24K-Production

Price Action Thesis

Given the recent tumult in United States Steel (NYSE:X) stock, we believe it’s apt to provide a timely update of a detailed price action analysis on X.

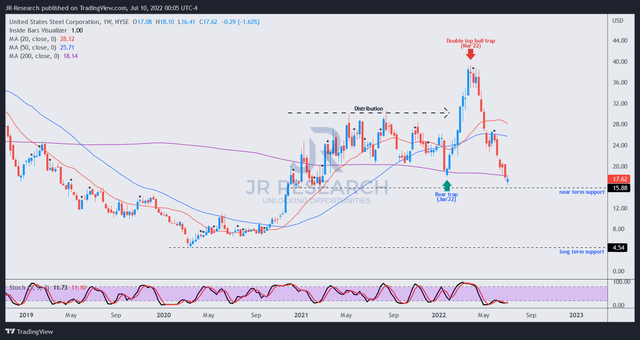

Recent reports of recessionary fears and stranded asset risks appeared to have weighed on the performance of X over the past four weeks. However, our analysis indicates that the market has already set up the decline since its double top bull trap (significant rejection of buying momentum) in March 2022. Therefore, the recent weakness was a continuation of March’s double top, which rejected an attempt to bottom in May.

However, we noted that X had fallen close to its near-term support ($15.9), which could provide some short-term respite. Notwithstanding, we don’t encourage investors to add yet, as the re-test has not occurred. Therefore, we urge investors to abstain from buying the dips at this point.

As such, we reiterate our Hold rating on X.

X – March’s Double Top Destroyed The Bulls

As seen above, the double top in March drew in dip buyers rapidly from its earlier bear trap (significant rejection of selling momentum) in January 2022. As such, it corroborated that the consolidation zone before its January bear trap was a distribution phase.

Investors are urged to pay particular attention to double tops, as they are the most potent bull traps. Moreover, our experience with double tops suggests they are usually early warning signals of a steeper fall ahead. Therefore, investors are encouraged to use double tops to cut exposure significantly and not hold the bag.

Notably, X has declined 55% from its March bull trap (as of July 8’s close). However, X appears to be forming a possible bottom close to its near-term support ($15.9). However, it’s still too early to assess whether its attempt to bottom is sustainable. Also, it has yet to re-test its near-term support, so there’s no need to rush in to buy the dips.

Furthermore, X has lost the bullish bias that sustained the advance from its March 2020 COVID-19 bottom. Therefore, we believe the price action doesn’t augur well for its upward momentum until proven otherwise.

U.S. Steel’s Revenue Growth And Profitability Are Expected To Fall Markedly

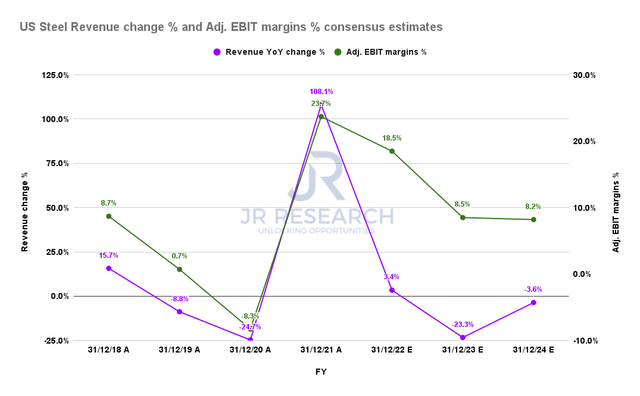

US Steel revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Furthermore, the consensus estimates (generally neutral) indicate that U.S. Steel’s revenue growth and profitability peaked in FY21. Therefore, we believe the recessionary headwinds worsened the market’s worries that the company is unlikely to sustain its growth moving forward.

As seen above, its revenue growth is projected to fall to -23.3% in FY23. However, its adjusted EBIT margins are still expected to hold above its pre-COVID metrics.

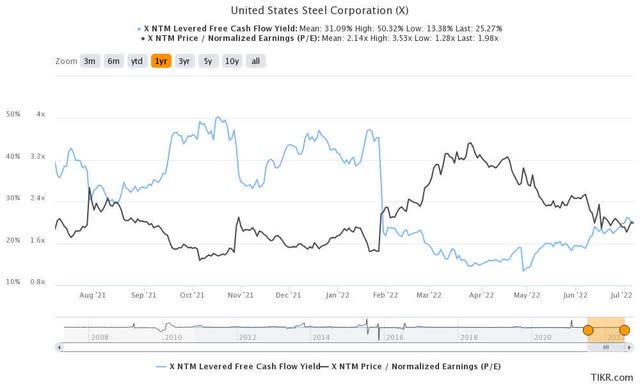

But, some investors could point to X’s NTM FCF yield of 25% and suggest that it’s too “cheap!”

We urge investors to consider why the market decided to derate X even though it traded close to 15% FCF yields in March when the market set up the double top.

We believe it demonstrated that the market considered a 15% yield too low to compensate for the risks in holding X stock. Therefore, it’s essential for investors to model the market’s valuation dynamics through significant price structures and not just look at its FCF yields per se.

Is 25% sufficient? As we mentioned, it’s still too early to assess, as the price action dynamics remain tentative.

Is X Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on X.

We continue to give higher precedence to its double top in March. However, the extent of its decline over the past three to four months could have absorbed a significant level of its potency.

Notwithstanding, the loss of its bullish bias and the lack of a bear trap price action suggests caution is still warranted.

We believe the market has justifiably derated X given possible recessionary headwinds and the normalization of its growth.

Be the first to comment