Gaston Brito Miserocchi/Getty Images News

No man’s life, liberty, or property are safe when the legislature is in session.

–Gideon J. Tucker, 1866

Introduction

Li-ion battery demand is expected to grow 22x within the span of this decade. Europe, China, and the US are all looking to send the internal combustion engine into terminal eclipse by 2040. As EV penetration increases, global lithium demand is expected to maintain a double-digit annual growth rate into the 2030s, giving Lithium carbonate equivalent (LCE) one of the best growth profiles among all commodities. This puts Sociedad Química y Minera de Chile S.A. (NYSE:SQM) in the proverbial sweet spot.

Operating in Chile’s Salar de Atacama, SQM is a titan in the LCE space. Besides being a chemical producer specializing in fertilizers and AG chemicals, SQM is arguably the world’s most important low-cost lithium producer. Lithium is either produced via lower-cost brine evaporation or higher-cost spodumene mining, making SQM’s extensive brine assets in the Atacama salt flats truly unique. The company enjoys a 22% share of the global lithium market with at least 20 to 25 years of reserves.

SQM is well-managed, enjoys enviable secular trends and offers a compelling valuation. For over two years, however, shares have been pressured by the uncertainty of a new constitutional overhaul and expropriation fears. Now, however, this political risk overhang – which appeared monumental just 4 months ago – may well ease within weeks.

Opinion has shifted in the streets of Santiago. The new constitution in Chile that was once assured popular passage in its upcoming plebiscite vote of September 4th, is now looking more and more unpopular.

An outright rejection of the new constitution – and the vast amounts of new tax and regulatory policy rewrite that would cascade from it – would be a significant catalyst for SQM. It would allow shares to break beyond prior highs this fall and reach $150 by late 2023. The stock’s valuation has not kept up with LCE prices or the firm’s astute management.

SQM’s Recent Quarter

Following 2Q results, SQM shares dropped 9% as the trading algorithms reacted negatively to below guidance margins and profits. But the selloff was unwarranted, and the market quickly swung back into the ticker as it became clear that the disappointment emerged from an accounting technicality – SQM pays Chile a royalty when product leaves the country not when it books profit – and this payment mismatch will help the upcoming quarter.

Total 2Q22 revenues for lithium and derivatives were impressive: $1.846 billion versus $163 million in 2Q21, an increase of 1,033%. Adjusted EBITDA was over 6 times the prior year. As automakers seek to lock in supply, SQM now has 72% of its LCE contracted at spot prices. Earlier this month, analyst Richard Fernandez suggested that, as these fixed contracts mature, the company should move to 100% spot LCE pricing with realized prices bounding higher.

Morningstar now expects the company’s 2022 average realized lithium prices will be roughly $60k per metric ton. LCE volumes in the back half of 2022 are expected to be 37% above the prior year’s period. Prices are expected to fall back to $30k per ton in late 2023 and stabilize around $25k per ton in 2024.

Backdrop: Secular Trends and Geo-Strategic Positioning

Beneath the surface of the Biden administration’s new Inflation Reduction Act is a geopolitical effort to re-shore strategic assets and recircuit supply chains to avoid peer competitors. It provides a $7500 tax credit for a new EV purchase in 2023, but to get that full credit at least 40% of the battery materials must be sourced from this US or a free trade agreement partner. This percentage rises to 80% in 2026!

These guidelines ice out China decidedly – and Indonesia, Bolivia, and Argentina tangentially – but it gives Chilean (and Aussie) miners like SQM a great deal of leverage. Multinational firms serving the US market are pushed to deepen investments with relevant FTA partners.

There is no way that the world gets to carbon neutrality by 2050 without Chile. The country’s preeminence in both copper and lithium reserves – two essential ingredients to every EV – makes it a pivotal force in the new era – perhaps the “indispensable nation.”

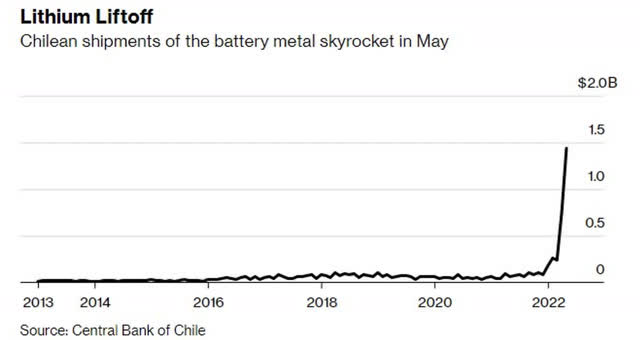

Chile’s lithium liftoff (Central Bank of Chile)

In late May Goldman Sachs (GS) put out a report suggesting a fall in LCE prices in 2023, and the market was quick to hammer the miners. But buried in the report was its discussion of an impending super cycle:

It is important to note that this phase of oversupply will ultimately sow the seeds of the battery materials super cycle over the second half of this decade, in our view, where the demand surge will more sustainably overcome current supply growth.

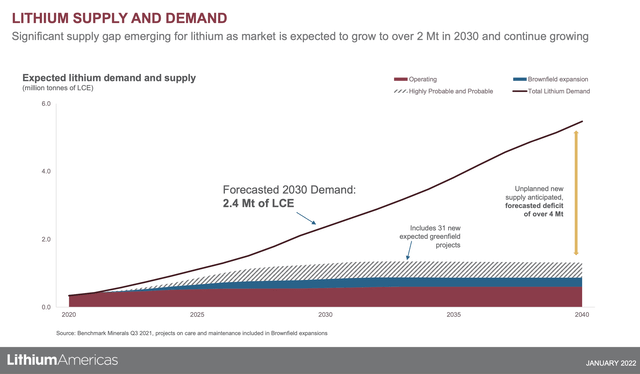

The following graph from Lithium Americas (LAC) also suggests a future supply demand imbalance.

Supply Demand Imbalance (Lithium Americas website)

Chile’s Idiosyncratic Political Risk

Despite these enormous structural tailwinds, intense political risk has pressured SQM and other Chilean miners for nearly three years as the issue of a new constitution was being meted out and as a new leftist administration swept to power following the Estallido Social protests of late 2019.

The protests suggested a new era in Chilean history. Gabriel Boric, a 35-year-old former student protest leader, won the presidential election in December 2021. He campaigned to expand the social safety net, increase mining royalties and taxes, and create a national lithium company. As with Lulu in Brazil in 2000, the financial markets reacted slowly and then sharply to the late polling: SQM’s stock price dropped about 30% from November 11 to early December 2021. The morning after Boric’s victory, the stock price of SQM fell 15%.

In the following months, the knifes were out. Those mining permits added in the waning days of the prior administration for BYD Chile SpA (October 2021), were stayed in January and later nullified in anticipation of the new constitution. On February 1, 2022, an Environmental Commission preliminarily approved a proposal that would require the state to cancel concessions and nationalize certain assets deemed “strategic” within one year of the adoption of the new constitution. The proposal, known as article 27, would have given the state exclusive mining rights over lithium, rare earth metals, oil, and a majority stake in copper mines. The concession rights of the current 1980 constitution would be replaced by temporary, revocable permits.

Most Americans don’t realize that Chile’s mines had been nationalized prior to Pinochet. SQM’s legacy relationship with billionaire Julio Ponce Lerou – the so-called Lithium King, former son-in-law of the dictator and the direct beneficiary of the mine’s privatization in the 80s —wouldn’t help matters with this new regime.

In early May, the constitutional assembly in Chile rejected plans to nationalize parts of the crucial mining industry, despite the Environmental Commission’s earlier recommendation. The commission submitted multiple variations of the article to a vote, but they all failed to achieve the 103-vote supermajority needed to pass into the draft constitution.

The market was relieved.

Of course, there are major changes to governance, licensing, and taxation that are in the new draft constitution. The government proposed rates would put mining taxes at over 66% in some circumstances, well above other mining jurisdictions. A separate clause, article 25, states that miners must set aside “resources to repair damage” to the environment will be in the new constitution. The assembly also approved banning mining in glaciers, protected areas and regions essential to protecting the water system, though the definitions of some of these entities are left unclear.

The shift from mining concessions – which traditionally can be inherited – to administrative authorization has the effect of weakening property rights. Expropriation can take two forms: direct (i.e., seizure), or indirect, restricting the aspects of the domain (use, enjoyment, disposal).

Issues of water seem to shift decisively from the domain of property rights to administrative control. Water use would be regulated via authorizations rather than ownership rights, and it will no longer be possible to sell water rights. The issue of a miner’s desalinization plants, and the use of the water produced, is not explicitly broached. What is clear: the framework will allow more “indirect expropriation” measures to be introduced later through legislation aligned with the new constitutional text. The slippery slope.

The Boric administration sees a generational opportunity to create a sustainable development model with social value. It is expansive and so novel in its environmental and social rights agenda that much is left to the later more granular statute processes. The new constitution – if enacted – will certainly trigger a year of new regulatory policy rewrites and certainly freeze new concessions in mining. It will have lithium miners searching to invest in more legible jurisdictions.

With investors nervous about putting money into Chile, some mining companies are already pouring money into Argentina, which has the fifth-largest global lithium reserves. Despite the raising of the LCE reference price of $53 per kilogram, the country remains hospitable to investment.

Argentina is not a free trade partner with the US (yet), but – unlike Chile – it does not consider lithium a strategic asset. As one analyst has stated: “Its legal system permits corporations to mine lithium through concessions that they can own in perpetuity if they meet certain investment criteria.”

In early 2022 Argentina had attracted some of the largest lithium deals in the market, with Lithium Americas’ Cauchari-Olaroz site allegedly the largest new battery-quality LCE brine operation to be constructed in 20 years. It is not too far from Salar de Atacama.

Boric’s plunging popularity

Until recently, it was expected that the new administration would have little trouble shepherding the new constitutional text through the plebiscite. Sailing into office with a near 12-point victory against his conservative opponent, President Boric would have the political capital to close the deal.

But a lot has changed since December.

In recent opinion polling, Boric’s support has plunged to 34%, the lowest level of his presidency. This mirrors fading support for the country’s new constitution.

There are several reasons for this –some of which can’t be completely blamed on the new administration:

- Inflation in Chile is currently running at an 11.5% annual rate. In March, the month Boric came to office, monthly inflation rose to a 30-year high. (The pandemic supply chain disruptions internationally can explain a lot of this).

- Chile might be heading into recession. On August 18, Reuters reported that Chile’s GDP came in below expectations in 2Q 2022, leading economists to forecast a potential recession. According to Capital Economics’ Latin America economist Kimberley Sperrfechter: “Chile’s economy merely stagnated in Q2 and the chances are high that it will fall into recession over the second half of the year.” (Investment hesitancy on the part of multinationals in the face of a new leftist regime could explain some of this.)

- Crime has been escalating for several years, but cartel-related crime has spiked. Homicides rose by 30% during the first half of 2022. The migration crisis in the north that has driven many Venezuelans into Chile has also allowed their violent crime syndicate Trena de Aragua to move into the upper coastal cities. Even many of the old placid working-class neighborhoods of Santiago are now plagued with violence. Likewise, drug trade cartels are exploiting the tensions between the state and indigenous groups in the South to stake new territory. (The administration has a not-fully-justified but assumed reputation of being soft on crime).

Of course, the young administration does appear more beholden to radical agendas and perhaps unprepared for the brass tack realities of governance. In particular, the troubles of the La Araucania region have some Chileans fearing that the new constitution may institute new era of perpetual disorder.

Boric’s campaign assurance that his presidency might bring stability and conciliation to the region was shattered in its first week in March when the visit of his Interior Minister Izkia Siches was interrupted by bullets. And last week, on August 25, Boric accepted the resignation of his Cabinet’s social development minister, the first shakeup of his young administration following a news report that one of her advisers was in contact with alleged arsonist Hector Llaitul, leader of CAM, the radical wing of the Mapuche indigenous movement which has called for an armed struggle against the state.

Fires in the streets and the fractious committee discussions expose the gaps that emerge when heady issues like pluri-nationalism hit the “who pays” brass tacks concerns of pipeline concessions, taxes, and public security. And “devolving power” to regions that could quickly become lawless narco-statelets becomes a quandary.

The end result: the new constitution’s vote is now a referendum on the Boric government and its rocky start.

The New Constitution: Novel, Ambitious, but Vague

The work of Chile’s Constitutional Convention started on July 4, 2021 with high expectations. A new constitution had been proposed by the government amid the 2019 protests and at the time 78% of voters supported the measure. Pinochet’s constitution – written by law professor Jaime Guzman in 1980, itself a replacement for a 1925 document – was widely seen as a way of keeping the country in the conservative cast via its bicameral structure (senate and lower house) and its high bar 4/7 vote for altering certain things.

Chile’s new constitution – to be submitted to vote on September 4 – ends the senate, decentralizes power across its distant regions, and explicitly describes the nation as a “social state.”

Regarding mining, things get hazy. It is unclear what entity will give permission to mine under the new constitution. Under the current text, it is the task of the judicial system; but with the new one, it might be given to a new administrative department.

The new constitution would leave the issue of concessions to be determined later by statute. The concession system might be kept or might be replaced depending on how successive legislatures approach the issue. This is a big uncertainty.

One change that is clear: whereas with the current compensation for expropriations is the “market value,” something that can be cross-referenced internationally, the new document changes this to a so-called “fair price.” It is assumed a state appointee will judge what is fair.

Big picture: much of the so-called “neoliberalism” implicit in the current constitution – used to assuage international investors during the 80s and 90s that ownership rights and mark-to-market pricing would be similar to the US – is gone.

Whereas strong legal and economic rights and a conservative upper chamber define the current constitution (and the American constitution for that matter), the new constitution shifts from rights to authorizations and devolves power to rather uncertain places. Chileans are seeing this in the final draft of the constitution, and it is changing their impression.

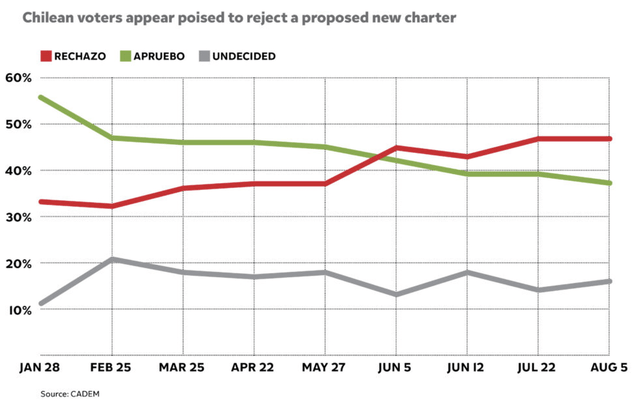

Opinion has turned sharply since January as inflation and crime rose, and plenary committee scandals mired the process. The “sausage was made in public” and inevitably the voters didn’t like what they saw. Though the mandatory voting and the inclusion of new voters could affect the outcome, recent polls now show voters are likely to reject the new constitution.

In a survey conducted on June 27, 2022, 51% of the population will reject the new text on September 4th, whereas 33% plan to approve it. 16% said they remained undecided.

A Shift in Sentiment (Americas Quarterly)

This represents a significant reversal in public sentiment over the course of the past six months: on January 28, 2022, 56% favored approval and 33% favored rejection.

Ironically, despite the binary aspect of the upcoming vote, few what to accept the new constitution without changes or keep the current one without changes. As analyst Pia Mundaca has astutely written:

Groups that want the new draft to be put into place without any changes aren’t numerous, and neither are those that want to keep the current charter, which dates from 1980, without modifications. The majority is split between those who support approving the new constitution and making changes in the short term, and those who support rejecting the new constitution and agreeing instead on modifications to the current charter.

One thing is clear: Rejection of the new constitution would be a major setback for the new government. Perhaps an irrevocable one. The plebiscite would suggest a Thermidorian Reaction of sorts. Boric will feel the need to regroup and dramatically exercise power with new legislation, or he might look to a more incremental approach, but it will take years to initiate another constitutional vote of this scale.

Operating within the current constitution (and modifying it) is far more appealing to miners like SQM than the uncertainty of the new one. Expect a relief bounce on September 5 if the trend in current polling holds.

Be the first to comment