ipopba

A Quick Take On Q2 Holdings

Q2 Holdings (NYSE:QTWO) reported its Q3 2022 financial results on November 8, 2022, missing revenue and beating EPS estimates.

The company provides cloud-based digital banking software to smaller banks in the U.S.

With QTWO producing worsening operating losses and EPS results in a rising cost of capital market that is penalizing loss-making companies, my outlook is on Hold until management can make progress on these critical indicators of business health.

Overview

Austin, Texas-based Q2 was founded in 2004 and provides a wide array of software functionalities to regional and community financial institutions [RCFIs] seeking to modernize their offerings and IT processes.

The firm is headed by Chief Executive Officer Matt Flake, who has been with the firm since 2005 when he started with the company as VP Sales. He previously held positions as Regional Sales Director at S1 Corporation and Regional Sales Manager at Q-Up Systems.

The company’s primary offerings include:

-

Digital banking

-

Digital lending

-

Customer insights

-

Analytics

-

Innovation Studio

The firm acquires customers via its in-house direct sales and marketing efforts and through partner referrals.

Market & Competition

According to a 2020 market research report by Mordor Intelligence, the global financial services application market was an estimated $104 billion in 2019 and is forecast to reach $164 billion by 2025.

This represents a forecast CAGR of 7.89% from 2020 to 2025.

The main drivers for this expected growth are a need for financial institutions to modernize their infrastructure stack to remain competitive for younger demographic users.

Also, the industry needs improved business intelligence solutions as competitive pressures increase from newer fintech firms.

Competitive or other industry participants include:

-

Major consulting firms

-

Systems integrators

-

Institutional financial software companies

Recent Financial Performance

-

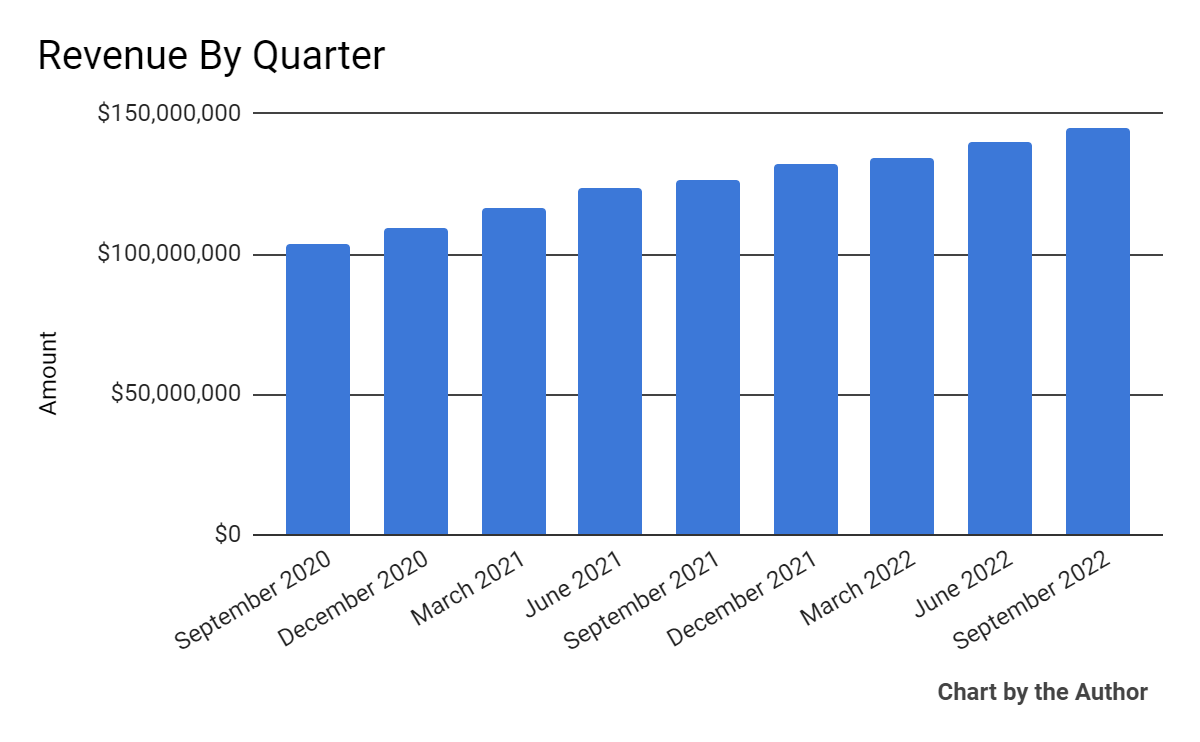

Total revenue by quarter has grown per the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

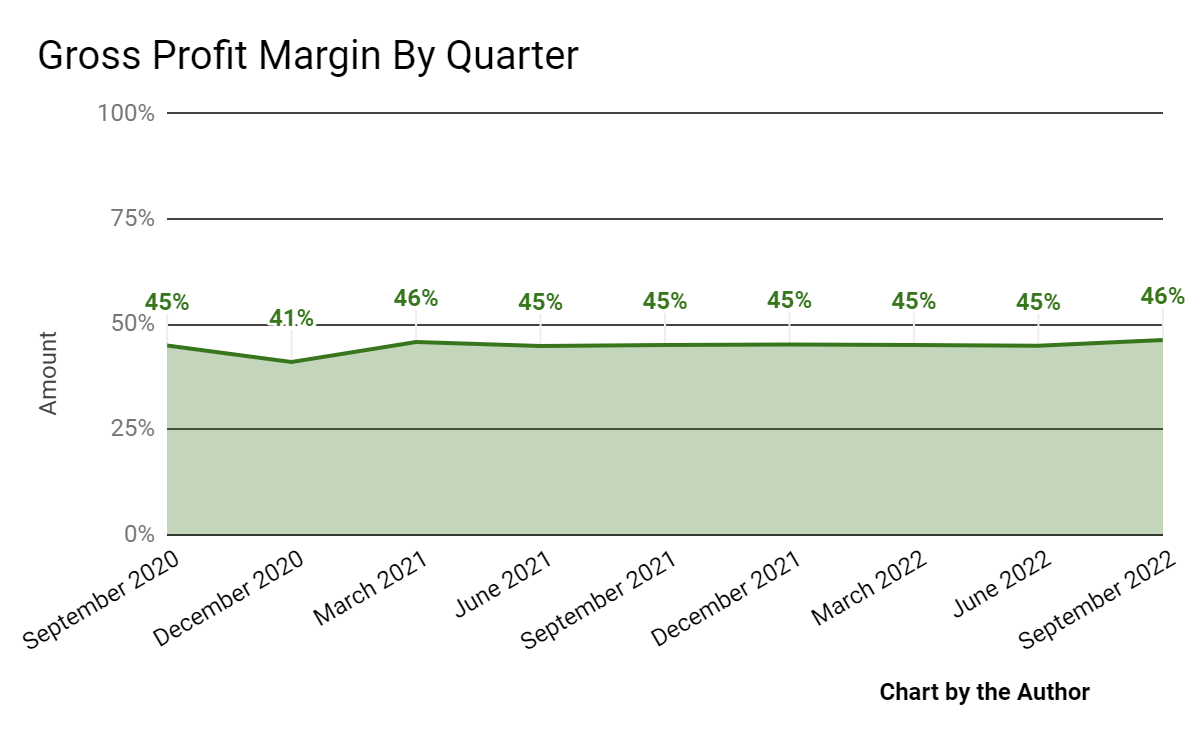

Gross profit margin by quarter has risen slightly in the most recent quarter:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

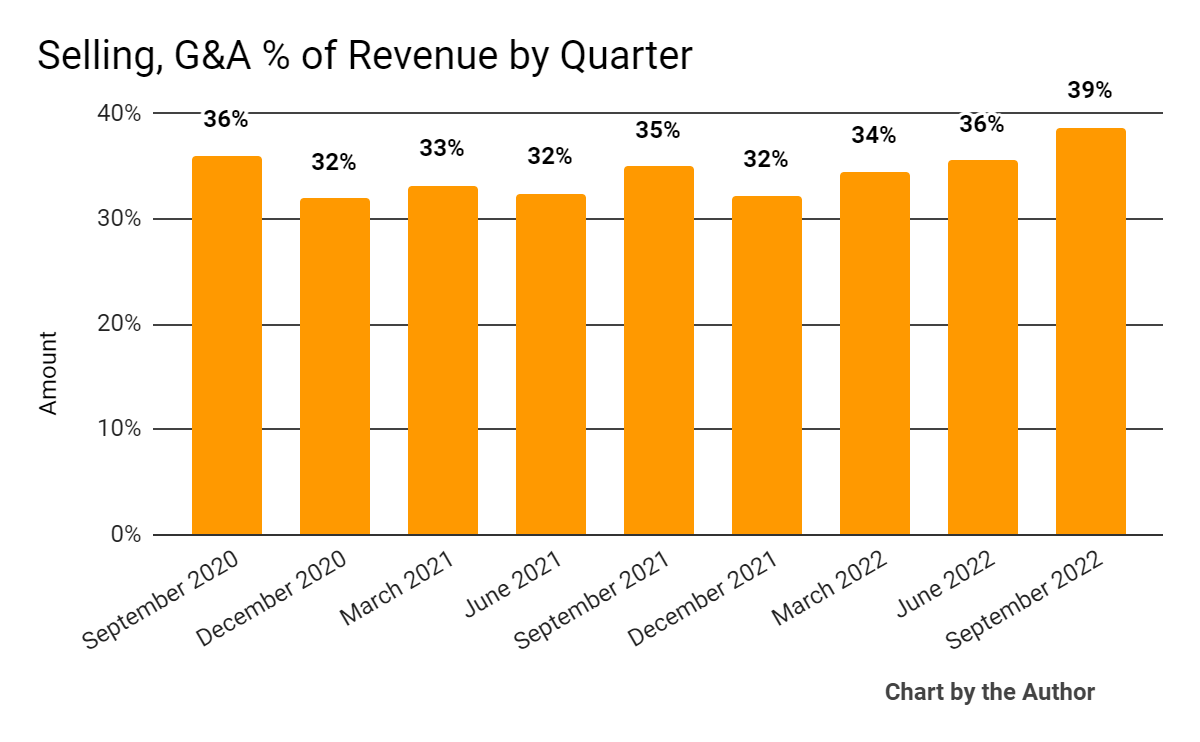

Selling, G&A expenses as a percentage of total revenue by quarter have risen in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

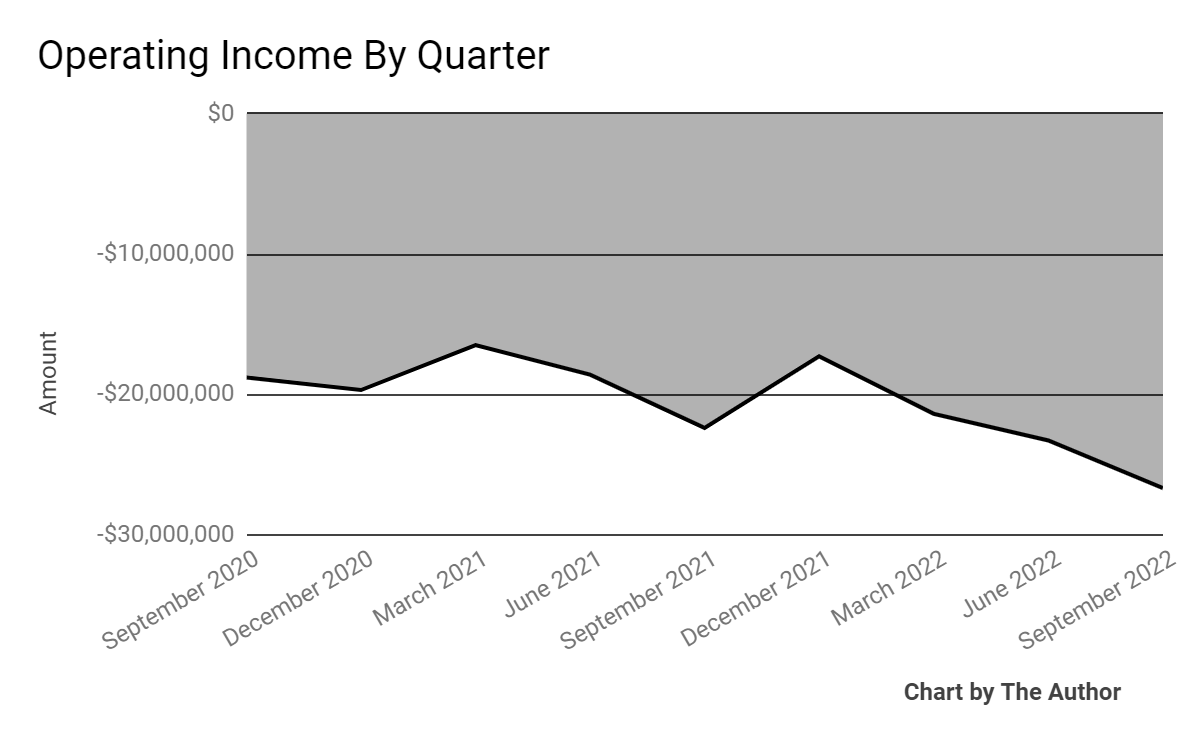

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Losses (Seeking Alpha)

-

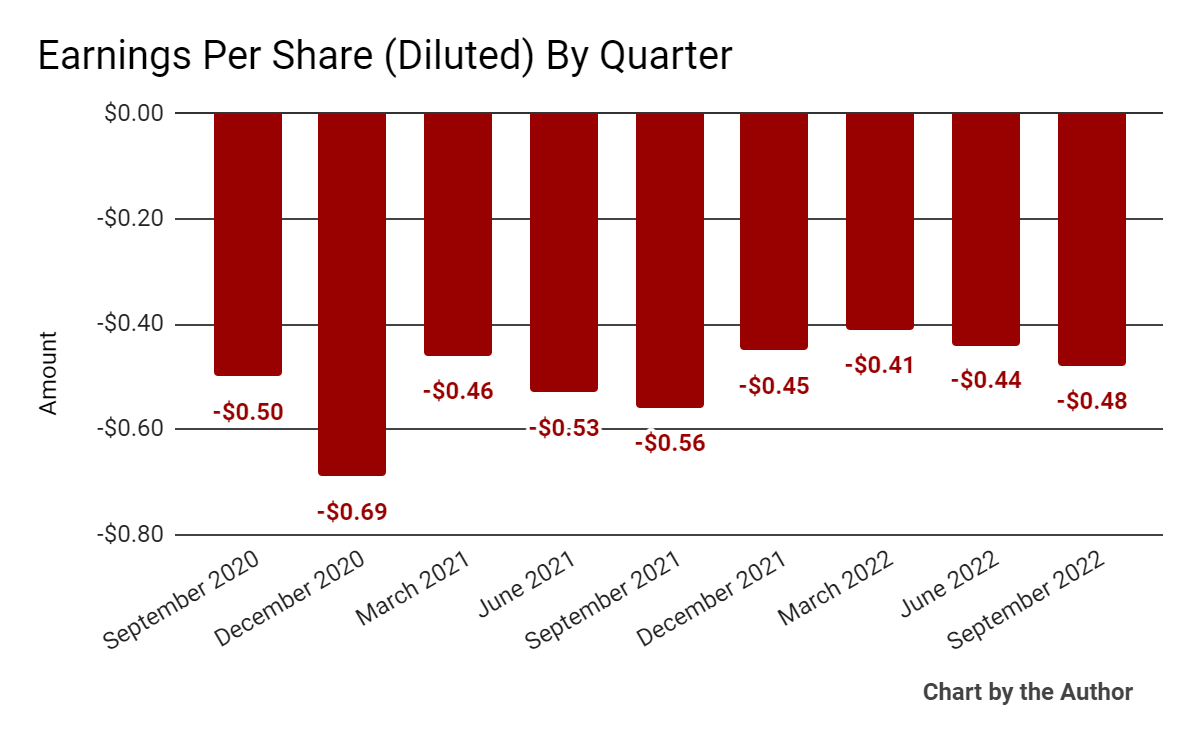

Earnings per share (Diluted) have remained substantially negative:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

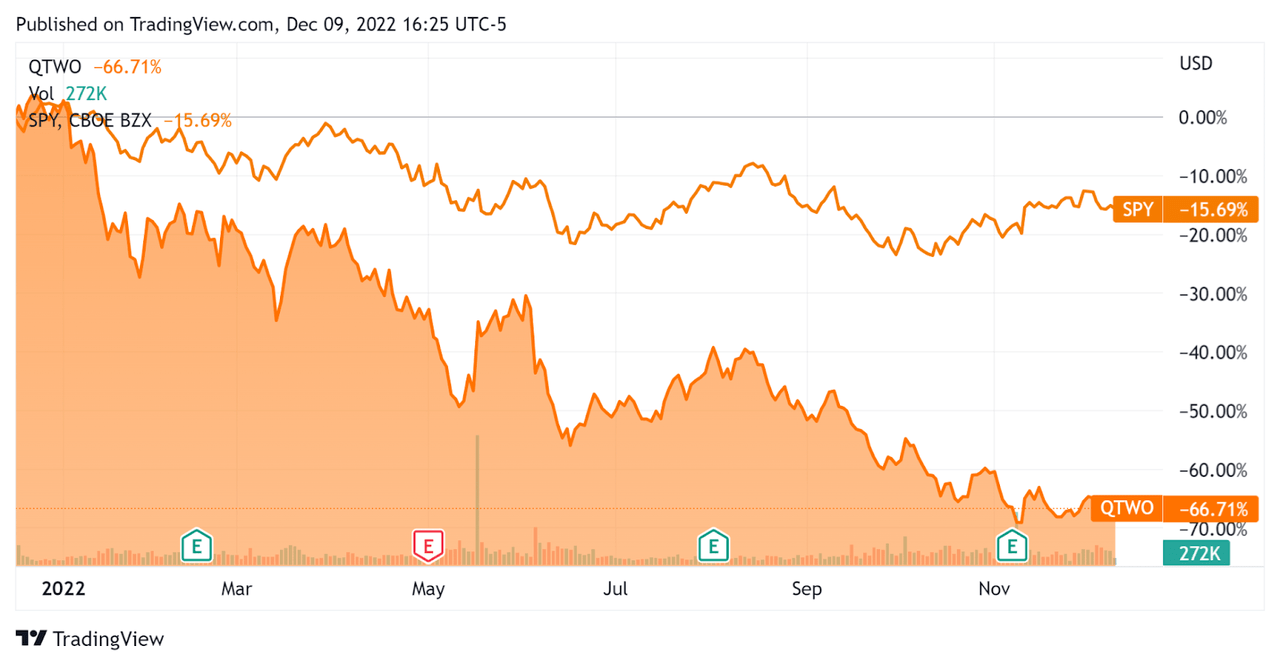

In the past 12 months, QTWO’s stock price has dropped 66.7% vs. the U.S. S&P 500 index’ drop of around 15.7%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

3.3 |

|

Revenue Growth Rate |

15.8% |

|

Net Income Margin |

-18.5% |

|

GAAP EBITDA % |

-9.5% |

|

Market Capitalization |

$1,464,382,460 |

|

Enterprise Value |

$1,801,443,460 |

|

Operating Cash Flow |

$31,065,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.78 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

Q2’s most recent GAAP Rule of 40 calculation was 6.3% as of Q3 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

15.8% |

|

GAAP EBITDA % |

-9.5% |

|

Total |

6.3% |

(Source – Seeking Alpha)

Commentary On Q2 Holdings

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted that the company produced strong sales execution, including a digital banking enterprise deal and 5 Tier 1 wins.

Q2 signed a new Helix customer and acquired Sensibill, a customer data platform. Their digital banking platform appears to be positioned competitively, and CEO Flake said that the demand for digital transformation remains strong.

The company also added over 700,000 users to its digital banking platform, a year-over-year increase of 9%.

As to its financial results, total revenue rose 14.3% year-over-year and gross profit margin was slightly higher, at 46%.

Revenue was below previous guidance due to ‘pressure on our transactional and lower margin services revenue streams.’

Management did not disclose any retention rate metric information. The company’s Rule of 40 results have been in need of significant improvement.

SG&A expenses as a percentage of total revenue has risen markedly in recent quarters, while operating losses have worsened materially and EPS has remained heavily negative.

For the balance sheet, the firm ended the quarter with $395.7 million in cash, equivalents and short-term investments and $668 million in total debt.

Over the trailing twelve months, free cash flow was $18.5 million, of which capital expenditures accounted for $12.6 million in cash used.

Looking ahead, management tempered its full-year revenue growth guidance to 13.5% at the midpoint of the range, while it expected adjusted EBITDA of $40 million.

Regarding valuation, the market is valuing QTWO at an EV/Sales multiple of around 3.3x.

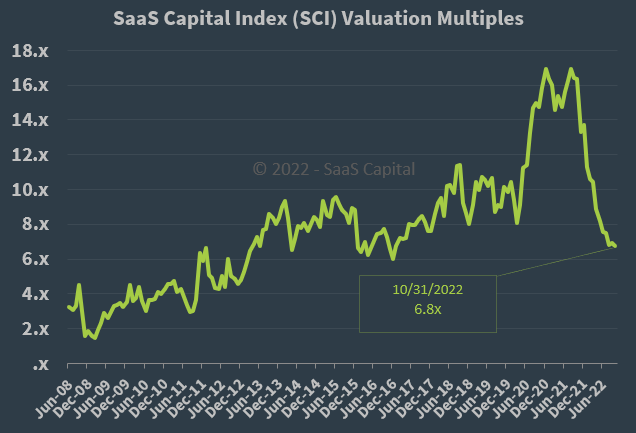

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at October 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, QTWO is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of October 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may accelerate new customer discounting, produce slower sales cycles and reduce its revenue growth trajectory.

With QTWO producing worsening operating losses and EPS results in a rising cost of capital market that is penalizing loss-making companies, my outlook is on Hold until management can make progress on these critical indicators of business health.

Be the first to comment