Brandon Bell/Getty Images News

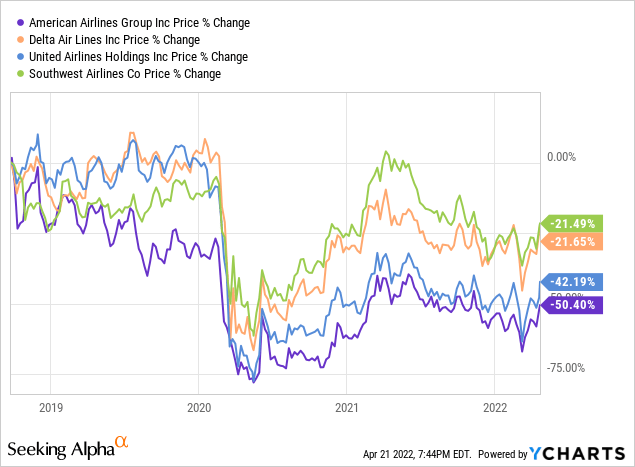

I have not been appreciated much by American Airlines (NASDAQ:AAL) bulls, at least since publishing my airline sector study in late 2018. Before the pandemic, the company stood out to me as the most leveraged, least profitable and arguably worst managed player among the top US carriers. Therefore, it was not a surprise to see AAL underperform the Big 4 airline stocks since that 2018 article, while my top pick has led the pack (see graph below).

Make no mistake: things did not get any better for American Airlines during the COVID-19 crisis. However, I think that the Fort Worth, Texas-based airline has done a good job navigating the downcycle and coming out of it in decent footing. Now, despite substantially higher oil prices and labor challenges, shares of the travel company seem to have their best chance in a while at climbing to early 2020 prices — which are still 40% above current levels.

American Airlines Earnings recap

American reported Q1 earnings on April 21, ahead of the opening bell. The headline numbers topped expectations, with revenues of $8.9 billion edging consensus by $80 million and steep adjusted net loss of $2.32 per share also coming in better than anticipated.

On operating performance, the good news included the sharp increase of almost 15 percentage points in load factor (a measure of occupancy) on the heels of nearly double the passenger revenue miles YOY. Both load factor and RPM are still quite a bit lower than the comparable quarter in 2019 (74.4% vs. 82.2% and 44.2 billion vs. 54.8 billion, respectively), but the trend is encouraging. Passenger revenue per available seat mile shot through the roof in the YOY comparison and is now barely a dollar below pre-pandemic levels.

To be fair, I don’t think that the financial performance in the most recent quarter is what should please investors most. Clearly, air travel did not return to normal in the first period of 2022 — although American reported record sales in March. But a path to full recovery between now and the summer months seems as clear as it has been in the past two years. This, in my view, is what could send airline stocks higher in the next few months.

There is a consensus among US-based airlines that the spring and summer season will be white-hot for the sector — whether you ask the executives at Delta (DAL), United (UAL) (“the strongest demand environment in three decades”) or others. The recent end of the mask mandate is just the icing on the cake. More importantly, and even as broad consumer spending has hiccupped recently due to a decline in product demand, the wallet share captured by service providers in the travel and leisure space continues to increase in this post-pandemic environment.

Why no longer an AAL bear

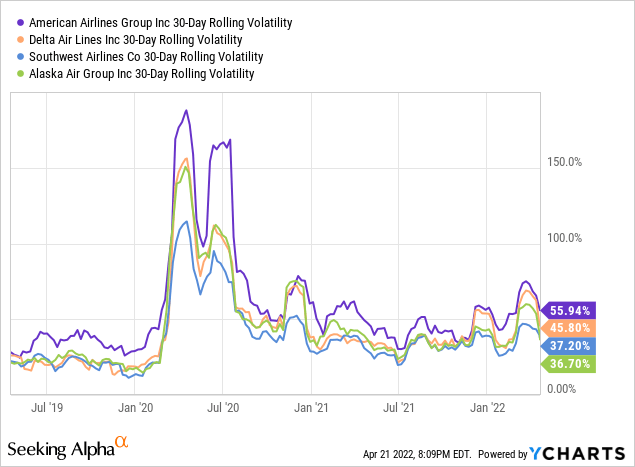

Notice that I still have some reservations about American Airlines, in part because of a bloated balance sheet that makes this stock particularly risky within an already risky sector. For this reason, AAL’s volatility has been justifiably higher (see graph below) compared to airline stocks that I consider to be of higher quality, including DAL, Southwest (LUV) and Alaska (ALK). High volatility bodes ill for risk-adjusted returns, which is why I choose to be neutral AAL and not bullish.

But at the same time, I see two counterpoints to my own skepticism. First, accepting more risk and leverage (both financial and operational) makes most sense when the industry landscape is favorable. It has not been for a while, but the tables seem to be finally turning now.

Second, American has arguably done a better job than its peers at protecting itself against the effects of the pandemic. For instance, American was nearly three times as leveraged as Delta and United at the end of 2019, as measured by net debt relative to total assets: 34% vs. an average of 14% for the two key competitors. As of the end of 2021, American was less than twice as leveraged: 39% vs. 21% average.

Given the above, I drop my bearish stance towards AAL. Investors with more of a risk appetite and understandably strong convictions about the airline space could benefit from going long this stock at current levels, which are still depressed relative to recent history.

Be the first to comment