oneillbro/iStock via Getty Images

Today’s article will be on Public Storage (NYSE:PSA), a well-known self storage REIT that has been around for decades. Chances are that you have seen numerous Public Storage facilities driving around in your day-to-day life, as the REIT is the largest in the storage sector with a market cap of $54B.

Investment Thesis

Public Storage is the largest REIT in the self-storage sector. They boast an A credit rating with a solid balance sheet and a couple successful investments in outside real estate opportunities. This includes an investment in PS Business Parks (PSB), which recently announced that it is going to be acquired by Blackstone (BX). The valuation is cheaper than it was a couple months ago when shares peaked above $420, but at price/FFO of 21.4x, I don’t there is a margin of safety right now. The other factor to consider is that dividend growth for Public Storage has stalled while several competitors have been aggressively hiking their dividends. The company is interesting as a defensive holding, but I think there are better options for investors looking at the self-storage sector.

The Business

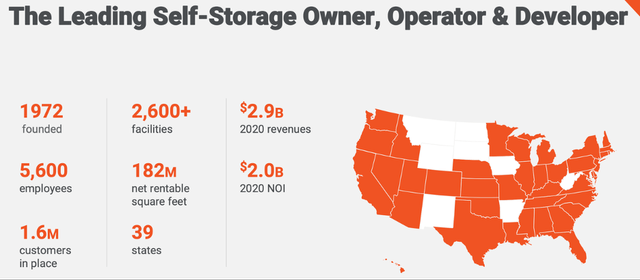

Public Storage was founded 50 years ago and has grown massively since then. They now have facilities across the US and have continued to grow through development as well as acquisitions. As a self-storage REIT, they are also better insulated from economic downturns, which might be attractive to some investors in today’s economic climate.

Public Storage Summary (publicstorage.com)

Public Storage also boasts a strong balance sheet, being one of a few REITs to earn an A credit rating. All their debt is below 4%, with the majority of it being closer to 2%. In addition to an expansive footprint and a solid balance sheet, they have also enjoyed success with outside investments in other public real estate companies here and in Europe.

Outside Investments

They also have a significant stake in PS Business Parks, which was valued at $2.4B at the end of Q1. Since then, Blackstone has agreed to acquire PSB at $187.50 per share. They have agreed to vote their 41% equity interest in favor of the deal (subject to certain conditions). PSA will receive $2.7B in cash and recognize a $2.2B gain, and they plan to distribute $2.3B to common shareholders. This could come in the form of a dividend raise or a special dividend, but my guess is that we will see that in the second half of 2022 or early in 2023. On top of their successful investment in PSB, PSA also owns a 35% interest in Shurgard, which was worth approximately $2B at the end of Q1.

Valuation

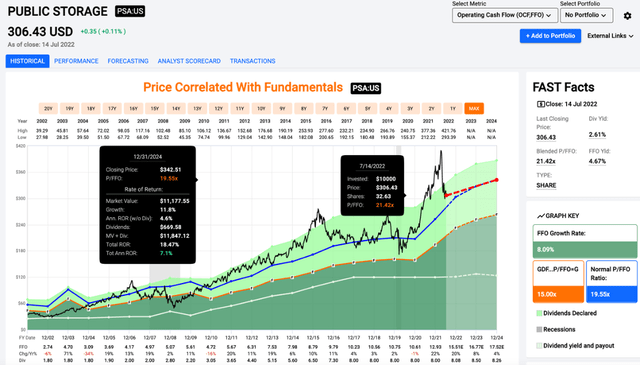

One of the reasons that I’m cautious on Public Storage is the valuation. The valuation is certainly better now after peaking in April around $420 a share, but I don’t think it is cheap yet. If the REIT was smaller and rapidly growing the dividend, I wouldn’t mind paying the current price/FFO of 21.4x. That is slightly above the average 19.6x multiple of the last two decades.

Some investors might argue that Public Storage deserves a premium valuation near 25x price/FFO as the largest self-storage REIT, but I think shares are somewhere near fair value at the current price. If we see continued selling, I might get interested. I think I would start looking closer if shares dropped into the mid-200 range, which would put the dividend yield above 3% and the price/FFO in the high teens. As I mentioned earlier, the dividend growth has been on hold for several years with Public Storage.

No Dividend Growth

While Public Storage hasn’t hiked the dividend since 2016, I don’t think they are at risk of a dividend cut with their balance sheet. However, one of the things that I prioritize with REITs (and other income investments) is a growing dividend. The current yield sits at 2.6%, which isn’t enough to compensate investors for the lack of income growth.

A quick comparison to a couple of competitors shows that there is dividend growth available in the sector. Life Storage (LSI) recently hiked their dividend another 8% to $1.08 per share. They have shown significant growth in the last year, as they were paying out $0.74 a quarter a year ago. You also get a higher forward yield at 3.8% and a lower price/FFO of 19.7x.

Another storage REIT, Extra Space Storage (EXR) has hiked their dividend 50% in the last year. A year ago they were paying out $1.00 a quarter and the most recent dividend was $1.50. With EXR, you get a similar price/FFO (22x), but a higher starting yield of 3.6%. While the dividend growth is likely to start again at some point for Public Storage, I don’t know if it will match some of the competition’s impressive dividend growth.

Conclusion

Public Storage is a business that many of us are familiar with as one of the largest storage REITs around. I’m sure that some of have even utilized their self-storage facilities at some point or another. While the company’s scale and track record are impressive, that doesn’t make it worth investing in today. The valuation leaves something to be desired when it comes to margin of safety and the lack of dividend growth over the last couple years is hard to ignore when other self-storage REITs like LSI and EXR have been aggressively hiking dividends. If the recent selloff continues, my rating might change, but for now, shares of Public Storage are a hold in my book.

Be the first to comment