Paul Morigi

The One Interesting Thing From The 10-Q

Writing regularly about Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) can sometimes be a challenge because the company periodically goes through periods of inactivity in its investments and M&A deals. For an investor, that is not necessarily a bad thing when the operating businesses and stock picks are good to begin with and don’t require change. One of Buffett’s best qualities is to ignore the calls of “Swing, you bum!” from the crowd. As you can see from my past articles, Berkshire had a frustrating period of inactivity in 2019 and 2020 while its pile of cash continued to grow while earning near zero interest rates. In 2021, the company greatly increased the size of its share buybacks, buying $27 billion worth that year. Buffett started swinging even more in 1Q 2022, when the company spent over $50 billion on new investments including companies in the Energy space such as Chevron (CVX) and Occidental Petroleum (OXY). Berkshire also announced the deal to acquire fellow insurer Allegheny Corp. for $11.2 billion in cash. That deal closed in October, subsequent to the end of the quarter just reported.

Since then, the company has entered another quiet period. In 3Q, buybacks were only $1 billion and stock investment has cooled off. Berkshire spent about $9 billion on new equity purchases and sold about $5.3 billion worth of stocks in 3Q. Berkshire’s cash balance grew again to $105 billion at quarter end, although $11.2 of that was spent in October on Allegheny. Operationally, insurance underwriting is having a tough year, with a $3.4 billion hit from Hurricane Ian ($2.7 billion post-tax). At least higher interest rates are helping insurance investment income. BNSF is dealing with higher fuel and personnel costs while volumes shipped are declining. Manufacturing, service, and retailing are holding up well so far, except in consumer-related businesses where margins have fallen. Berkshire Hathaway Energy continues to be the star performer with even bigger tax subsidies for wind power this quarter. The real estate business embedded within this utility division has taken a serious downturn, though, which could be a warning sign for some of Berkshire’s other businesses.

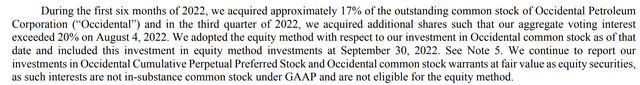

Altogether, the quarter was exactly what you would expect with an economy on the edge of a recession. I have no concerns about Berkshire being able to weather any downturn, but I’m not going to spend a lot of time this quarter on detailed analysis or valuation. Instead, I want to go over a big change in Berkshire’s financial reporting which will provide a bump to operating earnings. Berkshire exceeded 20% ownership of Occidental Petroleum and is now accounting for it by the equity method.

Berkshire Hathaway 3Q 2022 10-Q

Berkshire also accounts for its ownership of Kraft Heinz (KHC) this way. Berkshire also owns 20.3% of American Express (AXP) but does not use the equity method because of an agreement with the Federal Reserve to vote with board recommendations and not exercise influence on operations.

If Berkshire had owned the 20.9% stake in Oxy for the past year and accounted for it by the equity method, reported operating earnings would have been about $1.7 billion higher after tax, or approximately 7% of Berkshire’s YTD operating earnings.

This accounting method change does not impact the intrinsic value of Berkshire or its holdings in Oxy. Warren Buffett has always considered Berkshire’s share of the income of its investees to be “look-through earnings” with economic value to Berkshire even if they are not reported by the equity method because ownership is less than 20%. Buffett even used to include a calculation of look-through earnings in his annual shareholder letters such as this one from 1994. If you look at the table in that letter, you will see that these unreported look-through earnings were nearly as much as the reported earnings.

Moving Oxy to the equity method is just an accounting change but it serves to make the reported operating earnings more representative of the true economic earning power of Berkshire. Investors should be aware of this change when comparing performance from different periods.

So How Does The Equity Method Work?

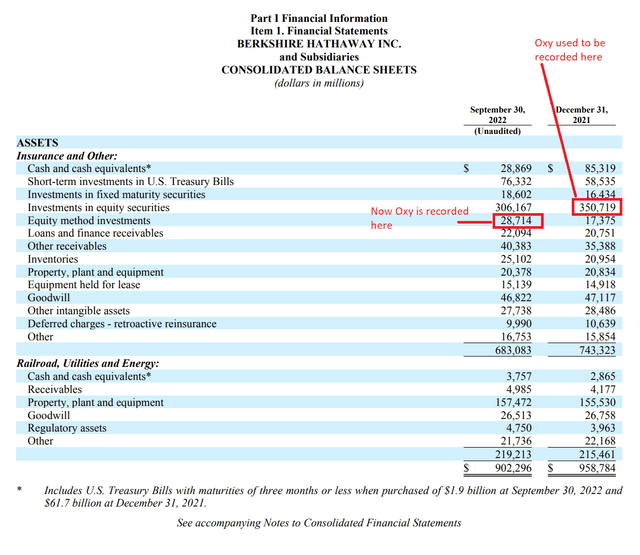

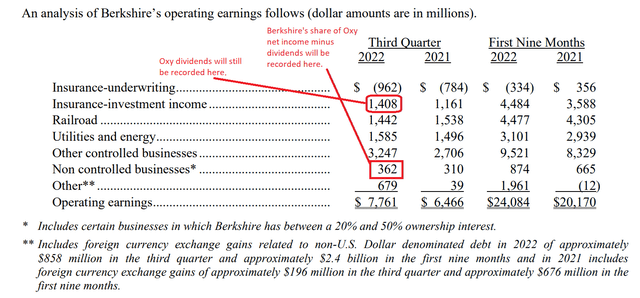

Until this quarter, Berkshire’s holdings in Oxy were valued on the balance sheet at market price. Dividends from Oxy were recorded on the income statement as investment income while changes in the share price from quarter to quarter were recorded on the income statement as investment gains and losses.

Going forward, Oxy’s value is recorded on the balance sheet as Equity Method Investments. This value is calculated by taking Berkshire’s original cost of its Oxy shares, adding Berkshire’s share of Oxy earnings (20.9% of Oxy’s reported net income) and subtracting any dividends received. (The dividends are still reported under investment income.)

The income, less dividends will now show up on the summary income statement within the “Non controlled businesses” line. It will therefore be counted as part of Berkshire’s operating earnings and will not impact investment gains and losses.

Because of the reporting schedule of Oxy, the equity income will be booked one quarter in arrears. Berkshire therefore recorded no equity income from Oxy this quarter but will include its share of Oxy 3Q earnings (to be reported on 11/8) in Berkshires 4th quarter results.

Berkshire Hathaway 3Q 2022 10-Q Berkshire Hathaway 3Q 2022 Earnings Release

Future Impact To Berkshire Earnings

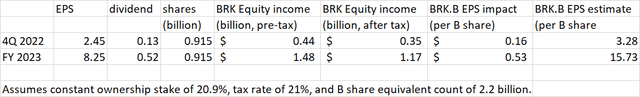

Looking at analyst estimates, Oxy is expected to earn $2.45 per share this quarter and $8.25 over the next four quarters. Assuming $0.13 per share quarterly dividend, 915 million shares outstanding, Berkshire’s 20.9% ownership and a 21% tax rate, Berkshire will report incremental operating income of $350 million in 4Q and $1.17 billion in 2023.

The change adds about 5% to 4Q and 3% to 2023 operating income per share. These numbers could increase with higher earnings from Oxy, further purchases of Oxy shares by Berkshire, or buybacks of own shares by Berkshire. They could decrease if Oxy raises its dividend but that would be reflected in higher investment income in Berkshire’s accounts.

Conclusion

Not much happened in 3Q to change the intrinsic value of Berkshire Hathaway but the 20.9% ownership of Occidental now requires Berkshire to use the equity method to account for this investment. This will increase the value of Berkshire’s reported operating earnings, a key quarterly metric that Buffett has focused Berkshire shareholders on over the past several years. This shift needs to be considered when comparing 2023 operating income to prior years. 2023 will also see increased earnings from a fully owned Allegheny and a greater equity stake in Pilot Flying J. These are real, economic additions to Berkshire’s earning power. Combined with the accounting change from Oxy, Berkshire is continuing its transition to be valued more on its operating earnings than its stock investments.

Be the first to comment