David Becker/Getty Images News

Qualcomm (NASDAQ:QCOM) had been working on diversifying its revenue streams by pushing into markets outside of mobile handsets since Cristiano Amon took the reins. To this end, I contended after FQ1’s earnings, both FQ2 and FQ3 would be materially higher than analysts estimated, as the company’s divisions outside of handsets will offset any handset seasonality. As it turns out, the company blew away not only analysts’ estimates but mine also, providing an FQ3 guide of $10.9B revenue versus my $10.36B estimate. It’s proving its diversification strategy is running at full throttle with no misfires. But then fuel, once removed from the tank, got injected back into the equation as rumors began circulating about Apple (NASDAQ:AAPL) failing to succeed with its self-supplied 5G modem – the same modem division Intel (INTC) divested. Therefore, the company’s momentum with diversification, along with confirmation it’s the king of 5G, places Qualcomm at the top of the semiconductor heavyweights list for growth.

Why Diversification And Supreme 5G Matters

Not only does Qualcomm continue to prove its diversification initiative is moving along better and stronger than analysts have postured, but the affirmation of producing a quality 5G modem is not an easy task puts the company in the most envious spot for an investor. The beauty is the market has cut down the share price and valuation in the face of consistent and building growth, expecting a cut to revenue once Apple rids itself of Qualcomm’s modems. This makes the stock very attractive and is at the top of my semiconductor list outside of more volatile stocks like Micron (MU) or Nvidia (NVDA).

But let me back up and flesh out some of the diversification a bit and then jump into Apple’s modem struggles for a few minutes.

Diversification Continues

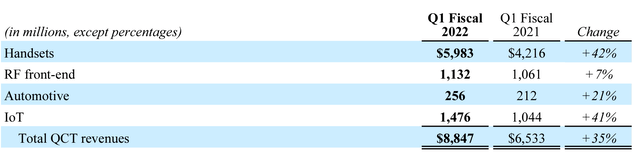

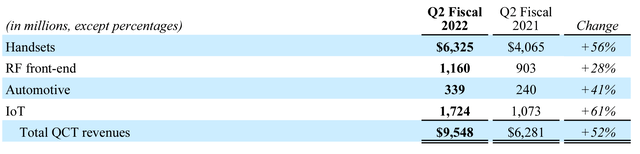

As I mentioned several months ago, Qualcomm has continued to push into IoT and Automotive at accelerating rates. As a result, IoT continues to be the company’s fastest-growing segment and is the second largest revenue center behind Handsets. Moreover, for two quarters in a row, IoT has grown as fast or faster than any of the other segments.

Qualcomm’s FQ1 ’22 Earnings Release

Qualcomm’s FQ2 ’22 Earnings Release

While small, Automotive isn’t out of the race. It has been growing faster than RFFE, a segment primarily dealing with handsets. I expect this trend to continue in FQ3 as the race for a more connected “smartcar” comes to the forefront of mainstream living.

I’ll be attacking the diversification away from mobile and into other arenas after the company reports FQ3 next Wednesday. But, for now, I want to get into the Apple modem initiative and what it means for Qualcomm.

Diversifying While Remaining King

Diversifying a company’s portfolio is typically more than not a positive strategy, especially when a company can easily apply its IP (intellectual property) to another market. Qualcomm recognized this as the only supplier with the full stack for 5G wireless connectivity. As I explained above, it’s working out bullishly for the company in real-time. But it never hurts to be affirmed as the king in what you initially did the most business, especially when the market no longer considers it.

Enter Apple’s strategy.

Apple bought Intel’s modem division mid-2019 and closed the deal before year-end. But Apple, who I typically expect to make sound business decisions, didn’t make a great choice here. And that’s not just my conjecture. All you have to do is ask Intel what they thought about its modem division:

Intel admitted that it sold its smartphone modem business to Apple at “a multi-billion dollar loss,” according to court documents unearthed by Reuters. Intel added that rival chipmaker Qualcomm’s patent licensing practices “strangled competition” and effectively forced it to exit the market.

Apple was buying an uncompetitive modem division, a division it wanted to use to replace Qualcomm’s modems. Intel admitted it couldn’t compete and was “forced out” of the market. That’s called starting off on the wrong foot.

However, sometimes old divisions are made new under new leadership. But, this technology has become nearly impossible without prior knowledge in combination with new technology and patents. But, it’s an uphill battle no matter who you are. However, having a solid foundation like Qualcomm, which owns the entire stack, gives it an edge.

Apple nonetheless set forth on this journey to internalize some of the components it outsources to save on costs. I can respect that, especially when the product is its main bread and butter, and cutting costs can improve the bottom line and drive shareholder returns.

However, the investment may be worse than the return.

As it turns out, 5G requires very close interconnectivity between the front-end systems and the modem. For Qualcomm, it’s nearly one and the same as it named its 5G modem package the “5G modem-RF system.” RF and modem were so tightly linked it named the package after both components.

This means Apple’s work is cut out for it, requiring not just a modem of its own but the ability to interact with that modem, foremost getting the signal to the modem without issue.

This brings me to my next point, and likely the most important one.

Apple’s misstep was trying to replace the number one 5G modem system. Please don’t misunderstand me here: anyone can unseat the incumbent. But this creates a requirement to go from the best connectivity component in your prized product to your own while maintaining the quality your customers have come to know. The new modem must work as well or better than the one Apple is replacing – as many or fewer dropped calls; as fast or faster download and upload speeds. And because of Qualcomm’s market-leading products, it means creating a market-leading product.

Otherwise, all the goodwill Apple customers have generated because they love their phones will be sent to the trash if the product can’t do the basic yet most integral function.

Apple cannot short-change itself on this replacement. And this is why I’m very confident Apple has continued to let its modem project slip.

But it gets even more tricky than just replacing the modem.

The modem can’t be decoupled from the rest of the system. Qualcomm’s advantage is providing the entire front end, modem, and processing as a package. As a result, it can tune all the components to work at the highest performance together. Therefore, if it hasn’t failed at the modem piece, Apple is undoubtedly struggling to integrate Qualcomm’s other components or create its own front-end to work with it.

But, all you have to do is look at the many open RF positions on Apple’s website, and you realize they are working down the 5G rabbit hole to build the next component to work with the last component.

Futurum said it best about this unique integration with 5G, referring to Qualcomm’s X65 modem:

Without the right RFFE technology to solve the complex engineering challenges presented by mmWave radio signals, both in the downlink and the uplink, including MIMO, the X65 modem by itself would essentially be like the fastest, most powerful race car in the world sitting there without wheels or tires.

Apple bought the engine team, and they can maybe make an OK engine, but they never produced an award-winning race engine capable of going the 500-mile distance. Moreover, if it hasn’t realized it by now, it bought an engine team but not a drivetrain team. As a result, all the horsepower generated can’t be transmitted to the wheels if the transmission, driveshaft, rear-end, and axles aren’t also up to snuff. Otherwise, it risks breaking any of those components due to the sheer power transmitted from the engine.

Where This Leaves Qualcomm

Set out to cut future costs and internalize components, Apple proved the throne is Qualcomm’s by being unable to unseat it by its 2023 deadline. Beforehand, QCOM was being rerated for the loss of Apple as a modem customer. However, as time has passed and the 2023 iPhone continues to approach, it appears the market is having to reintroduce the supposed lost revenue into its models.

The biggest win for Qualcomm was the diversity-out-of-necessity approach turning into diversity with a successful title defense outcome.

Qualcomm has risen through the ranks to not only find massive, consistent growth but is also being affirmed by its customers it can’t be matched. If the Apple rumors are true – which odds say they are, simply by the sheer technology know-how needed to produce a 5G-anything component – Qualcomm won’t have to fight an even more brutal uphill battle by replacing the 80% iPhone market share loss in 2023.

Apple is finding out the hard way it has no business being in the 5G modem and RFFE space. There’s a reason why Qualcomm has dozens of customers integrating its components into their products. Not only will Apple have to continue using Qualcomm products, but at some point, the return on investment will be too great for Apple to continue down the path to replace even the most expensive component in its flagship product.

Due to its failure to replicate the component, Apple’s foray into 5G modems wound up signaling Qualcomm’s dominant position to everyone in the handset market. Like the Apple Car, a 5G modem will continue to be kicked down the road (no pun intended). In fact, the Apple Car will rely on a 5G modem to operate, and if it can’t produce a high-quality, reliable 5G system, it will also be coming to Qualcomm for that supply.

Be the first to comment