Anurak Tepkhamtai

While being short the Euro was a good macro trade earlier in 2022, I believe conditions have changed, as the monetary policy difference between the ECB and the Fed has narrowed, benefitting the Euro. Investors may wish to stand to the sidelines until we get more guidance on monetary policy into 2023.

Fund Overview

The ProShares UltraShort Euro ETF (NYSEARCA:EUO) seeks to provide investors with -2x exposure to the daily returns of the Euro relative to the U.S. dollar. The EUO ETF has $80 million in assets. The fund charges a 0.95% expense ratio and does not pay a distribution.

Strategy

The EUO ETF achieves its investment objective by holding derivative instruments on the Euro and rebalancing the exposure daily.

Portfolio Holdings

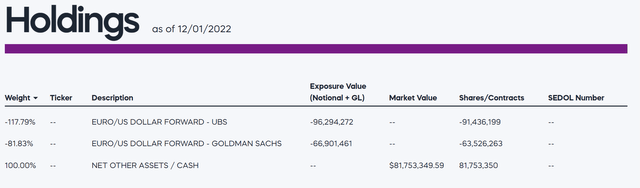

The EUO ETF holds cash and EUR/USD forward contracts with major investment banks such as UBS and Goldman Sachs (Figure 1). The forward contract amounts are adjusted every night to maintain -200% exposure.

Figure 1 – EUO holdings (proshares.com)

Returns

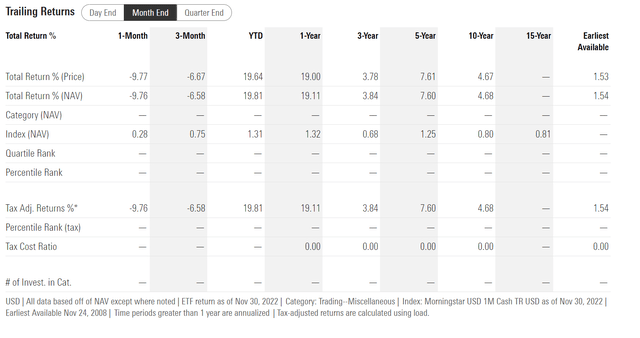

The EUO has delivered strong short-term returns, with YTD returns of 19.8% to November 30, 2022 (Figure 2).

Figure 2 – EUO returns (morningstar.com)

Weak Economy Lead To Weak Currency

So far in 2022, the European economy has suffered from an energy crisis caused by the Russia/Ukraine war. Soaring energy prices have led to reduced industrial output and weak economic growth.

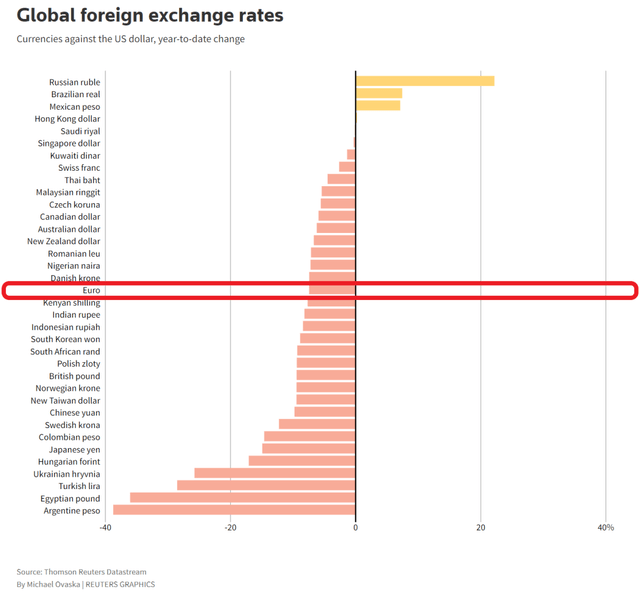

Like the US Federal Reserve, the European Central Bank (“ECB”) has tried to battle inflation with its own rate hikes. However, given the fact that the European economy was much weaker than America’s, the thinking was the ECB had less room to raise interest rates. Expectation of diverging monetary policies between the ECB and the Fed was the main cause of the Euro’s weakness vs. the USD (Figure 3).

Figure 3 – YTD performance of major currencies vs. the USD (reuters)

However, this dynamic appears to have reversed in recent weeks, leading to a sharp rebound in the Euro and a 1-month -9.8% loss for the EUO ETF. What happened and what should investors expect in the coming months?

ECB Have Actually Kept Pace With The Fed…

Although the US Federal Reserve began raising interest rates earlier (Fed began raising interest rates in March vs. July for the ECB), in recent months, the ECB have actually kept pace with the Fed. Since July, the ECB have raised interest rates by 200 bps vs. 225 bps for the Fed. The ECB’s fast pace of rate hikes caught investors off-guard, especially a surprise 75 bps hike in September.

…Leading Speculators To Flip From Short To Long

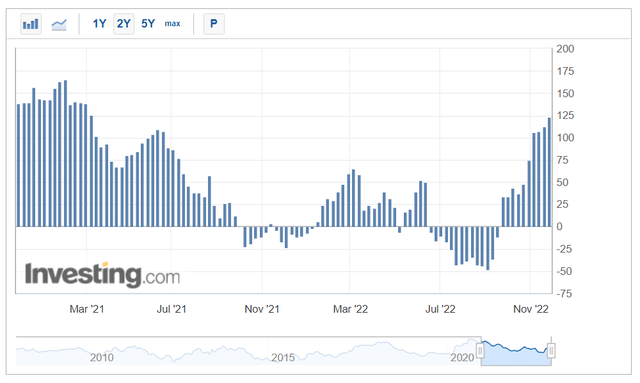

Speculators, who had been net short the Euro for most of the year, quickly flipped from a short to a long position after the September surprise. In recent weeks, speculators have pressed their longs to the highest levels since early 2021, extending the Euro’s gains vs. the USD (Figure 4).

Figure 4 – CFTC net speculative position in EUR (investing.com)

Forward Interest Rate Differentials May Narrow Further

Looking forward, we have the Federal Reserve likely slowing down the pace of its rate hikes to 50 bps in December, while the ECB may have to stay relatively more hawkish as the Eurozone inflation rate was still above 10% in November. If the ECB becomes more hawkish than the Fed, this will further narrow the interest rate differential between Europe and America, leading to appreciation of the Euro.

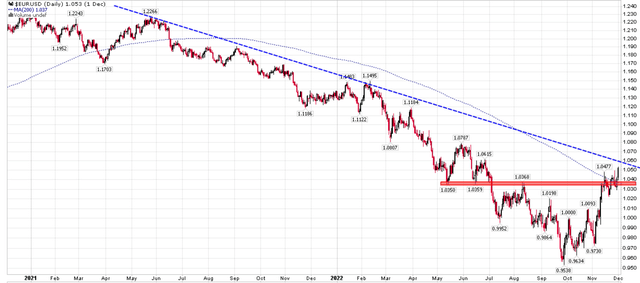

Technicals Approaching Key Downtrend

Technically, the EUR/USD FX rate is approaching an important multi-year downtrend. The Euro has already cleared resistance between 1.035/1.037, as well as the 200D moving average (Figure 5).

Figure 5 – EUR approaching key downtrend (Author created with price chart from stockcharts.com)

Risks

The key upcoming catalysts are the Fed and ECB monetary policy decisions on December 14th and December 15th respectively. Whether the Euro breaks the multi-year downtrend or reverse lower will depend on how the Fed and the ECB guide forward monetary policy expectations heading into 2023.

Conclusion

While being short the Euro was a good macro trade earlier in 2022, I believe conditions have changed, as the difference in monetary policies between the ECB and the Fed have narrowed. Investors may wish to stand to the sidelines until the dust settles on the December rate hikes.

Be the first to comment