gilaxia/E+ via Getty Images

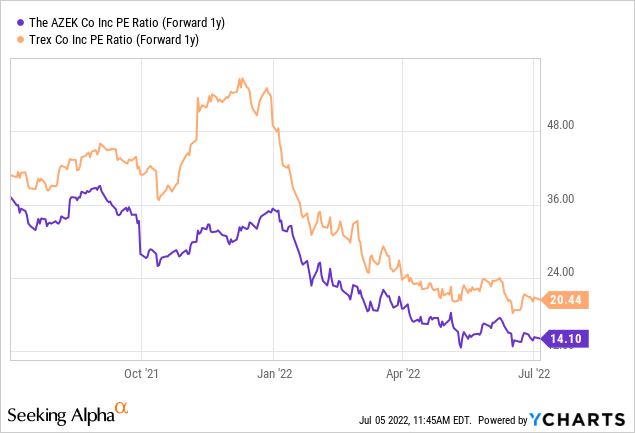

The AZEK Company (NYSE:AZEK), a leading manufacturer of residential composite decking and related products, has lagged its peers in recent months amid continued price/cost headwinds and concerns around a pending macro slowdown. Despite the near-term headwinds, I continue to believe in the AZEK medium-term earnings outlook on the back of the extensive decking conversion runway as well as the company’s various margin levers (e.g., recycling initiatives). With spending on the Boise expansion also set to wind down, the company’s cash generation should trend higher, clearing the path for accretive capital deployment opportunities ahead. Assuming management successfully unlocks the 500+bps of margin expansion guided at its investor day, margins should converge toward its closest peer, Trex Company (TREX), justifying a narrowing of the valuation gap.

Structural Tailwinds Underpin Top-Line Growth Targets

AZEK’s investor day event this year was a timely reminder that the growth story remains intact despite a recession looming. With inflation soaring, AZEK’s wide range of price points stands out, providing consumers with the flexibility to move up or down its product tiers through the macro cycles.

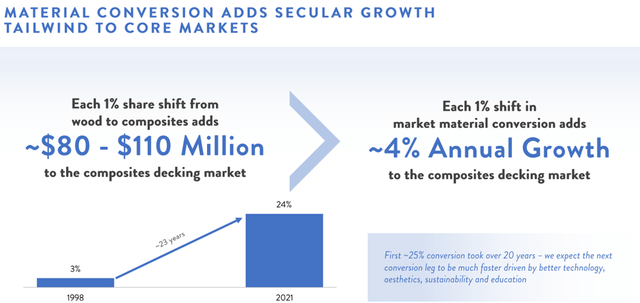

Over the longer term, industry trends also appear encouraging, as homeowners are increasingly prioritizing aesthetics in decks and moving away from wood – a recent proprietary survey of homeowners by AZEK indicated c. 55% would be more open to composite decks, suggesting a potential doubling of its TAM (“total addressable market”). As every 1% shift away from wood results in an additional 4% annual market growth, a further acceleration in composites’ share gains within the decking industry (note the shift has accelerated from an average of c. 45 bps/year from fiscal 2014-2018 to c. 175 bps/year from fiscal 2018-2021) is a nice revenue tailwind. The company’s expansion into adjacent markets like siding, cladding, and outdoor furniture has also been a highlight, and there remains plenty of growth from organic means and through acquisitions (e.g., its recent purchase of StruXure).

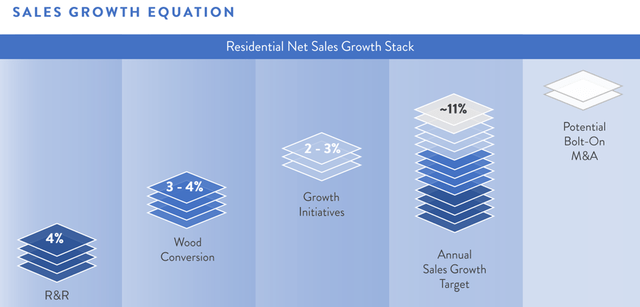

Over the medium term, AZEK projects $2.3 billion in top-line on the back of structural growth in the composite decking industry and residential sales growth of c. 11% (comprising +4% from repair and remodel growth, +3-4% from wood conversion, along with +2-3% from growth initiatives). Notably, the guidance embeds a fair bit of conservatism, assuming only c. 1% annual material conversion in the decking market (below the c. 175 bps/year between fiscal 2018-2021). The company’s track record of successfully developing and selling its new products is also worth taking into account – as of this year, AZEK expects products introduced since fiscal 2018 to represent c. 60% of total decking sales. Coupled with the potential for further expansion from bolt-on acquisitions, AZEK looks well-positioned to exceed its growth targets in the upcoming years.

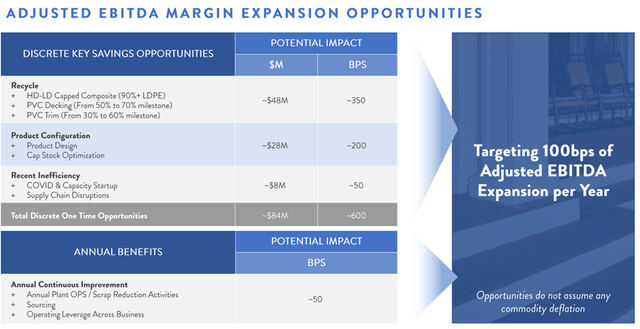

Plenty of Room for Upside from Margin Expansion Initiatives

Encouragingly, AZEK’s targeted 500bps EBITDA margin expansion (from fiscal 2019 levels) is intact, with c. 100bps improvement to be unlocked annually through fiscal 2027. Recent months have seen some of the margin efforts masked by inflation and startup costs, but concrete initiatives are in place for the longer term. These include increasing recycled content along with continuous operational improvements (c. 50bps/year). As current sustainability targets (70%+ recycled content in its PVC decks and 60+% recycled content in its PVC trim, along with 90% LDPE (“low density polyethylene”) in capped composite) would entail a substantial c. 350bps of gross margin improvement (or c. $50 million of cost savings), execution will be crucial.

Over the medium to longer term, I expect the EBITDA margin guidance will ultimately prove conservative, considering AZEK’s proven track record around production and new product development. Also worth noting is that the current guide does not embed any commodity deflation assumptions or any benefit from an estimated $30+ million (or 220+ bps margin) of positive price/cost carryover in fiscal 2023. Altogether, the combined impact of these one-time tailwinds and AZEK’s cost-saving opportunities should drive upside to the current 500bps target into fiscal 2027 and beyond.

Cleaner Balance Sheet Supports the Growth Outlook

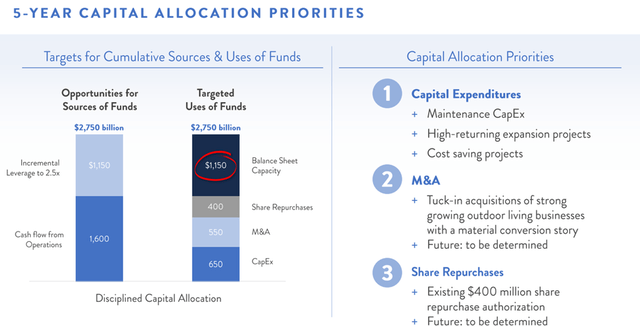

Having deleveraged significantly post-IPO, AZEK’s cumulative operating cash flow is now guided to reach an impressive c. $1.6 billion through fiscal 2027, effectively covering its financing needs and then some. Unsurprisingly, investing in growth opportunities remains the highest priority use of cash, followed by tuck-in acquisitions and share repurchases. Specifically, management has guided to capex of c. $650 million and c. $400 million of buybacks over the next five years, along with an additional c. $550 million for opportunistic deployment.

Also encouraging is AZEK’s flexibility – should a macro downturn materialize, the company can adjust its spending accordingly via maintenance capex ($30-50 million/year) and working capital ($30-40 million available). With AZEK also set to be in a net cash position by the end of this fiscal year, the company could unlock an additional c. $1.2 billion of balance sheet capacity by taking on incremental leverage (up to 2.5x). Nonetheless, my base case is for minimal earnings volatility – having reduced its commercial exposure and made its c. 90% of its COGS base variable following the ‘08/’09 housing downturn, AZEK is well-positioned to withstand economic turbulence.

Final Take

Overall, it was a positive investor day event by AZEK – its longer-term fundamentals around outdoor living remain intact, while its leadership within composite decking leaves it well-positioned to capitalize on the secular industry-wide shift away from wood in the upcoming years. In addition, AZEK has a clear margin improvement runway, led by the planned expansion of its recycling capabilities (in-line with peer TREX), in addition to continuous improvement initiatives. Yet, AZEK shares currently trade at an elevated relative discount to TREX– unfairly discounting the company’s fundamental prospects over the next few years as well as over the longer term.

Be the first to comment