DNY59

Introduction

The good news keeps coming. One of my largest holdings – and only REIT holding as of now – keeps benefiting from subdued supply growth in the self-storage space, high demand, and strong pricing. It even allows Public Storage (NYSE:PSA) to avoid weakness in residential housing as self-storage continues to be in high demand due to a shift in demand. Moreover, the company is outperforming the “average” REIT, it distributed a high special dividend, and the company is poised to keep outperforming the market thanks to rapidly improving fundamentals and high investments that are poised to pay off – even if it meant unchanged dividends for many consecutive years.

In this article, I will walk you through my thoughts and explain why Public Storage remains not only one of my favorite REIT investments, but one of my favorite dividend (growth) investments in general. This includes the chance of new dividend hikes starting in 2023.

So, bear with me!

A Macro-Dependent Self-Storage Giant

To avoid making things sound too complicated or fancy, with “macro-dependent”, I mean that Public Storage is so large that major economic trends tend to influence the stock price more than management decisions that have minor impacts on the day-to-day operations of the company.

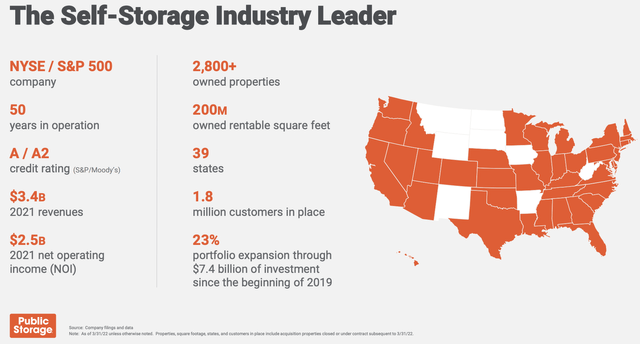

With a market cap of $60.7 billion, PSA is the nation’s largest self-storage REIT. It isn’t even close as the company is more than twice as large as its largest competitor Extra Space Storage (EXR).

The company operates in almost all states, owning more than 2,800 properties, covering more than 200 million rentable square feet, and serving 1.8 million customers.

One number on the presentation slide above is more interesting than the others – I think. Since 2019, the company has expanded its portfolio by 23%. That’s almost an addition of a quarter in less than three full years for a company with a 50-year history.

That’s a huge deal and it’s very important for two reasons. Reason one is obvious as most investors are buying PSA because of its ability to expand. Reason two is that the company hasn’t hiked its dividend in years, focussing on growth and financial stability.

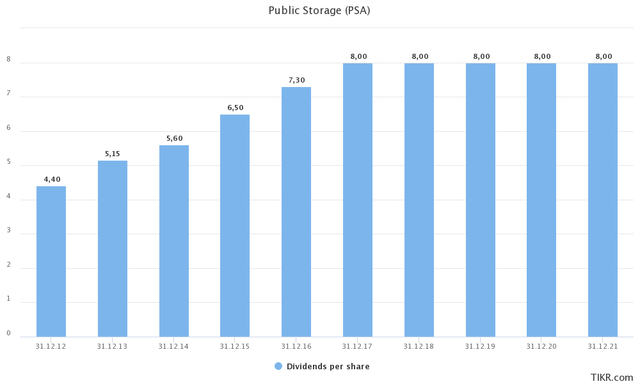

Excluding special dividends, the company hasn’t hiked its base dividend since 2016. That’s almost six years without a dividend hike. That’s a big deal for a lot of investors who like to buy reliably-rising dividends.

While there’s nothing wrong with dumping stocks that halt dividend growth on a prolonged basis, I tend to apply what I like to call an “ownership” focus by putting myself in the shoes of the company’s management.

As a long-term investor in PSA, I currently care more about being well-positioned for what I believe will be a very long bull market in self-storage.

Between 2012 and 2021, the company boosted its gross property, plant, and equipment (mainly property, in the case of REITs) from $11.1 billion to $23.1 billion.

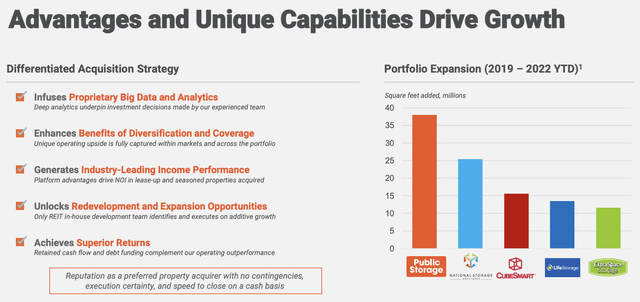

Since 2019, the company has invested $7.4 billion in new assets as I briefly mentioned. This added 38 million square feet, making it the biggest addition of new assets in the industry. As a matter of fact, the company almost added more assets than number two and three combined.

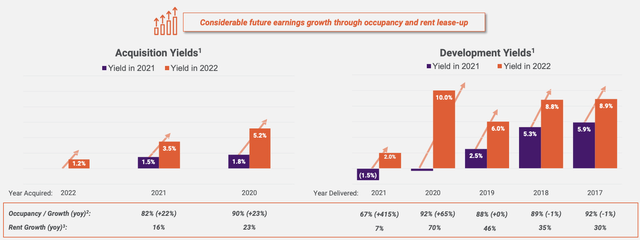

What matters is that the acquisition and development yields are good. Adding properties isn’t that hard. Managing them is what makes or breaks a company.

Looking at PSA’s results, acquisitions are successful, resulting in high occupancy rates, strong rent growth (more on that later), and high yields just 1-2 years after deals close. The same goes for developments, where yields are rising towards double-digits with high occupancy rates and outperforming rent growth as the company is adding value to its properties making it easier to ask for higher rents.

Now, with that said, the company is highly macro-dependent.

Hence, it’s a good thing that market fundamentals remain highly favorable, even if the company is losing some occupancy.

In 2Q22, occupancy fell to 95.8%, that’s down from 97.0%. The company calls this a seasonal effect, even if it’s stronger than in previous years.

According to the most recent Yardi Matrix national self-storage report, fundamentals remain strong, backed by high demand.

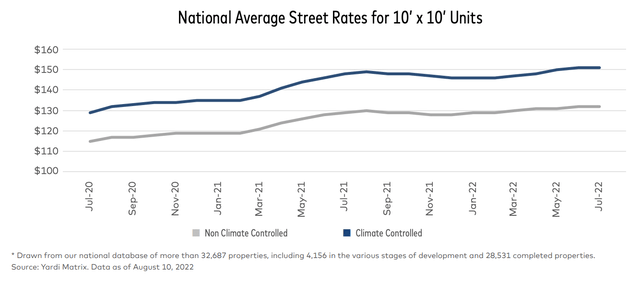

Essentially, while growth has moderated after a rapid pandemic-fueled expansion, demand is maintaining steady growth in rates according to the report:

As street rates have leveled at record highs, year-over-year growth has decelerated. The slowdown in growth was to be expected, as much of the industry anticipated gains in 2022 were unlikely to match the above-trend increases posted last year. Nationwide, the overall average street rate, which includes all unit sizes and types, grew 2.1% year-over-year in July, a 210-basis-point drop compared to June’s annual rate growth.

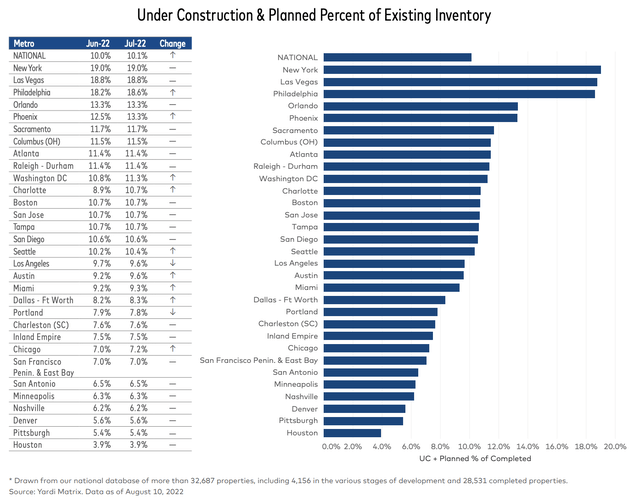

Moreover, one of the major issues facing the industry is new supply. Entry barriers are low to open new facilities.

As of July 2022, new supply under construction and planned is at 10.1% of the national existing inventory. Growth is especially high in New York, Las Vegas, and Philadelphia.

The good news for operators is that rapidly rising construction costs will likely prevent any major surges in new supply over the coming years.

According to the latest Yardi Matrix forecast, the amount of new supply delivered across the nation in 2022 will be equal to 3.2% of existing stock and annual deliveries will moderate to 2.5% of total stock by 2027.

That’s terrific news for large operators who not only have a large footprint already, but also better “value-adding” assets that most no-name operators cannot compete with. After all, the long-term surge in storage demand also comes with a demand for high-quality storage including safety, self-service support, climate control, and whatnot.

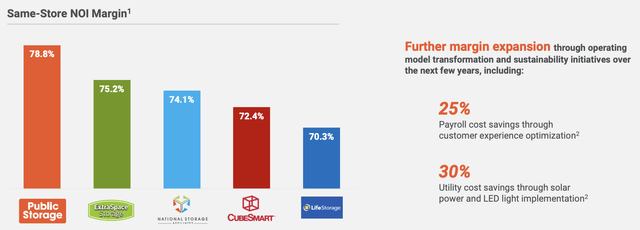

Strong pricing, acquired growth, and a high occupancy rate are what drive PSA. The company saw 15.9% higher revenues in 2Q22. Total direct operating costs rose by 8.7%, which resulted in 17.8% direct operating income growth.

Net operating income margins improved by another 160 basis points to 80.6%. Even before 2Q22, PSA was the leader in profitability in its industry.

Related to that, the company has outperformed the core real estate sector when it comes to same-store net operating income growth on a long-term basis.

Public Storage’s Dividend

I already briefly discussed the dividend but wanted to add some more color. PSA has not hiked its dividend since 4Q16 as a result of its focus on expanding its asset base and managing its balance sheet.

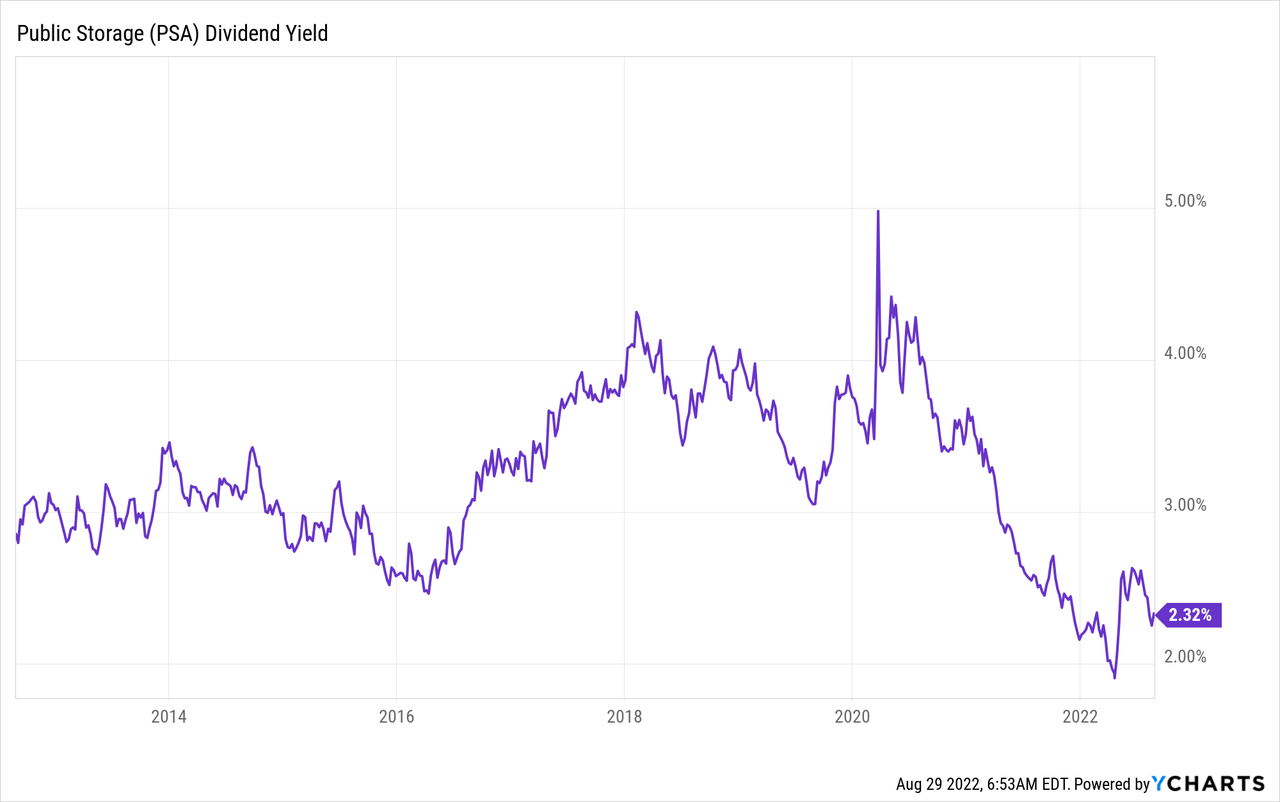

The company currently pays a $2.00 per share per quarter dividend, which translates to $8.00 per year, or 2.3% of the company’s stock price. Because the company hasn’t hiked since late 2016 the dividend yield is close to multi-year lows as the stock price continued to climb.

The good news is that shareholders did receive a special dividend in August of $13.15 per share. This was part of a $2.3 billion gain from the sale of PS Business Parks to Blackstone Real Estate. The company received $187.5 per share and unit for its 41% stake in PSB. The company had to distribute this cash to its shareholders to meet the REIT requirements.

When asked by analyst Mike Mueller (in the 2Q22 earnings call) what we can expect in terms of regular dividend growth, the company answered:

[…] it’s been some time and growth has been strong. It’s that as well as taxable income increasing that is likely to increase our dividend over time here as we move forward. And that’s something that we highlighted at Investor Day as well as taxable income increases. We’ll be poised to increase the current return to our shareholders. And that is, as we move forward into 2023, something that will begin to be more of a topic.

In other words, a hike is likely in 2023 and in the years after that – if fundamentals remain strong.

Balance Sheet, Valuation & Outperformance

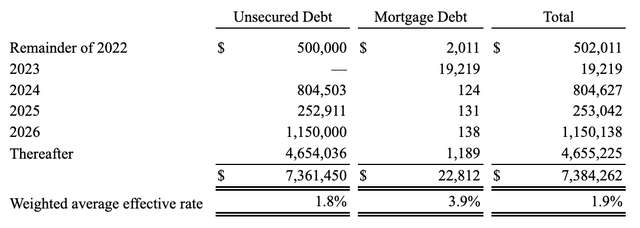

In 2020, the company had roughly $2.5 billion in financial debt on top of $4.1 billion in preferred equity. This year, the company has $5.8 billion in USD debt, $1.6 billion in EUR debt, and $4.4 billion in preferred equity. Debt is now 63% of funding, up from 38% with the cost of debt and preferred equity falling to 2.7%. That’s down from 3.9%.

Net debt plus preferred equity is roughly 4.0x EBITDA. That’s up from 3.0x EBITDA but against better borrowing rates. Moreover, the company’s long-term target is 4.0-5.0x EBITDA, which means it is in the range that supports higher dividends.

Moreover, the company has no major debt maturities until 2024, which means the company does not have major refinancing needs while rates are still high.

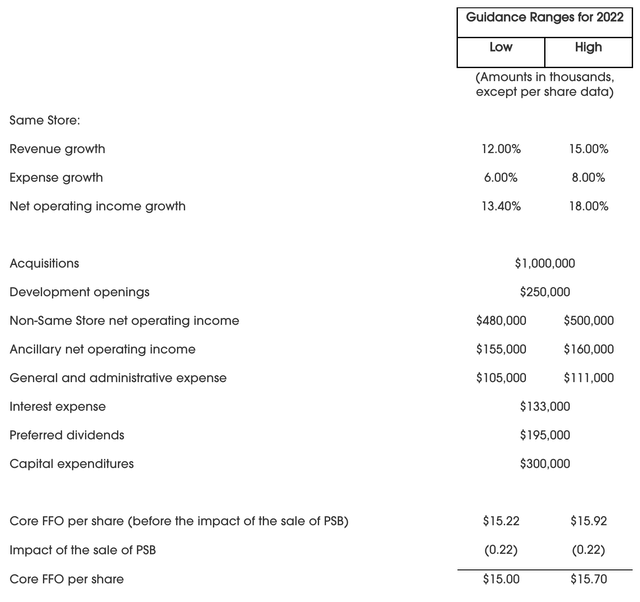

With regard to the valuation, the company is trading at 22-23x 2022 expected funds from operations. These numbers are adjusted for the sale of PSB to Blackstone and are based on outperforming revenue growth (versus expenses).

This valuation is a fair deal. As I wrote in my last article:

- “The company has a strong geographic mix with “A” locations.

- Margins are strong and improving despite high inflation.

- External growth is high, putting 25% of PSA’s portfolio in the high-growth non-same-store pool.

- Its balance sheet is stellar, protecting the company against high rates.

- Industry fundamentals continue to be supportive of strong growth.”

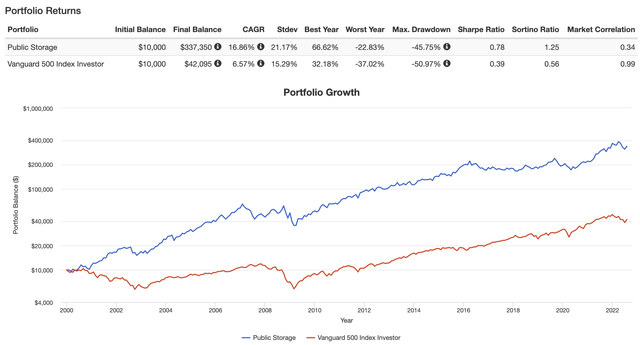

With that said, PSA offers long-term outperformance and subdued volatility. Since 2000, the company has returned 16.9% with a standard deviation of 21.2%, beating the S&P 500 on a total return and volatility-adjusted basis (Sharpe/Sortino ratios).

Takeaway

Public Storage continues to deliver. While real estate in general is facing demand headwinds, self-storage continues to ride a very strong wave backed by secular demand growth. Occupancy rates are high, demand is high in pretty much every market, rates remain strong – even compared to strong growth in 2021 – and new supply is expected to slow significantly in the years ahead.

It’s a fantastic market to be in for operators who have expanded aggressively in the past few years while offering services that most no-name operators cannot compete with. That’s what PSA does. While the company hasn’t hiked its dividend since 2016, it is now hinting that 2023 could see the first hike as the company is finally able to be more aggressive in distributing cash to shareholders.

Growth in net operating income and funds from operations has picked up, balance sheet health is taken care of, and both past acquisitions and new developments result in high investment yields.

Moreover, the stock remains fairly valued.

Long story short, PSA remains one of my all-time favorite REITs, and I have little doubt that PSA will continue to outperform the market on a long-term basis.

(Dis)agree? Let me know in the comments!

Be the first to comment