Sundry Photography

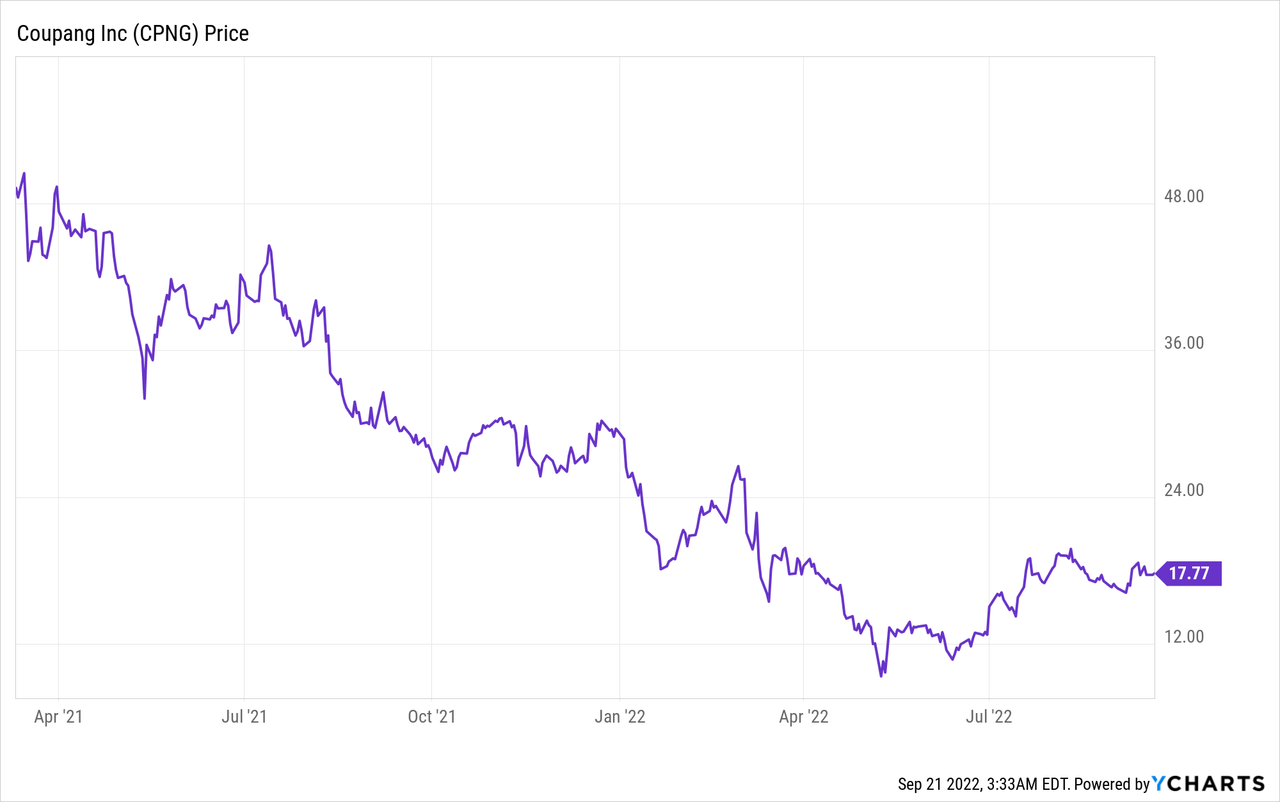

Coupang (NYSE:CPNG) is a leading eCommerce company often known as the “Amazon of South Korea”. The company IPO’d in March 2021, at $41 per share and a market capitalization of approximately $50 billion. A key point I observed during the IPO, is that the original valuation was close to $30 billion, but management decided to IPO at a higher price due to the market exuberance. This is always a red flag for investors in my eyes and thus my conclusion at the time was to “let the stock season” before diving in. Those who followed this strategy avoided the stock getting butchered by ~76% up until the bottom of $9-$11 per share in June 2022. This decline was mainly driven by the valuation multiples being compressed due to the high inflation and rising interest rate environment. The good news is that Coupang has still continued to grow and has recently beat analyst estimates for earnings, as profitability starts to become a key focus for management. The stock price has also risen by ~54% since the June lows, on strong momentum. Thus in this post, I’m going to break down the business model, financials, and valuation for this special stock, let’s dive in.

Business Model

Coupang is often called the “Amazon of South Korea”, the business is of course much smaller than the tech giant, but they do offer much better service than Amazon in many ways. Amazon is known for its “customer-centric” approach to business, but Coupang has what I like to call “ultra customer centricity”. Coupang offers all the “standard” stuff such as delivery 365 days per year, next-day delivery etc. But the business also goes one step further by offering “rocket delivery”, which basically means you can get a package the same day or even in the morning guaranteed, which is called “dawn delivery”. This is incredible as let’s say you need an item urgently for the following morning, you can order as late as midnight and get the item by the morning. The business has an average delivery time of fewer than 12 hours and 99% of orders are delivered within a day. But that is not all Coupang’s “ultra customer centricity” goes one step further by offering personal notes on the item which is great for personalized gifting. A popular example in South Korea is the delivery of a fresh birthday cake to a friend or family member with a note.

Coupang’s Rocket Fresh service is the nation’s largest grocer and offers rapid delivery of fresh food and groceries. Its “Quick Commerce” service enables the delivery of essentials in minutes. Coupang Eats which is the company’s version of Uber Eats was the most downloaded app in South Korea during the pandemic of 2020. The business operates with a “one order, one delivery” model to ensure your food doesn’t get cold, as the traditional delivery drivers tend to take detours and bulk carry orders to save cost.

The company ties all its services together with best-in-class technology and they even developed their own fintech payments solution called “Coupang Pay”, which is set to benefit from growth in buy now pay later [BNPL].

Coupang fresh (Coupang/Korea daily)

Logistics Network

Coupang’s “ultra customer centricity” is only possible thanks to its vast vertically integrated logistics network. This consists of over 100 fulfillment centers, covering 42 million square feet. This means that 70% of Korea’s population lives within 7 miles of a Coupang logistics center. The company uses AI and Machine learning models to predict demand spikes before they occur and have products deployed to close fulfillment centers as needed. This is really powerful as it effectively means the business can know what you want, even before you!

The company also has an import service called “Rocket Jikgu” which helps U.S.-based brands sell their products in South Korea via Coupang’s fulfillment network. For example “gluten-free” pasta is not really a thing in South Korea and thus many westerners living in the country order from overseas.

Coupang Play

As Coupang has scaled it has rolled out an Amazon Prime Video-style service called “Coupang Play”. This offers live streaming, movies, and Coupang original content, similar to “Netflix Originals”.

Coupang Play (created by author Ben at Motivation 2 Invest)

International Expansion Plans

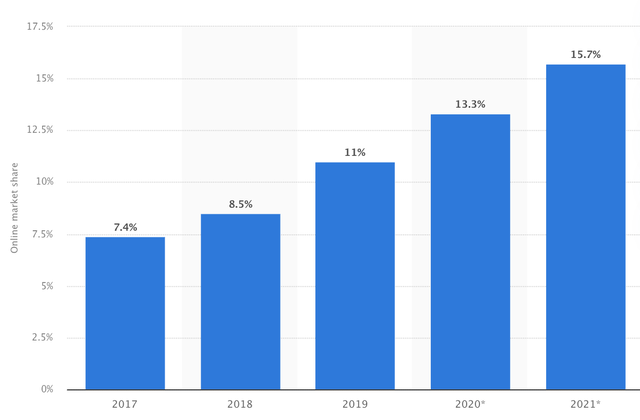

Coupang has come to dominate eCommerce in South Korea. The business has increased its market share, from 7.4% in 2017 to 15.7% by 2021 and now Bank of America estimates believe that figure is closer to 35% which is fantastic.

Coupang Market Share SK (Statista)

Coupang did face competition from eBay Korea which built up approximately a 12% market share before selling 80% of its business in 2021. The company sold to Shinsegae Group’s E-Mart for $3 Billion and combined the businesses now have ~15% market share of the South Korean market.

Coupang has offered exceptional service in South Korea, thanks to the densely populated nature of the country which has 51.7 million people, roughly one-sixth the population of the USA. Amazon dominates North America and Europe, while MercadoLibre dominates Latin America. Coupang aims to grow into densely populated but affluent countries and cities in Asia. They are rolling out services in Singapore, which has a population of ~5.7 million people. In addition, they are expanding into Japan which is larger than South Korea with a population of 126 million people. Tokyo is set to be a key battleground as the area is one of the most densely populated in the world with a population of ~14 million people. The country offers great potential but Amazon Japan does lead in the region. In addition, the market is fragmented with other players such as Rakuten and Yahoo Japan E-commerce. The good news is Bank of America analysts have reported that the company has gained “strong traction” in Japan’s quick commerce (non-restaurant orders), which is a positive sign.

Malaysia could be an easier area of expansion, the country isn’t extremely wealthy but the capital city Kuala Lumpur is more affluent and has a population of 8.2 million people. The real test for Coupang will be in expanding and proving its business model can be successful in other regions. Ecommerce companies tend to operate best when they reach a critical mass of logistics infrastructure which comes from being in a dominant market position.

Founder Led

A key tenet of my investing strategy is to focus on businesses that are founder-led. A founder generally keeps perspective, has a bold vision, and aligns with shareholders. If you think about the “FAANG” stocks they were all founder-led, for all or a large part of their history. From Facebook (META) (Mark Zuckerberg), to Amazon (AMZN) (Jeff Bezos) and even Apple (AAPL) with Steve Jobs for a period. We can also add Tesla (TSLA) (Elon Musk) to that list. Coupang’s founder is named Bom Kim, he is no Elon Musk, but he doesn’t need to be. Bom Kim isn’t trying to get to Mars, the Harvard graduate is simply trying to create an unbelievable eCommerce experience for customers. Bom Kim also has the template of Amazon to study, and improve upon. Bom Kim has a net worth of over $2 billion and has a 9.89% market share in the company which means he has “skin in the game”. The business is also backed by tech whale Softbank which owns a 26.1% market share. In addition to growth stock investor Baillie Gifford (an early Tesla investor) which owns a 6.13% market share.

Coupang Billionaire Founder Bom Kim (Coupang)

Solid Financials

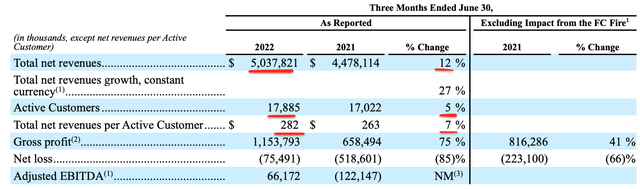

Coupang generated solid financials for the second quarter of 2022, net revenue was $5 billion which popped by 12% year over year, which is a far cry from its historic growth rates of +50%. However, the business did grow its revenue by ~27% on a constant currency basis which is still solid.

Coupang’s active customers increased to 17.9 million, up just 5% year over year which isn’t really a sign of meteoric growth. The good news is management has been focusing heavily on cross-selling and building profitability. In the second quarter, gross profit was $1.2 billion which popped by a rapid 75% year over year. However, it should be noted that this excludes the impact of a fulfillment center fire in 2021. This caused bad press for the business, as poor working conditions were highlighted similar to Amazon in the USA. Total net revenues per active customer also increased by a healthy 7% to $282.

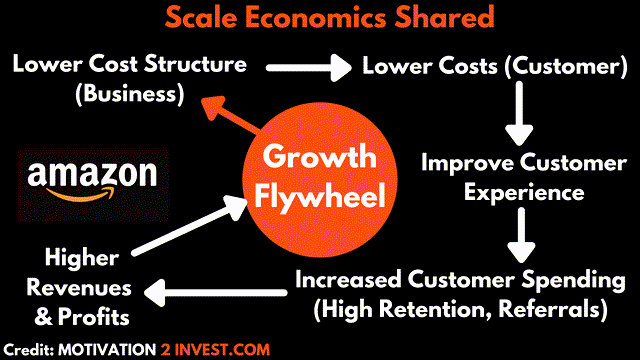

Coupang did produce an operating loss of $75.5 million, however, this is an improvement of the equivalent quarter last year when the operating loss was over half a billion dollars. The business has also increased their investment substantially to $500 million as they offer exclusive discounts, free rocket deliveries, and even free Coupang Play content for its “WOW” members, which are similar to the Prime members of Amazon. A KPMG study cited in the Coupang earnings call also highlighted that the business has a 25% to 60% average price advantage compared to major competitors for many top-selling items. Coupang is following a similar model to Amazon in that it benefits from economies of scale and then passes these savings back onto the customer in order to create a flywheel. Of course, with Coupang being much smaller this is riskier, but it is a practice that has worked for Amazon and Costco.

Scale Economics Shared (created by author Ben at Motivation 2 Invest)

Coupang has also achieved a positive adjusted EBITDA of $66 million, up $157 million from the prior quarter. Management has flipped its guidance for the full year of 2022 from a negative adjusted EBITDA expected to now positive for the full year.

The company has a robust balance sheet with cash, and cash equivalents of $3.1 billion. In addition to $596 million in total debt of which just $6.1 million which is a positive sign.

Advanced Valuation

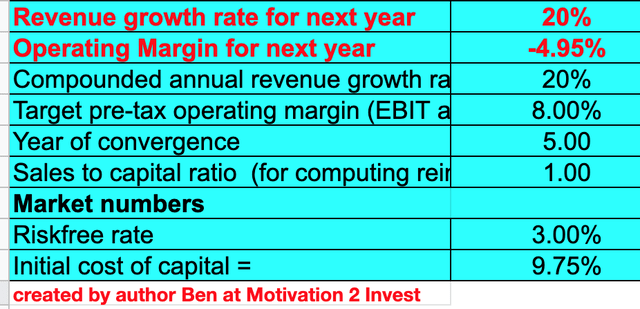

In order to value Coupang, I have plugged the latest financials into my advanced valuation model. I have forecasted 20% revenue growth per year over the next 5 years, which is more optimistic than analyst consensus estimates of ~16%. I expect this to be driven by a correction in the currency markets, as the FX headwinds subdue.

Coupang stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted the business operating margin to increase to 8% over the next 5 years. As the company increases its focus on profitability and the number of customer upsells.

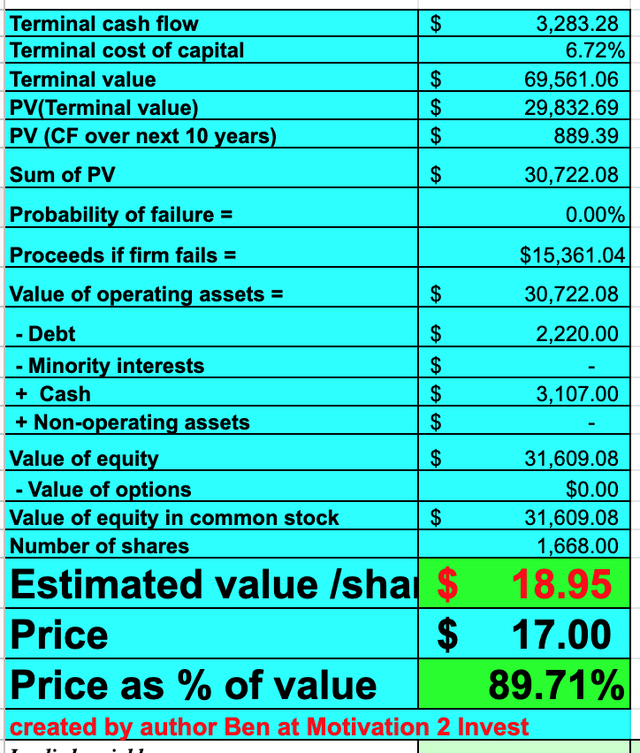

Coupang stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $18.95 per share, the stock is trading at ~$17 per share at the time of writing and thus is ~10% undervalued.

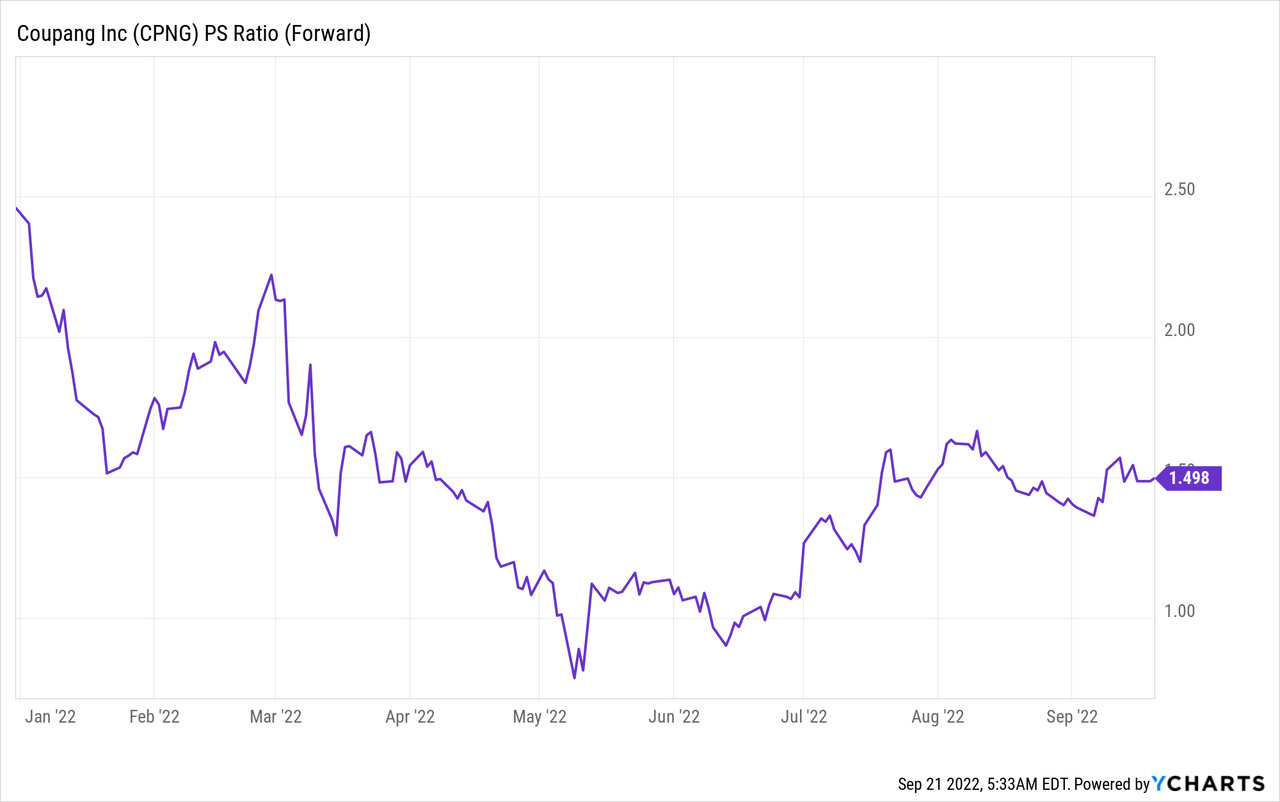

As an extra datapoint, Coupang trades at a Price to Sales ratio = 1.5, this is cheaper than the levels of between 1.6 and 2.4 seen in early 2022. However, the stock was trading at a price-to-sales ratio below 1 in June 2022. Therefore, I would deem the stock to be “fairly valued” relatively.

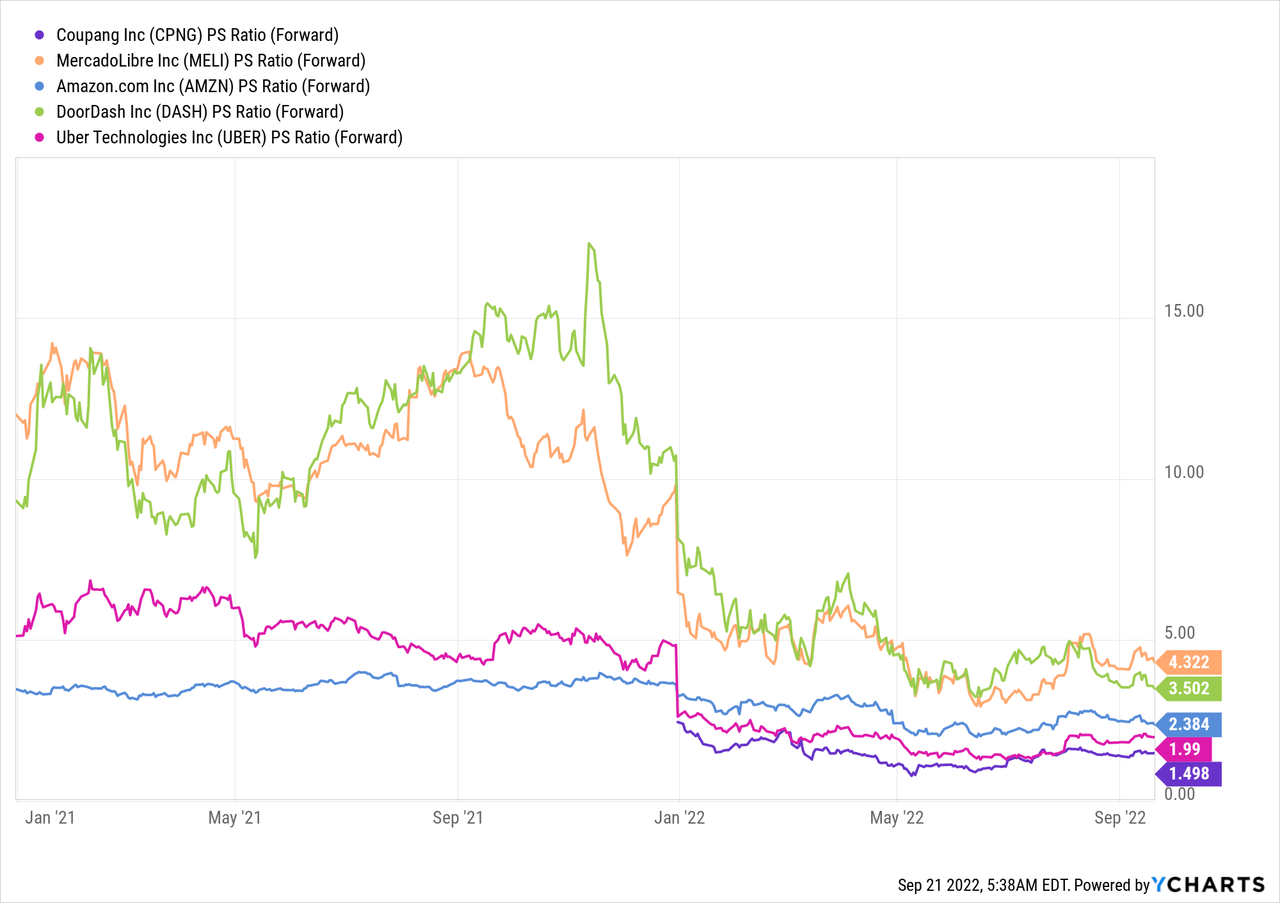

Comparing Coupang to other eCommerce companies is fairly difficult as they are all very unique and have different business models for some elements. For example, Amazon is a trillion-dollar company that owns the world’s largest cloud provider AWS. Amazon’s cloud business is its key profit and growth driver, while its core eCommerce business is not a big profit generator. With that as a caveat, we can see Coupang trades at a lower price-to-sales ratio than industry peers. It is much cheaper than the “Amazon of Latin America” which has a price-to-sales ratio = 4.3. In addition, I have compared the business to Uber (due to Uber Eats) which trades at a PS ratio = 1.99.

Risks

Slowing Revenue Growth

Slowing revenue and customer growth is still an issue for Coupang as mentioned prior. The real test will be whether this business can continue to expand outside of South Korea.

Inflation

The high inflation environment tends to squeeze low margin, eCommerce companies due to rising input costs such as fuel and products. We even saw the king of eCommerce Amazon have its profits decimated due to rising operating costs related to its logistics network. The good news is the South Korean economy has been in a high inflation environment since the 1960s with an average inflation rate of 7.8% per year over the period. The 2022 inflation rate has been ~5.7% so far which is less than US inflation rate of 8.3%. In addition, I suspect Coupang be used to operating in that environment and even may have adapted given they were founded in South Korea.

Final Thoughts

Coupang is the Amazon of South Korea and truly does offer spectacular customer service which in my opinion is even greater than the king of E-commerce Amazon. The business is struggling with customer and revenue growth but its increasing focus on profitability has proven to be positive. CPNG stock is undervalued intrinsically and fairly valued relative to historic multiples and thus this looks to be a great investment for the long term.

Be the first to comment