Imgorthand/E+ via Getty Images

Introduction

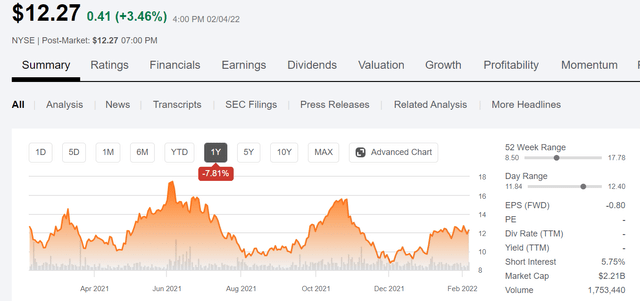

It’s been about a year since we looked at Liberty Oilfield Services (LBRT). Last April I put out a bullish article that suggested LBRT might rise to the high teens by the EOTY. As it turns out I was right, and LBRT rallied to $18 from $10 over the next couple of months. As the graph below shows, June was the time to sell as it’s been downhill ever since.

One year chart for LBRT (Seeking Alpha)

Recently as the year turned, the stock rallied back about 20% to the low $12s. Are we on the way back to $18 or more? It could be if you subscribe to the theory I first posited in the Nabors article back in early January. If you haven’t read it, I discussed the idea that DUC withdrawals were a finite resource, and soon drillers would… well heck, they aren’t good at much else, they’d just have to go back to drilling! Making new holes in the ground as it were.

That hasn’t happened yet as the January EIA-DPR revealed, but the rig and frac spread counts continue to nudge up week after week. For reference, Nabors Industries (NBR) is up 30% since that article and the stock of LBRT has lagged behind for most of that period, making its big move in mid-January.

If I am right, and we do see a 650-675 rig and 300 frac spread market in 2022, LBRT will hit that former high and push on through. LBRT reports Q-4 and the prior year on Feb. 9th. The seagulls have fairly modest expectations for the company with a low of $11 and a high of $16. I think that’s a bit conservative, and perhaps a bit dated, particularly as we have breached the low side. We will pick a high side target for the company later in this article.

The thesis for LBRT

We’ve heard it from Exxon Mobil (XOM) and we have heard from Chevron (CVX). Both are primarily Permian shale producers and are planning to ramp production up by 25%, respectively. Just between the two of them that’s another couple of hundred thousand barrels a day. Others will follow. Soon, in spite of protestations to the contrary, as The Motor City Madman, once crooned, it will be a Free For All. (Ok, Uncle Ted never crooned anything.)

That’s the plan anyway. As we have discussed, there could be a “Train-derailment” coming down the road. There simply may not be enough top tier inventory to sustain, what over the short run, this year and perhaps the next, the last great American oil boom!

There it is. I’ve jumped the shark and gone on record as predicting a boom. The prayers of tens of thousands of laid-off oil workers are about to come true. For some of them anyway who can be sweet-talked back into the patch.

It won’t last in any regard, and it won’t be of the magnitude where shale production was ramped from barely a million BOEPD to nine million BOEPD in early 2020. But it’s going to be fun to be an investor in oil related equities for the next few years as activity increases, IMO. It sure has been the last 18 months!

That’s the thesis for a number of our domestic OFS companies who are going to drill the wells, supply/store/transport the sand, frac the rock, and flow back the used, brackish water for recycling.

As far as LBRT specifically is concerned, they are at the top of the heap in the independent fracker category. Chris Wright, CEO who invented the frac model that is used to this day with variations and tune ups along the way. Pioneered it with his company, Pinnacle Technologies, then sold out to Halliburton for a gazillion bucks in 2006, waited out his non-compete clause running an operating company and then founded Liberty. Not all MIT grads do as well as Chris and he is a differentiator in this market!

The transformative deal with Schlumberger (SLB) is the final link in the puzzle for LBRT. SLB’s decision to go “asset-lite” and shed their frack equipment and sand mine in favor of a 39% stake in LBRT gave the company an edge coming out of the downturn.

A couple of key differentiators for LBRT

digifrac: There is a trend in the industry to eliminate older diesel burning Tier I, II, and III engines with cleaner, and more efficient units. Some are a blend of technologies such as the Dual-Gas Blend, or DGB equipment, then there are those just using gas for fuel. digifrac is a step beyond into an all electric frac fleet. Quieter, and emissions free, LBRT has been field trialing 4-digiFrac fleets with core customers. Chris Wright comments on the recent events surrounding digiFrac adoption-

There is significant interest in Liberty’s digiFrac electric fleet. We have completed 4 very successful field trials and over 30 technical and factory deep dives with customers and the response is overwhelmingly positive. We are excited to announce the execution of the first two multiyear arrangements to deploy digiFrac fleet in 2022 with two of the field trial partners. We are also in active negotiations with the others. The technical innovation and engineering control that these fleets exhibit, combined with the leading emissions profile and Liberty’s operational excellence is a combination that is hard to beat. We are continuing our multiyear deployment strategy centered around choosing the best partners, strategic frac deployments and strong returns on incremental capital deployed.

Last mile containerized logistics is left to third parties like Solaris Oilfield Infrastructure (SOI), a company that will be the subject of an article soon. With last fall’s $90 mm acquisition of PropX, LBRT took that function in-house. I like that as among other things it eliminates confusion between vendors. Handled properly this is the way to go.

PropX also brings a game-changing technology to fore. Sand is not traditionally an ESG friendly material. To flow properly it must be dried. Think sand castles, you use wet sand, right? That takes gas. Anyway the next thing you do with dried sand when it hits the rig is… wait for it… this is going to be great… surprise, you get it wet again! You can’t make this stuff up. Chris Wright comments on the PropX value proposition-

The dynamic team at PropX is a great cultural fit with Liberty. The addition of PropX integrates the latest proppant delivery technologies and software into our supply chain, including their new ESG friendly wet sand handling technology and expertise. We will continue to bring PropX technology, equipment and services to the whole industry. Together, we believe these solutions will reduce the environmental impact of last mile delivery and lower our total delivery cost to our customers. PropX has built the equipment and expertise to become the premier provider of this technology. Wet sand handling technology is a key enabler of the next step in cost and emissions reductions in the proppant industry. It is an ESG-friendly solution that allows for the delivery of wet sands to operators.

Q-3

LBRT beat on the top line, but missed on the bottom in Q-3. Revenues grew to $654 mm from $582 mm in the second, a time when the rig count only grew by ~50 rigs. Another 50 rigs were added in Q-4, so there is a linear metric to guesstimate revenues. The company realized a $39 GAAP loss on some non-monetary tax adjustments for legacy partners prior to going public. After adjustment they raked in $44 mm in OCF for the quarter, a quintupling from Q-2. EBITDA was slightly lower for the quarter due to logistics and acquisition integration costs for PropX. The company held $37 mm of cash on the books, a decline from the prior quarter due to cash cost for PropX. The total liquidity consists of $60 mm drawn on the $268 mm ABL. A secured asset facility was extended to 2024 in the amount of $350 mm with $100 mm drawn, with no payments to maturity.

Risks

I don’t want to paint too rosy a picture here. There is risk in a company like LBRT that you don’t see in Halliburton (HAL) or Schlumberger. The two big colors have a global footprint to balance activity surges and declines in a specific area. LBRT is a story about the Permian basin primarily and the stock will respond sharply to changes in perception as this regards it. You have been warned.

LBRT also has exposure to the same logistics and personnel issues now facing the industry. Costs are going up and not all is being absorbed yet by long term contract clients.

Your takeaway

Ok now comes the fun part. What do we think of LBRT’s prospects in the coming year. As I said, I think the seagulls are a little timid on this one. LBRT is trading at ~13X OCF on a one-year basis. That’s a little rich, but let’s remember this a business entering a growth cycle. One that we believe has a solid couple of years to play out. Also the share count has ballooned that to the SLB and PropX payouts to 178 mm shares.

Let’s say that OCF comes in at $70 mm for Q-4, a reasonable figure considering it’s half the $147 mm they did in Q-3 of 2019. On a one-year basis that takes us to 7X and LBRT becomes an underpriced bargain. Here’s the really fun part. If we only get to a 10X multiple, the stock must hit $18 a share, a 50% growth profile. Feel free to play with the numbers on your own while we are spitballing. If I am right about a last oilfield boom domestically, by next year these numbers could seem pretty quaint.

Chris Wright noted his optimism about the next few years in the call-

Global oil and gas supply remains constrained by underinvestment in both oil and gas production and the associated infrastructure. The urgent desire of many to see oil and gas transitioned away is running headlong into reality. In the year 2000, hydrocarbon supplied 86.1% of global energy, falling by less than 2% to 84.3% in 2020.

We’ll just see now, but that opinion fits fairly well into our thesis, and heck, Chris is an MIT double grad. Just think if he’d gone to A&M like a certain Fluidsdoc!

Be the first to comment