Joe Raedle/Getty Images News

Bitcoin Is Down

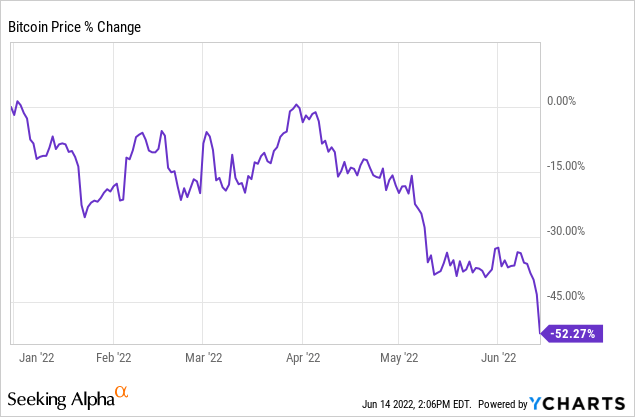

I shall first state the obvious truth. Bitcoin (BTC-USD) is down hard right now.

I like this chart because it shows that Bitcoin has been cut in half in 2022. It was down about 15% a few times through the beginning of May. That wasn’t pleasant. Then it settled in, down around 35%. And now, it’s fallen again, down near $20K.

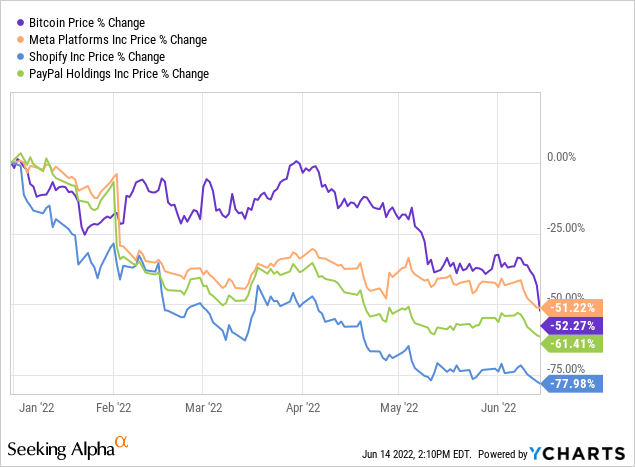

The first drop, near the start of the year, was likely a sympathetic drop alongside growth stocks, and the general anti-growth sentiment. Here’s an overlap to demonstrate the point.

I picked a few well known growth companies: Meta Platforms (META), Shopify (SHOP) and PayPal (PYPL) for this comparison. At first, Bitcoin held up well, but was still bouncy-and-down, like a growth stock. But, from April 2022 through today, there’s been a gnawing decline, I think largely in part from the ongoing shift from growth to value, interest rates hikes and inflation. Of course, they are all related.

Nevertheless, it doesn’t matter here if Bitcoin is down because it’s like a growth stock, or because of money printing, inflation, war, supply chains or anything else. What matters is that the actual price of Bitcoin is down, since that’s what’s directly impacting MicroStrategy (NASDAQ:MSTR).

In this article, I’ll quickly demonstrate exactly why it’s unlikely there will be any margin call on MSTR, or really any grave impact. While it’s true the stock price is highly correlated with Bitcoin, the business itself is not at risk.

The Margin Call Threat at $21,000 Per Bitcoin

First, what’s a margin call? In simple terms, it’s when one party demands a deposit of cash, funds or securities to cover possible losses. In other words, if your position isn’t fully covered by the assets in the account, then the other party can force you to “make good” since there’s credit or a debt position that needs to be satisfied. Margin calls often happen during periods of extreme volatility, particularly negative volatility, where the gap between prices and underlying assets has grown too large.

So, the news is that because Bitcoin has dropped so much MSTR is at risk of a margin call. Here’s how CNBC explains it:

The world’s biggest cryptocurrency briefly tumbled below $21,000 Tuesday, a key level at which MicroStrategy would be faced with a possible margin call that investors fear could force the company to liquidate its bitcoin holdings.

Now, here’s some added color, from President and CFO Phong Le in early May:

As far as where Bitcoin needs to fall, we took out the loan at a 25% LTV, the margin call occurs 50% LTV. So essentially, Bitcoin needs to cut in half or around $21,000 before we’d have a margin call. That said, before it gets to 50%, we could contribute more Bitcoin to the collateral package, so it never gets there, so we don’t ever get into a situation of March call also.

And…

So we have 95,643 encumbered bitcoin. So we have more that we could contribute in the case that we have a lot of downward volatility. But again, we’re talking about $21,000 before we get to a point where there needs to be more margin or more collateral contributors. So I think we’re in a pretty comfortable place where we are right now.

Now you know why $21,000 keeps showing up in various media channels.

No Real Margin Call Threat

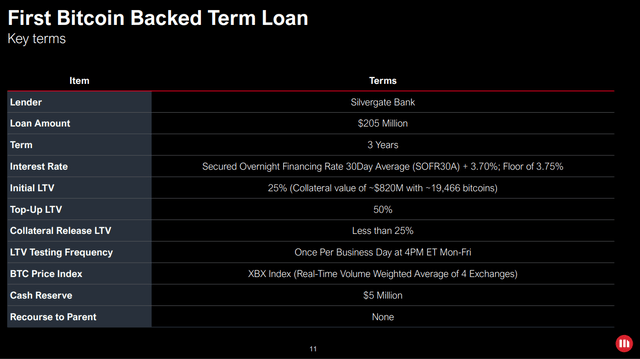

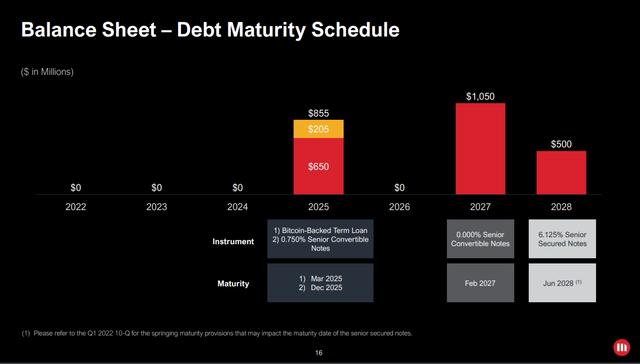

The various loans and obligations really don’t threaten MSTR much at all. The reasons are quite simple. MSTR does have a $205M term loan and needs to maintain $410M as collateral. But MSTR has over 115,000 BTC that it can pledge, if needed. Put another way, if the price of BTC falls below $3,562, then the company could post some other collateral.

MicroStrategy Backed Term Loan (MSTR Q1 Conference Call Slides)

Furthermore, as of March 31st, MSTR had 129,218 total Bitcoin. Of those, 33,575 were pledged, giving MSTR plenty of wiggle room, with Bitcoin itself.

The interest expense on MSTR’s Senior Secured Notes, Bitcoin-Backed Loan and Convertible Senior Notes is $43.7M (see slide #11).

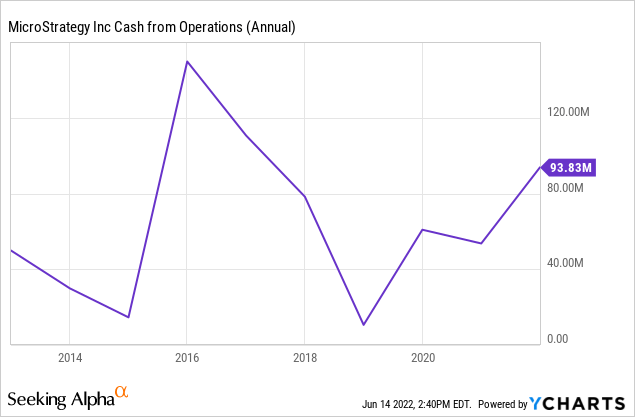

Although this isn’t a perfect way to say MSTR can cover the interest expense, nevertheless, take a look at the 10-year view of MSTR’s Cash from Operations. In short, it appears that MSTR isn’t in any real jeopardy of default.

Furthermore, this isn’t some true imminent or existential threat to MSTR, in terms of some kind of margin call. First, Bitcoin would have to fall another 85% from here to get down to $3.5K. And, second, the debt isn’t due for several more years from now.

MicroStrategy Debt maturity Schedule (MSTR Q1 2022 Earnings Call Slides)

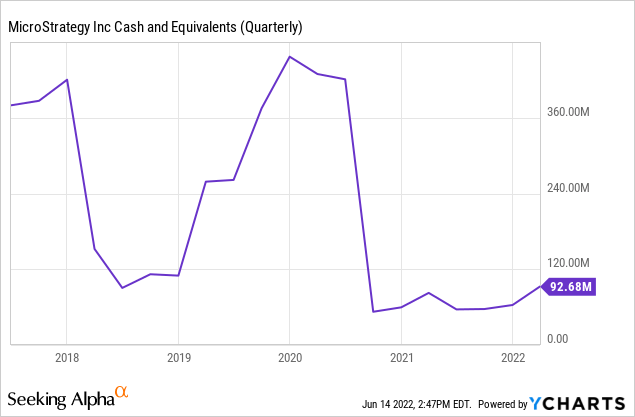

I should also point out that MSTR still has plenty of “fiat currency” available on the balance sheet, as shown below.

Again, this doesn’t appear to be a company with its back against the wall.

Wrap-Up

Because Bitcoin is down, MSTR is down right now. After all, MSTR has a tremendous pile of Bitcoin, as most investors know. It’s a type of Bitcoin proxy, and where Bitcoin goes, MSTR follows. It’s not really the other way around, even while it’s true that CEO Michael Saylor is one of key voices in the Bitcoin community.

In any case, the $21,000 siren song of a margin call for MSTR is misguided, and misquoted. It’s not good for MSTR, but Bitcoin in the low $20K range isn’t going to generate any major pain for the business. And, again, we’re not going to see any true margin call threat unless Bitcoin falls below $4K. If that happens, many other businesses and institutions are going to be feeling a tremendous amount of pain, and MSTR will be just one of many.

What does all this tell us about investing in MSTR? First, that MSTR is a proxy for Bitcoin, and it’s a way to get exposure without directly owning Bitcoin. Second, the analysis above indicates that MSTR’s capital structure is complex, but it’s not currently risking the collapse of the company. Analysts have to work harder to understand what’s going on, but that’s really about it. Third, if you hate Bitcoin, then you likely hate MSTR. Therefore, avoid. At the same time, if you love Bitcoin, but find it challenging to hold directly for whatever reason, MSTR is potentially a “deal” right now, especially if you’re dollar cost averaging.

Adding everything up, I see MSTR simply as a Hold. On the one hand, it’s an interesting company, deeply intertwined with Bitcoin itself. So, if Bitcoin takes off, MSTR will almost certainly take off as well. It’s possibly a good asymmetric bet on the future. On the other hand, Bitcoin is in a bear market right now. I don’t see any near-term catalysts, so buying in big now is a roll of the dice. A nice middle ground, with no strong commitment, is simply to say, it’s a hold.

Be the first to comment