Paul Bradbury/OJO Images via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the PIMCO Corporate & Income Opportunity Fund (NYSE:PTY) as an investment option at its current market price. The fund’s objective is “to seek high current income, with capital preservation and capital appreciation as a secondary objective”.

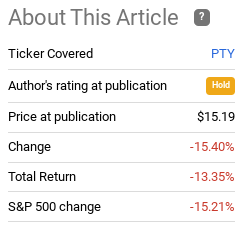

I cover PTY about once a quarter, with my most recent review about three and a half months ago in March. At that point, I reiterated a stance that I have held for a while – that PTY should be approached cautiously. Looking back, this passive outlook remained appropriate, with the fund dropping by over double-digits in the interim:

Fund Performance (Seeking Alpha)

Of course, the market as a whole has been under a lot of pressure, so we need to take this into account. This is primarily why I don’t think it would have been advantageous to take a more bearish stance. Yes, PTY did fall by quite a bit. But the result actually bests the broader equity market and bond funds by and large didn’t do so great either.

Therefore, I thought it was time to take another look at PTY to see if I can finally shift this fund into my “buy” column. Unfortunately, after review, I remain cautious on this option and will reaffirm a “hold” rating. The fund’s persistent premium to NAV gives me concern, although there are some positive attributes that suggest a downgrade is not appropriate either. I will explain these pros and cons in more detail below.

PTY Hasn’t Been Working In 2022

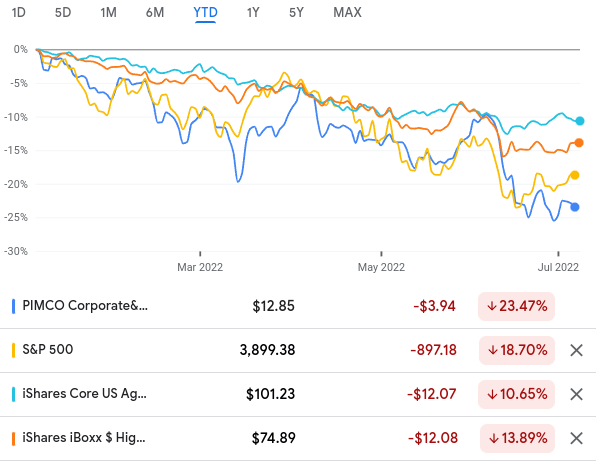

As we begin the second half of 2022, I thought it would make sense to examine the performance of this CEF for the first half of the year. Not surprisingly, the total return has been very poor. While the income stream is high enough to buffer some of this downtrend, readers should recognize that PTY has performed just about on-par with the S&P 500, and has lagged the aggregate bond index (as measured by the iShares Core U.S. Aggregate Bond ETF (AGG)) and the high yield corporate bond index (as measured by the iShares iBoxx $ High Yield Corporate Bond ETF (HYG)):

YTD Performance (Google Finance)

My takeaway from this is there is not a whole lot to be excited about. Most areas of the market have been in a correction or bear market, so it is not overly alarming that PTY is falling as well. But we see that it has not acted as a hedge against equities and has performed worse than other fixed-income alternatives. In a risk-off year, PTY has been hit – hard. This is important because we have to consider the likelihood of a turnaround in the second half of the year. If the macro-conditions stay the same in the U.S. and around the globe, how realistic that PTY is going to suddenly start out-performing? Not too likely in my opinion.

This highlights the inherent risk of buying a leveraged CEF that is long riskier debt. This is true of PTY, and the plethora of other options in this space, whether through PIMCO or other asset managers. When times are good, these funds can flourish, but the opposite is also true. And we are in one of those difficult stretches right now.

After The Drop, PTY Should Be A Bargain, Right? Nope

So PTY has been having a tough time in 2022. This much is known. But what is more important at this juncture is how it will fare for the remainder of the year. That is what investors who are considering buying now are most concerned with. On the surface, a drop of over 13% since late March should pique some interest. After all, with such a sharp drop, PTY is probably looking attractive from a valuation perspective. At least that is what one would think.

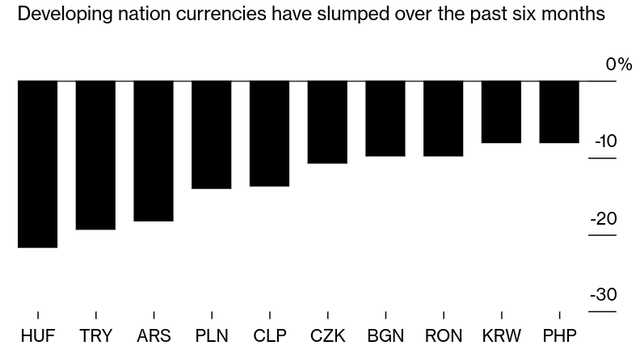

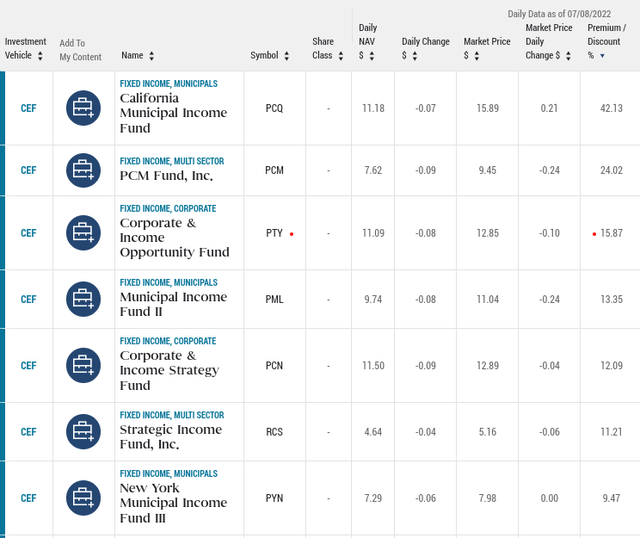

Unfortunately, that is actually not the case. Back in March, PTY was trading at a valuation that seemed much too pricey for me. Its premium was near 14%, a key reason why I advocated caution. Despite the drop in share price, this valuation story remains largely intact today. PTY remains one of the most expensive PIMCO CEFs available, and its premium has actually widened by 2%, to just under 16% at time of writing:

The natural question to ask here is how can this be happening? The reason isn’t pretty. While the share price has dropped off, the fund’s underlying value (or NAV) has fallen more aggressively. This is the opposite of what investors want to see:

| NAV as of 3/31/22 | NAV as of 7/8/22 | Change in NAV |

| $15.35/share | $12.85 | (16%) |

Source: PIMCO

There is not much positive we can take away from this. The fund’s underlying securities are losing value swiftly, and that has kept PTY’s premium from shrinking. Therefore, rather than being a value opportunity after the sell-off, PTY is even more expensive than before. That alone prevents me from upgrading my rating to “buy” at the moment.

So, Where’s The Good News?

So far, I have mentioned a few negative attributes for this fund. But as I started earlier there are some positives to consider. One of them in particular is the current yield, which comes in just over 11%. This is a very tempting income stream even when the Fed is raising interest rates. With the benchmark rate looking to settle around 3% in the near-term, an 11% distribution rate is nothing to sneeze at and will probably pique investor interest in the second half of the year.

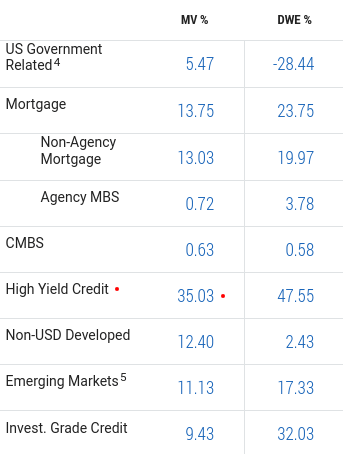

One of the reasons PTY’s yield has gotten so attractive is because the high yield corporate market has sold off. This is always an important consideration when evaluating PTY because high yield credit makes up over 1/3 of total fund assets, as shown below:

PTY’s Holdings (PIMCO)

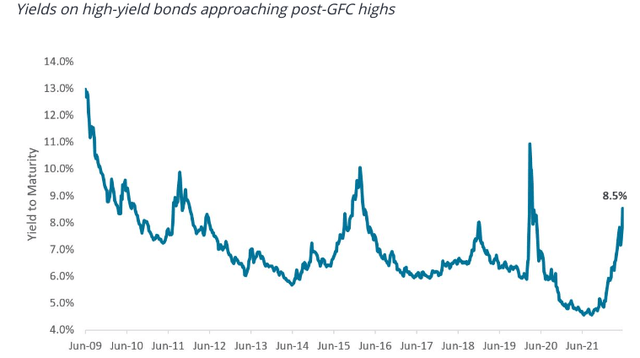

This can be good or bad, depending on one’s own risk tolerance and outlook. Given PTY’s use of leverage and overweight allocation to high yield credit, readers should approach this fund cautiously even in normal times. But for those who can tolerate more risk, there is definitely merit to giving it some consideration right now. This is because yield spreads have gotten extremely wide. In fact, the current spread is at one of the highest points it has been in the past decade:

Junk Bond Yields (On Average) (Janus Henderson)

What this tells us is that investors have fled the high yield sector. This makes some intuitive sense given all the problems facing the globe right now. With recession probability rising, investors are concerned about being paid back on their loans and debt securities. But the contrarian would see this as an opportunity. Everyone is selling – so why not buy? The yield is attractive, and delinquencies and defaults have not yet become material. While they could in the near-term, the income stream seems to suggest that taking on that risk is worth the payout. Ultimately, that is up for each individual investor to decide, but there is no denying this income level is historically quite high.

Income Metrics Are Very Solid

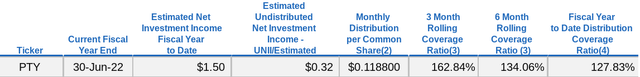

Expanding on the income discussion, followers of PTY would be put at ease somewhat when they consider the most recent income metrics published by PIMCO. PTY did disappoint not too long ago when it cut its distribution by around 8% back in September last year. But since then, it has kept its new distribution rate consistent. Further, that story is unlikely to change in the short-term because the fund’s UNII figures are very strong:

As you can see, the fund’s coverage ratios are well over 100%, suggesting the fund is comfortably earning what it needs to in order to pay its current distribution. Further, it has almost three full months of income in reserves for a rainy day. This suggests the income is safe – making the 11% yield quite compelling. There is the possibility of a year-end special distribution for this fund given the large UNII balance, so holding this CEF in a tax-deferred account would probably make sense for this reason.

Global Headwinds To Keep In Mind

My next topic is another point of concern I have for this fund in particular. As my readers know, my portfolio is namely U.S. based. However, I do branch out into foreign equities as a relative hedge, but this typically involves developed markets. I have only a small amount of exposure to emerging markets, and no “debt” funds specifically in that arena. PTY is by no means over-exposed to foreign markets, but its 11% weighting towards emerging markets is indeed something to consider before diving in.

This is attribute is similar to high yield in that it is very individually dependent. What I mean is, this risk and exposure may be right for some and not for others. There is no right or wrong here, simply risk tolerance and preference. For me, as a contrarian, there is some merit to buying into EM debt at the moment. But with the rise in the dollar, geo-political risks in Europe and brewing risks in Asia, as well as the potential for a recession, I don’t see a lot of upside for EM debt at the moment. Importantly, neither does the market as a whole, as investors have been pounding EM currencies recently:

EM Currency Performance (Bloomberg)

This certainly suggests a contrarian play to go against the market and bank on a turnaround. If that happens, PTY’s exposure to EM debt will help the underlying NAV. But I don’t see a lot of catalysts on the horizon near-term to markedly improve the prospects for EM nations. This is a corner of the market I want very little exposure, so I do not view PTY’s inclusion of it as a positive for now.

It’s Not Like Equities Are Cheap

My last point just touches on alternatives to PTY. Personally, there are a number of other PIMCO CEFs that have similar holdings, similar yields, and a cheaper valuation. For me, it makes sense to own those over PTY. But given the correlation between equities and high yield / EM debt, comparing the relative valuations of these assets also makes sense. After all, we don’t invest in a vacuum. So if one is concerned about PTY’s valuation and wants to stick that money into equities, they may actually not get quite the bargain they wanted.

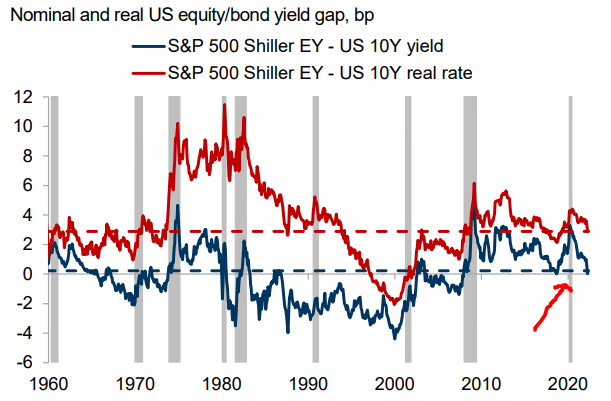

What I mean is, equities (or at least as measured by the S&P 500) are not cheap either. So when I suggest PTY is expensive, that doesn’t mean everything else is cheap. In fact, with inflation rising, recession concerns, and bond yields pushing higher, the attractiveness of equities to bonds has actually been falling over the past few quarters:

Equity valuations have re-rated vs bonds (Goldman Sachs)

What I am getting at here is that equities have risks of their own to consider. There is an argument to be made for moving into fixed-income, floating rate debt, commodities, real assets, or any number of alternatives. As such, PTY certainly could have a place in one’s portfolio, especially at the expense of equities. Holding high yield credit will almost certainly pay off if the U.S. avoids a recession, and that would give a boost to debt in foreign markets – developed and emerging – as well. But one has to decide if PTY is really the best way to play that trend. If you can get the same type of exposure without paying a 16% premium, it makes one wonder why they wouldn’t pursue an alternative option that is cheaper.

Bottom Line

PTY has had strong years in the past, so it has remained on my radar for a while. Yet, more recent memory is not kind for this one. I keep on reviewing it in the hopes that the value proposition will shift in my favor, but that has yet to occur. That’s why this is the “same old song and dance” for me at this time. PTY has some positive attributes, but the price to buy into them just seems too lofty. When I couple this with the fact this is debt with above-average risk and the U.S. is facing increasing odds of a recession, I will continue to pass. As a result, PTY remains a “hold” for me, and I suggest readers approach any new positions in the fund cautiously going forward.

Be the first to comment