Mario Tama

Altria Group, Inc. (NYSE:MO) has always been one of the largest holdings in our portfolio. Whether it is at #1 or #3 depends on the performance of the individual stocks, but it is a fair statement to say it has been a top-3 holding for a very long time. Given that, it is obvious that we notice the performance of Altria when looking at the overall portfolio, even if we don’t feel the urge to actually monitor this position too often given the reason (dividends) we hold this stock.

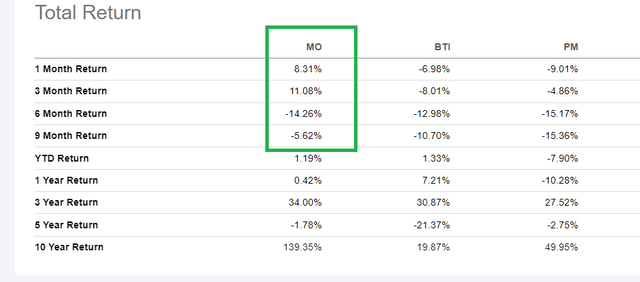

Before performing this exercise, we had a hunch that Altria should have outperformed the market in the recent months, and it sure has. Although the percentage varies, Altria’s outperformance over the S&P 500 Index (SPY) is telling whether you look at 1M, 6M, 1 Y, or YTD charts. Altria has also performed better than fellow tobacco stocks Philip Morris (PM) and British American Tobacco (BTI) in most of these timeframes. Only in the 6-month time frame does Altria lag slightly behind those two names, and that is attributed to the fact that Altria reached its 52-week high of $57.05 exactly 6 months ago.

MO Peer Evaluation (SeekingAlpha.Com)

Now, all that is hindsight. What about the future? No one has a crystal ball, but we offer the analysis below on why the recent outperformance is likely to continue at least ’till the end of the year.

Strong Dollar

In a market looking for excuses to sell off, a strong U.S. dollar causing headwinds to stocks with International exposure is next on the list as Seeking Alpha has covered here. In the short to medium term, this is expected to make things harder for stocks with international exposure, which means stocks like Altria with 100% domestic exposure should perform better when it comes to earnings (both actual and estimates). Add this to the fact that domestic stocks trade at a discount compared to International stock as shown in the excerpt taken from the article linked above:

“The median (domestic) stock trades at a 12% P/E discount to the median (international) stock (vs. a long-term average of 5%) and offers slightly faster 2023 EPS and sales growth.”

The flip side of it has always been that a weaker dollar benefits companies with international exposure, and Altria misses out.

Tax-Loss Harvesting

Tax-loss harvesting is well known to have an impact on the price of certain stocks towards the end of the year. This gets even more relevant in a massive down year like this, and one can expect losers to sell off even further to maximize the write-offs.

With a YTD performance of -5%, Altria will be at the very bottom of any such list. Not only will the stock not have this selling pressure, but may also benefit from the released funds getting reallocated to safer and cheaper names.

Good Riddance, JUUL

JUUL has been nothing short of a nightmare for Altria’s investors from the get go. Altria has been cushioning the blow by almost continually writing off the value of JUUL on its books each quarter, but the damage has been significant overall. So, what is good about this now?

- The present valuation of JUUL on Altria’s books is just $450 Million, a miniscule amount for an $81 Billion company.

- Altria has ended its non-compete agreement with JUUL. This could mean the company is either on the lookout for a better e-cigarette brand or is working on its own to master this market. As long-term Altria investors, we hope the company takes its sweet time to figure out the next step in this space, instead of wasting another $10 Billion in a rushed effort. Or Altria could be thinking about the recouping its JUUL losses in a different way as written below.

- JUUL is preparing to file Chapter 11. Altria is likely to be the first in line in the event that JUUL’s IP and valuable assets are on sale. With its larger network and deeper pockets, Altria may just be able to run things better than JUUL was. But this is a long shot at this point since the large shadow of the FDA is still lurking with respect to vaping.

Inflation Hedge

Not only does MO stock yield twice the 10-year treasury yield in spite of rising rates, but the company also is one of the best bets during an inflationary environment. The beauty of selling an addictive consumer product in billions of units is that even in a declining volume business under an inflationary environment, the company can and does pass on a few cents of price increases profitably. The consumers usually don’t even feel the pinch and even if they do, they are unlikely to kick their habits in mass.

Conclusion

Altria’s impressive start to 2022 went downhill since reaching $57 in April. But the stock’s recent relative outperformance shows investors are appreciating safety over growth and risky assets right now. We expect this trend to continue for at least the next two quarters until clarity emerges on taming inflation and Fed’s policies. This is not to say Altria, or any stock for that matter, is a buy at any price. Our sweet spot for buying Altria is between a multiple of 9 and 12. Using the current forward EPS estimate of $4.84, that would be between $43.56 and $58.08.

Good luck out there and stay safe.

Be the first to comment