metamorworks

Investment Thesis

PubMatic (NASDAQ:PUBM) is a ~$1 billion company operating in the half a trillion-dollar advertising industry, and it focuses on sell-side programmatic advertising – for anyone unfamiliar with the digital advertising industry, I break down exactly what ‘sell-side programmatic advertising’ means in my previous article, as well as my broad investment thesis for PubMatic.

In short, I think that PubMatic’s current size combined with the opportunity ahead of it makes it a very attractive small cap investment right now, with a bunch of economic moats, a founder-led management team, and a strong financial profile that should deliver impressive long-term returns for investors.

One common thread that I have seen throughout advertising companies this earnings season has been the recessionary difficulties faced, as advertising spend is being cut by just about everyone due to the wider macroeconomic concerns. This was seen with Meta (META), Roku (ROKU), Snap (SNAP), and pretty much any other advertising company, apart from one crown jewel that is The Trade Desk (TTD).

So, did PubMatic deliver for investors in Q2, or was it another advertising company that fell victim of the macroeconomic pressures? Well… a bit of both.

Earnings Overview

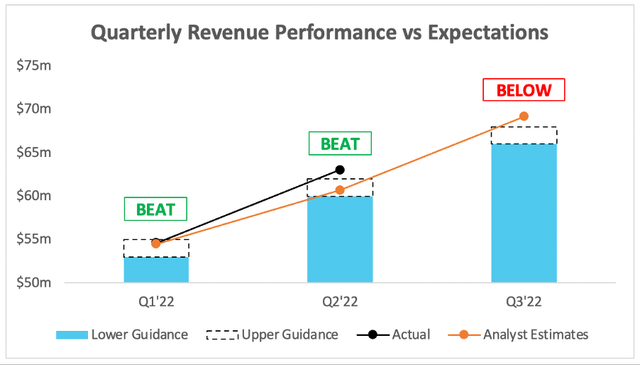

Starting from the top; PubMatic grew revenue 27% YoY to $63.0m, coming in above analysts’ estimates of $60.7m & also beating management’s guidance of $60.0-$62.0m – a strong start given the difficult macroeconomic environment for any company involved in advertising.

Investing.com / PubMatic / Excel

Unfortunately, the revenue outlook for Q3’22 of $66.0-$68.0m came in below analysts’ expectations of $69.2m. CFO Steven Pantelick outlined the rationale on the earnings call:

For Q3, specifically, we expect revenue of between $66 and $68 million or 15% at the midpoint for year over year growth. Keep in mind that we’re comparing against a 54% growth rate from Q3 last year. On a two-year stacked basis, our guidance translates to approximately 70% growth. We expect Adjusted EBITDA between $23 and $25 million, or approximately a 36% margin at the midpoint.

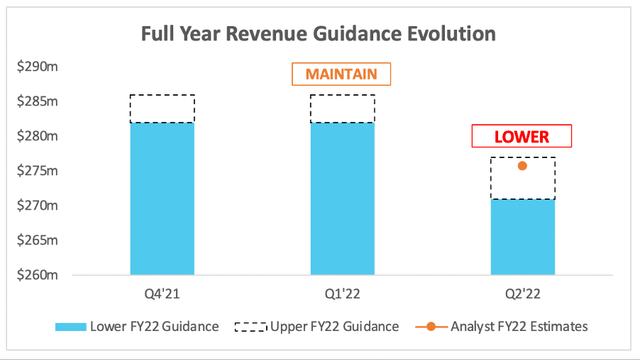

The conservatism on guidance was also reflected in PubMatic’s lowering of its full year outlook from $282-$286m to $271-$287m, although analysts’ estimates of $276m still fall within this new guidance range.

Seeking Alpha / PubMatic / Excel

Pantelick went on to give some more colour about the rationale for this:

For Q4, we are adopting a conservative outlook as well based on the challenging economic factors cited earlier. To be clear, we remain optimistic about growth from our SPO relationships, continued ramp up of our omnichannel video business and incremental political ad spending.

Based on our revenue over achievement in Q2 and the de-risking of our second half, we are revising our full year revenue guidance to $277 million to $281 million or 23% growth at the midpoint. With digital advertising slated to grow approximately 12% in 2022, we are well positioned to continue to grow our market share.

So clearly, PubMatic expects to be impacted by macroeconomic weakness, but it still has a number of tailwinds that will continue to push the business forward.

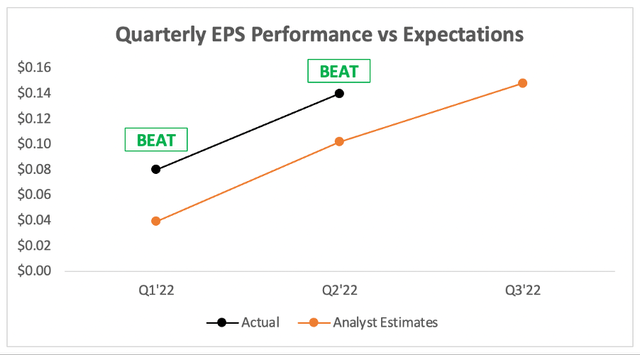

It’s also not all bad news, as the company’s GAAP EPS of $0.14 comfortably beat analysts’ expectations of $0.10.

Investing.com / PubMatic / Excel

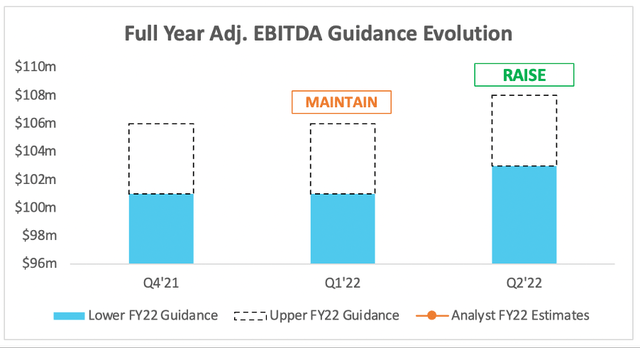

In fact, profitability became a major focus for PubMatic this quarter – as is prudent, given the difficult economic environment – and on this front the company certainly delivered. Not only did it beat on EPS, but the company actually raised its full year adjusted EBITDA forecast despite lowering its revenue guidance.

Again, CFO Pantelick offered up an explanation:

As a result of our increasing global scale and favorable revenue mix towards high margin video formats combined with the cost optimization plans in place, we are increasing our full year Adjusted EBITDA range to between $103 million and $108 million, or 38% margin at the midpoint.

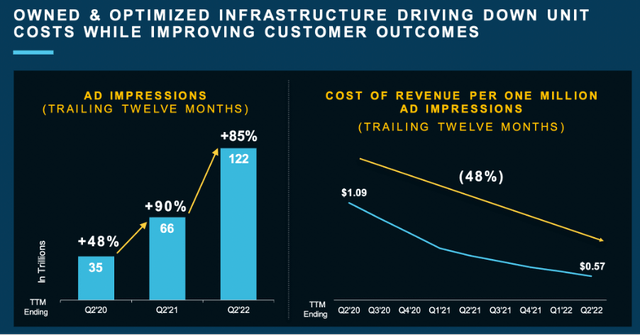

This should be music to investors’ ears on two fronts. Any investment thesis for PubMatic assumes that margins will improve as the company scales, primarily because the company actually owns its own data centers. This means more capex investment up front, but it’s also likely to mean more opportunity to expand margins as the company gets larger – pain now, gain later, I like it! As we can see below, the company is continuing to become more and more efficient.

PubMatic Q2’22 Investor Presentation

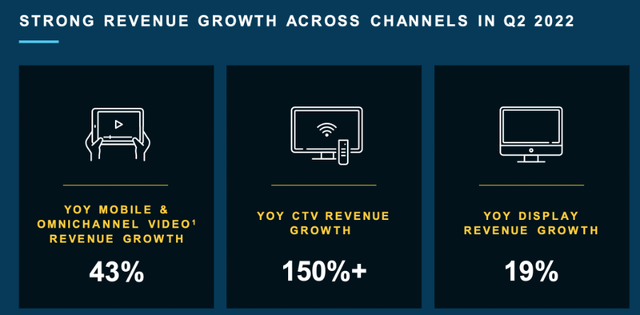

The second reason that investors should be smiling is the fact that ‘high margin video formats’ are the future for PubMatic, with CTV in particular being its fastest growing channel by far.

PubMatic Q2’22 Investor Presentation

Despite the lowering of full year revenue guidance, there was certainly enough in this earnings report to make investors happy – and, apparently, enough to make Wall Street happy as well, since the stock popped more than 20% following these results! I think this was merited – the results weren’t perfect, but PubMatic’s shares did look extremely cheap going into this report, so semi-strong results would naturally lead to a bump in the share price.

All in all, a strong quarter in very challenging circumstances.

Key Takeaways For Investors

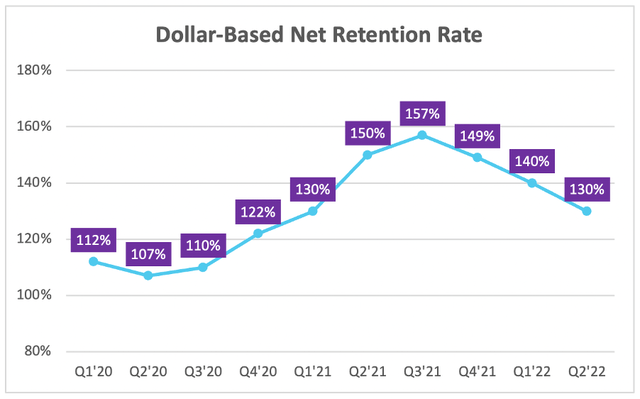

One of the key metrics for investors to watch is PubMatic’s dollar-based net revenue retention rate, as this demonstrates how many customers are sticking with the platform and also spending more money with PubMatic.

Whilst the trend is down YoY, a DBNRR of 130% is still extremely strong and implies that PubMatic’s land and expand strategy is continuing to work. Also, 2021 was a standout year for PubMatic and so a slowdown into a recession is a surprise to nobody – but the fact that the company still boasts a DBNRR in excess of 120% is very impressive.

There are also a number of industry trends going in PubMatic’s favor, as the following extract from Co-Founder, CEO, and EY Entrepreneur Of The Year 2022 Bay Area Award finalist Rajeev Goel highlights:

For the trailing twelve months, net dollar retention was 130%, a stand-out achievement among our software peers. On the buy-side of the ecosystem, consolidation is manifesting itself in several ways. In Q2, supply path optimization, or SPO represented approximately 30% of total activity on our platform, up from 24% a year ago. In addition, the efficiency of our platform and the access to inventory and audiences from top publishers is reinforcing the value of our platform to both publishers and buyers.

DSP partners are also engaging in consolidation, allocating more impression capacity to the PubMatic platform because of the quality of our inventory and the efficiency of our platform. For example, in Q2, a major DSP nearly doubled the impression capacity allocated to PubMatic versus Q1, which allowed us to grow their spend with PubMatic considerably. Importantly, this fuels our flywheel.

As we attract more spend from buyers, publishers increase their revenue from PubMatic, which causes them to add more inventory formats, geographies, or properties to our platform, which in turn provides us with an increased ability to invest and innovate. We view this as a significant moat that we continue to scale as we secure growing capacity share from many of the largest DSPs.

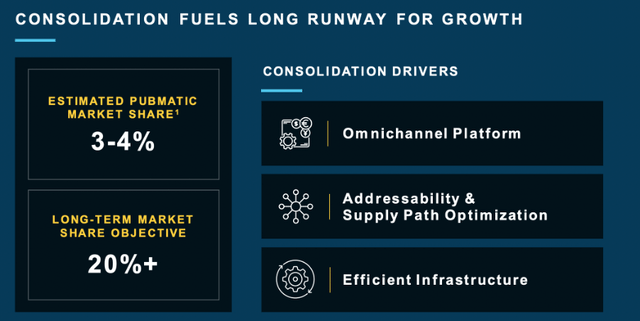

With top publishers and buyers actively consolidating their spend onto PubMatic, our runway for growth has never been clearer. I remain as optimistic as ever that we will meet our long-term market share goals of 20% plus. Customers and partners value our global, omnichannel scale as well as our robust solutions that solve for the future of audience addressability. They also benefit from the efficiencies gained from our owned and operated infrastructure, superior ROI outcomes, and our ability to invest in continued innovation on their behalf.

PubMatic Q2’22 Investor Presentation

It’s quite a bit to take in, but I wanted to demonstrate just how commercially successful PubMatic is becoming. I’m sure this is yet another reason for the pop in PubMatic shares.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether PubMatic is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

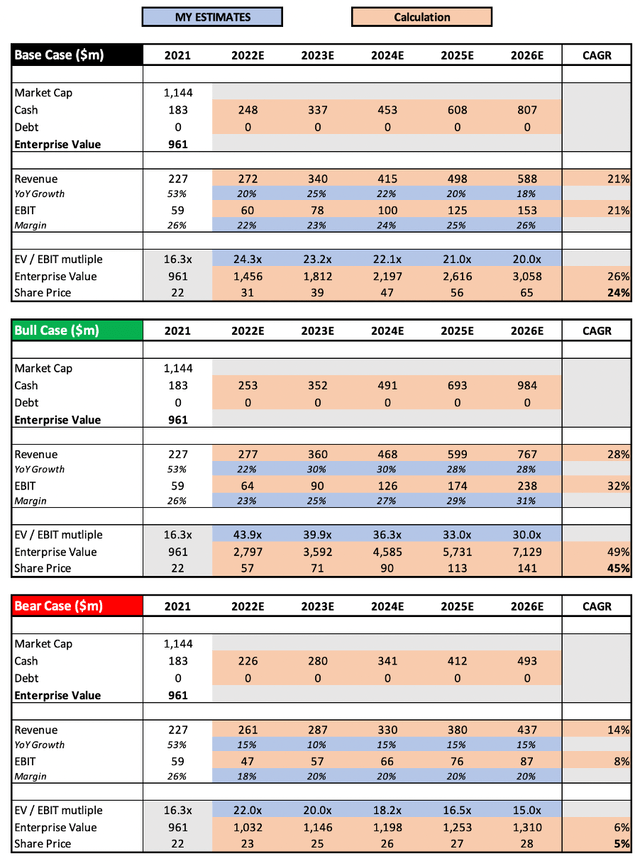

I have changed my valuation model approach slightly since my previous article, in order to better represent the opportunity and risks associated with bull and bear cases.

In my base case, I have assumed that revenue for 2022 comes in towards the low end of management’s guidance. I go on to assume a 21% revenue CAGR through to 2026, as the company continues to benefit from the tailwinds driving it forward and keeps executing on its strategy. I have also assumed margin expansion over the period, as PubMatic continues to benefit from the fact that it owns its own infrastructure. In each scenario, I have used an EV/EBIT multiple that I feel is appropriate given the revenue growth and margin expansion potential from 2026 onwards.

In my bull case scenario, I have assumed that revenue growth re-accelerates following the difficult comparisons in 2022 and an easing of pressure on the economy, achieving a CAGR of 28% through to 2026. I have also assumed that PubMatic’s EBIT margins rise alongside these increasing revenues, as it benefits even further from its scale. My bear case scenario essentially assumes the opposite; that the recession hits hard and impacts PubMatic severely, limiting revenue growth to a 14% CAGR, and as such the margin expansion does not materialize.

Put all that together, and I can see PubMatic shares achieving a 5%, 24%, and 45% CAGR through to 2026 in my respective bear, base, and bull case scenarios. I truly think this is a company that has gone under Wall Street’s radar, and it is priced as such.

Investment Thesis: On Track

Despite a very tough macroeconomic environment, PubMatic continues to do a solid job and shareholders were rewarded following the announcement of Q2 results.

Yet, my valuation model shows that I believe there is substantially more upside available for PubMatic shareholders over the next 5 years. Given the combination of this very inexpensive share price and the fact that my thesis remains on track (even during a difficult period for advertising companies), I will confidently reiterate my ‘Strong Buy’ recommendation for PubMatic.

Be the first to comment