kynny/iStock via Getty Images

Thesis

QuantumScape Corporation (NYSE:QS) is slated to report its Q2 earnings card on July 27. However, we have consistently urged investors to avoid adding QS, given its highly speculative business and uncertain fundamental metrics.

Notably, QS fell further since our previous update and reached its all-time lows in June, down an incredible 94% from its highs as it reached rock bottom. Some investors may be tempted to make a speculative bet on QS at the current levels. However, we continue to urge caution. We believe QuantumScape will continue to face significant challenges in scaling, even if it can produce a successful prototype for adoption.

Coupled with intensely competitive headwinds and worsening macros, we don’t encourage investors to add exposure to fundamentally weak stocks like QS.

Therefore, we reiterate our Hold rating on QS, heading into its Q2 card.

QuantumScape’s Weak Fundamentals Exacerbated By Uncertain Manufacturing Scale

QuantumScape is expected to continue burning through its $1.35B in cash and equivalents rapidly through FY26. As a result, we expect QuantumScape to require additional financing over the next few years. In addition, investors should note that battery manufacturing is a CapEx-intensive process that results in relatively low free cash flow (FCF) profitability. QuantumScape also cautioned in its filings (edited):

The development, design, manufacture and sale of batteries is a capital-intensive business, which we currently finance through joint venture arrangements and other third-party financings. Over time, we expect that we will need to raise additional funds. We cannot be certain that additional capital will be available on attractive terms, if at all, when needed, which could be dilutive to stockholders, and our financial condition, results of operations, business and prospects could be materially and adversely affected. (QuantumScape FQ1’22 10-Q)

Notwithstanding, QuantumScape is unlikely to burn through its cash hoard in the near term. Therefore, QuantumScape should be able to leverage more positive market sentiments if the bear market recovers over the next two years.

However, QuantumScape’s ability to deliver robust FCF profitability is predicated on the company’s capability to “achieve significant cost savings in battery design and manufacturing, in addition to the cost savings associated with the elimination of an anode from our solid-state battery cells, while controlling costs associated with the manufacture of our solid-state separator.”

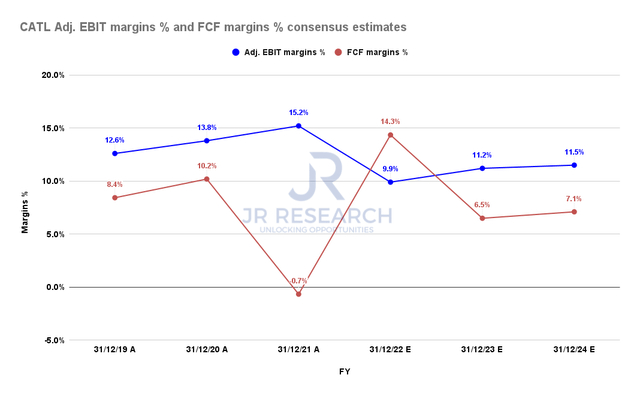

CATL adjusted EBIT margins % and FCF margins % consensus estimates (S&P Cap IQ)

We believe that assumption is critical because battery manufacturing is a relatively low FCF margins business. As seen above, even global EV battery leader CATL’s FCF margins are expected to moderate through FY24, reaching 7.1%.

Coupled with QuantumScape’s early-stage operating model, it’s incredibly challenging even to assess what level of profitability it can deliver at scale. Therefore, investors need to make highly uncertain assumptions in their valuation models. The company also accentuated such risks in its filings (edited):

Even if we complete development and achieve volume production of our solid-state battery, if the cost, performance characteristics or other specifications of the battery fall short of our targets, our sales, product pricing and margins would likely be adversely affected. (10-Q)

Recessionary Headwinds Could Impact Market Sentiments Further

Morgan Stanley (MS) also updated in a recent note that recessionary headwinds could impact the sentiments in the automotive industry as it cut its forecasts. Moreover, we believe that the market could be even less receptive to supporting highly speculative stocks like QS, given its unprofitability.

In addition, investors should also keep in mind that QuantumScape faces competitive challenges not just from solid state battery makers but also against the manufacturing scale and improvement of the current battery technologies. It articulated (edited):

In addition, lithium-ion battery manufacturers may continue to reduce cost and expand the supply of conventional batteries and therefore reduce the prospects for our business or negatively impact the ability for us to sell our products at a market-competitive price and yet at sufficient margins. Many automotive OEMs and a number of battery technology companies are researching and investing in solid-state battery efforts and, in some cases, in battery development and production. (10-Q)

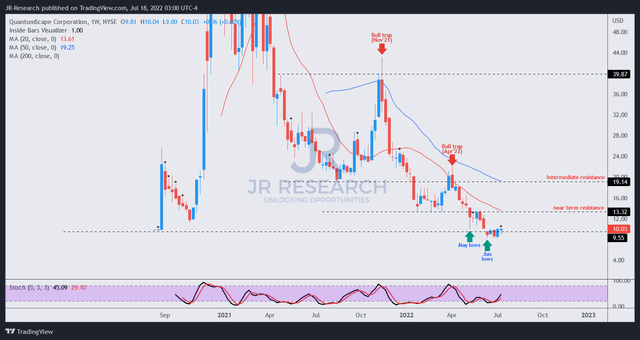

QS price chart (TradingView)

Accordingly, we are not surprised that the market sentiments toward QS have been increasingly bearish over the last few months.

QS reached a new all-time low in June and has continued to hold its June bottom. However, we don’t encourage investors to add at the current levels, as we have yet to observe a sustained bottom, despite having been battered massively.

Is QS Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on QS.

Given its dramatic collapse, we believe many investors who bought its hype have already given up and left the train. We believe that newer holders who joined the bagholders recently need QuantumScape to deliver a multi-year execution plan with tremendous success to see QS re-rated.

However, there are too many unknowns; as we indicated, making even a speculative bet seems overly speculative.

Be the first to comment