da-kuk

Thesis

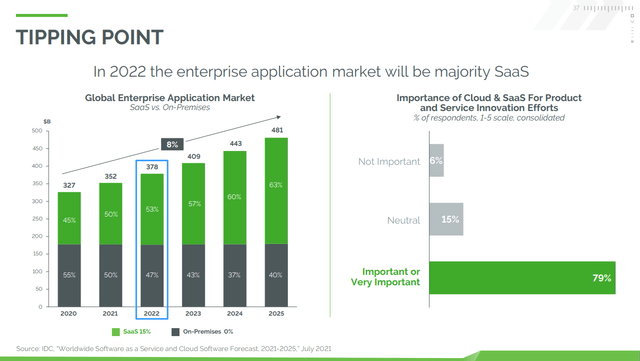

PTC Inc. (NASDAQ:PTC) is a leader in enterprise software for manufacturers and engineers. The company started early to talk about a transition from an On-Premise model to a software as a service model, just a few years after it got pioneered by Microsoft (MSFT) and Adobe (ADBE). The global enterprise application market is at a tipping point, where SaaS software is overtaking On-Premise, but can PTC capitalize on this trend? I am not convinced.

Global enterprise application market (PTC investor presentation)

The SaaS transition plan

PTC started out as a software provider for Product Lifecycle Management (PLM) in 1998 and in 2011 the company released its Computer-Aided Design (CAD) software. In 2013 the management announced that the company is going to transition to a Software as a Service (SaaS) business model. In 2014 the company launched its Internet of Things ((IoT)) software offering, and in 2016 the artificial reality (AR) product launched. The company expects SaaS to increase the value proposition of its product compared to the competition that primarily offers On-Premise solutions. On-Premise solutions require the customer to provide its own hardware and software infrastructure and just get the application software provided by PTC, while SaaS solutions deliver all of that via the cloud and the customer only needs to do the system integration.

SaaS is still a minor part of the business

What surprised me while looking into PTC is that while they constantly talk about their transition to SaaS, reality doesn’t paint the same picture. PTC takes inspiration from On-Prem to SaaS pioneers like Microsoft and Adobe. Microsoft started its transition to a SaaS business model in June 2011, when Office 365 become generally available. Since then, the company managed to turn almost its entire business into SaaS. A similar story can be observed with Adobe, which started its transition just 4 months later than Microsoft, in October 2011. In May 2013, Adobe cut updates for its legacy On-Prem solutions and now has a full SaaS business. These are textbook transitions that helped grow margins and revenues significantly.

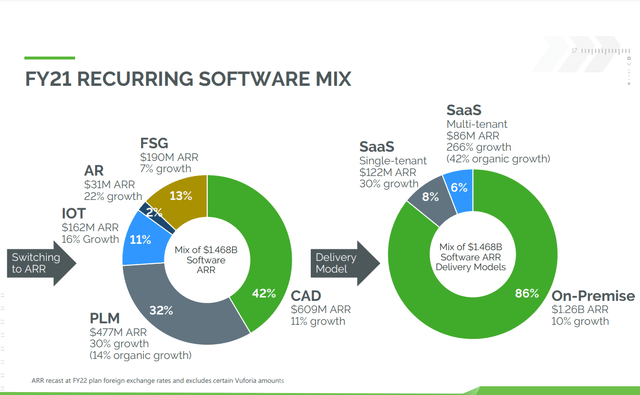

If we now take a look at PTC’s Recurring software revenue mix, we can see that just a mere 14% of revenue is SaaS, while 86% is still On-Premise. That is an awfully small contribution for SaaS, considering that they started the transition 9 years ago. Sadly, PTC doesn’t disclose its sales mix by On-Premise and SaaS outside of its investor days, so it’s not easy to track this metric, either. We can see, though, that all segments are seeing good growth rates, with the SaaS categories outgrowing the On-Prem solutions by a lot (30% and 42% versus 10%).

PTC recurring software mix (PTC investor day)

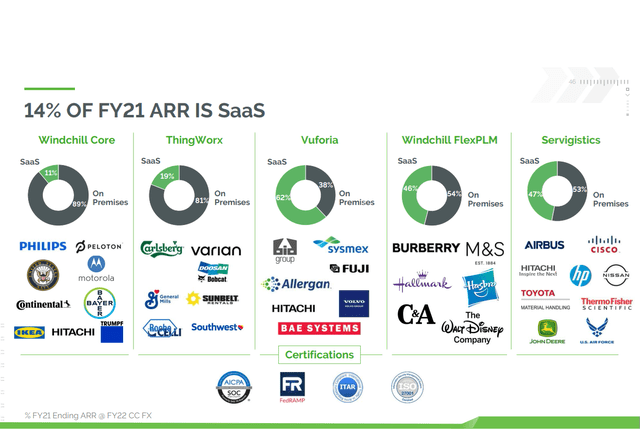

On investor day, the company disclosed its SaaS percentages per product. What really surprised me is that the IoT solution (ThingWorx) has a significant share of On-Premise revenue. I expected the legacy solutions PLM and CAD to be the businesses lacking SaaS penetration (which is the case for the core Windchill offering, but FlexPLM has a bigger 46% SaaS penetration).

PTC SaaS per segment (PTC investor day)

Growth is finally accelerating

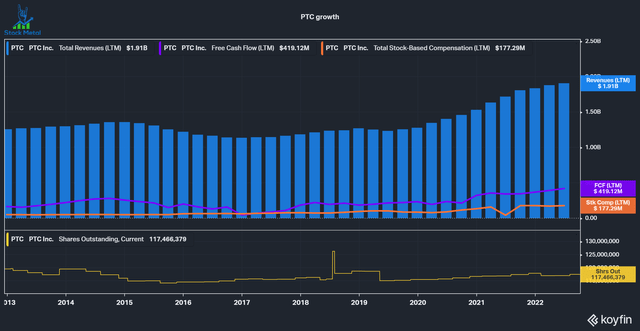

After 2013, PTC struggled to grow its revenue and even saw it decline for a few years. In 2019, the company had the same revenues as it had in 2013. With the pandemic, growth reaccelerated, though, and the company managed to grow revenues by 15% over the last 3 years. Knowing that the company announced the SaaS transition in 2013, I would have guessed that this slump in revenues resulted in a temporary shift from On-Premise revenues to SaaS revenues, but we established that SaaS still is a rather insignificant part of the business in the previous segment. It will be interesting to see if the growth is here to stay and if revenues can continue to grow at a 15% CAGR.

Capital Allocation

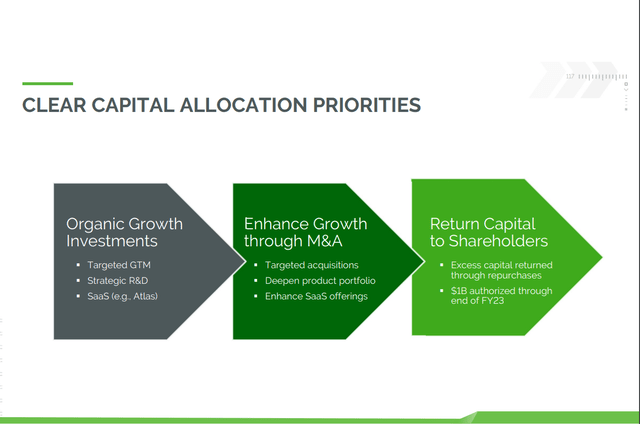

PTC shows us an easy and clear capital allocation framework. So far a very sound approach: above all else, reinvest into the business for organic growth. If there are M&A opportunities to deepen the product portfolio and enhance the SaaS offering, then reinvest into inorganic acquisitions and after that return capital to shareholders.

I have a few problems with this presentation, though:

- Nowhere are M&A criteria outlined. What kind of multiples are they looking to pay? How are deals financed? How fast should they be EPS accretive? I’d like to know more details about such an integral part of the capital allocation strategy.

- I have a problem with calling buybacks a Return of Capital to the shareholders. I think about buybacks as an investment, you decide to buy back shares if is under their intrinsic value. The company laid out the following framework for buybacks a few slides later:

On a go-forward basis, assuming our Debt/EBITDA is below 3x, we will target to return approximately 50% of our FCF to shareholders via share repurchases

This approach does not take valuation into account, it only says that if the company is not leveraged too high, then we will return money via buybacks. How this type of buyback strategy typically turns out is that companies buy back when everything is going well, the cash is flowing and the multiple is high. The cash flows usually weaken when there are problems in the market and valuations are getting crushed or the company has internal problems. Then, when buybacks actually make sense, there often isn’t money to buy back shares. I would prefer if PTC opted for a dividend instead of buybacks with this approach.

PTC Capital allocation (PTC investor day)

Valuation

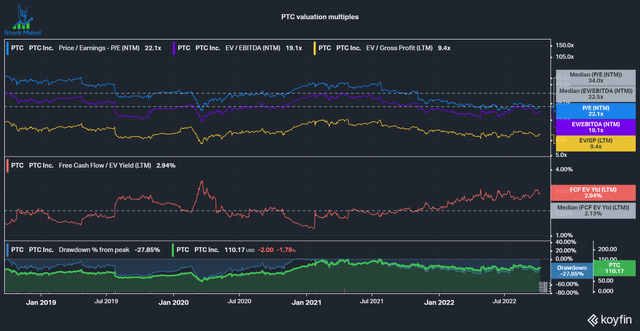

I look at valuations in two different ways: Historical multiples and an inverse discounted cash flow (“DCF”). On a historical multiples basis, we can see that PTC trades below its historical 3-year multiples. After growth reaccelerated for the company, multiples exploded up to almost 50 times forward P/E. Now, at 22, it still is elevated compared to the S&P 500, but considering that it’s a high-margin software business, that is understandable.

PTC historical multiples (Koyfin)

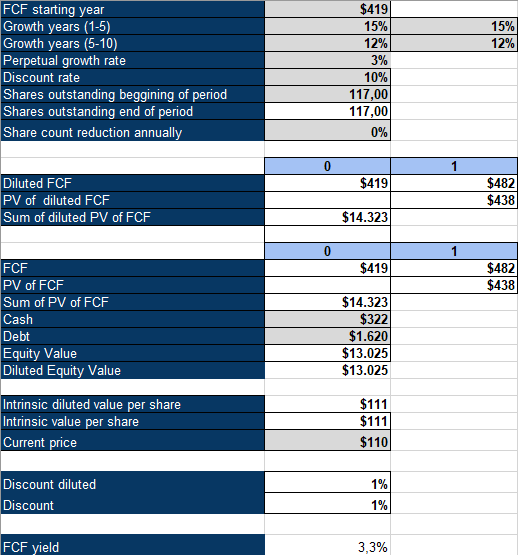

The assumptions I used in my Inverse DCF model are a discount rate of 10% (my required rate of return), a perpetual growth rate of 3% and a dilution rate of 0%. PTC is giving out a lot of stock-based compensation (“SBC”) to employees: in the last 12 months, the company generated $419 million in Free Cash Flows but spent $177 million on SBC. Intending to spend 50% of the FCF to shareholders, this basically just evens out dilution. With these assumptions, I get a 15% FCF growth rate in the first 5 years, followed by 12% in the following 5 years to justify the current price of $110 per share.

PTC inverse DCF (Authors model)

Conclusion

PTC has good products in an industry that is ripe for a transition to SaaS, but the company leaves me with a lot of question marks for the future. How long will it take the company to transition to a full SaaS business model, considering they have been at it for 9 years? Will they do reasonable M&A considering the lack of M&A criteria communicated with shareholders? The market estimates a growth rate in line with the revenue CAGR of the last 3 years, but was that just aided by Covid or is it an accelerated digital transition?

Considering all these question marks and also the high amount of dilution that is offset with half of the company’s FCF makes me put a hold on PTC. The company has potential, but at this point it’s not investable for me.

Be the first to comment