georgeclerk

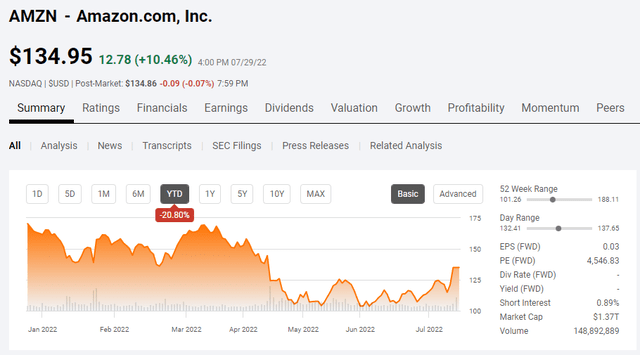

Amazon (NASDAQ:AMZN) has accomplished what few companies are capable of. Only a handful of companies have the ability to generate $100 billion of revenue annually, and AMZN has just recorded its 7th consecutive quarter of generating $100 billion+ of revenue. AMZN delivered a large revenue beat of $2.04 billion on the top line, coming in with $121.2 billion of revenue in Q2, which was a 7.2% YoY increase. AMZN guided for $125-$130 billion of revenue in Q3, while the combination of forward guidance and AWS growth negated its bottom line numbers. I have been bullish on AMZN for years, I have been a shareholder for years, but the Q2 numbers didn’t eliminate my concerns addressed in my previous article. I love what I see on the top line, but AMZN’s margins and cash flow statement are concerning to me.

Tearing through the numbers and highlighting my concerns

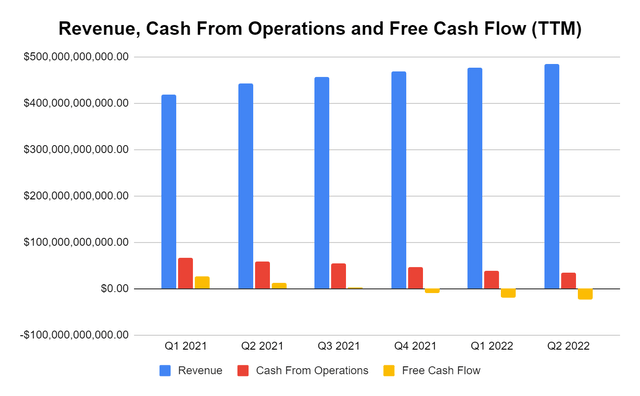

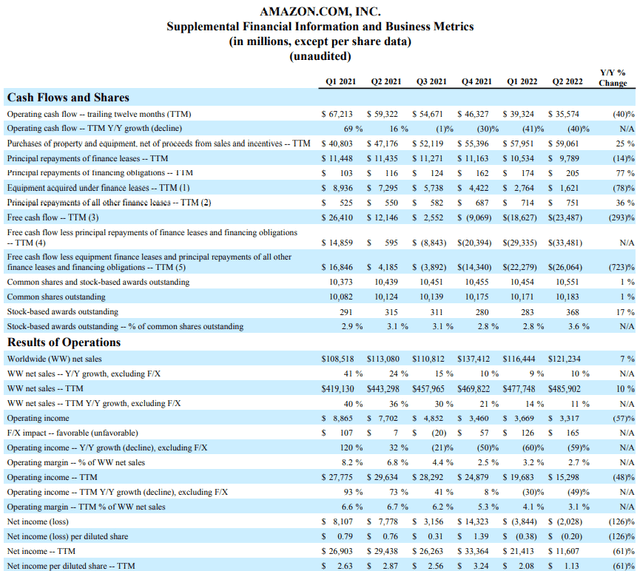

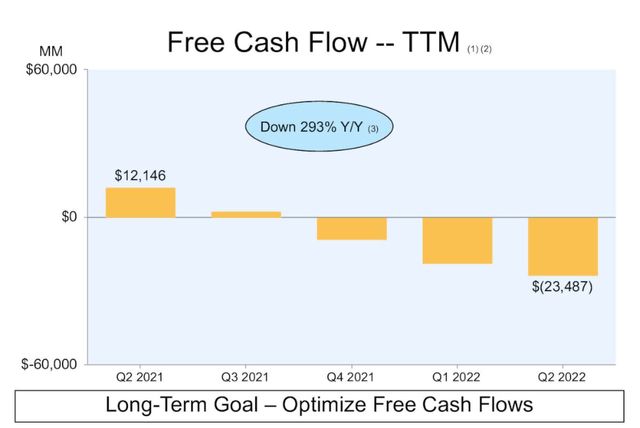

The first concern I have can be found in AMZN’s cash flow statement. In Q1 of 2021, AMZN reported stellar numbers up and down the line throughout its cash flow statement. AMZN reports each of these numbers on a trailing-twelve-month (TTM) basis. AMZN generated $67.21 billion of cash from operations, and its free cash flow (FCF) was $26.41 billion. AMZN’s total TTM revenue in Q1 of 2021 was $419.13 billion. AMZN had a 16.04% margin in cash generated from operations and a 6.3% FCF margin. We know AMZN runs a capital-intensive business, and their margins will never look like a SaaS company, which is fine. What concerns me is that over the next 5 quarters, AMZN’s revenue continued to increase, but its margins, cash from operations, and FCF decreased.

Just as AMZN’s revenue increased QoQ on a TTM basis, its cash from operations and FCF declined on a QoQ basis. Over the span of 5 quarters, AMZN’s revenue increased by $66.77 billion (15.93%) while its cash from operations declined -$31.64 billion (-47.07%), and its FCF declined by -$49.9 billion (-188.93%). While the Street is celebrating AMZN’s top line growth, I’m not too fond of its statement of cash flows. AMZN’s ability to generate cash from operations has been cut almost in half while its revenue increased by more than what many companies generate annually. The other aspect that is concerning is that this occurred while AMZN increased its capital expenditure spend. Just in AMZN’s purchases of property and equipment, AMZN’s expenses increased from $40.8 billion to $59.06 billion ($18.26 billion, 44.75%). AMZN continued investing in its business, drove revenue, and its cash-generating ability diminished.

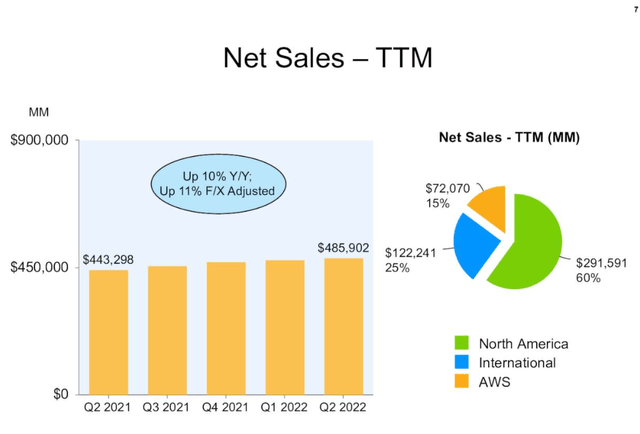

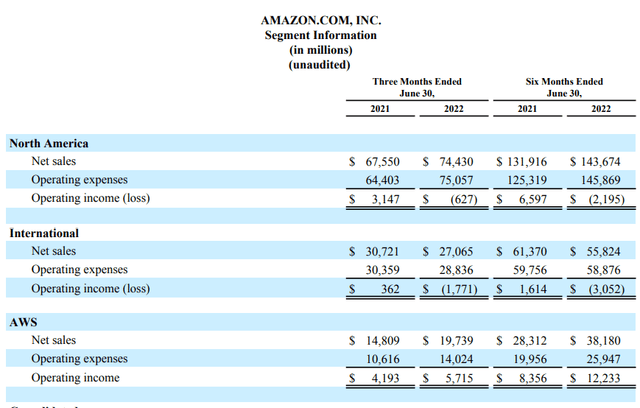

My next concern is that AWS generated every dollar of operating income in Q2. AMZN breaks its revenue up into 3 segments, North America, International, and AWS. On a TTM basis, AWS represents 15% of AMZN’s revenue.

Looking at Q2, North America’s revenue increased by $6.88 billion (10.18%), but that didn’t outpace expenses as the cost of revenue increased by $10.65 billion for this segment. The North American segment lost -627 million in Q2 on an operating income basis. This is a QoQ decline of -$3.77 billion. On the international side, AMZN’s revenue declined QoQ by -$3.66 billion (-11.9%). While their costs also declined, they still exceeded the revenue generated, and AMZN’s operating income was -$1.77 billion from the international segment.

The saving grace in Q2 was AWS. AWS grew its revenue QoQ by $4.93 billion (32.1%) as it generated $19.74 billion. AWS drove $5.72 billion of operating income to AMZN’s bottom line, which was an additional $1.52 billion (36.3%) compared to Q1. This seems to have been enough to negate the bottom line concerns across the market, but the reality is that AMZN’s largest business segments lost money in Q2 and AWS carried the ship. Depending on how you look at it, this can be good, or it can be bad. On the one hand, AWS is growing rapidly and is a profit center, but on the other, AMZN has been increasing its CapEx; its revenue has ultimately grown, but its margins have eroded due to its main business no longer being profitable.

Brian Olsavsky, AMZN’s CFO, addressed many factors that have impacted its operations on the Q2 earnings call. In Q2, incremental costs were in line with expectations, coming in at approximately $4 billion. Higher fuel, trucking, air, and ocean shipping costs created inflationary pressures, similar to what AMZN experienced in Q1 and Mr. Olsavsky expects these elevated costs to continue in Q3. AMZN’s fixed cost leverage was consistent with Q1, creating a negative YoY impact. Fixed cost leverage was derived from an unfavorable comparison to very high holiday level utilization rates seen in the first half of 2021 and decreasing volumes off the Q4 peak that was seen in the 1st half of 2022. On the bright side, AMZN sees the fixed cost impacts to be alleviated in the 2nd half of 2022 due to AMZN growing into its capacity and slowing future network capacity additions.

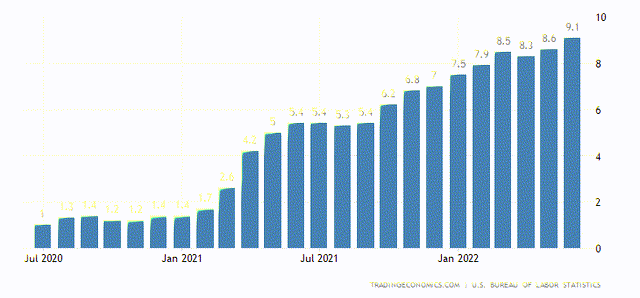

Mr. Olsavsky’s comments are both promising and alarming. On one side, AMZN is becoming more efficient as they improved delivery route density and package deliveries per hour. The uncertain variables that inflation creates is a negative as AMZN sees these negative impacts carrying over into Q3 at a minimum. AMZN has always figured out how to succeed on an operational level, but inflation is an aspect that can’t be controlled, and it is adding tremendous pressure to AMZN’s margins.

In Q1 2021, the average rate of inflation was 1.9%, and the prior 6 months leading up to Q1 ranged from 1% to 1.4%. AMZN’s cash from operations was $67.21 billion on a TTM basis in Q1 2021, which was in a low inflationary period. Each quarter cash from operations declined QoQ sequentially on a TTM basis as inflation rose. Q3 2021, on a TTM basis, was the last time AMZN generated positive FCF on a TTM basis with $2.55 billion. Inflation ranged from 1.2% – 5.4%, and the average rate of inflation throughout the Q3 2021 TTM period was 3.35%. Does this mean the average rate of inflation needs to be 3.35% for AMZN to be FCF positive? Not necessarily, but I believe it’s a strong indication that inflation could be an ongoing problem for AMZN’s FCF into Q4 and possibly 2023.

Conclusion

While I am critical of the numbers, there was a lot I liked in Q2, and I still think the future is bright for AMZN. I am bullish on Amazon Ads, AWS, and ultimately its core businesses running at a positive operating margin. AMZN has invested heavily in entertainment and its e-commerce business which should continue driving revenue QoQ. AMZN is a cost-intensive business, and it could be a rocky road on the bottom line for several quarters until inflation subsidies. The combination of AWS’s forward growth and AMZN’s core businesses running in the black could set the stage for substantial future gains. When that occurs is another story. It’s hard to drown out the cash flow statement just because of the top line growth. Right now, I think AMZN is a hold due to its inability to generate FCF and its ongoing trend of declining cash from operations. This doesn’t mean that AMZN wouldn’t rally if a bottom was reached in the middle of June and the markets form a sustainable rally going into the back half of 2022. AMZN has never had an issue with execution, and many of its cash flow issues are related to higher costs. I think AMZN is a hold for the time being, and if shares end up selling off, they could reach an attractive buy point.

Be the first to comment