AutumnSkyPhotography

Despite a vastly expanded business model, Qualcomm (NASDAQ:QCOM) still can’t move beyond an inventory correction in the wireless handset market. As with a lot of technology stocks, the wireless giant now trades close to pre-covid levels. My investment thesis is far more Bullish on the stock trading close to $105 when the wireless and IoT opportunities are combined with a $30 billion backlog in Automotive.

Different Level

Qualcomm reported FQ4’22 revenues of $11.4 billion grew 22% YoY and beat analyst estimates ever so slightly. The wireless giant matched the EPS target at $3.13 for a monster boost above only $0.78 earned back in FQ4’19.

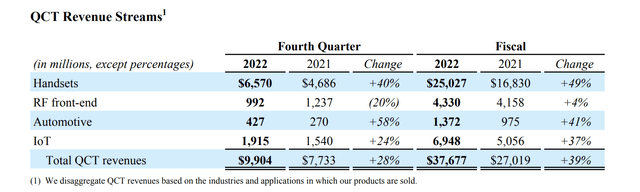

While Qualcomm wasn’t expected to maintain massive growth in the year ahead, the boost from the Automotive and IoT growth drivers was expected to offset some declines in Handsets. In FQ4, these segments grew revenues by $522 million YoY and the demand in the Automotive and IoT categories is only expected to grow over the years.

Source: Qualcomm FQ4’22 earnings release

The Handsets segment still dwarfs the new growth segments and apparently an inventory correction has hit Qualcomm like other chip companies. The wireless chip company only guided to FQ1’23 revenues of $9.2 billion at the low end after reporting a quarter with revenues at $11.4 billion. Consensus analyst estimates expected revenues to jump further in the December quarter to $12.1 billion.

The sudden drop in inventories has dramatically disrupted the quarterly numbers. The market will have to spend the next few quarters trying to figure out what normalized demand equals with Qualcomm forecasting an inventory glut of 8 to 10 weeks of supply.

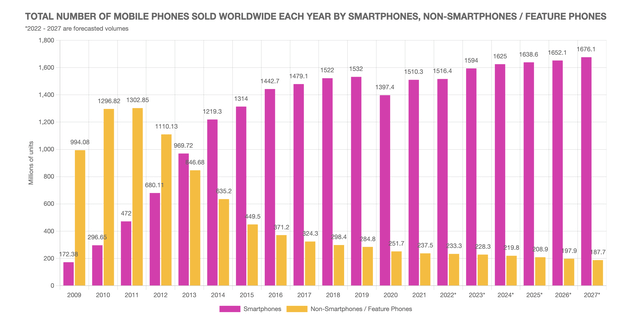

According to Qualcomm, the handset market is facing a near unprecedented decline this year with a forecast for a dip in excess of 10% during 2022.

Given the uncertainty caused by the macroeconomic environment, we are updating our guidance for calendar year 2022 3G/4G/5G handset volumes from a year-over-year mid-single-digit percentage decline, to a low double-digit percentage decline.

The odd part is that smartphone sales didn’t soar during covid lockdowns like PCs, as most consumers already had phones. In fact, smartphone sales initially dipped in 2020 due to covid and hadn’t fully rebounded suggesting the ability to expand demand.

Qualcomm was growing Handset revenues due to additional content in 5G phones and the return of Apple (AAPL) and Samsung (OTCPK:SSNLF) back to using Snapdragon chips. In essence, the data doesn’t suggest Qualcomm should have any lingering impact from this inventory correction and could see a snapback in demand as China reopens from covid lockdowns and smartphone demand normalizes.

On the FQ4’22 earnings call, CEO Cristiano Amon was quick to point out this fact:

It is important to note that the current inventory drawdown is a cyclical adjustment that has no impact on the underlying growth and earnings power of the company in the long term. And we are in a strong position to manage the near-term headwinds.

The executive sees Automotive and Snapdragon PCs providing growth avenues in the future beyond wireless.

Better Than The Past

Even with the big inventory correction forecast for FQ1, Qualcomm guided to an EPS of $2.35. The wireless giant still forecasts a massive profit in the quarter with an $0.80 hit from the inventory correction.

With the above data suggesting any dip in Handsets revenue should only rebound to even higher levels in the future. Investors need to not lose focus on the record FY22 numbers as a platform for growth in the future.

Qualcomm still forecasts Automotive revenues to reach $4.0 billion annually in FY26 after the company only reported $1.4 billion in category revenues this year. Just the growth in Automotive alone will grow the business by over ~7% in the next few years with the backlog supportive of vastly higher revenues in the years after.

The company faces a scenario where Apple chip revenue could disappear starting in FY24, but the tech giant continues to struggle to develop a replacement. Besides, Samsung is expected to further boost Snapdragon chips to 100% of smartphones this year, somewhat offsetting any risk of losing business with Apple.

Qualcomm earned $12.53 per share last year and investors shouldn’t alter expectations for the EPS to top $13 and $14 per share as previous predictions forecast. The stock only trades at $106 providing a quick disconnect with the market.

Clearly, Qualcomm will struggle to rally in the months and quarters ahead due to the stock market these days fixated by short-term hiccups caused by the covid disruptions to the economy whether good or bad.

Takeaway

The key investor takeaway is that Qualcomm is far better positioned than in the past. The wireless chip giant shouldn’t be trading at pre-covid levels when even an inventory correction doesn’t leave the financials anywhere close to back at prior levels.

Investors should clearly use this weakness to load up on the stock, though the length of any inventory correction is still highly unknown and will definitely last into the March quarter.

Be the first to comment