DNY59

Thesis

Investors in business development companies (BDC) are often afforded high dividend yields, as they distribute most of their net investment income (NII). Furthermore, these payouts are based mostly on senior debt securities, providing high visibility and security for investors.

We are generally optimistic about the prospects of the leading BDCs through the looming recession, even though there could be downside volatility in the near term. However, we elect to be cautious about the execution risks of Prospect Capital Corporation (NASDAQ:PSEC) through the cycle, given its less reliable track record in sustaining its net asset value (NAV) growth.

Therefore, we assess a more significant margin of safety is justified against its current valuation. However, we parse that PSEC’s valuation seems well-balanced at best. Therefore, we urge investors to be patient in considering adding more exposure to PSEC.

Accordingly, we rate PSEC as a Hold for now.

Unconvincing NAV Growth Cadence Justifies More Caution

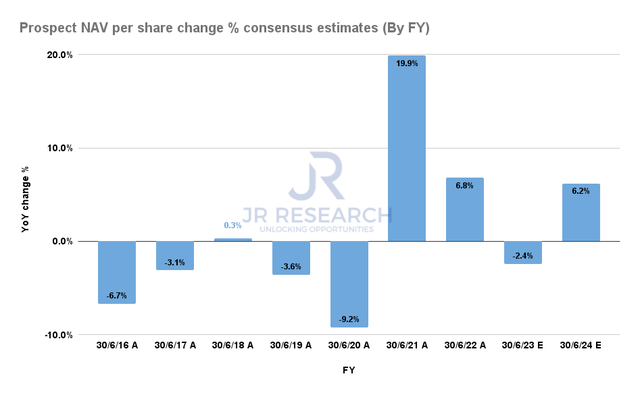

Prospect NAV per share change % (By FY) (S&P Cap IQ)

As seen above, we believe it’s essential to be more cautious with Prospect Capital through worsening macro headwinds, as management has not convinced us of its track record.

Note that Prospect delivered highly disappointing NAV per share growth from 2016 to 2020, even though the recovery from 2021 was remarkable (also lifted by easier comps).

Furthermore, the consensus estimates indicate that Prospect’s NAV per share growth could be impacted further through 2023, which could put more pressure on its valuation unless it has been battered significantly.

Accordingly, we believe there are reasons to be more cautious with Prospect at the current levels. The company highlighted that 77% of its portfolio is invested in “non-cyclical” industries.

However, it also has a sizeable real estate portfolio that accounted for 18% of its portfolio fair value as of FQ4’22 (quarter ended June 2022). Given the current upheavals in the real estate market, we believe further caution is warranted as the Fed’s aggressive rate hikes could cause more compression in its real estate portfolio.

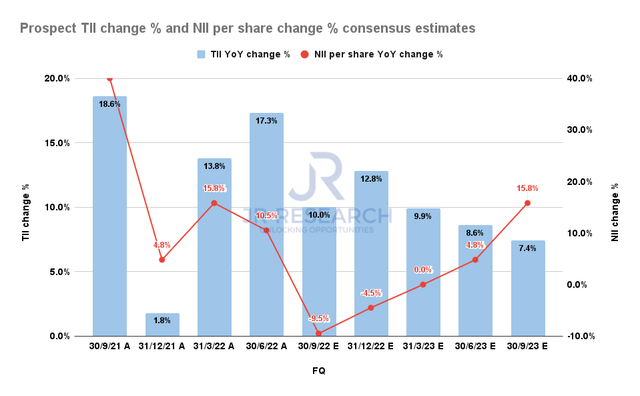

Prospect total investment income change % and net investment income per share change % consensus estimates (S&P Cap IQ)

However, Prospect Capital’s primarily floating rate debt (of which 94% has a LIBOR floor rate) should be lifted by the Fed’s more hawkish posture in combating record inflation.

As such, the company’s NII per share is projected to be bolstered by the Fed’s rate hike tailwinds through H1’23 before tapering toward H2’23. However, investors are urged to consider that the rate hike tailwinds are not expected to be structural unless the Fed revises its median terminal rate (currently at 4.6%) upward significantly for 2023/24.

As such, we believe it’s more important to focus on its execution in delivering NAV growth as its performance yardstick.

PSEC’s Valuations Are Well-Balanced, But Not Undervalued

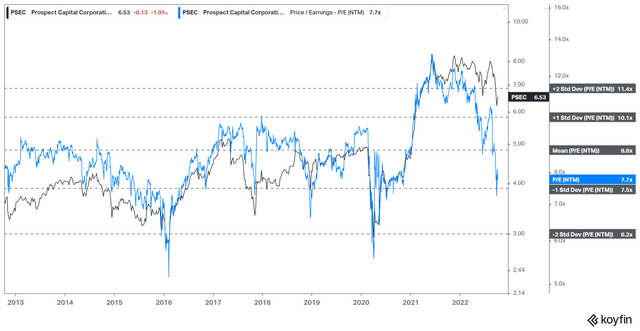

PSEC NTM NII per share multiples valuation trend (koyfin)

PSEC’s NII multiples have moderated markedly toward the one standard deviation zone under its 10Y mean. Therefore, we believe some investors may be encouraged to pull the buy trigger at the current levels.

However, we urge investors to demonstrate some patience, given the execution risks of Prospect Capital through the cycle.

We believe adding at levels closer to the two standard deviation zone (6.2x) under the 10Y mean should be more appropriate.

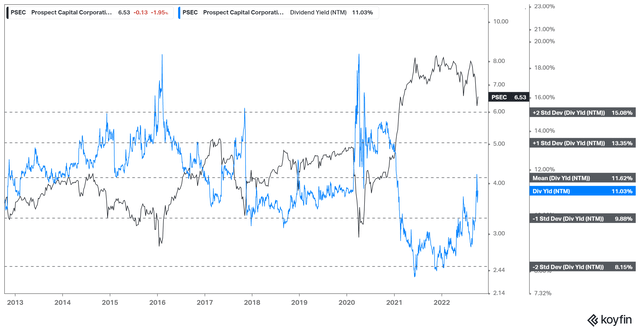

PSEC NTM Dividend yields % valuation trend (koyfin)

Our assessment of PSEC’s NTM dividend yields corroborates our observation of its more well-balanced valuation, but it’s nowhere near undervalued. As seen above, its dividend yield has surged to a 10Y mean of 11.6%, but still far from what we could consider undervaluation at 15%.

Is PSEC Stock A Buy, Sell, Or Hold?

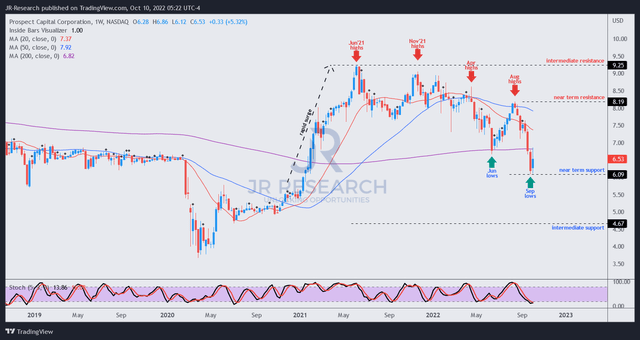

PSEC price chart (weekly) (TradingView)

We gleaned that PSEC is likely at a near-term bottom, given the steep selloff from its August highs. Hence, we postulate that it could consolidate at the current levels before attempting a recovery.

It would be critical for PSEC to recover its June lows decisively to stage a sustained recovery of its bullish bias, which has been lost since late 2021. Therefore, we would be keen to observe whether PSEC could overcome the bearish bias by also retaking its near-term resistance moving ahead.

Failing which, we deduce further downside volatility could be in store, potentially sending PSEC toward the gap between its near-term and intermediate support

We rate PSEC as a Hold for now.

Be the first to comment