PBFloyd/iStock via Getty Images

Investment Thesis

ProPhase Labs, Inc. (NASDAQ:PRPH) is a diagnostics and genomics company that has expanded its in-house laboratory capacity. I believe this expansion will cater to the robust demand and contribute to the company’s organic growth in the coming quarters. The company has also received the licensing rights of the portfolio of anti-cancer medicines. I think the company is in the high growth phase and assign a buy rating.

Company Overview

ProPhase Labs offers diagnostic testing, genomics testing, and contract manufacturing services. It seeks to leverage its CLIA lab services to provide whole genome sequencing and research directly to consumers and build a genomics database for further research. The business is still offering the conventional molecular laboratory services required by CLIA, such as COVID-19 testing. The focus of ProPhase Precision Medicine, Inc. is on the development of technology for genomics testing, which is an all-encompassing method for assessing entire genomes, including the genes and chromosomes found in DNA. The business is still offering the conventional molecular laboratory services required by CLIA, such as COVID-19 testing.

The information collected through genomic testing can be used to help identify hereditary illnesses and inclinations, predict disease risk, help identify expected medication responses, and help define genetic alterations, including mutations responsible for the advancement of cancer. The company operates its business through four segments: diagnostic services, contract manufacturing, retail, and genomic products & services.

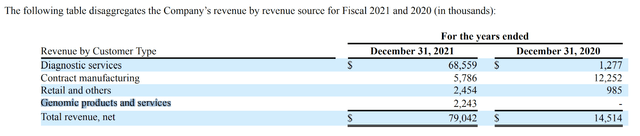

The company generates 86.7% from diagnostic services, while contract manufacturing contributes 7.3% of the total revenue. The company’s retail segment is 3.1% of the income, and genomic products & services contribute 2.9% of the revenue. As we can see, diagnostic services contribute the most significant chunk of all, and the company has expanded its in-house testing capabilities.

Laboratory Expansion

The company has expanded its in-house testing capabilities for the diagnostics of the new clinical chemistry, immunoassay, hematology, hemostasis, and urinalysis analyzers. The company has announced plans to use the additional space to expand its high-complexity molecular diagnostics laboratory services to include traditional clinical testing that spans several different specialized areas. This expansion indicates that the company is experiencing an incremental and sustainable demand that cannot be fulfilled with the current capacity.

The company generates most of the revenue from diagnostic services, and I believe this event may boost the organic growth in the coming quarters as the company is planning to offer complex diagnostic testing which is scalable and can be customized according to physicians’ requirements. The company is also planning to expand its in-house genomics testing with the new genomics laboratory at its Garden City facility, which is also going to offer customized tests as per physicians’ needs and genome sequencing for universities that conduct genetic research. As part of this expansion, the capabilities to extract DNA and RNA from various sources have been added. In the lab in Garden City, the company will determine the purity and concentration of the DNA and RNA that were acquired.

Currently, the genomic products & services segment is the least contributor among all the revenue segments. The management believes that the company will be a crucial player in the genomics industry’s expansion and growth with this expansion. I think with this new genomics laboratory, the company’s earnings will increase significantly as it can target new customers from the mostly unexplored market.

Licensing of New Investigational Cancer Compounds

Recently, the company has successfully obtained rights to commercialize the Linebacker portfolio (LB-1 and LB-2), two patented small molecule PIM kinase inhibitors in the licensing agreement with Global BioLife, Inc. LB-1 is an anti-cancer agent which potentially slows the growth of cancer and is used for co-therapy that targets PIM kinase receptors, a catalyst expressed in cancer. ProPhase BioPharma (PBIO), a subsidiary of ProPhase Labs, has received the rights to produce and commercialize the Linebacker portfolio, which it is planning to sell to treat cancer inflammatory diseases or symptoms and memory-related syndromes such as dementia and Alzheimer’s. This is the second licensing deal of the company after the formation of the PBIO last month. I believe the formation of the PBIO might turn out as the biggest growth factor as it will help the company to strengthen its presence in the international market. I also believe it is a young business currently, and its impact will be limited in FY22, but in the long term, this business can turn out as a growth factor for the company.

Quant Ratings and Valuation

Seeking Alpha

PRPH has a Quant rating of strong, which aligns with my recommendation. The company is ranked 2 out of 225 companies in the pharmaceutical industry and 4 out of 1157 in the Health Care sector as per the Quant ranking. This is an indicator of the company’s consistent performance and strong growth prospects. Wall Street also has a strong buy rating on the company, further strengthening by thesis.

Financials

PRPH has a market cap of $162 million and is trading at a share price of $8.96, a YTD increase of 31.8%. PRPH is trading at a P/E multiple of 10.3x with an EPS estimate for FY22 at $0.87. The stock price has seen a 17% correction in the last month over the speculation of performance in Q2, 2022. I believe this correction has made the stock even more attractive, and it is a good entry point for investors as the company has many growth factors driving its growth. I believe the company is on a growth track and is a great investment opportunity at the current price level with tremendous upside potential.

Conclusion

The company’s laboratory expansion and licensing of new Investigational Cancer Compounds will increase its capacity and product line. This is expected to drive significant growth in the future. The company is trading at an attractive valuation with the recent price correction. I believe the company will meet its targets for FY22, and investors should not miss this dip to take a position in the stock. I assign a buy rating for PRPH after considering all these factors.

Be the first to comment