Iryna Drozd

Apellis Pharmaceuticals (NASDAQ:APLS) rallied yesterday on news that the company’s new drug application for intravitreal pegcetacoplan for the treatment of geographic atrophy was accepted by the FDA and that the application was granted Priority Review which shortens the review period to six months from the date of the application. This is a decent regulatory win for Apellis, but I believe it is more a reflection of the unmet need for the condition and that it does not guarantee approval.

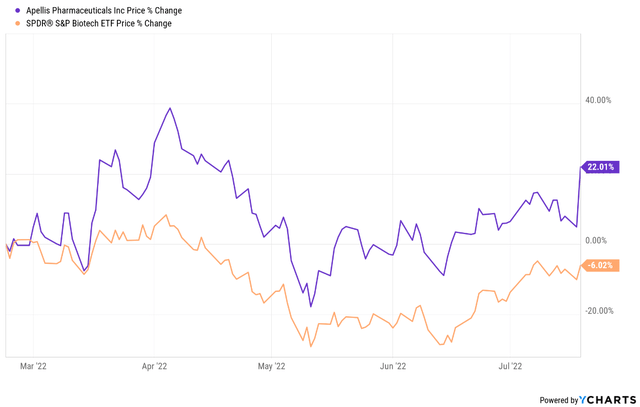

With the stock rallying 22% since my last update versus a 6% decline for XBI and with the upside being heavily dependent on intravitreal pegcetacoplan in geographic atrophy, I am shifting from a previously bullish view to neutral on Apellis.

Priority review does not guarantee approval

Priority review granted by the FDA for a drug’s application is always good news, but by itself, it does not guarantee a successful outcome, or a timely outcome, for that matter. Of course, if the application is strong and if there are no outstanding questions about the data generated in clinical trials, this usually results in a swift approval, evidenced by the recent approval of Horizon Therapeutics’ (HZNP) Krystexxa in combination with methotrexate for the treatment of uncontrolled gout. This application was also granted priority review by the FDA, and it received timely approval.

But other examples point to a not-so-clear-cut situation as there can always be issues – from manufacturing and technical issues to issues with clinical data itself. For example, Heron Therapeutics’ (HRTX) Zynrelef was also granted priority review by the FDA, but it ended up being rejected twice by the FDA due to manufacturing issues before getting approved at the third attempt and two years after the original target date for approval.

Another example is Axsome Therapeutics’ (AXSM) AXS-05, which was also granted priority review and where we still do not know the outcome nearly a year after the original PDUFA date – AXS-05 is still under FDA review without a new PDUFA date.

At the moment, there is no way of knowing if Apellis’ application will have issues on the manufacturing side, that is always the unknown, especially with less experienced companies like Apellis that only has one approved product. But the fact that it is the same active ingredient as Empaveli increases the probability of success on the manufacturing side.

As covered previously, the data intravitreal pegcetacoplan generated in geographic atrophy are not really clean – one trial was successful, the other one technically failed to achieve statistical significance, but it showed similar trends to the successful one. And the company claims the successful phase 2 trial serves as the second required pivotal trial to secure FDA approval. I think this is plausible and that the company has a good shot at getting intravitreal pegcetacoplan approved, but I believe a successful outcome is far from guaranteed at this point. However, the unmet need part may prevail, and my probability of success estimate is in the 65-70% range.

But, as I also covered in the above-linked article, I have concerns about the commercial viability of this candidate due to the modest efficacy that is very hard for the patients themselves to notice and this could be a tough launch that requires significant resources.

Other recent developments

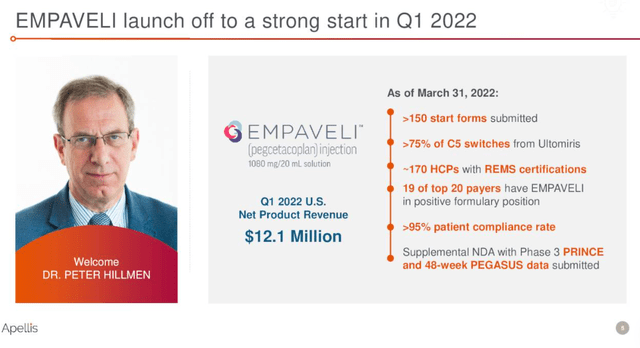

Empaveli’s launch looked good after the first few quarters on the market, but growth seems to be slowing as of late. Dethroning AstraZeneca’s (AZN) Soliris and Ultomiris which were the only two products approved for PNH before Empaveli is a very difficult task.

After 60 and 40 new patient start forms in the first two quarters on the market, we saw 25 new start forms in Q4 2021 and Q1 2022, and net sales rose from $9.2 million in the fourth quarter of last year to $12.1 million in the first quarter.

Partner Sobi launched Aspaveli (the name of the product in Europe) earlier this year and has generated SEK4 million and SEK38 million in Q1 and Q2, respectively, or approximately $0.4 million and $3.8 million based on current exchange rates.

This does not look like a blockbuster launch but I never expected it to be. I recently thought there was upside to my $400-500 million peak sales estimate range for Empaveli in the PNH market, but as of today, it looks like it is headed to that range rather than higher.

On the financial side, a lot of credit goes to the management team to secure the cash the company needs to commercialize Empaveli and launch intravitreal pegcetacoplan if approved. In late March, the company raised $402.5 million in gross proceeds after pricing the follow-on offering at $47 per share. The $965 million in cash and investments at the end of Q1 are expected to provide a runway into Q1 2024. But this also means another relatively substantial raise will be required at some point in the next six to nine months as no serious biotech company wants to have less than 12 months of cash on hand.

Conclusion

With a market cap of around $5.6 billion as of this writing, and with further upside mostly depending on intravitreal pegcetacoplan in geographic atrophy, I am shifting from bullish to neutral on Apellis. I could be wrong, but I still like the systemic side of pegcetacoplan (Empaveli) much more than the potential in geographic atrophy. And I do not like the risk-reward heading into the PDUFA date for intravitreal pegcetacoplan at these levels. I would estimate that the approval itself could drive the stock to $60-65 per share but with limited further upside and some downside if the launch disappoints in the following quarters, and that the stock could fall back to the low 30s if the application is rejected by the FDA.

Be the first to comment