David Tran

After the market closes on September 15th, the management team at Adobe (NASDAQ:NASDAQ:ADBE) will be reporting financial results covering the third quarter of the company’s 2022 fiscal year. Heading into that release, investors should be aware of what to look out for. Although Adobe is a rapidly growing enterprise that generates significant cash flow, it’s also a rather pricey business that could see pain if everything doesn’t go well enough to make investors content. In particular, analysts seem to be especially hopeful for this quarter, with their own estimates even topping what management previously forecasted. So long as the company falls within the fairly narrow range between what it has guided toward and what analysts are anticipating, it’s likely that the enterprise will be considered to be in great health and a valid investment opportunity for many of its fans and current shareholders. Although I still maintain that upside, for now, is likely limited until we see faster growth or shares decline in price.

Adobe – A great company that’s expected to deliver

Back in early May of this year, I wrote my first detailed analysis of Adobe, a software enterprise that has a variety of offerings dedicated largely toward a large swath of digitally oriented consumers spread between the creative, managerial, and publishing/advertising markets. In that article, I said that management had demonstrated the enterprise, over the prior several years, to be a best-of-breed software firm with attractive revenue and cash flows. I believed that, long term, the future for the company would be bright. Even so, shares of the enterprise looked to be a bit pricey, leading me to rate it a ‘hold’ instead of a ‘buy’. When I rate a company a ‘hold’, I anticipate that it will generate returns that more or less match the broader market as defined by the S&P 500. So far, the company has delivered along those lines. While the S&P 500 is down by 2.3%, investors who would have bought into Adobe would be down by roughly 4%.

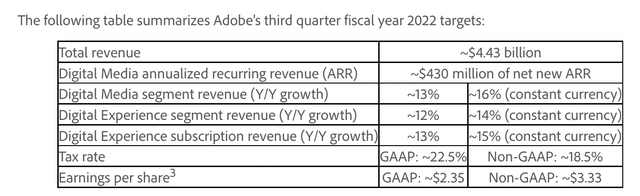

Whether or not this slight underperformance will continue, intensify, or reverse, could very well be determined in the coming days. Earnings are important for every business. But for a company that’s trading at lofty multiples like Adobe, earnings releases can be a source of extreme volatility. Even if the business grows at a rate that would make many investors happy, falling short of what investors hope for can result in significant downside for shares. The first thing that investors should be aware of is where analysts stand when it comes to revenue. For the third quarter of the year, the current expectation is for the company to generate sales of $4.44 billion. If this comes to fruition, it would translate to a roughly 12.8% increase over the $3.94 billion generated just one year earlier.

To some, this anticipated improvement may seem unrealistic because of current economic issues. However, management has forecasted similar growth for the third quarter. For the Digital Media segment, which is the largest portion of the enterprise, management forecasted revenue growth year over year of 13%. For the Digital Experience segment, sales growth is forecasted to come in at roughly 12%. Unfortunately, management has not provided any guidance when it comes to the much smaller Publishing and Advertising segment. But if that matches the $85 million generated in the third quarter of 2021, then the business would generate sales of roughly $4.43 billion. It’s also not unthinkable that management might perform better than anticipated on this front. After all, in the second quarter of the year, sales came in at $4.39 billion. That translated to a year-over-year growth rate of 14.4%, allowing the company to generate revenue that was $39.2 million higher than analysts thought it would.

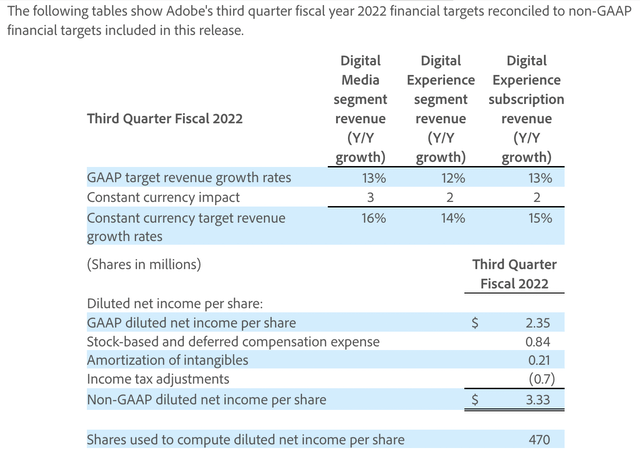

When it comes to profitability, the current expectation is for earnings per share of $2.40 and adjusted earnings per share of $3.35. On this front, management has been far more transparent. Their current forecast for the third quarter which for earnings per share of $2.35 and for adjusted earnings per share of $3.33. Once again, analysts are more aggressive. But it’s worth noting that while in the second quarter of this year the company’s $2.49 in reported earnings per share matched expectations, adjusted earnings per share of $3.35 topped expectations by $0.04 per share. Of course, there is more than just the profitability picture to factor in on this front. The number of shares outstanding will also be important, and that can change significantly based on management’s share buybacks. At the end of the latest quarter, the company had 473 million shares outstanding. That’s down from the 481 million the business had at the same time last year. The current forecast provided by management calls for roughly 470 million shares of stock outstanding for the quarter.

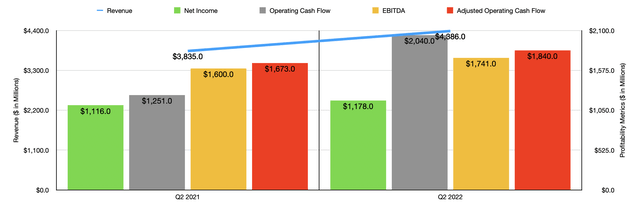

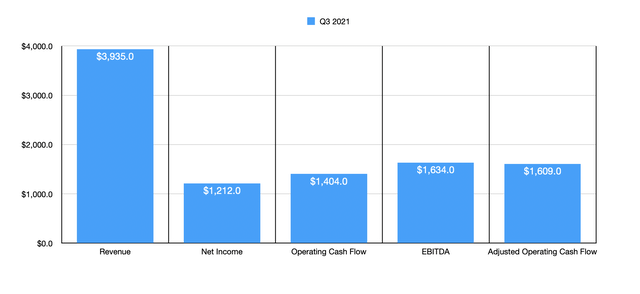

Based on management’s projected share count, meeting the expectations that the company set for itself would translate to net income of $1.10 billion and adjusted net income of $1.57 billion. Sticking with just the official earnings per share, that number in the third quarter of last year translated to net profits of $1.10 billion. So while the company is forecasted to grow its revenue, overall net profits are expected to remain more or less flat. Whether or not this will come to pass is anybody’s guess. But if we look at data from the second quarter of this year compared to the same quarter last year, that seems improbable. Net income in the second quarter was $1.18 billion. That compares to the $1.12 billion reported the same time of the company’s 2021 fiscal year.

We should also be paying attention to other profitability metrics. Operating cash flow in the third quarter of last year was $1.40 billion. From the second quarter of last year to the second quarter of this year, that metric rose from $1.25 billion to $2.04 billion. If we adjust for changes in working capital, it would have risen from $1.67 billion to $1.84 billion. On the other hand, operating cash flow in the third quarter of last year was $1.40 billion, while the adjusted figure for this would be $1.61 billion. And finally, we also have EBITDA to consider. In the second quarter of last year, this metric hit $1.60 billion. This ended up rising to $1.74 billion this year. In last year’s third quarter, the metric came in at $1.63 billion, so a reading in excess of $1.74 billion would not be unrealistic.

All of this, naturally, seems to be focused on the short term. It’s important, then, to make sure that we continue to focus on the long haul as well. As a large and innovative technology-oriented business, Adobe continues to make interesting moves and the data provided by management looks bullish for the industry for the foreseeable future. As an example, on August 25th, the management team at Adobe revealed that more than 165 million creators joined the global creator economy over the prior two-year window. That included 34 million new creators from the U.S. market alone. This kind of trend is incredibly important to a company like Adobe since that is the kind of customer base it generates at least a sizable portion of its revenue from. To see strong growth on that front is a good sign of health in the market and could bode well for both the near-term and long-term growth of the business.

Takeaway

Normally, when I write an article about a company, I like to value it each time. But given how little the fundamental picture for the company has changed and since its share price has not changed all that much either, such an exercise would be redundant. I still do maintain, however, that shares of the firm are rather pricey. At the same time, there’s the expectation that it will continue to fare well and, as a result, potentially reward shareholders handsomely. It will be interesting to see if this comes to pass. I, for one, am not planning to buy into Adobe at this time because I believe there’s limited upside for the foreseeable future. But for investors who are bullish about the upcoming earnings release and bullish about the firm in general, now might be as good a time as ever to pull the trigger.

Be the first to comment