Athitat Shinagowin/iStock via Getty Images

By Robert Eisenbeis, Ph.D.

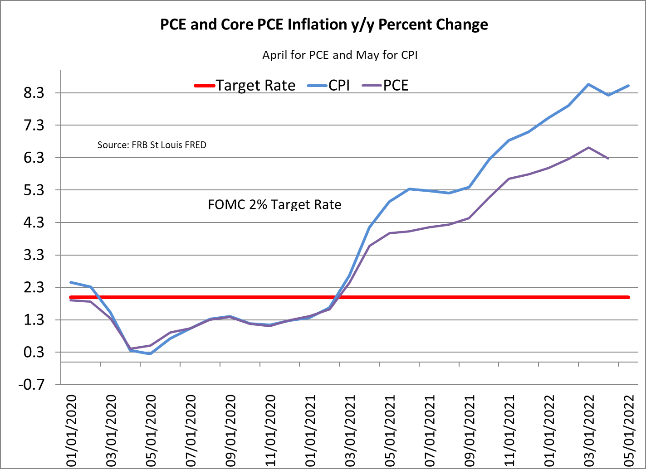

Faced with evidence of PCE inflation’s being above target for the month of April and evidence of an accelerating CPI from April to May (see the chart below), the FOMC is virtually certain to raise its target range for federal funds by another 50 basis points, as committee members have telegraphed. The move is even more likely as the committee moves to reestablish credibility in the wake of its previous stance that the rise in prices was only transitory.

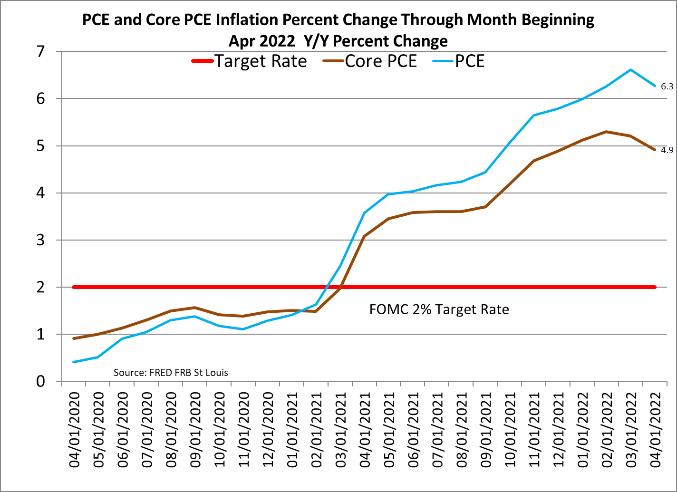

Clearly, the war in Ukraine has significantly impacted both food and energy prices, and this is reflected in the difference between the headline PCE and Core PCE, as shown in the next chart.

Energy prices have increased 30.4%, and food prices have increased 10%. A little more current information on price increases is contained in the CPI release. It shows that, for the month of May, food and energy prices rose a combined 6%, with the energy index up 34.6% and food up 10.1%, both numbers consistent with those in the FOMC’s preferred measure, the PCE.

The view that it is appropriate for the Fed to raise rates is bolstered by evidence of continued growth at a moderate pace, as reflected in the Beige Book, as well as evidence of a strong labor market, with new claims for unemployment insurance low for several weeks now and the most recent release being only slightly above those of previous weeks. The unemployment rate remains at 3.6; and while there are about 5 million unemployed people, there are about 11.3 million job vacancies or more than two jobs for every unemployed person. Wages increased in May, and average hourly wages are now $31.95, representing an increase of 5.2% but below the rate of inflation. The strong labor market stands in contrast with the 1.5% decline in real GDP for Q1 2022, after showing strong growth in 2021.

Overall, the US economy remains strong and should stand another rate increase by the FOMC without triggering a full-blown recession, the negative sentiment in US equity markets notwithstanding. Thirty-year fixed-rate mortgages have already moved over 6% in anticipation of further rate hikes. Indeed, some are now predicting that the FOMC might even move by 75 basis points rather than 50 at its meeting this week.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment