zirconicusso

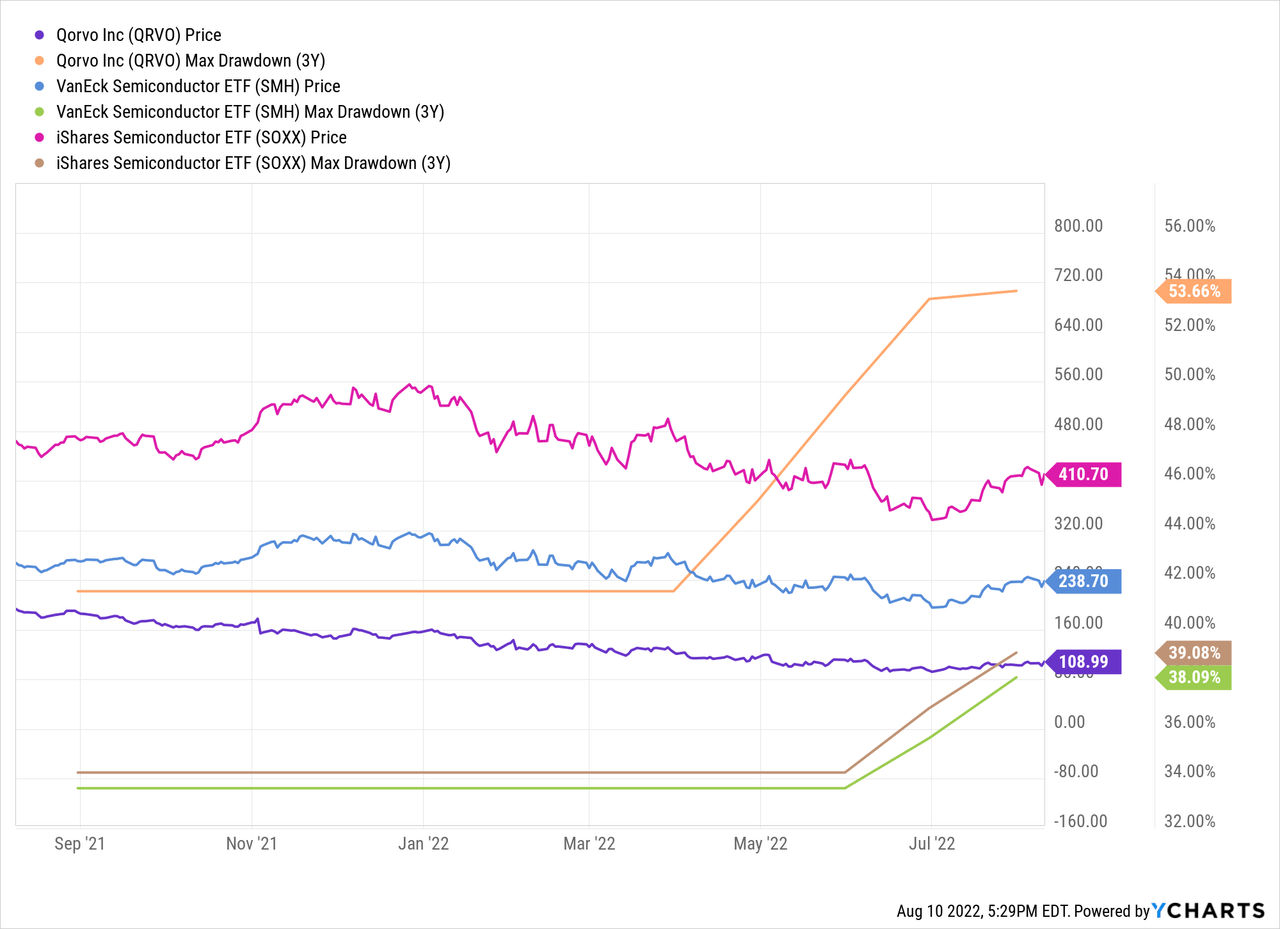

In May 2021, I over-enthusiastically wrote about Qorvo (NASDAQ:QRVO) and rated it as a buy. Here is the link to my article from a year ago. Qorvo, similar to the overall semiconductor market, has had a rough time. When comparing Qorvo with the VanEck Semiconductor ETF (SMH) and iShares Semiconductor ETF (SOXX), Qorvo’s maximum drawdown is 53.66%, while SMH and SOXX drawdowns are 38.09% and 39.08%.

I made a mistake back then and gave Qorvo, relative to its industry peers, a buy rating and didn’t look at how Qorvo’s markets were evolving. Yet, I considered Qorvo as “not cheap” back then. But at the end of my previous article, I wrote the following:

With a TTM PE of 27 and an FWD PE of 16, Qorvo is valued lower than the average company in the semiconductor indices. If the investor wants to have a foot in the 5G market and enjoy its growth, Qorvo is definitely a good option.

A neutral rating back then would have been more appropriate when considering Qorvo’s markets. I recorded this mistake and will work on improving!

Thesis

Qorvo is operating in growing industries. It experienced a significant backdrop in China which has been its largest market. Demand for Qorvo’s 5G mobile solutions broke down, and we’ll see why in a later section.

While demand in China broke down, demand in other markets in industries remains strong, and the market likely tilted the valuation pendulum too far to the oversold direction creating an opportunity for investors.

Demand Misprediction

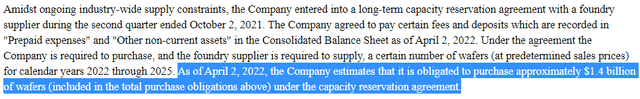

Diminishing demand in China hit Qorvo hard. Management at Qorvo entered a long-term capacity reservation agreement with a foundry during Q2 2021. This is an extract from Qorvo’s 2022 annual reports discussing this matter.

Extract from Qorvo Quarterly Report (Qorvo Q1 2022)

They were concerned about supply constraints and wanted to ensure they had enough capacity. Management falsely predicted the demand for wireless solutions for smartphones, tablets, and laptops after the COVID-19 demand surge.

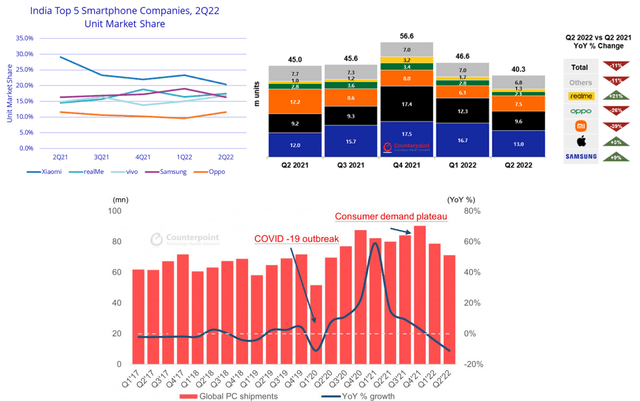

China’s quarterly smartphone sales have been in a downtrend since late 2017.

China Quarterly Smartphone Sales (Counterpoint Market Pulse)

Qorvo’s largest market is mobile devices. This includes smartphones, wearables, laptops, tablets, and other devices. The pandemic induced a non-lasting surge in demand around the world. Qorvo benefited from this surge as people worldwide bought themselves new smartphones, laptops, and wearables as they transitioned to working from home.

Qorvo’s stock price reflects the global demand pattern. At its peak, investors quickly turned around and took their profits. I composed different research diagrams depicting the worldwide demand for smartphones and laptops.

Global Smartphone Market Projections (Keyanoush – The Value Bull, Various)

Looking at the charts above, smartphone sales (except for a few companies like Apple (AAPL) and Samsung (OTCPK:SSNLF)) are in a slump. The Chinese market hit Qorvo the hardest, as seen from the year-over-year quarterly revenue composition.

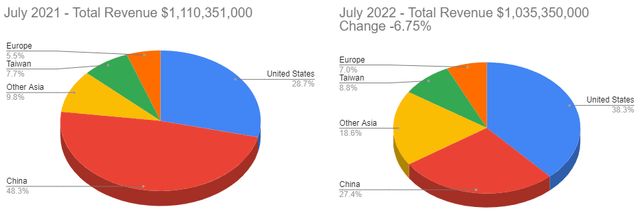

Qorvo’s Revenue Segmentation by Geography (Qorvo Quarterly Report 2022)

A year ago, China made up nearly 50% of Qorvo’s revenue. Now, it’s 27%. The decrease in total revenue is $74mn YoY. China’s Zero-COVID policy has resulted in halts in the production of smartphones. The debt crisis is no help for the Chinese consumer as well.

Qorvo’s other markets were able to dampen the drop. Demand in the US increased by ~20%, in “Other Asia” by ~90%, in Taiwan by ~10%, and in Europe by 20%.

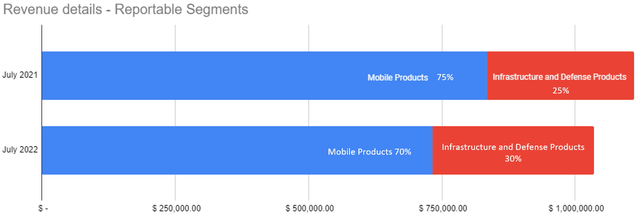

Qorvo’s revenue mix is concentrated around mobile products. In Q1 2021, Mobile products made up 75% of Qorvo’s revenue. This year it’s 70%. IDP’s revenue increased in revenue and as a share of Qorvo’s revenue mix.

Qorvo Reportable Segments (Qorvo Quarterly Report)

Qorvo Margin Contraction – Capacity Reservation Agreement

In Q2 2021, Qorvo entered a capacity reservation agreement with a foundry supplier. Under the agreements, Qorvo must purchase a certain number of wafers at predetermined sales prices for 2022-2025. The total size of this agreement is $1.4bn.

Demand evaporated, but Qorvo is bound by the agreement, resulting in impairment and costs of $110mn to Q1 2023. The shortfall in the purchase agreement resulted in an impairment to the prepaid refundable deposit of approximately $13mn in Q1 of 2023. $11mn was recorded for inventory in excess of management’s demand forecast, and $86mn is the estimated shortfall over the remaining term of the agreement.

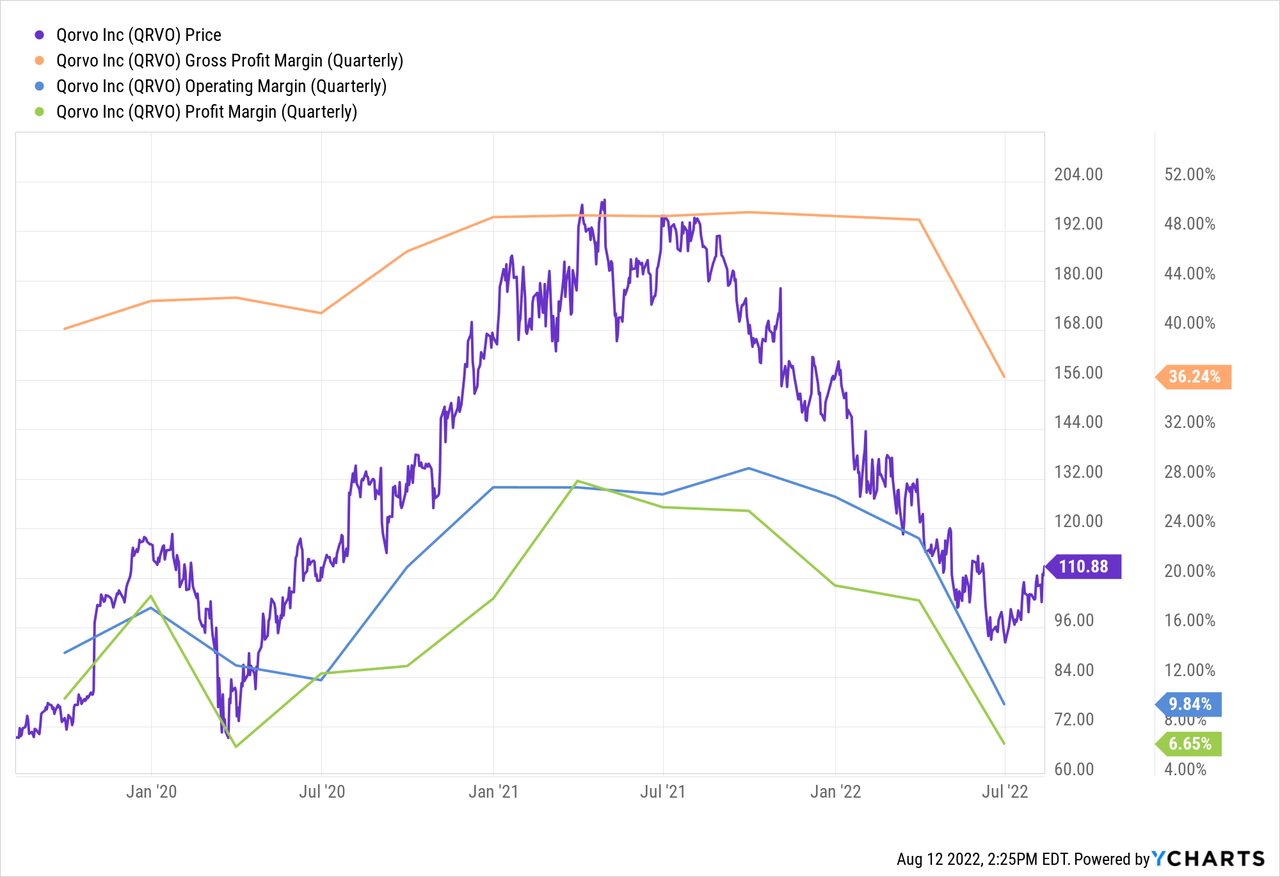

The $110mn increase in costs of goods sold negatively impacted margins. Gross, operating, and net margins took a hit this quarter.

Short Term Risks

With the ongoing zero-COVID policy in China, the increasing interest rates, and inflation still in the 9% neighborhood, demand for smartphones, wearables, tablets, and laptops is unlikely to rise quickly.

The minimum purchase agreement could continue to harm Qorvo over the next few quarters as they increase their inventory levels and potentially impair further costs of the agreement over time.

IDP makes up only 30% of Qorvo’s revenue, and even with stable to increasing demand in this segment, it cannot sufficiently offset demand in Qorvo’s much larger MP segment.

Rising inventory means that cash is tied up, and other investments may take a hit over time. We can’t be sure about ongoing demand in the next few quarters.

Long Term View

Qorvo’s markets are growing rapidly. It owns crucial patents in the 5G space and won designs with Apple, Samsung, Oppo, Honor, and many more.

Qorvo completed MFi certification interoperability for its Ultra-Wideband solutions with the Apple U1 chips. That allows Qorvo to supply the chips for designers of Apple-compatible UWB-enabled accessories.

In the electric vehicle space, Qorvo announced (by recently acquired United Silicon Carbide) the new most efficient 750V SiC FET portfolio for power designs. Tesla’s cars were the first to deploy Silicon Carbide in their power modules, and the rest of the industry is following suit. As combustion engines are phased out, this market will grow fast.

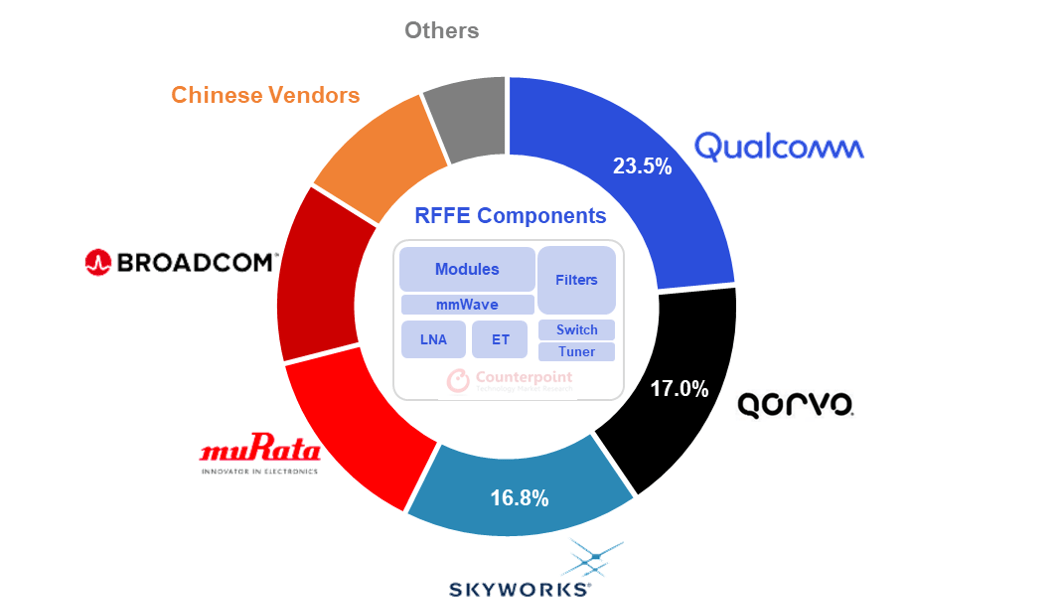

Qorvo won Android front-end module design in the smartphone market and increased its RF front-end revenue share.

Smartphone RF Front-End Revenue Share (Counterpoint Research)

Samsung’s flagship phones and mass-market 5G smartphones use Qorvo’s power amplifier module, RF switches, and WiFi 6 front-end modules. Honor, the only smartphone manufacturer in China growing rapidly in the Chinese market, has a strategic partnership with Qorvo for its RF front-end components.

Qorvo will also gain from the CHIPS act. Qorvo has its own foundry for filters, radar, advanced communications, or aerospace.

Conclusion

Qorvo has been steadily declining since mid-2021 in tandem with declining smartphone and wearable demand and the uncertain situation in China.

I think the market overdid it with Qorvo. Even the substantial decline in Qorvo’s margins due to the failure with the purchase agreement did not adversely affect its share price.

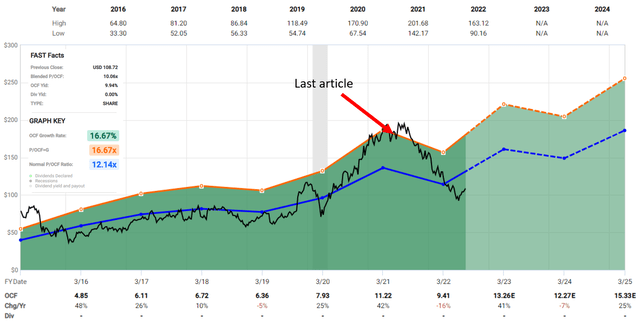

Qorvo Historical Price Performance (Fastgraphs)

When I wrote my last article, Qorvo traded above its historical valuation metrics. I even wrote the following in May 2021:

With a current PE ratio of nearly 27, Qorvo is not exactly what I would call cheap, but it’s still cheaper than the overall semiconductor indices like SMH with a PE of 32 and SOXX with a PE of 51.88.

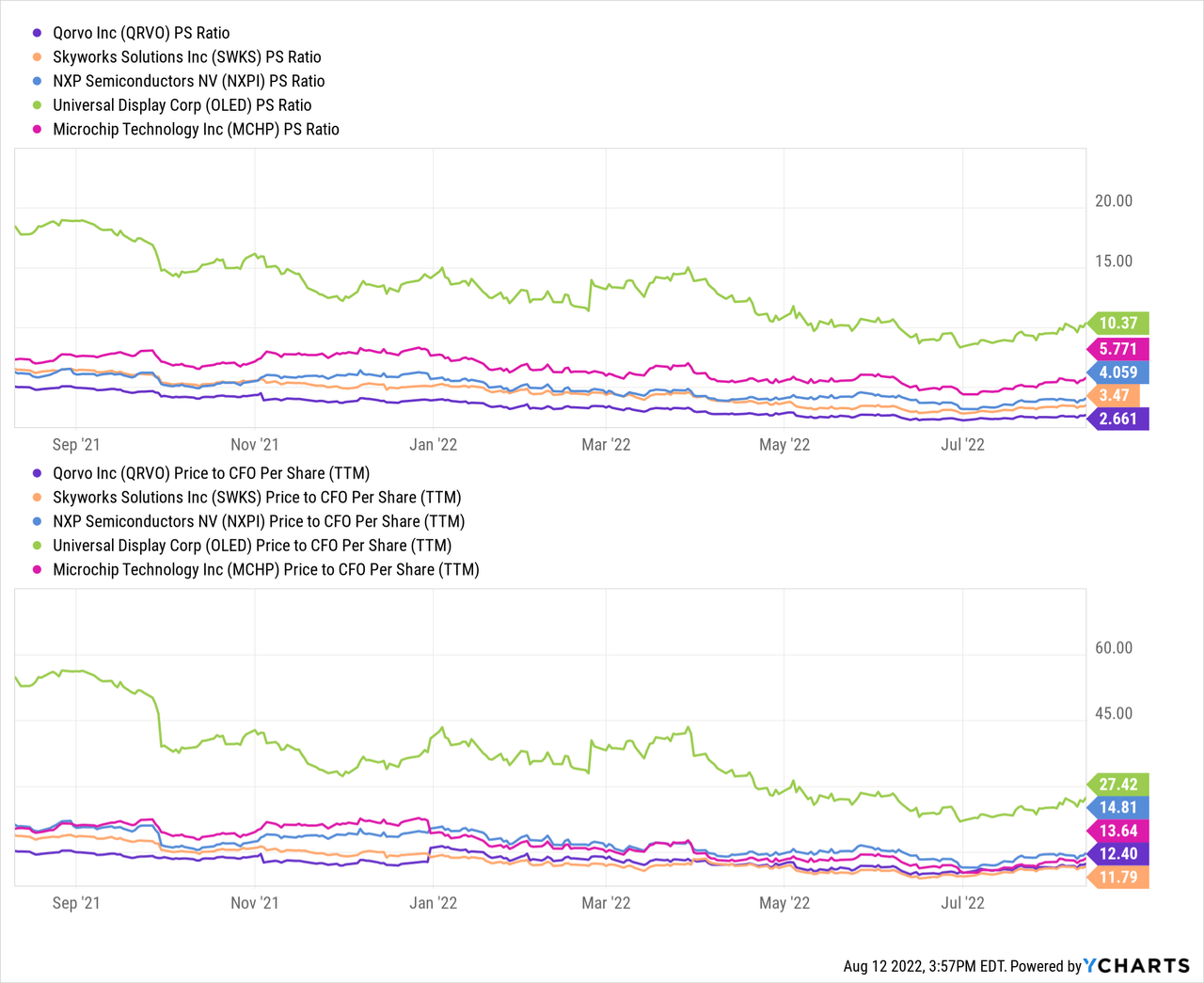

Now, Qorvo is trading below its historical metrics and the industry average.

The next few months will be challenging for Qorvo and its shareholders. Inflation remains high, interest rates are rising, and demand for luxury goods is declining.

Qorvo is well-positioned in the 5G, WiFi 6, power management solutions, and RF segments. Each one of these markets has double-digit expected growth rates. Qorvo showed that it can win designs for the latest flagship phones in the market.

I am comparing Qorvo, STMicroelectronics (STM), and NXP Semiconductors (NXPI) as an addition to the semiconductor portion of my growth portfolio. I will publish my analysis of the other two contenders shortly and then release the complete comparison of the three before including one of them in my portfolio.

I always welcome constructive criticism and open discussions. Please feel free to comment about my calculations and/or sources that I use in my articles.

Be the first to comment