EschCollection/DigitalVision via Getty Images

Investment thesis

Itochu’s (OTCPK:ITOCY) shares have underperformed its peers, but H1 FY3/2023 results highlighted that the company is executing well and have raised its FY earnings outlook. With a stable dividend on offer, we reiterate our buy rating.

Quick primer

Itochu is one of the top five Japanese trading companies with its roots dating back to 1858. Initially operating in the textile industry, Itochu has focused more on non-resource businesses such as food and technology compared to peers Mitsubishi Corp. (OTCPK:MSBHF) and Mitsui & Co. (OTCPK:MITSY). It has an effective 10% stake in Chinese financial services firm CITIC Limited (OTCPK:CTPCF) and a 25% stake in C.P. Pokphand Co. Ltd (0043.HK) (OTCPK:CPKPY) (OTCPK:CPKPF), a material group company of Thailand’s Charoen Pokphand Group.

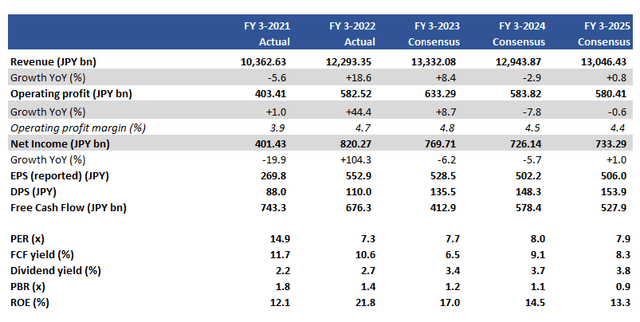

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

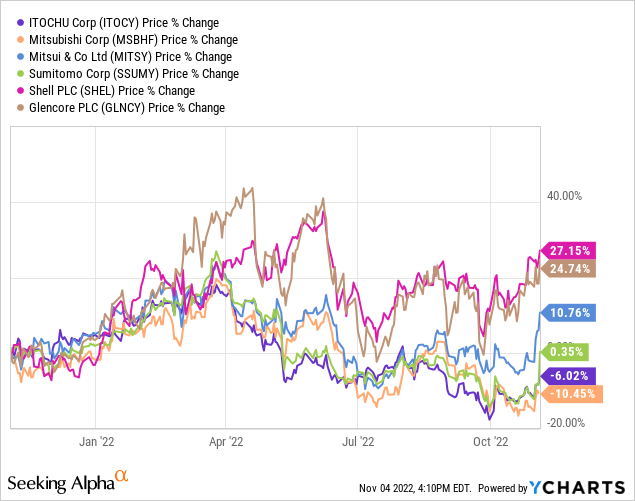

The Japanese trading companies have outperformed most indices YTD, despite their predominantly cyclical nature. Exposure to resources has been a supportive theme, although as a group they have underperformed pureplay energy names such as Shell (SHEL) and mining firm Glencore (OTCPK:GLNCY).

Itochu stands out as an underperformer, and on the surface, this can be explained by the company’s strategic focus on non-natural resources. In this piece, we want to re-assess our bullish view from July 2021.

Robust start to FY3/2023

Trading companies are effectively portfolio managers, allocating capital to assets that will provide the best returns in a diversified strategy. Itochu with its singular focus on non-resource businesses (76% of H1 FY3/2023 of net profit was non-resource) (page 3) would mean in the current environment of rising energy prices will not be a major boost compared to its peers. However, this has not deterred them from making solid progress in H1 FY3/2023, raising FY guidance and already raising FY dividends from JPY130 to a minimum of JPY140 per share. The other key characteristic of trading companies is that they are all beneficiaries of a weakening Japanese yen, as much of the activity is to do with generating income overseas or trading with global customers in US dollars.

Digging into H1 FY3/2023 results highlights the following three factors. Firstly, trading has been strong due to strong charter income from favorable shipping rates in a tight freight market. This was observed in the Machinery segment which also saw a one-off gain from the sale of a North American beverage equipment maintenance company, showing evidence of capital re-allocation. Secondly, despite the non-resource focus Itochu benefitted from high pulp prices at its European operations IFL. Thirdly, net profits were boosted ahead of expectation as the initial average company forecasts for the USDJPY rate was JPY120, whilst the actual average rate in H1 FY3/2023 was 130.45 (+8.7% from the original), favorably impacting net profit. Sensitivity is estimated to be around JPY1.7 billion/USD11.7 million per a one yen depreciation against the dollar.

FX will continue to play a key role in H2 FY3/2023. The company has raised FY guidance, raising net profit to JPY800 billion/USD5.5 billion from JPY700 billion (+14% increase from original). With the new USDJPY forecast average rate at JPY135, we believe there is further upside potential given current rates remain around JPY145.

Outlook for shareholder returns

The company raised its FY earnings outlook and guided a minimum JPY140 dividend per share implying a payout ratio of 25.6%. It is positive to see that the company remains on track to its target payout ratio of 30%, although this is still a fairly low level. Although the amount has fallen by 40% YoY, the company will continue to conduct share buybacks to the tune of JPY35 billion/USD240 million, making it seven consecutive years of buybacks which is a positive trend.

We believe that despite the relatively volatile nature of earnings at trading companies, it is the intent of Itochu management to have a stable dividend. While JPY140 may not seem that generous, we anticipate this level will be the floor going forwards with limited risk over dividend cuts going forwards; dividends have been rising now for nine consecutive years.

Valuations

Consensus forecasts for FY3/2023 remain below company guidance at the net profit level. This may highlight varying views over FX and resource prices at the year-end. However, based on JPY140 DPS the current dividend yield of 3.5% appears attractive in our view due to its stable nature. Consensus expects earnings to fall slightly YoY into FY3/2024 but expects dividends to increase, given the company’s aim to reach a 30% payout ratio by that time.

Risks

Upside risk comes from continuing depreciation of the Japanese yen versus the US dollar. Current rates have not been seen since the late 1990s, and to see higher sustained rates we would have to go back to the mid-1980s. The company has forecast a small extraordinary loss buffer of JPY20 billion/USD138 million for FY3/2023 – if this is not utilized, net profits can slightly increase.

The downside risk comes from a strengthening Japanese yen, which would act negatively on FX translation. There is also Itochu’s accounting of the securities business in CITIC Limited which gave rise to a revaluation gain in H1 FY3/2023 results. Although this does not appear to be a material gain, the methodology and disclosure are opaque which makes us think that companies with high China exposure may be seen as riskier and consequently suffer discounted valuations.

Conclusion

In a turbulent business environment, we believe Itochu is executing well. Its portfolio is enjoying the tailwinds of a depreciating Japanese yen, and management’s view of shareholder returns is positive. Our view is that the shares offer a stable dividend and on a yield of 3.5%, we reiterate our buy rating.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment