Martina Birnbaum

APA Corporation (NASDAQ:APA) is a fairly large independent exploration and production company that operates in both the United States and abroad. This makes the company one of the unique independents as most of them only have domestic operations. The fact that the company is considerably larger and more diversified than many of its peers does not mean that it represents a poor opportunity, though. In fact, APA Corporation appears to be considerably undervalued at the current price despite the fact that investors have been more interested than usual in traditional energy names. There is a good reason for this as the traditional fossil fuels sector has been one of the few highlights in the market so far this year. APA Corporation is no exception to this as the stock price is up 44.87% over the past year, considerably beating the S&P 500 index (SPY). There are some very real signs that the stock still has room to appreciate further though, so it may still be deserving of a position in anyone’s portfolio.

About APA Corporation

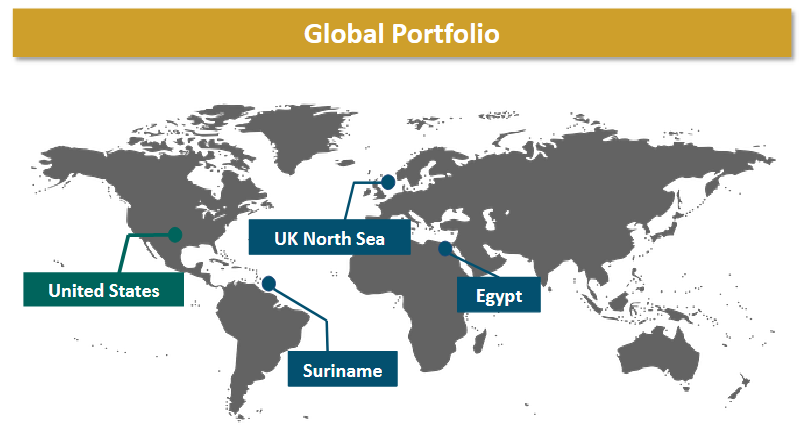

As stated in the introduction, APA Corporation is an independent exploration and production company that operates in multiple markets around the world. Currently, the company has operations in the United States, Suriname, the UK North Sea, and Egypt:

APA Corporation

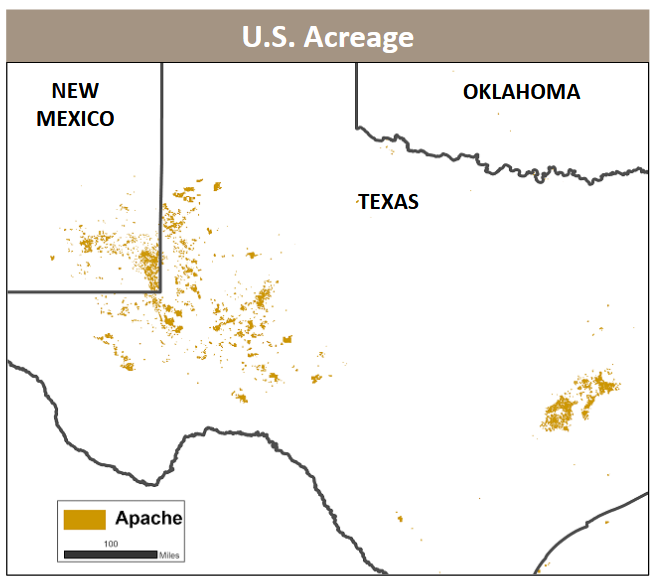

This makes the company one of the few independent producers that have operations in multiple markets around the world. However, the overwhelming majority of its production is in the United States. In fact, currently, 52% of the company’s production takes place in the United States, which accounted for 53% of the company’s second-quarter 2022 operating cash flow. As is the case with many other American exploration and production companies, APA’s production in the country takes place in the Permian Basin:

APA Corporation

The Permian Basin is a name that will undoubtedly be familiar to anyone that has followed the energy industry over the past several years. This is because this region has been at the center of the American energy boom for much of the past decade due largely to its resource wealth. According to the Energy Information Administration, the Permian Basin currently contains approximately five billion barrels of recoverable crude oil and nineteen trillion cubic feet of recoverable natural gas despite having been exploited since the 1920s. The basin is by far the richest in the United States and is generally considered to be one of the wealthiest in the world. This has served APA Corporation quite well as it positions the company for production growth. The company drilled sixteen wells on its acreage in the first half of the year but it expects to drill approximately thirty wells during the second half of the year. Although the company has not released any actual production estimates, we can assume that this will significantly increase the company’s production as we enter 2023.

This is nice because increasing production is one of only two ways that an energy company can generate earnings growth. After all, the more product that the company pulls out of the ground, the more that it has to sell and generate revenue off of so all else being equal, revenue and cash flow should increase. The other method through which a company like APA Corporation can generate earnings growth is by having the price of crude oil or natural gas go up, which is of course completely out of control. Thus, increasing production is the only generally reliable way to generate earnings growth. It is therefore rather nice to see that APA Corporation is currently focusing some of its efforts on accomplishing this.

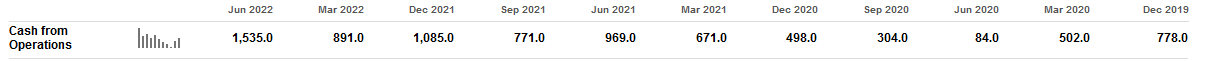

This would represent a continuation of the company’s growth over the past several quarters. As we can see here, APA Corporation’s operating cash flow has generally been increasing over the past eleven quarters, although it has been somewhat choppy over time:

Seeking Alpha

This is at least partially due to energy prices. We especially notice this in the second quarter of 2020 when the COVID-19 lockdowns sharply reduced the demand for crude oil and subsequently the price. In fact, West Texas Intermediate crude oil prices briefly went negative in April of that year. The price of the substance rebounded sharply after the presidential election and has generally been rising since. APA Corporation has clearly been benefiting from the higher prices and its planned production growth is the company’s effort to essentially double down on that benefit by giving it more products to sell at today’s high prices.

As we will see later in this article, the long-term fundamentals for fossil fuels point toward high prices for both crude oil and natural gas. However, we might see a decline in the short term. Yesterday, Bloomberg stated that the Biden Administration is planning to release another ten to fifteen million barrels from the Strategic Petroleum Reserve prior to the midterm elections in a few weeks. In my opinion, this is obviously a political move meant to shore up his party’s lagging approval among likely voters but its effects on crude oil prices is very real. It is likely that this will only have a very temporary effect on energy prices, however. The United States consumes just over eighteen million barrels of crude oil per day so the White House’s planned release represents less than a single day’s consumption. It actually represents about one day’s imports so the actual effect will not likely be much but the market has a tendency to exaggerate the actual impact of events such as this. While this sort of action would probably have no impact on APA Corporation’s current production plans, it may cause a decline in the stock price that would provide us with a better opportunity to purchase shares in the firm.

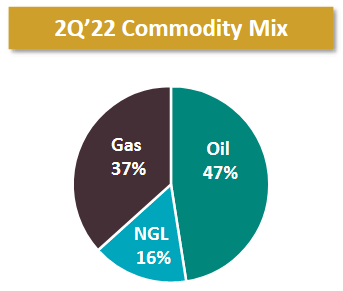

Another very nice thing about APA Corporation is that the company’s production is reasonably well-balanced between crude oil, natural gas, and natural gas liquids.

APA Corporation

As we can see, fully 37% of the company’s production in the second quarter was natural gas. This is quite nice to see because of the strong fundamentals for natural gas relative to crude oil. As long-time energy investors may recall, about a decade ago it was desirable for a company to have as high an allocation to crude oil as natural gas was so cheap that it was essentially worthless. That is not the case anymore. In fact, over the past year West Texas Intermediate crude oil is up only 3.86% but natural gas at Henry Hub is up 10.91%. The fact that APA’s production is reasonably well balanced between the two is therefore nice to see because it allows the company to experience the best of both worlds, so to speak.

So far, this article has focused mostly on operating cash flow. However, free cash flow is more important for most investment purposes. This is because free cash flow is the money that is generated by a company’s ordinary operations that is left over after a company makes all necessary capital investments and pays all its bills. This is ultimately the money that is available to reward the shareholders. Fortunately, APA Corporation has been quite successful at generating a growing free cash flow over the past several quarters:

|

Q2 2022 |

Q1 2022 |

Q4 2021 |

Q3 2021 |

Q2 2021 |

Q1 2021 |

|

|

Unlevered Free Cash Flow |

1,135.1 |

1,300.6 |

784.6 |

589.8 |

773.4 |

415.9 |

|

Levered Free Cash Flow |

1,085.8 |

1,245.0 |

725.9 |

526.6 |

704.0 |

345.9 |

(all figures in millions of U.S. dollars)

While one reason for the company’s strong free cash flow is crude oil prices, we can see that it managed to generate positive free cash flow even back in the first quarter of 2021 when prices were much lower than today. This is because the company has fairly low production costs, which results in APA Corporation having remarkably strong margins. It only costs APA $15 per barrel to produce crude oil in the Permian Basin, $10 per barrel to produce in Egypt, and $37 per barrel to produce in the UK North Sea. Obviously, all of these prices are substantially below today’s oil prices so the company is making a considerable profit on each barrel of crude oil that it produces. This could give it some advantages should a recession cause crude oil prices to decline, which could be a risk in the near future. The classic definition of a recession is two consecutive quarters of negative gross domestic product growth, which we have now seen in the United States. As I pointed out in a recent article, it is quite likely that the country will see negative gross domestic product growth in the third quarter of 2022 as well, which would deepen the economic turmoil facing the nation. A decline in crude oil prices usually accompanies a recession so this could be an issue near-term. However, as we just saw, APA Corporation should be able to remain profitable even if oil prices do fall fairly considerably.

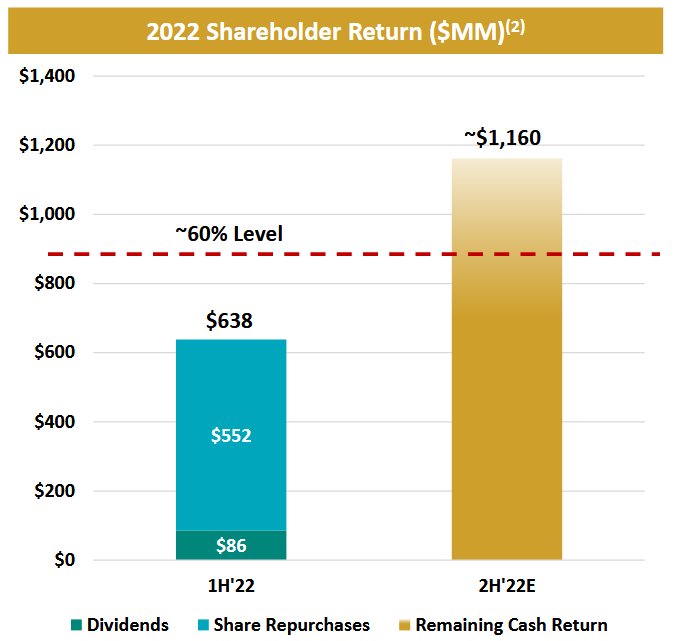

In the meantime, however, investors can benefit from APA Corporation’s remarkably high margins. As we have seen, the company has been able to translate its large margins into considerable amounts of free cash flow. APA Corporation has committed to using this free cash flow to reward its shareholders. The company intends to return 60% of its free cash flow to its shareholders but it is currently well below this level. Indeed, during the first half of 2022, APA Corporation only returned 43% of its free cash flow to the investors:

APA Corporation

Unlike many of its peers, the company is not opting to do a variable dividend program. It is instead maintaining a flat dividend, although it did double its dividend recently. The company has opted to use share buybacks to reward its shareholders. This has resulted in the company having an annualized yield of 2.49% at the current stock price, which is substantially below many of its peers. I will confess that I am not a particularly big fan of share buybacks since they only put cash in the shareholder’s pocket if the shareholder opts to sell the stock. As a buy-and-hold investor, I generally do not sell stocks unless the fundamentals of the company change so stock buybacks have little positive impact. I would much rather see the company pay out a special dividend for this reason. Obviously, the company’s policy somewhat lessens its appeal compared to many peers, but there are still reasons to buy it, such as the company’s forward growth.

Fundamentals Of Crude Oil And Natural Gas

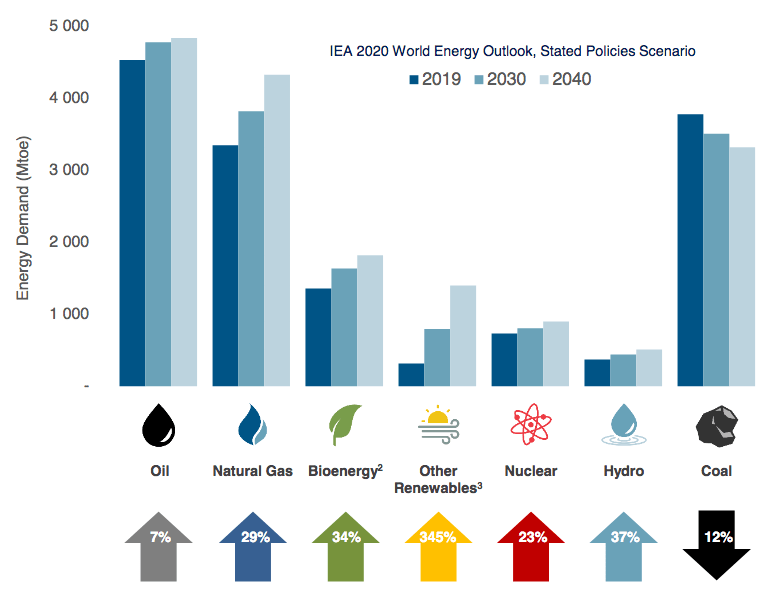

As we have already seen, APA Corporation’s production is relatively balanced between crude oil and natural gas. Thus, it may be a good idea to take a look at the fundamentals of these two products, particularly as politicians, the media, and others have been very loudly discussing the obsolescence of these products. Despite the cries of the industry’s critics though, the fundamentals for both crude oil and natural gas are quite strong with both products likely to see growing demand over the coming years. According to the International Energy Agency, the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2022 World Energy Outlook

Perhaps surprisingly, the projected growth in natural gas demand is being driven by global concerns about climate change. As most people reading this likely know, these concerns have induced governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. One of the most common strategies that are being employed is to encourage utilities to retire old coal-fired power plants and replace them with renewable energy sources. This is because coal is far more polluting than any other fuel in common use today. However, renewables lack the reliability needed to ensure the stability that we expect from a modern electrical grid. After all, solar power does not generate energy when the sun is not shining and wind power does not work when the air is still. The common solution to this problem is to supplement renewables with natural gas turbines as natural gas burns much cleaner than other fossil fuels and is capable of providing energy reliably. This is why natural gas is sometimes called a “transition fuel,” as it provides a method by which carbon emissions can be reduced and modern society maintained until renewable technologies advance enough to be able to perform this task on their own.

The demand growth for crude oil may be somewhat more difficult to understand. After all, many Western politicians are actively attempting to reduce the consumption of crude oil within their borders. However, it is a very different story within emerging markets around the world. These nations are expected to see tremendous economic growth over the projection period. This economic growth will have the effect of lifting the citizens of these nations out of poverty and putting them securely into the middle class. These newly middle-class people will naturally begin to desire a lifestyle that is much closer to that of their developed nation counterparts than they have now. This will result in a growing consumption of energy, including energy derived from crude oil. As the populations of these nations are substantially larger than those of the developed nations, the growing demand for crude oil from emerging nations will more than offset the stagnant-to-declining demand for crude oil in the world’s developed markets.

It is unlikely that the energy industry will increase production sufficiently to satisfy this demand growth, which is why the fundamentals point to higher energy prices over longer periods of time. One reason for this is that the energy industry has been substantially underinvesting in upstream and midstream capacity since the 2015 crude oil bear market. This is one reason why the offshore drilling industry never recovered from the events of that year. According to Moody’s, the energy industry must immediately increase upstream spending by $542 billion annually in order to avoid a supply shock because of this situation. It is highly unlikely that energy companies in aggregate will increase their spending to that degree. After all, the industry is currently under tremendous pressure from both politicians and environmental activists to improve the sustainability of its operations. It is also under pressure from investors that are demanding higher returns than the industry has delivered over the past decade. Thus, the most logical solution for most companies is to hold production flat or slowly increase it in order to maximize free cash flow for their investors. Overall, this situation results in demand growth exceeding supply growth going forward, which the laws of economics tell us should result in higher prices. We have already seen how APA Corporation benefits from higher energy prices so investors in the company will likely enjoy the extra money even though they will likely be paying more than usual in their role as energy consumers.

Financial Considerations

It is always critical that we examine the way that a company is financing itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. As this is typically accomplished by issuing new debt to repay the maturing debt, a company may see its interest costs increase following a rollover depending on market conditions. In addition, a company must make regular payments on its debts if it wishes to remain solvent. Thus, a decline in cash flow could push a company into financial distress if it has too much debt. When we consider the overall volatility of commodity prices, this is a risk that we should never ignore with energy companies.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity can cover its debt obligations in the event of a liquidation or bankruptcy, which is arguably more important.

As of June 30, 2022, APA Corporation had $5.124 billion of net debt compared to $1.505 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 3.40. Here is how that compares to some of the company’s peers:

|

Company |

Net Debt-to-Equity |

|

APA Corporation |

3.40 |

|

Continental Resources (CLR) |

0.61 |

|

Diamondback Energy (FANG) |

0.39 |

|

Pioneer Natural Resources (PXD) |

0.12 |

|

Range Resources (RRC) |

1.21 |

As we can clearly see, APA Corporation is far more levered than its peers. This is in spite of the fact that the company paid down $1.6 billion worth of debt during the first half of the year. The fact that the firm’s ratio is so much higher than its peers could be a sign that it is relying too heavily on debt to finance itself, which obviously presents a risk to investors. It may be advisable to exercise some caution here as a result.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of an independent exploration and production company like APA Corporation, one method that we can use to value it is by looking at the price-to-earnings growth ratio. This is a modified form of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued based on its forward earnings per share growth and vice versa. However, pretty much everything in the traditional energy space is significantly undervalued right now so the best way to analyze APA’s price is to compare it to some of its peers in order to determine which company offers the most attractive relative valuation.

According to Zacks Investment Research, APA Corporation will grow its earnings per share at a 29.34% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 0.15 at the current price. Here is how that compares to the company’s peers:

|

Company |

PEG Ratio |

|

APA Corporation |

0.15 |

|

Continental Resources |

0.18 |

|

Diamondback Energy |

0.25 |

|

Pioneer Natural Resources |

0.87 |

|

Range Resources |

0.18 |

Here, we do get confirmation that most companies in the traditional energy space are undervalued relative to their forward earnings per share growth. However, APA Corporation offers the most attractive valuation of any of these firms right now. This may be due to the aforementioned risks associated with the company’s relatively high leverage. An investor with a sufficiently high risk tolerance might still find APA Corporation to be the most attractive opportunity here, though.

Conclusion

In conclusion, there are a few things to like about APA Corporation right now. The company’s incredibly high margins afford it a considerable amount of free cash flow that it can use to provide generous a share buyback program to its shareholders. The company is also positioning itself for production growth as we enter into 2023, which should result in cash flow growth as long as energy prices remain around their current level. Unfortunately, though, the company’s dividend yield leaves quite a bit to be desired relative to peers that have implemented a variable dividend program. The company also appears to be incredibly highly levered relative to its peers. However, the valuation is attractive enough that some people might be willing to overlook these flaws. It may be a buying opportunity if you are willing to do so.

Be the first to comment