Mongkol Onnuan

Chimera Investment Corp (NYSE:CIM) invests primarily in residential mortgages, but unlike its large cap peers, it operates in the credit space rather than agency backed. This makes the company inherently higher risk/reward as it enjoys substantially higher net interest margin (NIM) at the tradeoff of default risk.

I think the common equity is appropriately priced at 91% of book value as the rapid interest rate increases of the 2nd quarter will likely come with book value declines in the form of mark-to-market. The preferred equity, however, offers substantial mispricing which could be a good way to collect outsized yield as well as capital gains.

The Preferred Buy Thesis

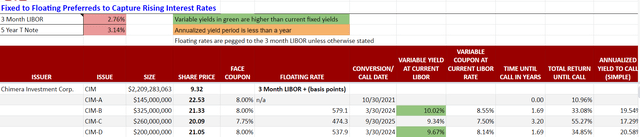

The slightly higher risk business model is reflected in higher coupons of its preferreds, which have roughly 8% coupons and floating rate conversions down the road at generous spreads over LIBOR.

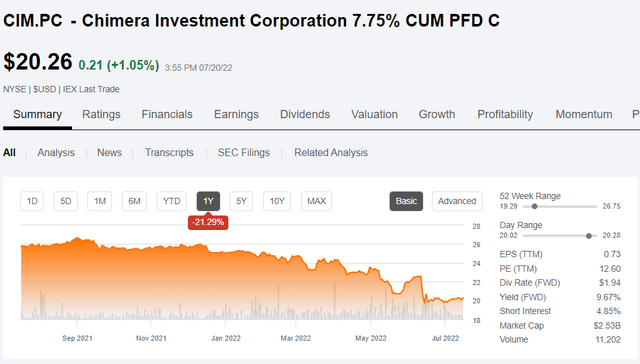

I find the coupons to correctly reflect the risk, but opportunity comes from the substantial discount to par at which these issues trade. Depending on the series, market prices of $20-$22.50 against par value of $25 provides double digit annualized yield to call and carrying yields in the 9s with the B series over 10% carrying yield.

Fear has crept into the market with a looming potential recession and a slowing housing market such that anything residential is getting heavily discounted. In analyzing Chimera’s business and capital structure I think the chance of these headwinds impacting the preferred fundamentally is quite low. Therefore, my base case is that Chimera will muddle through the difficult year or two, lose maybe 10% of its book value, and retain full ability to pay preferred dividends and fully support the liquidation preference. Coming out the other side I see no fundamental reason these preferreds will not return to approximately par value, providing an excellent return for those who get in at these discounted prices.

Let met begin with an overview of Chimera so as to get a sense for the general risk level and follow with the opportunity specific to the preferreds.

Business overview

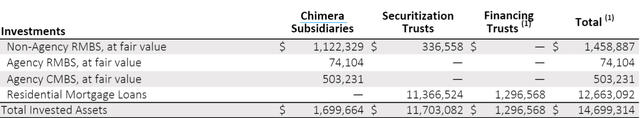

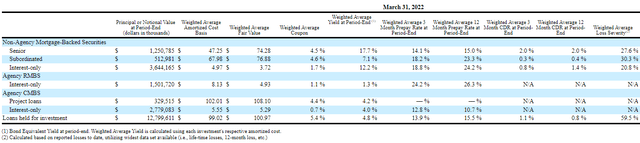

As of the most recent quarter, Chimera had $14.699 billion in total investments with $12.663B of these in residential mortgage loans.

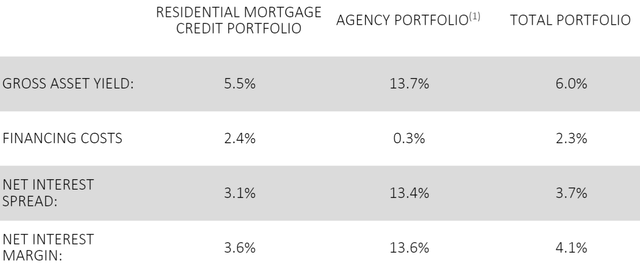

These loans have fairly high yields on them resulting in an overall asset yield of 6%.

Cheap financing results in net interest margin of 4.1% which is far higher than the purely agency mREITs.

I think the market is looking at Chimera as strictly riskier than Annaly (NLY) or AGNC Investment (AGNC), but the different business model comes with higher NIM which has 2 implications:

- The company doesn’t need to lever up as much to generate a certain ROE

- Each asset is more risky due to default risk

This makes it a bit unclear as to which is overall more risky

|

Company |

Riskiness of assets |

Debt to equity |

|

NLY |

Very low |

5.32 |

|

AGNC |

Very low |

5.02 |

|

CIM |

Low to medium |

3.45 |

My estimation is that CIM is a bit risker even with its lower leverage, but not by a whole lot.

In this particular environment, the main risks are wildly fluctuating interest rates with steepening, flattening and inverting of the yield curve which causes big swings via mark-to-market. These sorts of mark to market swings hit agency backed assets just as hard as they hit non-agency mortgages.

The main aspect that makes credit mortgages riskier is default risk and that, compared to history, is relatively muted. Consumers broadly are in good financial shape. Savings rates are high and underwriting standards on loans are substantially stronger than they used to be.

Further, the weakness that many believe is coming to the housing market is not credit related. It is just that mortgage rates rising makes it more difficult to buy a home which is hurting demand. Existing mortgages are not threatened by this and in fact benefit from lower prepayment rates as people cling to their fixed rate cheap mortgages.

I think the market is falsely attributing much higher risk to CIM based on a perceived weakness in the upcoming housing market.

That said, CIM is fishing in a fairly high-risk pool with exposure to reperforming loans and less than ideal credit.

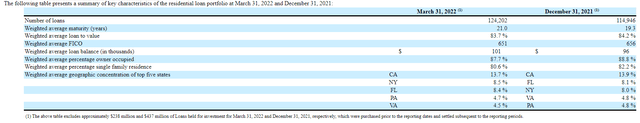

The average FICO score in CIM’s residential loan portfolio is 651 and the average loan to value is 83.7%.

Source: 10-Q

The 12 month default rate for the loans held for investment was 0.8%.

Delinquency is significantly improved from 12/31/21 and seems to be within normal range.

Typical mREIT outlook

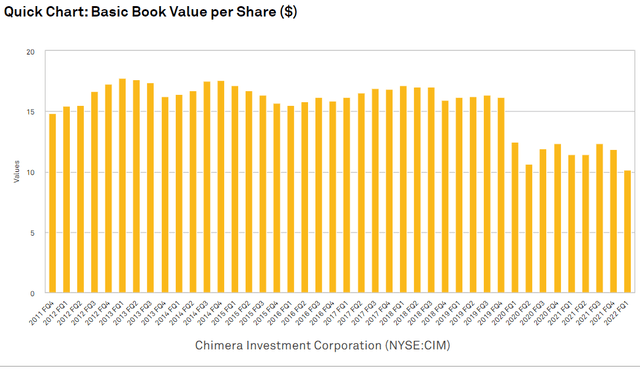

As we discussed more thoroughly in previous articles, mREITs tend to erode book value over time because they pay out virtually all of their earnings as dividends which leaves little profits to cushion when things inevitably go wrong.

Chimera has a typical pace of erosion roughly in-line with peers.

S&P Global Market Intelligence

They are generally profitable with occasional hiccups related to mark to market of securities portfolios and default events. The rapid rise in interest rates will likely take another bite out of book value and this market has priced this in. As of the 1Q earnings call, management estimated a roughly 5% hit, but the Fed has gotten more aggressive since that call so I think it will be closer to 10%.

Delinquencies and credit risk look quite normal. Inflation is hurting consumer sentiment but doesn’t really impact ability to pay mortgages. Jobs would be a better leading indicator and so far employment remains healthy.

Overall risk level

I would spot Chimera’s overall risk level as in-line with the CRE mREITs and slightly higher than that of the agency mREITs. It looks stable, but unimpressive with respect to the common. While the eye-popping 14.3% yield is tantalizing, one should factor in the book value erosion which makes the overall return to the common significantly lower.

As is a recurring theme in these preferred articles, the slow bleed to book value is not much of a risk to the preferred. Even if book value drops 20% from here which would be quite a severe bear scenario, the preferreds would still have a $25 liquidation preference and still be owed the same dividend yield.

I lean toward the preferreds with large equity bases underneath as they have bigger cushions. This is why I like NLY and AGNC preferreds, but CIM’s also are fairly well protected with its roughly $2.5B of common equity.

Mispriced preferreds provide outsized yield and capital appreciation potential

As interest rates started to rise we began to take note of how preferreds started to sell off almost universally. For many preferreds this makes sense as higher discount rates make fixed coupons relatively less desirable, but there are about $7.2B of fixed to floating preferreds that should not be falling with the rest.

The reasoning for this is simple. Since these convert to floating rate, the yield to investors will rise with the discount rate. For most, the floating yield has now surpassed the fixed yield and some of the yields are approaching 10%.

We built out a spreadsheet tracking these preferreds in real time on Portfolio Income Solutions. Quite a few now look opportunistic. There are the NLY preferreds and AGNC preferreds on which we have previously written here and here. Chimera’s preferreds have now sold off to levels that make them quite attractive as well.

Portfolio Income Solutions Fixed to Floating Preferred Tracker

If you study the table above perhaps you will notice the same obvious mispricing that I did.

CIM-A is demonstrably worse than CIM-B.

It appears to be inferior in just about every category:

- Same coupon

- Higher market price

- Smaller issue size (less liquidity)

- Earlier call date

CIM-B is very close to what an economist or game theorist would call pareto superior.

The only way this pricing would make sense is if the market is valuing the floating feature that begins on 3/30/24 as a negative. Perhaps there is some outlier scenario where LIBOR (or SOFR by the time 2024 hits) will be so low that the variable rate is smaller than the fixed rate, but this strikes me as unlikely.

Using today’s 3 month LIBOR, the variable coupon on CIM-B would be 8.55% resulting in a carrying yield of 10.02% compared to 8.9% on CIM-A. LIBOR would have to fall quite a bit to make the A better and most are projecting LIBOR to rise.

The Fed is anticipated to raise by 75 basis points in July with some fringe whispers of 100 basis points. They are further projected to continue raising after that although likely at smaller increments.

The threat of interest rates continuing to rise is a legitimate risk for fixed rate preferreds, but this floating feature present in the series B, series C, and series D makes them roughly the same discount rate adjusted yield regardless of where interest rates move.

Thus, I see the floating rate feature as a bonus that both enhances yield potential and derisks the instrument to interest rates.

The best within the stack

CIM-B and CIM C are the superior options within the Chimera preferred stack. Which one is better depends on how the future plays out.

CIM-B has the best floating conversion feature with its rate going to LIBOR plus 579.1 basis points. This is among the most generous spreads over LIBOR, not just within CIM, but across the entire fixed to floating preferred spectrum.

CIM-C trades at a huge discount to par with a market price of $20.09. It provides the investor with nearly 25% capital gains if the preferred is ever redeemed, liquidated or floats back up to par where it has historically traded.

The bottom line

The market is seriously misunderstanding fixed to floating preferreds resulting in highly opportunistic pricing. Prices are volatile resulting in frequent bouts of enhanced opportunity. To capture advantage as it appears, I am tracking price movements, risk factors, LIBOR fluctuations, yield to call, redemption prevalence/viability, and a whole host of other factors. These are shared in real time with members of Portfolio Income Solutions. AGNC, New Residential (NRZ) and NLY preferreds have been clean sources of outsized yield for a while and recent price drops in CIM-B and CIM-C have brought them into highly opportunistic territory as well.

Be the first to comment