marchmeena29

On Monday, July 18, I posted an article discussing why productivity growth had disappeared in the United States economy.

I concluded that productivity growth had disappeared because corporations had diverted their “investment” decisions away from productive capital investment programs and, instead, placed “investment” monies into the purchase of assets.

Money was made on rising asset prices and not on the increase in the real output of goods and services.

And, money was made more constantly without the riskiness of waiting for the investment in real capital assets to provide a more variable, more uncertain return.

Today, in the Financial Times, Martin Sandbu writes a supporting article titled, “The Investment Drought Of The Past Two Decades Is Catching Up With Us.”

Mr. Sandbu writes that:

“For decades, most advanced economies did not build their future but languished in an investment drought, the scandal of which is greater for being unacknowledged.”

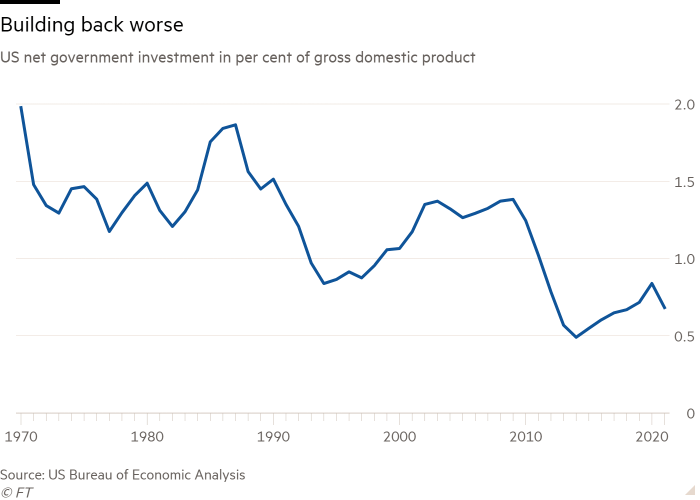

In the 1970 through 1989 period, the United States devoted 22.6 percent of Gross Domestic Product to investment expenditures.

Since that time, the United States has matched this level of investment only twice…in the boom years of 2000 and 2005-2006.

Even with an aggressive Federal Reserve during this period of time and an era of “lower-than-ever financing costs,” investment expenditures stayed low.

Net Investment as a percentage of GDP (Financial Times)

Bernanke Period

The Federal Reserve can be held accountable for some of this shortfall.

Federal Reserve Chairman Ben Bernanke, in order to combat the Great Recession, set out the Federal Reserve to generate a wealth effect through rising stock prices. The rising consumer wealth caused by the rising stock prices would result in greater consumer spending, and this would generate and sustain the economic recovery.

And, Mr. Bernanke and the Federal Reserve were very successful.

But, this policy program created rising asset prices, which resulted in a changing strategy for corporations.

Corporations could set aside monies and buy back their stocks or could pay larger dividends.

This would sustain rising stock prices and make stockholders wealthier.

But, the program would lessen the funds going into real capital expenditures that would raise productivity growth.

This government effort was consistent with the overall government policy of “credit inflation” to support higher levels of employment in the economy.

Mr. Bernanke and his successors and the Federal Reserve were very successful in pulling off this policy victory.

Government Direction

The Bernanke thrust was just perfect for the times.

Mr. Sandbu apparently thinks so as well.

“I think our failure to invest is profoundly political.”

“Raising the investment-to-GDP ratio, whether through boosts to private of public investment, or both, means that a smaller ratio of GDP is left over for consumption.”

“Even if this prepares a better future, it can feel like a measlier existence today.”

“And that is something a generation of politicians across the rich world have been afraid to inflict on their voters.”

So, to match the business community and its stock buybacks and higher dividends, the government engages “in transfer payments, tax cuts, and immediate public goods.”

And, this is the whole basis of “credit inflation.”

Credit Inflation

As regular readers of my posts recognize, I take the beginning of the government’s credit inflation program back into the 1960s.

The Kennedy-Johnson presidential administrations generated the program to stimulate the economy and keep the economy growing.

Adding to this effort were the statistical results of the “Phillips Curve,” which showed a negative relationship between inflation and the rate of unemployment. That is, the Phillips Curve showed that adding a little bit more inflation to an economy could generate a little lower level of unemployment.

This seemed like a very good tradeoff for politicians.

President Richard Nixon brought this approach to the Republican Party, and so the policy of credit inflation became a bi-partisan program.

And, since the program required the government to keep its foot on the gas pedal, the stimulus of the program became almost a constant factor in the economy.

Hence, with the government supporting a 2 percent rate of inflation or so to keep unemployment as low as possible, price inflation became predictable and steady.

This was the factor that gave corporations the confidence to “bet” on rising asset prices and forego investing in real capital investment.

And, so we got stock buybacks, etc.

Added Government Efforts

Mr. Sandbu adds one more factor to the picture.

Mr. Sandbu emphasizes the role the Federal Reserve played in the credit inflation stimulus of the past sixty years or so, but he also brings into the picture the “central banks’ ultra-lax monetary policy” of the previous three years went the Fed was fighting the effects of the spread of the Covid-19 pandemic and subsequent recession.

This latter influx of money ended up going more into financial enterprises (see “Fallout Continues From The Fed’s Largess“) than into productive investments.

And, this final addition to the credit inflation is causing major problems for the Federal Reserve as it now tries to cool-off inflationary pressures.

The Point

The fiscal and monetary policies of the U.S. government over the past sixty years or so have created an environment that encourages investors and corporations to direct their money into assets, like stocks and commodities, that will produce faster, surer returns than innovative real capital investment.

The result has been an OK economy, with relatively high levels of employment, but with only modest amounts of economic growth.

Asset prices have generated relatively steady, massive rewards for those concentrating on these asset markets.

The income/wealth distribution has also skewed toward the wealthier during this same time period.

The point that Mr. Sandbu, myself, and others are trying to make is that government policies need to be aimed at generating real capital investment in the economy, investments that will raise labor productivity.

These policies are primarily supply-side programs and not demand-side programs. Demand-side programs produce results that politicians can show off to voters faster than do supply-side programs.

Mr. Sandbu closes with the following:

“Western voters and governments have both unlearned the virtue of delayed gratification.”

“They have to relearn it, and fast.”

Be the first to comment