dbvirago

Investment Thesis

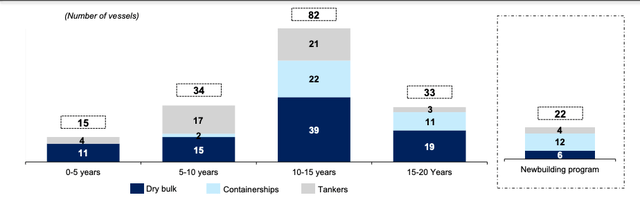

Navios Maritime Partners ((NYSE:NYSE:NMM), from here on out we will simply refer to it as “Navios”) is a multinational shipping and logistics company specializing in dry bulk shipping such as iron ore, coal, and grain. Navios operates 188 vessels with a carrying capacity of 251,822 Twenty-foot Equivalent Units (TEU, 1 TEU is a single 20-foot cargo container) for cargo ships, 10.6 million tons of Dry Weight Tonnage (DWT) in bulk cargo (DWT includes non-cargo weight), 5.9 million DWT for tankers, and an average fleet age of only 9.5 years

NMM has a 33.8% reported Loan to Value (LTV) ratio, including ships recently acquired, but also a very low to a 2.6x debt-to-EBITDA, both of which are average for the sector. Navios’ valuation is compelling with its book-value-per-share of $63.94 and a rock-bottom price-to-earnings multiple of 1.7, indicating that even with the significant price increase in the last 2 years, Navios is still undervalued from a fundamental perspective.

Navios is aiming to be one of the first fleets to be net-zero admissions being two years ahead of its peers for meeting environmental targets. Pricing has been strong since COVID for transportation. There is a shortage of shipyards to meet the demand for new ships ensuring the market stays tight and pricing favorable.

We believe that Navios with its low valuation and growth plans is an excellent choice to take advantage of strong pricing in the maritime shipping sector.

|

Navios Maritime Partners |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

0.6 |

0.6 |

0.5 |

|

Price-to-Earnings |

1.5 |

1.3 |

1.3 |

|

EV/EBITDA |

3.3 |

3.0 |

2.9 |

Operations

|

Ship Type |

Total Fleet Tonnage |

Number of Vessels |

|

Dry Bulk Goods Carrier |

6.6 million DWT |

90 |

|

Container Ship |

236,422 TEU |

49 |

|

Tanker |

5.9 million DWT |

49 |

DWT is Dry Weight Tonnage and includes fuel. For dry bulk ships, DWT is used as it is a unit of mass, and TEU is a unit of area.

Navios targets pre-reserved term shipping time by leasing out their ships to other maritime carrying companies such as MSC or Maersk and transporting cargo for individual firms like Saudi Aramco or Costco Wholesale. Charters are issued on a basis from a single trip (spot), up to multi-year long contracts. Maintaining a mix between the two is important since when demand is low ship availability may exceed demand leading to low charter rates. However, too many long-term contracts mean missing out on taking advantage of high-demand, tight markets when pricing is high.

While average prices for spot rates have significantly fallen since this time last year, they are still more than sustainable for Navios who has a breakeven cost of $14,219 per available day (and $28,966 in contracted revenue). Navios calculates breakeven and daily revenue by dividing total cash expense by available days (either for spot contracts or contracted trips) across the fleet.

90% of international trade goes through maritime shipping companies like Navios with the tonnage growing steadily year over year. The bulk cargo market is tight and Navios is expanding its fleet to take advantage of this market with new fuel-efficient ships.

Currently Navios’ container ships are at an all time high demand price, with 99% of available shipping days already filled for the remainder of the year- and charter rates are at an all-time high. Drybulk carriers only have 22.4% available days used, which is slightly below the 20-year average. Tankers are sitting at 61.9% — 20% above the 20-year average.

For the remainder of the year, Navios has 51.3% days reserved, exceeding operating expenses by $18.7 million with the remaining fleet being available for spot contracts.

Expansion

Since end of FY2020, Navios increased the number of vessels in its fleet by 121%. With increase to demand for shipping and the addition of new ships to the fleet, Navios has increased its contracted revenue by 173.8% year over year.

Navios is acquiring 4 in-progress oil tankers, totaling 115,000 extra DWT. These investments are expected to yield 10% per year, with a 20 year useful life. Additionally, Navios will charter 2 new 7,700 TEU cargo ships being completed in 2025. Navios has already contracted these ships out for 12 years, at an average of $42,288 per day. This is already on top of the 22 (17.2% of fleet) new ships Navios is expected to have delivered by 1Q25, and the 119 vessels acquired since FY2020.

Navios is made up of several companies with various roles, however, most of them (most recently Navios Maritime Acquisition) have been absorbed into NMM per an initiative to simplify the structure of NMM. The final contract expiration of the parent company Navios Maritime Holdings’ own charters occurs in 2024. It is possible that then NMM may absorb the parent company to become a single-ticker-traded entity encompassing the entire Navios Group – the impacts of this would be minimal on operation but may have additional value-added implications for investors.

In 2Q22, Navios acquired 36 dry bulk ships from Navios Maritime Holdings (NM), adding a massive 3.9 million dry weight tons. These vessels are expected to generate yearly EBITDA of $164 million with $81.5 million being added to free cash, starting in 2023.

Risks

Navios was adversely affected by demand shocks that happened during COVID-19, where supply was high but demand was low. Navios depends on continued demand growth for international goods and should demand fall it could adversely affect the bottom line. COVID-19, related supply chain chokes, and inflation have all resulted in volatility in charter markets. While international shipping is semi-seasonal, a decrease in the targeted long-term contracts may mean Navios has to compete in the spot market where pricing may be adverse.

Should a Navios vessel run aground, sink, be damaged, or another unforeseen event it could be disastrous legally, financially, and environmentally. As more carriers target net-zero or decreased emissions Navios may see a drop in demand for its older fleet of ships that use a much harsher bunkering fuel or are not able to be equipped with appropriate scrubbing equipment.

Be the first to comment