Dimitrios Kambouris

This past Sunday, the U.S. Senate passed the Inflation Reduction Act, a spending bill containing a variety of climate change related measures. Among the most discussed measures in the bill is a change to the electric vehicle (“EV”) tax credit. Under previous rules, a company would lose its eligibility for EV credits after selling its 200,000th car. Tesla (NASDAQ:TSLA) crossed the 200,000 car threshold in 2018, and its tax credits were phased out over three years. By early 2022, Teslas were no longer eligible for the tax credit.

With the passage of the Inflation Reduction Act, that has changed. The current version of the act, which will be debated by the House of Representatives this week, removes the 200,000 car limit for credit eligibility. Now, buyers of some Tesla models can enjoy the full $7,500 credit toward the purchase of their vehicles. There are some limits to this – the credit applies to sedans up to $55,000 and SUVs up to $80,000 – but many Teslas will be eligible. The EV tax credit notably requires that the vehicle’s battery be 40% sourced from the U.S. or allies – Tesla’s Model S meets this standard, most competitors’ offerings don’t.

Tesla Model 3 meets the standard, most don’t (roadandtrack.com)

This is great news for a company that some say was built on government subsidies. Many of Elon Musk’s critics allege that Tesla has been taking enormous amounts of government assistance over the years. When we dig into the details, we see that Tesla did benefit from the EV tax credit in its early days. Furthermore, it benefits from similar credits in other countries today. The point about Tesla’s reliance on tax breaks can be overstated, but there’s no doubt that when a consumer gets a tax break for buying an EV, they’re more likely to buy one.

Given that Tesla has the most brand awareness of all the major EV companies, it benefits from consumers being incentivized to buy EVs. According to a 2018 Energy Policy article, every $1,000 in EV credits leads to a 2.6% increase in EV sales. With Tesla having a large share of the U.S. EV market, it’s likely to gain revenue from the revamped tax credit. This credit could therefore serve as a catalyst improving Tesla’s business performance in the second half. However, as I’ll demonstrate shortly, this catalyst alone doesn’t automatically make the stock a great value.

How the EV Tax Credit Works

To understand how the revamped EV tax credit helps Tesla, we need to know how the credit works. The EV tax credit has been around in some form since 2009, having been announced in 2008’s Energy Improvement and Extension Act. The way the credit works has changed since it was first introduced.

The way the credit originally worked was like this:

Every electric vehicle got a base credit of $2,500. A person buying any EV would get $2,500 plus an extra $417 per kilowatt-hour of battery capacity. For passenger cars, this increase in credits continued up until $7,500 worth of tax credits were earned. Any American who bought an EV would get to claim this credit on their taxes and deduct the appropriate percentage of $7,500 from their income.

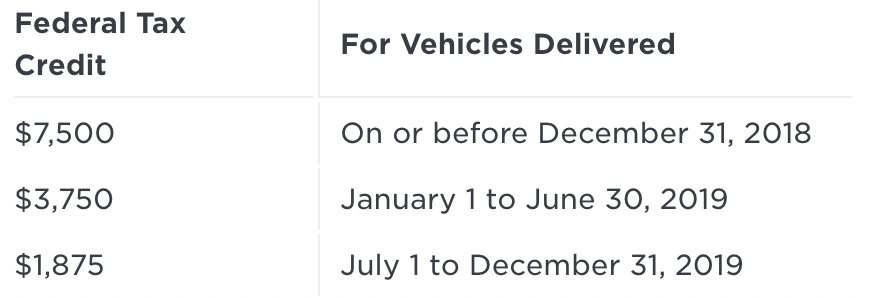

The EV tax credit also had a cap on how many cars a manufacturer could sell and still be eligible for the credit. Once a manufacturer surpassed 200,000 cars sold in the United States, their tax credits would be phased out over three years. Tesla hit the 200,000 car milestone in 2008. Its tax credits were phased out on the schedule shown below:

Tesla’s EV credit phase out (Tesla)

As the table above shows, all of the credits on Tesla models S, X and 3 were phased out by the end of 2019. This was where things stood for most of the last two years: Teslas weren’t eligible for the credit. Technically, this is still the case, but the Inflation Reduction Act looks quite likely to pass. The Act passed 51-50 in the Senate, and is heading to the House of Representatives for review this week. If it passes, then Teslas will be eligible for the EV tax credit once more. The version of the Act that passed in the Senate puts no cap on how many EVs a manufacturer can sell, so not only will Tesla buyers get the credit again, they’ll continue to get it indefinitely. To top it off: there are Tesla models that meet the act’s strict sourcing requirements, while many competitors’ offerings don’t make the grade.

Business Implications

Tesla regaining the EV tax credit has important business implications. Academic research suggests that every $1,000 worth of EV tax credits drives a 2.6% increase in EV sales. As an example, if we have a country where 100,000 EVs are being sold per year, then adding a $1,000 credit increases sales to 102,600. The higher the dollar value of the credit, the more the sales increase. The research I’m citing doesn’t say whether the effect increases linearly or compounds with the size of the credit. If the effect is linear, then a $7,500 credit would increase the number of vehicles sold by 19,500. If it compounds, then it adds 21,228 extra sales. Either way, we should see a significant boost in sales from a $7,500 tax credit.

Furthermore, we would expect Tesla to gain from this disproportionately. Many of Tesla’s competitors haven’t shipped 200,000 cars yet, but Tesla has. Lucid (LCID) is aiming for 14,000 cumulative deliveries by year’s end, Ford (F) has sold 37,000 or so, Rivian (RIVN) has only delivered a handful of cars to employees. None of these companies are anywhere near the 200,000 deliveries threshold, so they’re getting the credit already. Tesla, on the other hand, passed the threshold in 2018, so it will be eligible for the credit again. Therefore, we’d expect the Inflation Reduction Act to boost Tesla’s sales while leaving its competitors’ sales unchanged.

Tesla’s Valuation

Valuing a company like Tesla is always tough. The company has historically had high growth, which makes estimating its future cash flows difficult. Nevertheless, we can safely assume that, with its tax credits back, Tesla will grow faster than it would have without them. So, we can start by making a projection of Tesla’s revenue and build a discounted cash flow model from there.

According to Seeking Alpha Quant, Tesla’s five year CAGR revenue growth rate is 46%. The rate in the most recent quarter was 43%. We have indications that the growth rate will slow down. First, the most recent quarterly growth rate is lower than the five year rate. Second, the five year growth rate is only half the 10 year growth rate. It wouldn’t be conservative to assume that TSLA can keep up 43% growth forever. So, I’ll use Valuates Report’s 18.2% CAGR EV industry forecast as my revenue growth estimate. However, to account for the bullish impact of the EV tax credits Tesla is about to get, I’ll add an extra 19.5% on to the first year’s growth. So the first year will see 41.2% growth (1.182 times 1.195), followed by 18.2% growth thereafter. Tesla’s revenue for the trailing 12 month period is $67.1 billion, so we get:

-

Base year: $67.1B.

-

Year 1: $94.74B.

-

Year 2: $112B.

-

Year 3: $132B.

-

Year 4: $156B.

-

Year 5: $185B.

This gives us an overall CAGR growth rate of 22%. With that established, we can look at costs. Tesla had $48 billion in cost of goods sold (“COGS”) in the last 12 months. COGS scales up directly with revenue so I’ll assume that this portion of costs rises at 22%. Tesla’s operating costs have risen at 20% CAGR over the last five years, so I’ll assume they continue growing at that rate. Tesla’s tax rate in the trailing 12 month period was 10%, but I’ll up that to 15% to account for the new minimum tax included in the Inflation Reduction Act. Finally, I’ll add in non-cash costs at 6% of revenue (the percentage in the trailing 12 month period) to get a model that approximates cash from operations (“CFO”).

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

|

Revenue |

$94.74B |

$112B |

$132B |

$156B |

$185B |

|

COGS |

$69B |

$81.6B |

$96.5B |

$114B |

$135B |

|

Operating costs |

$8.76B |

$10.5B |

$12.6B |

$15B |

$18B |

|

EBIT |

$16.98 |

$19.9B |

$22.9B |

$27B |

$32B |

|

After tax |

$14.43B |

$16.9B |

$19.46B |

$22.95B |

$27.2B |

|

Non-cash costs (added back in) |

$5.7B |

$6.72B |

$7.9B |

$9.36B |

$11.1B |

|

CFO |

$20.13B |

$23.62B |

$27.36B |

$32.31B |

$38.3B |

Tesla has 1.155 billion shares outstanding, so these CFO figures on a per share basis add up to:

-

TTM: $12.18.

-

Year 1: $17.42.

-

Year 2: $20.45

-

Year 3: $23.68.

-

Year 4: $27.97.

-

Year 5: $33.16.

So, we get a 22% growth rate in cash flows per share. Using 8% as the discount rate and assuming a 5% perpetual growth rate after five years, we get a fair value of $879. This is only a 3.4% upside to the price at the time of writing ($850), so I conclude that Tesla is fully valued.

The Big Risk to Watch Out For

As I’ve shown in this article, Tesla’s EV tax credit could create a sales spike in the year ahead that gives the stock slight upside to today’s price. Without the sales spike caused by tax credits, my model would have yielded about $825, suggesting slight overvaluation. This stock is trading very close to conservative estimates of fair value, even when you account for the EV tax credit causing sales to spike. The credit is a catalyst, but not a big one, adding only a very slight amount of upside.

For this reason, Tesla investors are going to want to be on the lookout for one big risk:

Revenue deceleration.

Most industry forecasts have EVs growing at 18 to 22% for the next five years. If Tesla simply grows at that rate then its stock is not worth what it trades for today. You have to assume at least one more year of 40%+ growth to get an intrinsic value estimate for this stock that exceeds its current value. It’s so expensive already that if it grows at 18% for the next five years–a fantastic growth rate in absolute terms–it’s overvalued. The EV tax credit, or a similar catalyst, is needed for the stock to have just a little upside.

So, I rate Tesla stock a hold. It is unlikely that the stock will tumble to unheard-of lows from today’s level, but it needs a lot of things to go right in order to rise. The stock’s valuation today really assumes many more years of strong growth. The EV tax credit makes a plausible case for that happening, but it’s not a sure thing.

Be the first to comment