Tero Vesalainen

(Note: This article was in the newsletter November 15, 2022.)

Warner Bros. Discovery, Inc. (NASDAQ:WBD) is not going to go broke. The prime reason is that management is taking action right away to fix the situation. That is the kind of thing that prevents bankruptcy much of the time unless the deal is so bad that the situation is hopeless. But the same managements that turn things around right away often do their due diligence, so they do not get into hopeless situations.

In contrast, the managements I have followed that have gone broke either take no action or take inadequate action for what is about to happen. Usually, both of those unsatisfactory management activities are in evidence (unfortunately very upfront and sometimes in very generous amounts). Similarly, if an acquisition is made, the due diligence is generally lacking, so the acquisition adds to the company problems rather than making things better. The key here to all of this is inaction followed by lack of significant action.

First Quarter Earnings Call

This management began taking action right away. One of the things I noted was the apparently pitiful, if any, free cash flow that came with this giant acquisition. This is an industry that usually generates free cash flow such that free cash flow is a major acquisition consideration.

Warner Bros Discovery Statement Of Action Plan Upon Completion Of The Merger (Warner Bros Discovery First Quarter 2022, Earnings Conference Call Transcript)

Management right away “hit the ground running.” Evidence of this was in the headlines as well as the announcement of succeeding write-offs, layoffs, and other adjustments that have filled the airwaves since then. This is a management that knew they were getting a deal on something that needed considerable work to be satisfactory (and even more work to meet their own standards).

Now, note that management has really not impaired the major profit centers of the acquisition, nor has management yet reported a major profit reduction in the future. Timing has changed on the recovery. But management has not stated “we thought this would make money and it will not.” That is important, because it means the basic premise of the deal is still in place in terms of the major profit centers.

The market often confuses what is going on here with something like General Electric (GE), where things were allowed to deteriorate for as long as I can remember. Decades ago, I was studying what the accounting was telling the public and how much management ignored it in business school. Yet the size of the company allowed things to continue for some time. Now, it is pretty much a very hard if not impossible situation because action was not taken when it should have been.

In the case of Warner Bros. Discovery, management has acquired a business that it very much knows. When AT&T (T) owned the company, this acquisition was a venture into new territory that management hoped (emphasis on hope) would enable the company to enter a bright future. But it is also clear that the Warner Bros business was so unlike the telephone business that management was clearly in over their heads. So, they sold the business before things became so bad that it was worthless.

Both the new Warner Bros. Discovery, Inc. and AT&T are examples of management that does something before the whole situation becomes so untenable that the business ends up filing for reorganization. It really does not take much to avoid bankruptcy. So, usually when a company is going to go under, the signs of it are obvious inaction for a prolonged period of time that inevitably dooms the business.

Third Quarter

By the time the latest quarter rolled around, there were some market fears about the macroeconomic environment combined with the upheavals of the company to produce a disaster. It can happen, but again, usually it happens with managements that do too little too late.

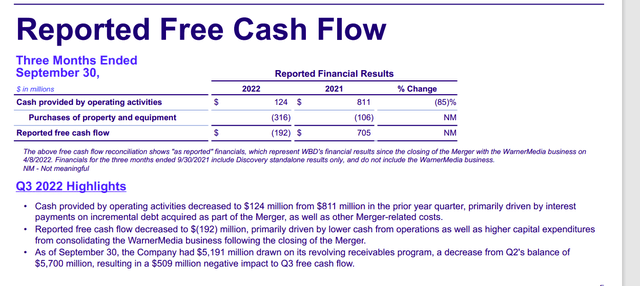

Warner Bros Discovery Discussion Of Free Cash Flow Changes (Warner Bros Discovery Third Quarter 2022, Earnings Press Release)

Probably the focus of the coming “disaster” was the disappearance of cash flow in general combined with the negative free cash flow above. But just reading the explanation below the comparison demonstrates a lot of nonrecurring expenditures due to the merger. That means that the business generated the usual cash flow. But there were expenditures that counted as expenses and so decreased cash flow from operating activities and then put a good sized “dent” in the free cash flow calculation. Even so, the company still has free cash flow on a year-to-date basis. Cash flow has so far only “disappeared” for one quarter.

Yet Mr. Market acted as though this was going to continue “forever.” In some ways, the repayment of the various forms of debt are going to continue “forever” because Mr. Market has a short attention span for some things. On the other hand, repayment of debt is a good thing back when I was in business school. Yet the market managed to make it a bad thing because it “hurt” free cash flow.

Further on in the report, management shows on the cash flow statement that about $6 billion of debt was repaid. That was a demonstration of faith by management in the turnaround efforts or else they would have kept the cash “just in case.” There is not that much debt due immediately. So, an early repayment of debt because management feels the flexibility is not needed is a good thing (or at least it used to be).

Improving Cash Generation

More importantly the cash flow statement demonstrates an improved ability to generate cash. That is a huge deal.

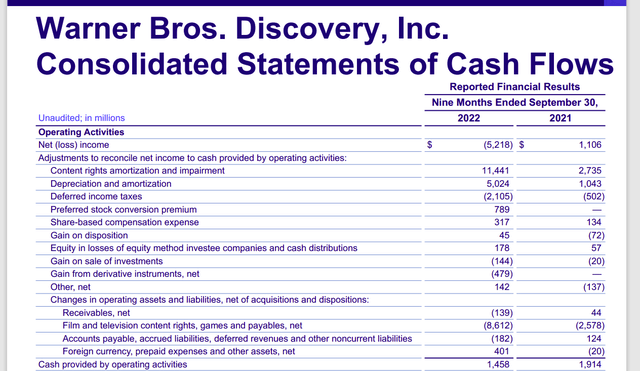

Warner Bros Discovery Third Quarter 2022, Cash Flow Generation (Warner Bros Discovery Third Quarter 2022, Earnings Press Release)

The big deal to note is the huge negative swing on “Film and Television Content Rights” when compared to the year before. The company operations had to generate the cash to pay for that swing. It indicates that company operations generated about 3 times the cash flow before “Changes in Operating Assets and Dispositions.” That is very likely evidence of cash flow improvement since the acquisition was made that will be in evidence next fiscal year when there is very unlikely to be that kind of unfavorable variance that uses a lot of cash flow.

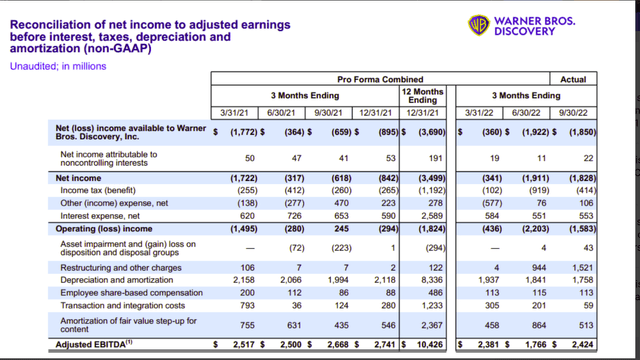

Warner Brother Discovery EBTIDA Trend Before And After Acquisiton (Warner Bros Discovery Third Quarter 2022, Trending Schedules And Non-GAAP Reconciliations)

Further evidence of improvement is shown in the EBITDA calculation. Note that quarterly EBITDA headed upwards in the latest quarter. That definitely needs to continue to go quite a bit higher. But improvement needs to start somewhere. This is evidence that management has taken action to improve the situation right away.

The market focused on the quarterly comparison which was lower. Both comparisons matter. What is likely to matter more is getting that EBITDA climbing sequentially during the fiscal year for a while.

Debt Implications

What is at stake here is access to the debt market. Management undoubtedly got the debt part of the acquisition done because of their reputation. That means lenders have certain expectations about progress that have to be met. The interest rate that the company is paying on the debt indicates a fair amount of faith that management will perform as the debt market intends.

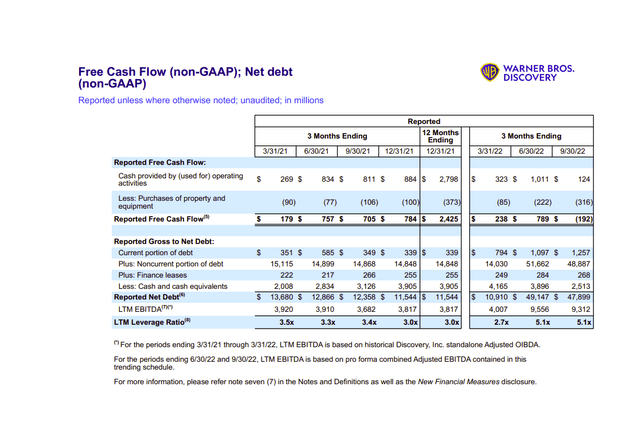

Management reported that the leverage ratio was 5.1 and that the interest rate averaged around 4.3%. That interest rate will not be available at refinance time if the debt market does not see material improvements to the leverage ratio. It is one of the reasons that this management “hit the ground running.”

Key Takeaways

The current debt trend since the merger appears to be one of improvement.

Warner Bros Discovery Debt Ratio Calculation And Free Cash Flow Calculation (Warner Bros Discovery Trending Schedules And Non-GAAP Reconciliations)

This management understands that a quick deleveraging process is very necessary. To that extent there has been some long-term debt repaid every quarter. As can be seen from the chart above, there is still more debt that management intends to repay that is shown as current.

But the ratio has another number in the numerator. Management intends to increase that and is showing shareholders progress by using the trend reports. The fact that management is working on both numbers of the leverage calculation should ensure a rapid change for the better.

One thing that management can do with lenders is list the one-time payments that have to do with the acquisition. When that is taken into consideration, the cash flow statement shown earlier provides clues of the ability of the combined entity to generate quite a bit of cash. Getting that cash to the Free Cash Flow statement is the obvious goal that management is managing towards.

It does appear that the business is able to generate roughly $13 billion or so in cash on an annual basis before changes in accounts. Then the key action is to take the steps necessary to see that the cash flow is not used for items not providing an adequate return. This is why there are so many announcements of rightsizing and layoffs.

Increasing profitability will take a little longer. But the good news is there appears to be a decent amount of cash generation to work with at the present time.

Risks

There is a current worry about the weak advertising market. If it is about the recession fears, then recessions have a way of disappearing rather quickly. Clearly the market is way overdoing any worries about this based upon current information.

There is the risk of a mistake. This management appears to be putting controls in place to correct any mistakes quickly.

The recession turns out to be worse than expected. This risk would likely lead to deeper personnel cuts and other cutbacks to survive a downturn. It would take a depression to cause the merger to fail.

The Future

Warner Bros. Discovery management is doing what it can to turn the whole situation around. There are avenues like more quality movies to properly exploit the owned franchises that are very likely to increase cash flow even during a recession. Similarly, online sports betting may be another avenue for this management to explore in the future.

But overall, there were some worries about the decrease in EBITDA. That should have been expected by the market as a possibility once management gained control of the assets. The next fiscal year will likely be a lot better. Timing of a recovery and turnaround can be tricky when the forecast is made before the acquisition is complete. Now that management controls the assets, those guidance numbers will be revised well into probably next year because this is such a large acquisition.

Turnarounds of this size often take a while. So, the impairments and layoffs should have been expected. But from here on in, improvements are likely to begin to dominate any more “bad news” as the “big stuff” has likely been dealt with.

One thing to remember is that this kind of deal gets done because management can at least double the valued paid. That implies a fair amount of upside over the next 5 years. Most deals like this get done to triple the value in 5 years to overcome the risk in doing the deal in the first place. Whether management actually gets there is another matter. But the Warner Bros. Discovery, Inc. stock price has declined enough that investors should do well regardless of how close management comes to the presumed goal. The chances of total failure from the current levels of the stock are not that great.

Be the first to comment