Lemon_tm/iStock via Getty Images

My Background

Each investor faces a different set of circumstances. Now 35, I have been investing since I was 22 years old. My first investment in individual stocks was made in the heart of the financial crisis back in May of 2009. I purchased 40 shares (80, split-adjusted) of Toronto-Dominion Bank (TD). However, for years before making that purchase I had been researching the best methods available for both wealth creation and preservation.

I don’t believe in taking unnecessary risks and feel the whims of the stock market are too fickle as far as capital gains are concerned to base my aspirations of financial freedom on. Dividend growth investing stands out as it is far more predictable that a healthy company might increase its dividend by 6% than to make any sort of prediction about stock price volatility in the near term.

On this basis and from my initial foray into the markets with TD, I’ve built a portfolio of over 30 cash-flowing equities. My goal is ultimately to have a stock market portfolio which provides enough income to cover all of my expenses.

While some feel that it only requires ten companies to achieve ultimate diversification, I believe there is room for a healthy level of redundancy to avoid the hiccups involved with company-specific performance. Regardless, I endeavor to always own the best of breed companies in their respective industries. I can live with slower growth if it means greater security for my invested dollars.

This is a strategy I have researched over time and came to trust because it can work for me both as a young investor and likewise carry me through the decades to come. While it may not turn heads at a dinner party, it has proven its value over the past few hundred years and remains as relevant as ever today in our digital age.

Having noted the above, it is truly a great time to be a dividend growth investor. The companies I own are committed to rewarding shareholders and I love nothing more than to reinvest back into them to further increase the compounding power in my portfolio

Dividend Summary

I earned income from 36 companies in total, comprised of 25 payments in CAD and 11 in USD.

Please note that all Canadian companies are owned in CAD on Canadian exchanges. KO and JNJ are owned in CAD within my portfolio, though they reside on the NYSE.

CAD Dividends

| Company | CAD Payments ($) | Div Change (%) |

| Toronto-Dominion Bank (TD) | 178.00 | |

| RioCan Real Estate Investment Trust (OTCPK:RIOCF) | 66.57 | |

| The Coca-Cola Company (KO) | 73.02 | 4.76 |

| Johnson & Johnson (JNJ) | 90.17 | 6.60 |

| BCE Inc. (BCE) | 202.40 | 5.14 |

| Canadian Imperial Bank of Commerce (CM) | 19.32 | |

| Corby Spirit and Wine Ltd. (OTCPK:CBYDF) | 12.00 | |

| Bank of Nova Scotia (BNS) | 100.00 | |

| TELUS Corporation (TU) | 70.39 | |

| Rogers Communications Inc. (RCI) | 27.50 | |

| Fortis Inc. (FTS) | 96.30 | |

| Canadian Utilities Ltd. (OTCPK:CDUAF) | 104.39 | |

| Canadian National Railway Company (CNI) | 32.96 | |

| Canadian Pacific Railway Limited (CP) | 9.50 | |

| Hydro One Ltd. (OTC:HRNNF) | 72.70 | 4.99 |

| Chartwell Retirement Residences (CWSRF) | 15.30 | |

| Metro Inc. (OTCPK:MTRAF) | 5.50 | |

| Brookfield Renewable Partners L.P. (BEP) | 115.35 | |

| Brookfield Renewable Corporation (BEPC) | 52.62 | |

| Brookfield Asset Management (BAM) | 3.98 | |

| Brookfield Infrastructure Partners L.P. (BIP) | 13.66 | |

| Brookfield Infrastructure Corporation (BIPC) | 1.37 | |

| A&W Revenue Royalties Income Fund (OTC:AWRRF) | 18.60 | |

| Enbridge Inc. (ENB) | 21.50 | |

| Saputo Inc. (OTCPK:SAPIF) | 5.40 |

USD Dividends

| Company | USD Payments ($) | Div Change (%) |

| Waste Management, Inc. (WM) | 27.63 | |

| McDonald’s Corporation (MCD) | 24.64 | |

| Yum! Brands (YUM) | 18.90 | |

| Yum China (YUMC) | 3.98 | |

| PepsiCo, Inc. (PEP) | 9.78 | 6.98 |

| Walmart Inc. (WMT)* | 14.28 | 1.82 |

| Visa Inc. (V) | 4.79 | |

| AbbVie Inc. (ABBV) | 63.45 | |

| Microsoft Corporation (MSFT) | 6.86 | |

| Mastercard Incorporated (MA) | 2.92 | |

| Apple Inc. (AAPL) | 3.45 | 4.55 |

* WMT paid two dividends in Q2.

Dividend Totals

My dividends churned off C$1,408.50 and U$180.68, combining for a currency-neutral sum of $1,589.18. This comes as a 7.07% increase over my portfolio income from Q2 2021.

As I have continued building out the technology segment of my portfolio which tends to provide lower yields (if any), this is a nice boost. As in the past, all dividends continue to be selectively reinvested in order to compound the wealth machine.

The first half of the year has been solid and brought in $3,087.02:

| Quarter | Dividend Income ($) |

| Q1 | 1,497.84 |

| Q2 | 1,589.18 |

A Dividend King is Born

One noteworthy event from the portfolio payments is that this most recent payment from PEP represents its 50th consecutive dividend raise, putting the business in elite company. This staying power is exactly what I am always looking for. It signals that the business model has genuine durability across different business cycles.

I’ve been a shareholder of PEP going back to early 2015. I’ve been fortunate to be along for a steady ride of increases along the way. My plan with this one is to hold it for life.

Market Activity

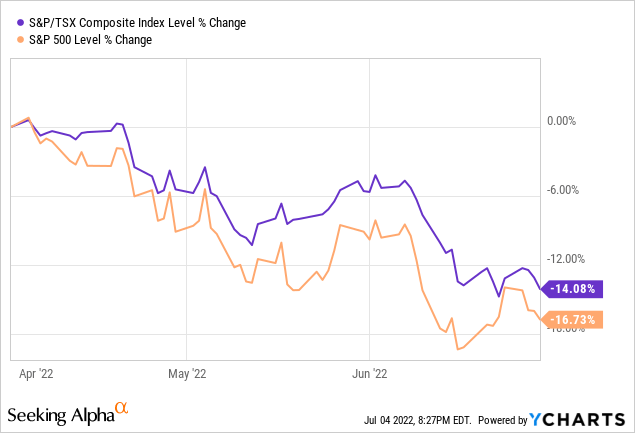

The market has continued to recede continuously over the course of the past three months:

The combination of rising interest rates, fears of recession, and massive geopolitical uncertainty have provided considerable headwinds for stocks. All the same, my long term views and belief that the future will always be brighter than the past remain unchanged.

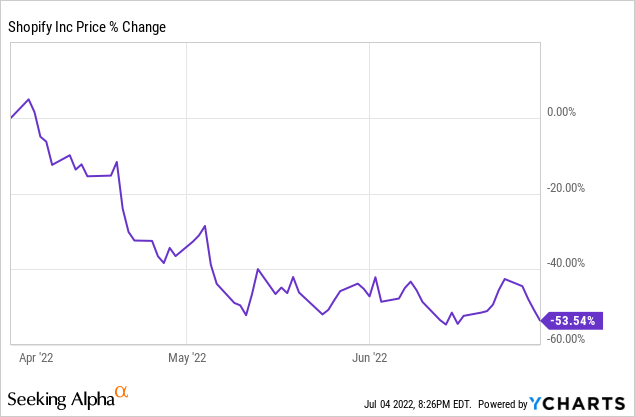

Accordingly, I bought Shopify Inc. (SHOP) in three tranches from April through June. I wanted to take advantage of the recent price weakness:

My purchases came together for a grand total of C$3,456.74.

Q3 2022 Stock Considerations

As noted, there are a fair number of macro factors weighing on stocks. I hope and suspect that the opportunities to double down will persist.

Real wealth is made on downturns, not when the market is frothy.

I recently highlighted Microsoft (MSFT) and Oracle Corporation (ORCL) as being two firm stocks which can succeed in an inflationary environment. They both have robust earnings streams with secular tailwinds propelling them forward. As prices across the system rise, they will be able to keep pace with their new contracts and renewals.

On the Canadian side of the equation, I picked out TD and CNI for my July Dividend Growth Stock Watchlist. Both companies are heavily investing in new technology such as AI and machine learning to ensure they remain ahead of the curve in their respective industries. Combine that with incredible balance sheets and healthy, rising dividends, and it’s a winning formula.

Near Term Cash Crunch

All the same, it is likely that my ability to capitalize on pullbacks will be diminished in the second half of the way based on two key factors:

- I’ve just purchased a home.

- A friend is getting married in Europe, which I’ve turned into an opportunity for a sizeable vacation.

These two events are taking up a large chunk of my cash flow and will continue to do so over the next two months.

As such, my plan will be to mostly redeploy the dividends stacking up in my account. This will keep the cash snowball rolling and accumulating.

Conclusion

The second quarter of the year raked in +$1.5k in dividends. This is a nice psychological threshold as it represents +$500 in monthly dividend income.

That’s cash flow I can count on regardless of market conditions because it comes from such a wide variety of quality companies. Even through the pandemic, my portfolio saw very little turbulence. In fact, there were far more dividend increases than suspensions or cuts.

The main thing is to not get sucked in by high yields. Instead, focus on the underlying business models and demonstrated track record of rewarding shareholders.

I appreciate you reading and following my journey.

Be the first to comment