Lemon_tm/iStock via Getty Images

Introduction

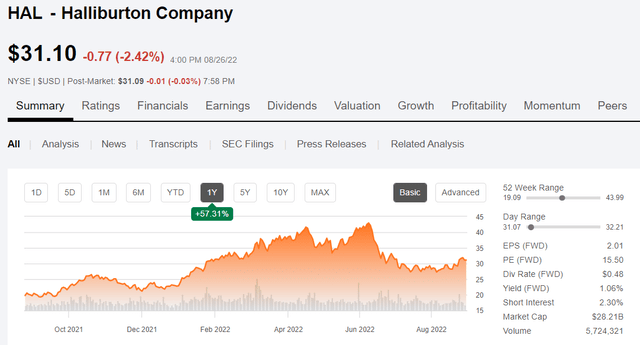

Halliburton Company, (NYSE:HAL) delivered the mail for Q-2, beating on the top and bottom lines, to no one’s great surprise. Even in the adverse market we have currently, the share price has nudged firmly back into the low $30’s since this report first came out. We see reasons for optimism that this trend will continue as the year concludes, and will discuss an investment thesis for Halliburton at current levels.

Halliburton Price chart (Seeking Alpha)

Over the past two months service company shares are down ~30% from June highs. The bipolarity of the market-up one day, down the next, has investors wondering if the upcycle that’s been extant since early 2021, and really kicked into high gear in the fall of last year, has run its course and the easiest path is lower. The ~10 mm bbl inventory draws the last couple of weeks have helped to assuage these fears, and investors have cautiously tip-toed back into energy stocks. Jeff Miller, Halliburton’s CEO made some bullish commentary about the state of the market in his opening remarks in the earnings call:

Despite this near-term volatility, I believe the oil and gas market fundamentals still strongly support a multiyear energy upcycle. From a demand perspective, oil and gas remains a critical component of long-term economic growth. Post pandemic economic expansion, energy security requirements and population growth will continue to drive demand.

Today, oil and gas supply is tight, despite an environment muted by ongoing China lockdowns and jet fuel demand below historical norms. Meaningful supply solutions will take time, OPEC spare capacity is at historical lows, the strategic petroleum reserve release is unsustainable, and the risk to Russia supply remains high.

Miller has an eagle-eye view of the market from his perch atop the second largest OFS company. His viewpoint comes from meeting with the CEOs of the major International, and National oil companies about their plans for the coming years, and a common thread runs through all the commentary I read. Supplies of oil are tight, and driven by current activity.

If this view pans out, then Halliburton remains attractive just below current levels for those looking to add or initiate new positions in the stock.

Let’s look at what the oil market is telling us about supply

There is no question that there is an overhang on the market from recession fears domestically and abroad. The China lockdowns and recent bellicosity in regard to Taiwan have been the key drivers for weakness in oil. Who’s buying stocks when WWIII may turn the world into a smoking ruin?

Another core belief in the recent oil market sell-off has been the expectation that as much as a million new U.S. barrels would hit the market by mid-2023.

U.S. crude oil production in our forecast averages 11.9 million b/d in 2022 and 12.8 million b/d in 2023, which would set a record for most U.S. crude oil production in a year. The current record is 12.3 million b/d, set in 2019. (Source: STEO)

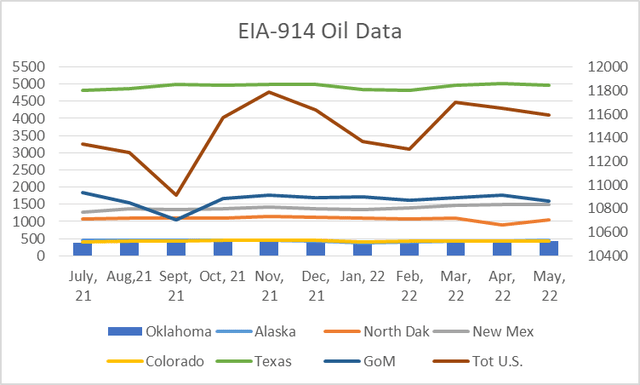

Well the folks at the EIA are way smarter than I am, and mid-2023 is nearly a year off- and a lot can happen, but nothing in the EIA data I’ve reviewed recently supports this contention. Not to put too a fine a point on it, but if we are going to average 11.9 mm BOPD in 2022, we’re going to have to run pretty hard. So far, I’m not seeing it.

The graph above was compiled from the most recent EIA-914 monthly report, and shows production data through May at 11,595 BOPD. Every single major basin was trending flat to down, with exception of North Dakota

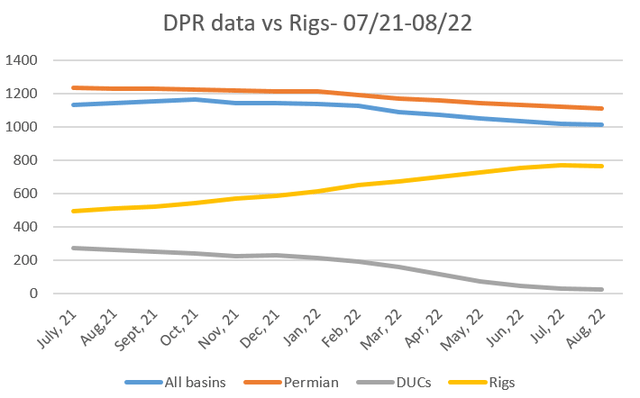

This graph below from the EIA DPR data, shows a trend of new well production from the Permian and all key basins. Data is gathered from public sources-typically state regulatory and permitting boards.

This graph shows that in spite of increased drilling, new production is not outpacing field declines using a simple average of oil per day/active rigs.

The next big swath of ‘hopium’ comes from the thought that OPEC+ is increasing output. They say they are, but in actuality are falling some 3mm BOPD short of their official production target of 42mm BOPD, as the linked WSJ article notes. As of their most recent report OPEC+ is producing 28.5 mm + 10.3 mm BOPD or 38.8 mm BOPD. Russia, Nigeria, Iraq, Iran, and Libya are the key laggards.

Wrapping this up. Miller’s assertion that supply will remain tight appears well founded in data. This creates a very supportive environment for Halliburton.

This time it’s different

Miller made a key point in the call that this upcycle is different than past upcycles.

The activity mix in this upcycle is different from prior cycles. Today, operators focus more on developing known resources and less on long-term exploration programs. This means drilling more wellbores. The products and services customers require for drilling more wellbores benefit Halliburton.

We see this in offshore rig rates, which have been climbing but still aren’t adequate to propel rig company stocks higher, with the possible exception of Valaris, (VAL). Exploration activity is the missing ingredient in the mix today as it has been for the last 7-years.

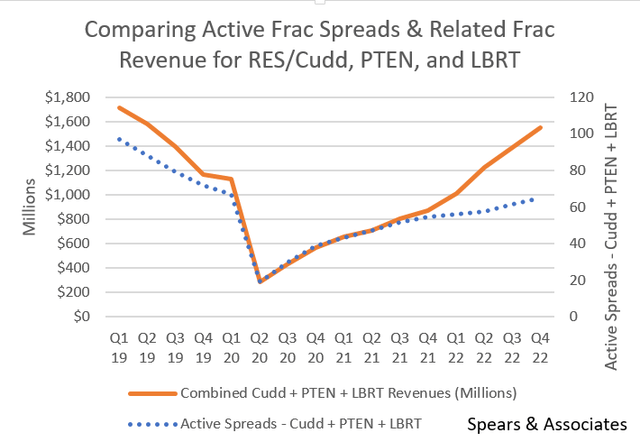

Profit has finally made it back to the service sector

My friend and fellow oilie, Richard Spears made this graph available to me. It shows quite dramatically the increase in revenue per frac spread that is being paid to frackers now. The message here is that service companies are now able to do the balance sheet repair, stock buyback and eventual shareholder direct capital return, that the operators have been showering on their investors.

Spreads Vs Revenue (Spears & Associates)

Jeff Miller lost no time in pointing this out in his opening remarks on the call:

As I stated before, this is a margin cycle, not a build cycle. In North America, net pricing improvements drove our strong C&P margin expansion in the second quarter, and I expect pricing gains to continue. Here’s why. Existing active equipment and experienced crews are in high demand and will continue to be highly sought after to efficiently execute programs in the second half of this year and into 2023. The market remains all, but sold out.

Supply chain bottlenecks even for diesel fleets make it almost impossible to add incremental capacity this year. Halliburton has the additional advantage that our fleet primarily competes at the higher end of the pricing spectrum. Our portfolio of low emissions equipment commands premium prices and our customers see value in the efficiency and emissions profile we provide.

Internationally, we see structural tightness in many product lines, particularly drilling and wireline. Increasing activity soaks up capacity market-wide. And recently, some customer request for additional equipment had to go unanswered. As equipment availability continues to tighten, we expect prices will increase further.

Halliburton was early to the game of retiring Tier IV diesel fleets and building out its capacity of Tier I, II DGB dual fuel fleets and Zeus Electric frack fleets. They are sold out as noted in the call, and have no interest in expanding their fleets, something that was unheard of just a few years ago.

Catalysts for Halliburton

One of the problems you have working in the Eastern Hemisphere is supply chain related. Most basic chemicals are made in the Western Hemisphere, U.S. Gulf Coast, Germany, and imported into receiving countries. Halliburton changed that model by building a sophisticated chemical reaction plant in Saudi Arabia. It just opened in March of this year and is already paying dividends for the company. Jeff Miller comments on the strides they are making in the EH:

During the downturn, we brought the chemical supply chain closer to our international customers and localized our workforce. This improved our cost competitiveness and the margins. Our new chemical reaction plant in Saudi Arabia mixed the first batch of chemicals last month and is on track to meet its ramp-up goals.

This year, we expect the plant to manufacture products for our production chemicals contract with a large IOC in Oman and chemicals for our drilling fluids, specialty chemicals and hydraulic fracturing product service lines.

This is a big deal. Many of these systems are big volume item. Drilling fluids, for example can run to tens of thousands of barrels. These systems are built from the ground up nearly every time. Every well is different in some small way and having this capability in the EH makes Halliburton more nimble and competitive.

There is a lot of profit in chemistry. Being able to easily adjust properties of a chemical application that will benefit a well can bring huge revenue and profit increases. Here’s an example. I once did a test on return permeability on a mud additive. It turned out it improved the return to flow number 5% higher. It doubled the cost of the mud, but the client thought it was worth it.

Halliburton is also making strides with their Summit ESP acquisition of a few years ago. This was a market that Baker Hughes almost controlled with their Centrilift offering until this point, and was a big reason Halliburton wanted to buy them in 2016. Miller comments on Summit progress in the EH and in Latin America:

This month, we completed our first year of operations on our electric submersible pump contract in Kuwait. We have already installed almost 200 ESPs, built an artificial lift service facility in country and delivered excellent performance for KOC.

We also have successful installations in Oman and have ongoing ESP trials in Saudi Arabia. Upon completion of trials at the end of the year, we expect prequalification to participate in Saudi Aramco’s future artificial lift tenders.

Latin America is another successful market for our artificial lift business, where we operate in all significant land markets and just installed our 500th ESP in Ecuador.

Artificial Lift is a big deal. As natural pressure depletes or in the case of an under-pressured reservoir, artificial lift is necessary to bring oil and gas to the surface. (Note-remember the ubiquitous ‘rocking horses’- pump jacks? Those are a surface form of artificial lift using sucker rods. It’s way more efficient to put a turbine pump-ESP, downhole, and that’s what Halliburton is selling. It should be noted that these are multi-million dollar pieces of kit when all the relevant hardware is considered.

Next Halliburton’s leading position in fracking in the U.S. will drive revenues and profits in this upcycle, which shows no sign of abating even as production remains stagnant.

Q-2 for Halliburton

Total company revenue for the quarter was $5.1 billion and adjusted operating income was $718 million, an increase of 18% and 35%, respectively. Higher equipment utilization and net pricing gains supported these strong results. In the second quarter, a pre-tax charge of $344 million was taken as result the decision to exit Russia due to sanctions.

Completion and Production division, revenue was $2.9 billion, an increase of 24% while operating income was $499 million, an increase of 69%. These results were driven by increased pressure pumping services in the Western Hemisphere; higher completion tool sales globally, increased artificial lift activity in North America land and Kuwait, and improved cementing activity in the Eastern Hemisphere. These improvements were partially offset by lower stimulation activity in Oman and decreased artificial lift activity in Latin America.

In the Drilling and Evaluation division, revenue was $2.2 billion, a 12% increase, while operating income was $286 million, a decrease of 3%. This revenue increase was due to higher fluid services and wireline activity globally, increased project management activity in Latin America and the Middle East, and increased drilling services in Latin America. Operating income decrease was driven by seasonally lower software sales globally and decreased drilling services in Brazil.

In North America, revenue grew 26%, primarily driven by increased pressure pumping services and artificial lift activity in North America land, increased fluid services, wireline activity, well intervention services and higher completion tool sales across the region and increased cementing activity in the Gulf of Mexico. These increases were partially offset by lower stimulation activity in the Gulf of Mexico.

Latin American revenue increased 16% due to improved activity across multiple product service lines in Argentina and Colombia, increased stimulation and well construction services in Mexico, increased drilling related services in the Caribbean, improved stimulation activity in Brazil and higher project management activity in Ecuador. Partially offsetting these increases were decreased drilling related services in Brazil and lower artificial lift activity in Argentina and Ecuador.

In Europe/Africa/CIS, revenue increased 6% resulting from higher activity across multiple product service lines in Angola and Eastern Mediterranean, improved cementing activity, pipeline services, wireline activity, and testing services across the region and increased through its services and completion tool sales in the UK. These increases were partially offset by the impact of the wind down of the of business in Russia and decreased drilling services in Norway. In the Middle East/Asia region, revenue increased 14%, primarily resulting from higher activity across multiple product service lines in the Middle East, Australia and Brunei. These increases were partially offset by reduced stimulation activity in Oman. All regions experienced a seasonal decline in software sales.

Capital expenditure for the quarter were $221 million and will steadily increase for the remainder of the year. For the full year, the company expects CapEx to remain at 5% to 6% of revenue.

Turning to cash flow – Halliburton generated $376 million of cash from operations and $215 million of free cash flow during the second quarter. Working capital investments grew to support the 18% sequential revenue growth.

Q-3 Lookahead: In the Completion and Production division, they expect third quarter revenue to grow in the mid-single digits and margins to improve 75 to 125 basis points. In the Drilling and Evaluation division, they expect third quarter revenue to grow in the low to middle single digits.

Your takeaway

Halliburton is primed for continued growth in the coming years. At current prices it’s trading at just under 10X EV/EBITDA. Traditionally a little on the high side. I didn’t use the usual metric of OCF-cash flow as it was distorted by working capital builds as the company ramped up inventories to service new contracts. For reference Schlumberger, (SLB) is trading at just under 10X EV/EBITDA as well. Baker Hughes, (BKR) trades at 11.3X, so there really no substantial difference between the big three on this metric.

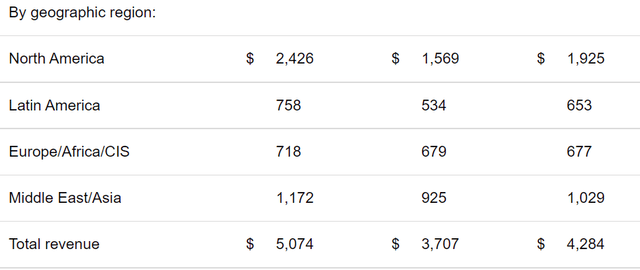

Their pivot to international over the last few years will balance out their revenue streams, and it’s happening already. Halliburton grew international revenues~ 20% year over year and about 10% quarter over quarter. A few years back it was 80/20.

Hally Revenue by Region (Seeking Alpha)

Jeff Miller closed out his direct commentary with his view of Halliburton’s international progress:

Customer spend remains on track to increase by mid-teens this year, with the Middle East and Latin America expected to grow the most on a full year basis. New project announcements across the world, including in the Eastern Mediterranean, Australia and West Africa, give us confidence in continued activity acceleration in 2023 and beyond.

I consider Halliburton very attractive for growth under $30. It is focusing-as it should on debt reduction now, but in a couple of years will be a position to pivot shareholder rewards. Eric Carre, CFO commented in regard to a question from an analyst:

So maybe let me summarize how we think about this. So first, to your point, we’d like to continue to pay down more debt. Then we would like to continue to return more cash to shareholders. We’ve retired $1.8 billion worth of debt, $600 million this year. If you look at what’s ahead of us, we have about $1 billion coming up between 2023 and 2025. The other point I would make is that in Q1 of this year, we did both. So we did retire that and we increased dividend about triple — pretty close to triple the dividend. And finally, I would say that we fully expect to continue to grow shareholder distribution as the upcycle accelerates.

Halliburton is a company you want to own in the growth cycle that is upon us. It is one of the key technology leaders in the service industry and has positioned itself to thrive. Timing is everything with a service company though. In the up one day and down the next market we have currently, I would wait for an entry point under $30.

Analysts predict growth for the company with an overweight rating. Price targets range from $32 to $53, with an average of $42. Once sentiment shifts in the market to a more favorable condition, I can certainly see a return to the mid-$40’s in this stock. It’s anybody’s guess when the turn will come.

Be the first to comment