Khanchit Khirisutchalual

I have been following PubMatic (NASDAQ:PUBM) since the company came public in the second half of 2020 as it was a new player in a fast growing market and was actually boasting impressive metrics, such as very high gross margins, revenue growth and was also consistently profitable. With these characteristics, it didn’t take long for the stock to be caught in the last tail of the market bubble, and the stock was quickly bid up 158% in February 2021. From that moment, the stock only went down and is sitting now over 70% down from all-time highs, at a market cap just shy of $900 million.

Nevertheless, quarter after quarter the company never disappointed and has actually proven to be able to keep growing its business in a sustainable way, practically with no acquisitions while still maintaining both positive GAAP net income as well as free cash flow, a very rare sight among very high growth companies. With the shares declining so much over the past year, I believe the valuation is more than fair at the moment and an investment in PubMatic appears quite favourable.

General thesis and recent performance

The main thesis around an investment in PubMatic revolves certainly around the increasing digitalization of advertising as a whole. The company operates in digital advertising, providing an infrastructure to its customers that enables real-time programmatic advertising transactions. Co-Founder and CEO Rajeev Goel has stated during the last earnings call that “all advertising will be digital, and all digital advertising will be transacted programmatically”. While the statement will probably not be proven to be exactly correct (I believe there will always be a part of advertising which won’t be digital or programmatic), the global macro trend is indisputable and PubMatic seems well positioned to gain shares of it. In 2022, around 63% of total ad spending is estimated to be spent towards digital ads, a share that is also estimated to grow to 73% in 2026 according to Insider Intelligence and eMarketer.

The trend is also clear in Connected TV (CTV) and streaming as a whole: both Disney+ and Netflix have plans to soon introduce ad-supported tiers of their streaming services which will further fuel the growth of the area in which PubMatic is more specialized. In the last quarter, CTV revenue growth hit over 150% while omnichannel video share of total revenue reached over 30%.

PubMatic Q2 2022 Earnings Report

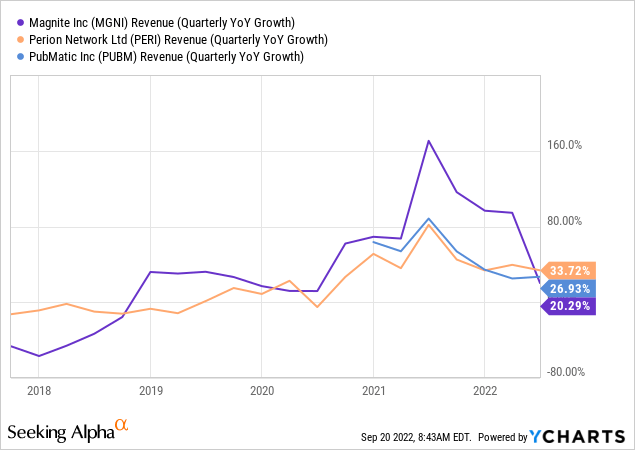

PubMatic has definitely experienced a slowdown in revenue growth from mid-2021 onwards, in line with the Federal Reserve starting a new cycle of more hawkish monetary policy and the looming of a potential hard landing induced recession spelling fear for many industries, advertising included. There is no beating around the bush that in a recession businesses generally devote less of their budget to advertising and more to, well, navigating the hardship. However, as the following chart demonstrates the slowdown in revenue growth is absolutely not unique to PubMatic but instead has hit also its more direct competitors Magnite (MGNI) and Perion Network (PERI).

YCharts – Seeking Alpha

What is however unique to PubMatic compared to the aforementioned competitors is being consistently profitable since going public: the last Q2 2022 was the 13th consecutive quarter generating positive GAAP Net Income, and also marked a sequential re-acceleration of revenue growth from 25% YoY reached in Q1 2022 to 27% YoY growth in Q2 2022.

PubMatic Q2 Earnings Report

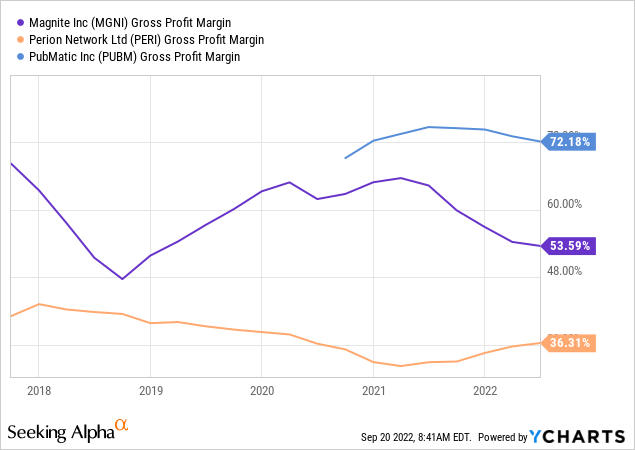

Moreover, PubMatic is also enjoying an impressively high gross profit margin thanks to owning and managing its own digital infrastructure:

By owning and operating our infrastructure we have been able to drive down our unit costs. Over the last two years, we have reduced our cost of revenue per million impressions processed by approximately 50%. Our experience has shown us that the return on investment for incremental capacity is high and typically pays for itself on a cash basis in months. With this cost advantage, where we see incremental revenue opportunities, we will expand our processing capacity and further increase our competitive moat.

YCharts, Seeking Alpha

Building and operating the infrastructure naturally translates into higher capital expenditures at the moment, however this is the classic example of short term pain for long term gains. Management has highlighted how the timing of certain equipment purchases will look particularly unfavourable in the current quarter; however, the free cash flow trend should normalize in the future:

We anticipate CapEx between $33 million and $36 million this year. Based on timing of equipment availability and shipments, the bulk of our CapEx will occur this quarter and will reduce our free cash flow. We anticipate a return to a more typical pattern of free cash flow generation in Q4. Looking ahead, as video and other high value formats become a greater share of our revenue mix, and as we continue optimizing new infrastructure, we anticipate that our CapEx to revenue ratio will decline.

Management has also highlighted PubMatic’s Net Revenue Retention Rate of 130%, meaning that any customer acquired in the past by the company has actually spent 30% more this year compared to the past. This metric is well known to investors that follow Software-as-a-service stocks as it is commonly shared by such companies, however it’s unusual for an advertising business to retain such a high level number of customers and also manage to grow their spending on the platform.

What could go wrong

It’s always beneficial to review the risks of any investment as there is no such a thing as “risk-free”. First and foremost, PubMatic is still a small player in an increasingly important and competitive industry. Programmatic digital advertising will grow for years to come and will also need to adapt to new technological challenges such as the onset of new mediums and even new regulations. Advertising today is incredibly different than 15 years ago, and there is a chance that it will be very different again in 15 years’ time. While The Trade Desk appears as of today as a clear winner on the demand side of the equation, the jury is still out on who is going to be the clear winner (if any) on the supply side. As of today any metric suggests that PubMatic is well positioned for operating successfully in the future, but anything can happen. Luckily investors can manage this risk simply by allocating a small percentage of their portfolio to such bets in order to reduce the overall exposure to uncertain outcomes.

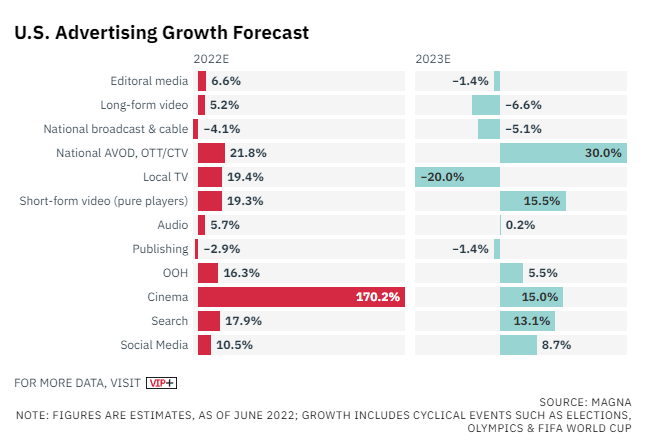

In the short term there is no doubt that a possible recession in the US and elsewhere will have an impact on the advertising business overall. We recently had a glimpse of what could happen during the quick COVID downturn in early 2020, which had such a profound impact that global advertising spending for 2020 actually declined 4.2% according to media investment company Magna. Estimates for full 2022 and 2023 in the US are indeed not that rosy: while the midterm election should provide a boost in 2022 through higher political ad spending, estimates for 2023 show various declines with the only bright spots being AVDO, OTT and CTV – PubMatic’s strong suit.

Magna – Variety

In August 2022 during the latest Q2 2022 report, the company has already revised the full year revenue guidance down to $277 million to $281 million (23% growth at the midpoint), citing well known global uncertainties especially in the Europe and APAC region such as high inflation, energy crisis, the war in Ukraine and COVID-zero policy in China destabilizing supply chains and consumer activity. Nevertheless, management seems on top of things and has already initiated cost-cutting initiatives that should enable full year Adjusted EBITDA margin at around 38%. Balance sheet is actually also very solid with $183 million of cash and cash equivalents and only about $22 million of long term debt, hence a cash crunch during an economic downturn does not appear to be an issue for PubMatic.

Valuation and Key Takeaway

PubMatic has seen its share price under pressure for over 18 months now, leaving the company trading for a very reasonable valuation in my opinion. The company is currently trading at Price to Sales of just 2.84, destined to quickly get lower given that Wall Street analysts also estimate about 19% revenue growth for 2023. With the macro environment getting better maybe in 2024 or 2025 I wouldn’t be surprised at all to see PubMatic growth rate actually accelerate again together with the global advertising market rebound. On the earnings side, P/E of about 18 is reasonable compared of PERI’s P/E of 14 while MGNI has no GAAP net income to compare yet. A slight premium for PubMatic based on much higher gross margins as stated above and solid balance sheet is an acceptable price to pay.

I believe at the current price PubMatic has the potential to deliver long term growth assuming it will be able to consistently deliver as done in the past. I would still not allocate a large portion of my portfolio to the company as its size still adds considerable risk; however, a moderate approach by averaging down if the price will keep falling could be a winning strategy until reaching full allocation size.

Be the first to comment