Enes Evren/iStock via Getty Images

This article was coproduced with Nicholas Ward.

Without a doubt, Prologis, Inc. (NYSE:PLD) is one of the highest quality REITs in iREIT on Alpha’s entire coverage spectrum. Frankly, it’s one of the highest quality companies in the entire stock market. Using iREIT’s quality-metric based rating system, we see that PLD receives an iREIT IQ rating of 100/100.

It doesn’t get any better than that!

However, valuation is just one side of an investment thesis.

To receive truly great returns in the market, we believe that investors must focus on both quality metrics and valuation metrics. In other words, no matter how great a company is, if its stock does not offer an attractive margin of safety, then future return prospects are likely to be muted.

With that being said, iREIT on Alpha has had a “Sell” rating on PLD for quite some time, due to the significant premium that the market has been willing to place on shares in recent years.

However, we also understand that many of our members/readers maintain long-term positions in PLD that they are completely happy to hold, regardless of valuation, because of their low-cost basis, their high yield on cost, and an unwillingness to spark a significant taxable event (by locking in profits).

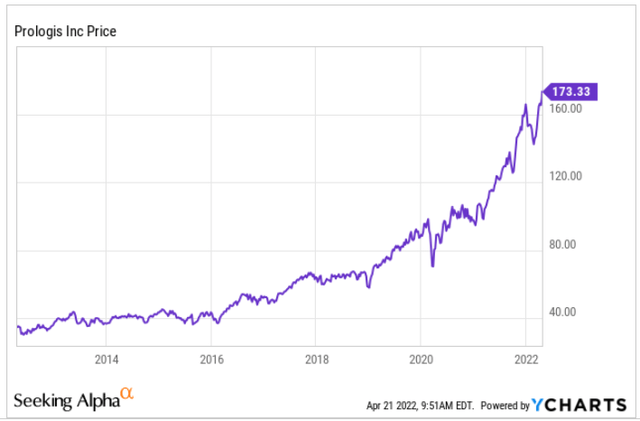

Buy and hold investing, especially when it comes to best-in-breed companies like PLD, has certainly proven to be a great way to generate wealth in the markets.

For instance, PLD shares are +218% during the last 5 years and +399% during the past decade…both of these figures beat the S&P 500 by a wide margin (the S&P 500 has posted gains of 90.85% and 224.08% during the last 5 and 10-year periods, respectively).

Therefore, we’re always happy to provide coverage of PLD’s earnings reports, even if we aren’t interested in buying shares of this blue chip in iREIT portfolios at the moment, because we understand that this is a stock that many of our readers either own – or wish to own.

In this piece, we’ll break down the stock’s recent quarterly results, provide analysis of its valuation, and highlight the area where we’d be looking to buy PLD if the stock were to experience near-term weakness.

PLD shares recently hit all-time highs on the heels of its Q1 beat.

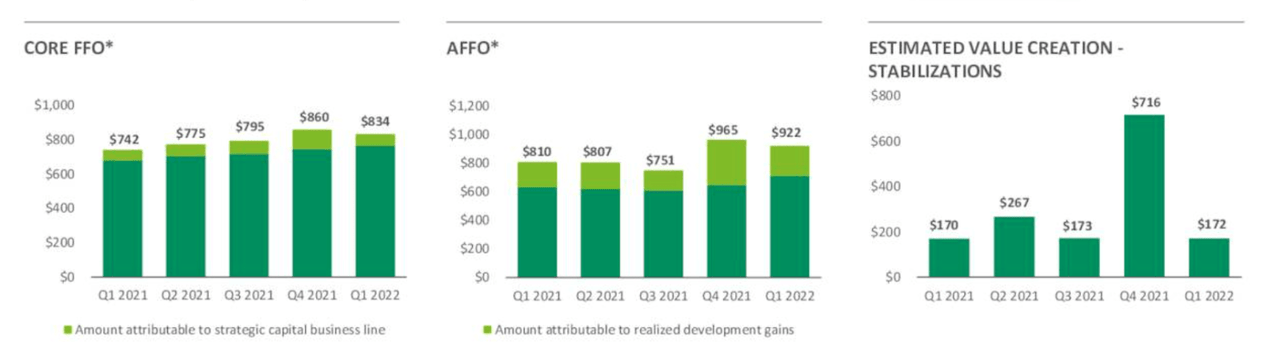

PLD Q1-22 Earnings Presentation

The company posted FFO of $1.09 during Q1, beating consensus estimates by $0.02/share.

PLD posted sales of $1.22 billion during the first quarter, beating Wall Street estimates by $130. This $1.22 billion revenue figure represented 6.1% YOY growth. The company’s core FFO came in at $1.09, up 12.4% above last year’s $0.97/share Q1 result.

In short, the company continues to grow in today’s volatile market/economic environment. The company’s CEO, Hamid R. Moghadam, touched upon this early on in the earnings report, saying:

“The need for resilience in the supply chain continues to drive record demand despite today’s economic and geopolitical risks. With our well-positioned portfolio, irreplaceable land bank, abundant investment capacity and differentiated customer solutions, we expect to continue to outperform while delivering exceptional customer service.”

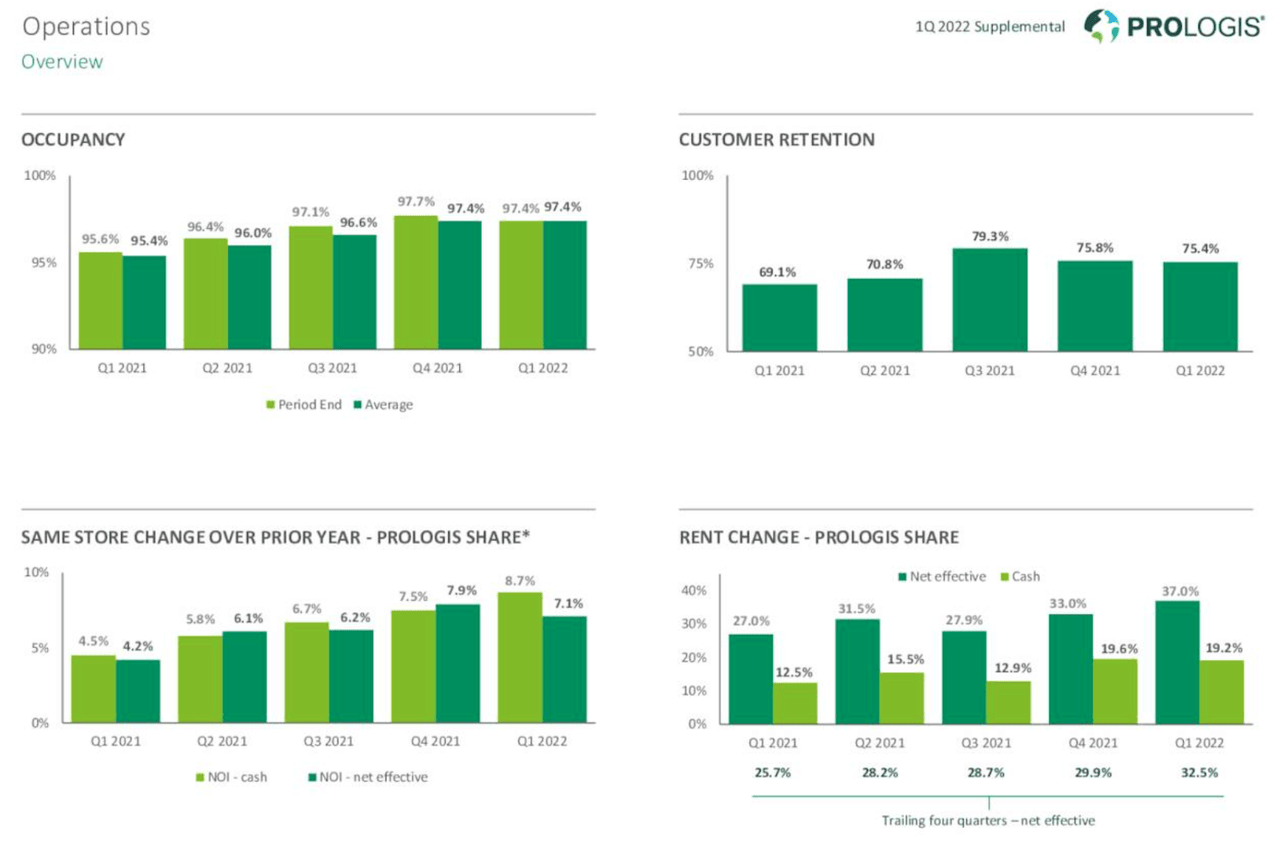

PLD: Q1 Earnings Presentation

During Q1, PLD’s average occupancy came in at 97.4%. 98.1% of the company’s portfolio was leased as of 3/31/2022.

Prologis’ same-store rent was up 8.7% on a YOY basis during Q1, highlighting the strong demand for its blue-chip retail properties. The company noted that same-store-rent in the U.S. was up 9.7% YOY during the quarter.

During Q1, PLD made $98 million worth of acquisitions, with a weighted average stabilized cap rate of 3.7%.

The company saw $212 million of development stabilizations and started on $1.02 billion worth of development projects during the quarter.

PLD flexed its financial muscle during the quarter, raising cash at an extremely low rate. The company said,

“During the first quarter, Prologis and its co-investment ventures issued $2.6 billion of debt at a weighted average interest rate of 1.5 percent. This activity includes $1.6 billion in green bond raises. The company has maintained its leading liquidity position with approximately $6.8 billion in cash and availability on its credit facilities.”

PLD is an A- rated company and its low cost of capital certainly plays a role in its consistent growth. The balance sheet remains strong with 4.7x Debt/Adj. EBITDA excluding development gains (-40bps q/q). During Q1-22, PLD and its JVs issued $2.6B of debt at a weighted average interest rate of 1.5%, including $1.6B of green bonds. PLD has $6.8B in cash and availability.

Regarding the overall debt load on its balance sheet, the company said,

“As of March 31, 2022, debt as a percentage of total market capitalization was 13.5%, and the company’s weighted average interest rate on its share of total debt was 1.7% with a weighted average term of 10.0 years.”

Because of the strong Q1 results and a positive outlook in the logistics space moving forward, PLD management increased its 2022 guidance during the Q1 report.

Previously, the company was calling for net earnings to come in a range of $4.40-$4.55 during 2022. The company’s prior core FFO guidance called for a range of $5.00-$5.10. Now, PLD is expecting to see net earnings of $4.85-$5.00 and core FFO of $5.10-$5.16.

At the mid-points of these new ranges, the new guidance for net earnings is 10.1% higher than previous guidance, and core FFO is 1.6% higher at the mid-point.

All in all, the quarter looked solid. We’ve come to expect to see beats and raises from this company. Unfortunately, so has the rest of the market, with investors flooding into PLD shares, which are largely viewed as a strong defensive investment that benefits from secular growth tailwinds (meaning reliable fundamental growth throughout a wide variety of economic circumstances).

With that said, we’ll transition into our discussion of valuation.

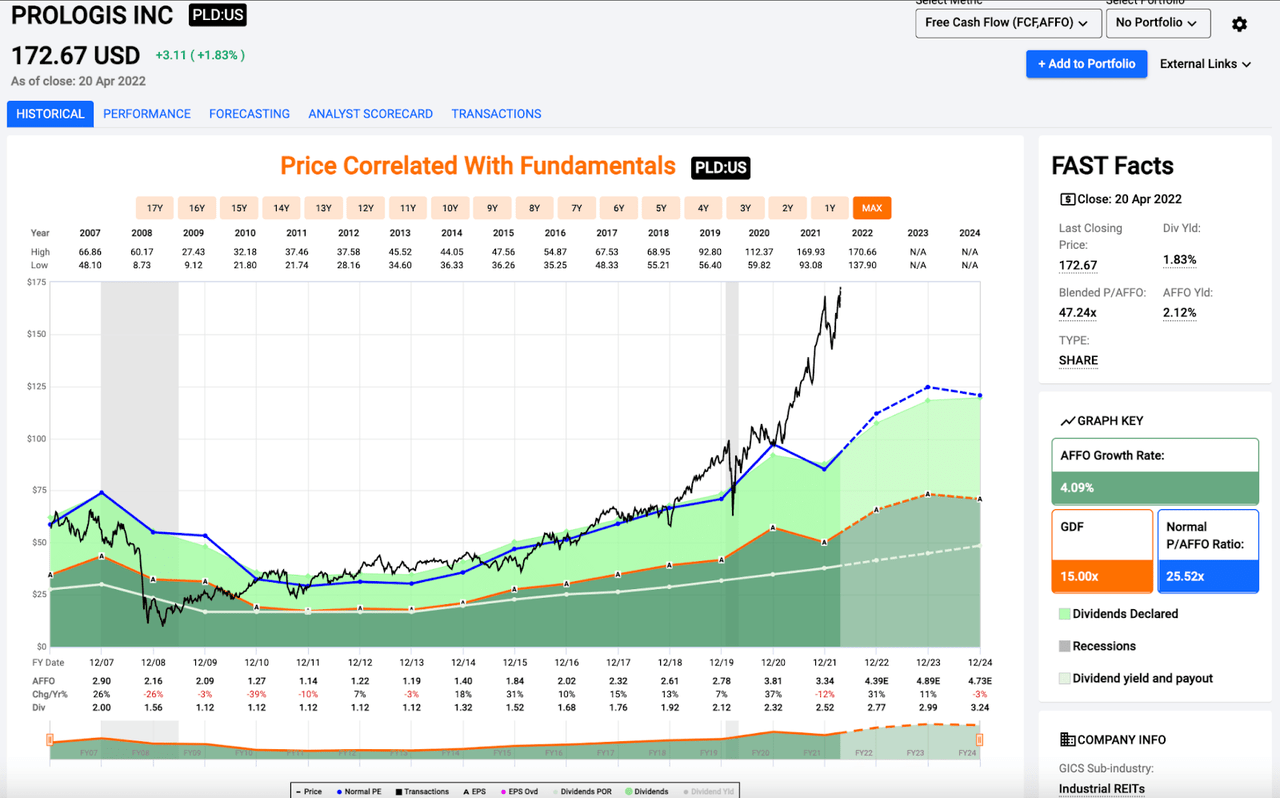

Sitting here at all-time highs, you can see the PLD’s price-to-adjusted FFO ratio is at unprecedented levels.

Fast Graphs

PLD is trading with a blended P/AFFO ratio of 47.24x, well above its long-term average of 25.5x.

Right now, analysts are expecting to see the company post 31% AFFO growth this year. Therefore, on a forward-looking basis, PLD’s P/AFFO multiple currently sits at 39.3x. That’s better than the 47x blended figure, but it still represents a massive premium to the company’s historical averages.

PLD’s average 5, 10, and 20-year P/AFFO multiples are 28x, 28x, and 25.5x, respectively.

What’s more, while the bottom-line growth that the company is expected to produce in 2022 and 2023 is great (31% and 11%, respectively), this is somewhat in-line with the performance that we’ve come to see from PLD over the last 5 years or so. Therefore, we don’t believe that the historically high premium is justified by the fundamental growth outlook.

As you can see on the chart below, even if PLD manages to hit the strong double digit growth estimates that Wall Street has during 2022 and 2023, investors buying shares today are setting themselves up to generate -10% annualized returns, assuming that we see mean reversion and multiple contraction back to that 5 and 10-year average of 28x AFFO.

Yes, this company quality is off the charts. And yes, the stock’s dividend yield is incredibly safe (PLD yields 1.83% and recently increased its dividend by 25.4%). However, even with strong forward looking dividend growth prospects in mind, the total return outlook here has been muted by the strong bullish sentiment that surrounds shares and the sky-high premium that it has resulted in.

Because of the beat/raise, we’re raising our fair value estimate of PLD to $120.00. However, even with that in mind, the margin of safety here with the shares trading for $172.67 is not attractive.

Prologis is a stock that we’ll always be looking to buy when shares trade at or below fair value. However, we’d need to see an extreme sell-off for that to occur and therefore, right now, we’re looking to allocate capital elsewhere throughout REIT-dom when making moves in the various iREIT portfolios.

Be the first to comment