FG Trade/E+ via Getty Images

After the close of trading on Tuesday, we received second quarter results from cryptocurrency platform Coinbase (NASDAQ:COIN), which can be seen in this Q2 2022 shareholder letter. While expectations were low given the fall in many coins so far this year, the company still found a way to disappoint. With shares still more than double that of their recent lows, it wouldn’t be out of the question to see this stock fall a bit moving forward thanks to these dreadful results.

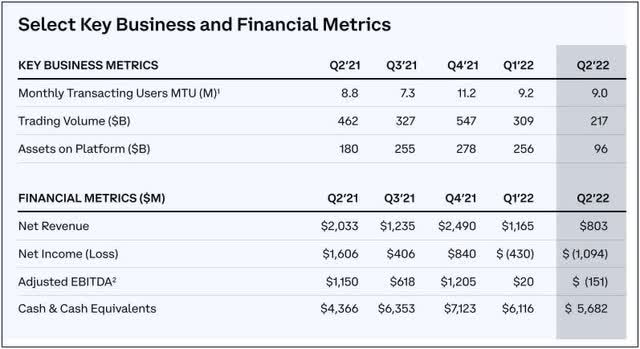

For the second quarter of 2022, Coinbase reported total revenues of $803 million. This top line number was down more than 60% over the prior year period, and fell over $360 million on a sequential basis. Analysts were looking for more than $868 million in Q2, so this was quite a large revenue miss. In the graphic below, you can see some of the company’s key metrics going back to last year’s Q2 period.

Quarterly Key Items (Company Filings)

Interestingly enough, there were more monthly transacting users in this year’s Q2 than last year’s period. However, with the amount of pain we’ve seen in many cryptocurrencies, trading volumes and assets on the platform dropped significantly. With revenues falling this quickly, it’s hard to curb expenses in a timely matter, so Coinbase lost over a billion dollars in the period. The company did mention that a good portion of this loss was due to impairment charges, and absent these non-cash charges, the net loss would have been $647 million.

Even after these major charges, the company would have lost almost $3 per share, much worse than the $1.23 non-GAAP loss average the Street was looking for. This adjusted result also was about 15 cents worse than the Street expectation for a $2.77 per share GAAP loss. Including those charges, the company lost almost $5 per share on a diluted GAAP basis, after a profit of $6.42 per share in the year ago period. For the first half of the year, Coinbase lost more than $1.52 billion, a dramatic change from a more than $1.8 billion profit attributable to common shareholders in the first six months of 2021.

Unfortunately for investors, commentary on Q3 wasn’t much better. The company stated that monthly transacting users were 8.0 million in July, as compared to 8.9 million back in April. Total transaction volume declined even more sharply, coming in at $51 billion for July, down nearly a third from the $74 billion referenced for April in the Q1 shareholder letter. Analysts were expecting $806 million in Q3 revenues, so a further decline from Q2 levels would imply that the company would fall short of current estimates. While the company has taken actions to reduce its expense base, it’s likely that we’ll see another large loss in Q3 if current revenue trends continue.

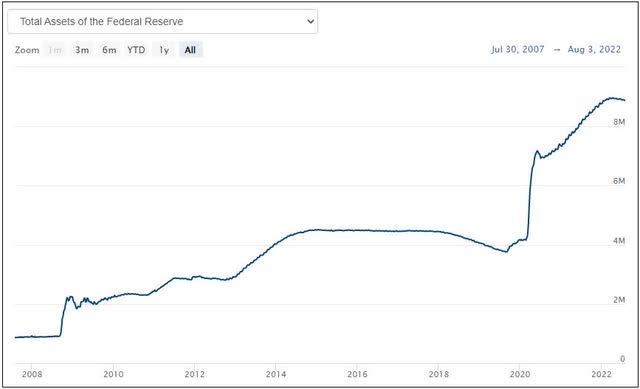

With Bitcoin in the low $20,000 area, investors hoping to see $68,000 again are likely to be disappointed, especially in the short term. An increase in expected regulation in this space was a key reason why major supporter Cathie Wood recently sold a chunk of her stake in Coinbase. Also, as the chart below shows, the Federal Reserve’s balance sheet has barely budged from its nearly $9 trillion peak. If that asset base finally starts to come down in a meaningful way, risky assets such as cryptocurrencies could see even more pain.

Fed Balance Sheet (M) (Federal Reserve)

Unless something dramatic happens in the next few months, Coinbase could easily see total revenues down more than 50% this year. The current average street estimate says that we won’t see revenues back to 2021 levels until at least 2027, and the latest revenue miss could impact that expectation timeline. At these low sales numbers, profitability may not come for some time, and the company is also burning cash currently. Fortunately, the balance sheet is in decent shape for now, but another few quarters of really bad results could eventually result in a capital raise.

I mentioned back in July that Coinbase was one of the most heavily shorted large cap stocks in today’s market. I will be curious to see how many of those naysayers remained through the first half of August, because a partnership with Blackrock was announced last week. This news sent Coinbase shares sharply higher initially, topping out at $116.30, which was nearly triple their public trading low from earlier this year. However, the stock quickly retreated from there, down about $30 from that peak into the Q2 report.

Coinbase shares finished Tuesday’s after-hours session down more than 5.3%, ending the session just under $83. The average price target on the Street has declined another $5 to just over $95 since I wrote about Cathie Wood selling, but it seems likely we’ll see more target cuts after this bad Q2 report. If shares do start to fall quite a bit, I’ll be curious to see if the stock can hold its 50-day moving average. That key technical trend line is currently above $63, but it is rising by the day for now as seen in the chart below.

Coinbase Year To Date (Yahoo! Finance)

In the end, Coinbase reported terrible Q2 results on Tuesday, further helping to put an end to the recent surge in shares. Revenues for the period fell dramatically short of estimates as users declined slightly and transaction volumes plunged sequentially, and the company lost more than a billion dollars when including impairment charges. Management detailed that Q3 is off to an even weaker start than Q2’s beginning, so expect lots of negative analyst notes in the coming days. Shares are still more than double their yearly low, but this stock is not going to hold up well for the long term unless we start to see a decent rally in the cryptocurrency space.

Be the first to comment