude. So far, the company has remained profitable, however, historically that’s been known to change.

Investors should pay close attention not only to market prices, but trends. A recession could quickly drive down prices.

Conclusion

Exxon Mobil has a unique and impressive portfolio of assets. The company spent $10s of billions on capital growth during a difficult time for the markets, and now the company is reaping the rewards of those significant investments. Its most recent FCF annualized means a double-digit dividend yield for the company.

The company is generating future shareholder rewards through a variety of avenues. It’s continuing to invest heavily in capital growth. It has an almost 4% dividend yield. It has an almost 5% share buyback yield. And it’s adding more than $30 billion to its bottom line. It’s debt yield is manageable. Regardless of how the company spends money it generates high shareholder rewards.

Be the first to comment