Black_Kira/iStock via Getty Images

By Will Summerlin

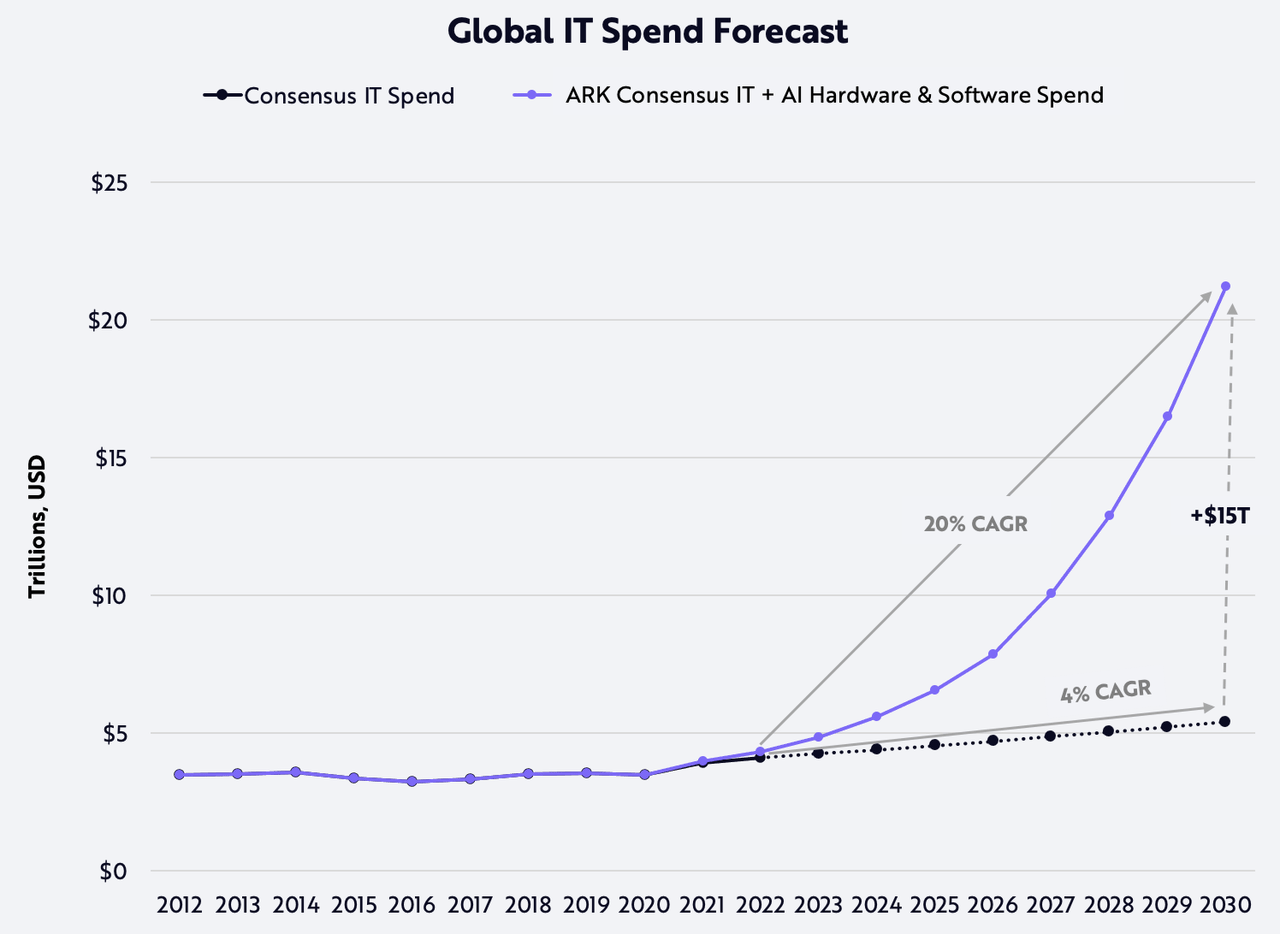

As companies generate profound productivity gains from artificial intelligence, we estimate that software spend per year could grow at a 42% compound annual rate from just under $1 trillion today to $14 trillion in 2030. According to our estimates for 2030, propelled by AI software, total IT spend could increase 20% at an annual rate and surpass $20 trillion, which is four times the ~$5 trillion consensus estimate, as shown below.

Source: ARK Investment Management LLC, 2022 based on data from company-derived statistics and Gartner gartner.com/en/newsroom/press-releases/2021-10-20-gartner-forecasts-worldwide-it-spending-to-exceed-4-trillion-in-2022

Forecasts are inherently unpredictable and cannot be relied upon.

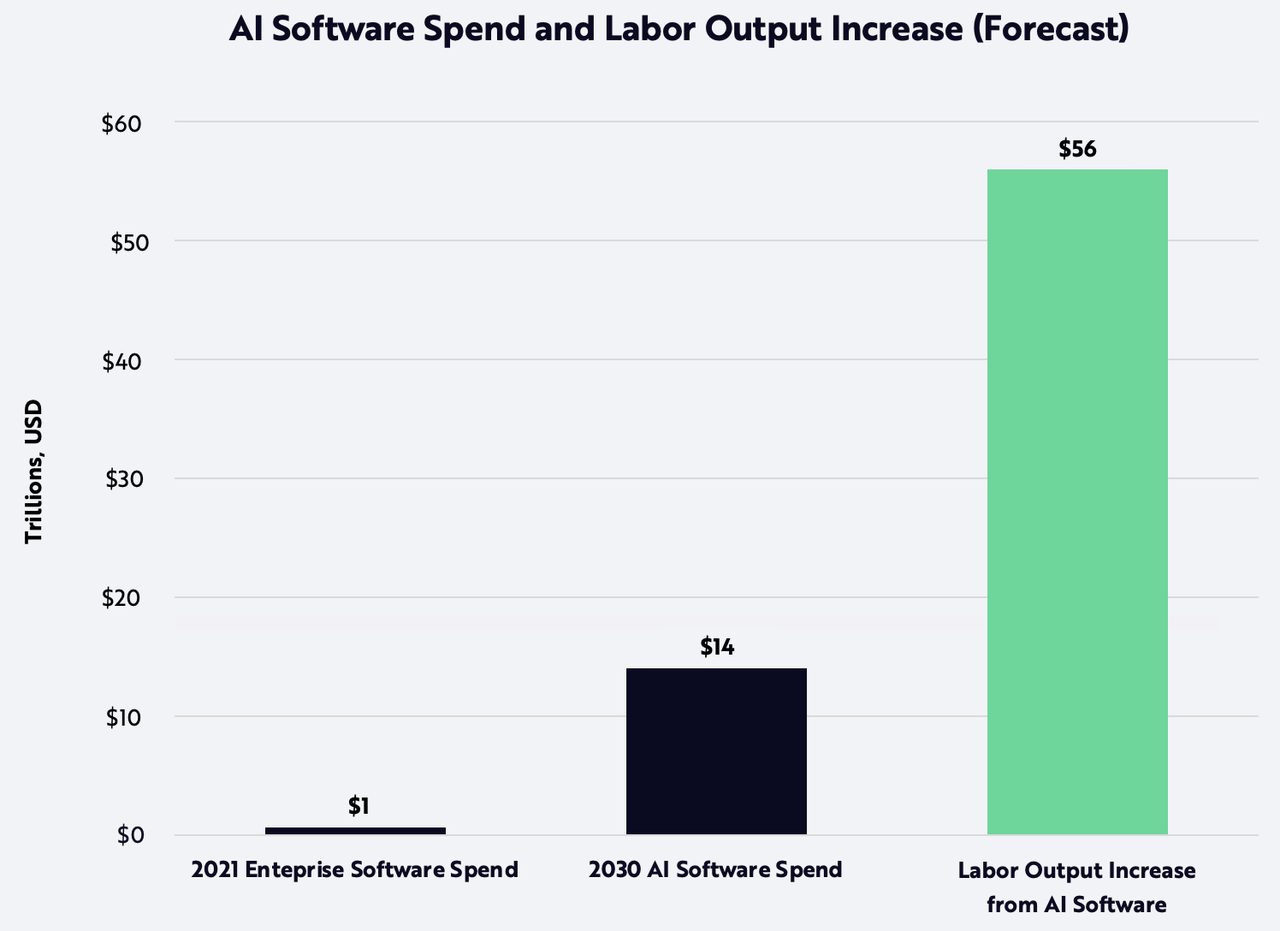

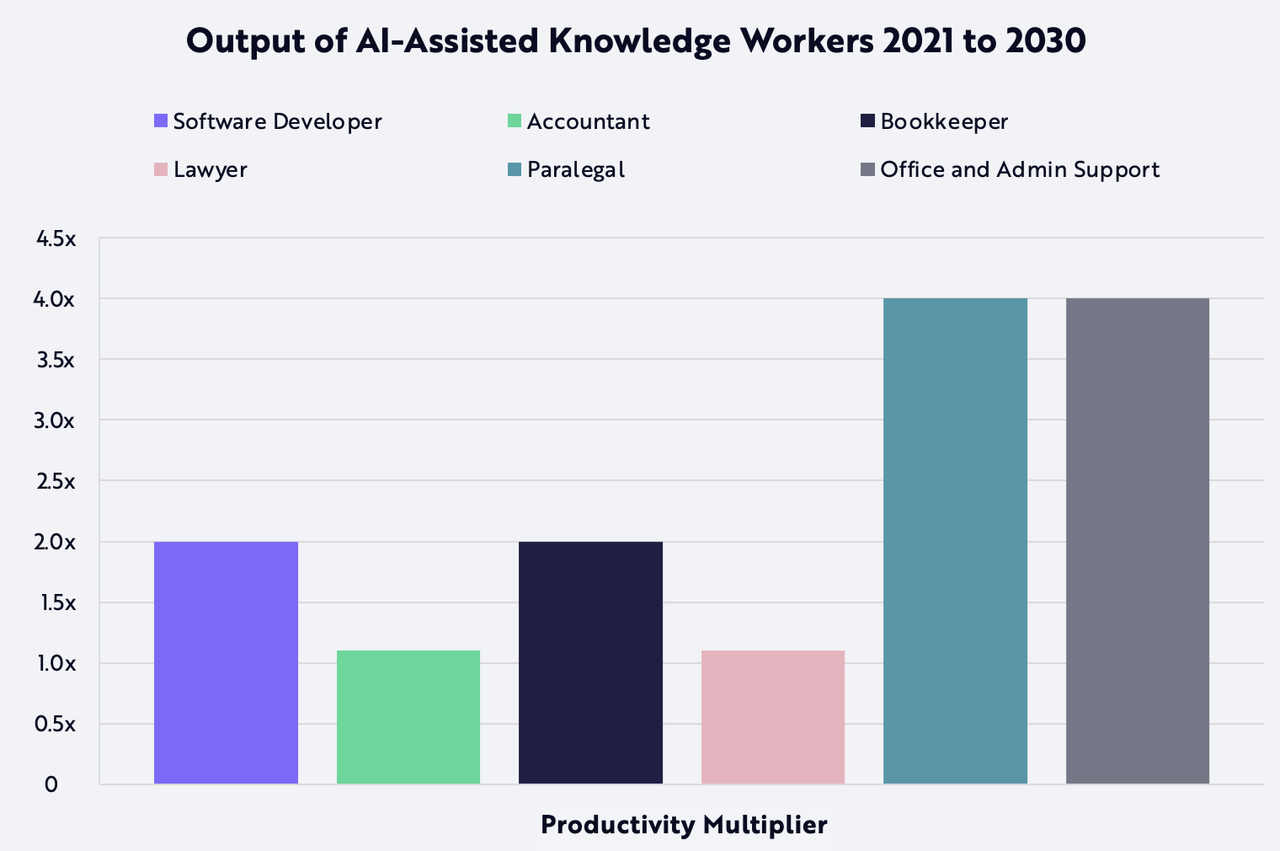

According to our research, during the next eight years AI software could boost the productivity of the average knowledge worker by nearly 140%, adding approximately $50,000 in value per worker, or $56 trillion globally, as shown below. We expect the value of a knowledge worker empowered with AI to increase ~15% at an annual rate, compared to the 2.7% consensus expectation for annualized wage growth through 2030.

Anticipating more than a doubling in productivity, companies are likely to purchase AI software at a 75% discount to the boost in worker productivity. In other words, for every $1 gain in productivity, they probably will be willing to dedicate $0.25 to software licensing.

Important to note, we do not believe AI will lower the overall demand for human labor. Instead, productivity and GDP gains should enhance the health of labor markets over time.

Source: ARK Investment Management LLC, 2022.

Forecasts are inherently unpredictable and cannot be relied upon.

Today, Open AI’s Codex coding tool uses neural networks to autocomplete tasks and can complete more than 30% of coding problems associated with simple tasks like creating website forms in minutes instead of hours. Given current rates of improvement, tools like Codex are likely to take over specific tasks in nearly every job category, from accounting to engineering.

Another recent example is DALL·E 2, which produces strikingly creative images from text prompts. The Twitter account @Dalle2Pics documents many examples of DALL·E-generated images, such as the one below, its response to the following prompt: “Early designs of the iPhone by Leonardo da Vinci.” We plan to publish additional research related to DALL·E 2 and its impact on productivity in the near future.

“Early designs of the iPhone by Leonardo da Vinci” by DALL·E 2

We have estimated the value of the productivity gains based on the “automatability”––or productivity multiplier––of various labor tasks relative to the wages associated with several job categories, discounted to account for lower international wages, detailed in the US Bureau of Labor Statistics, as shown below.

Source: ARK Investment Management LLC, 2022.

Forecasts are inherently unpredictable and cannot be relied upon.

| Job Category | Automatability of Labor Tasks | Output of Human + AI | Percentage of US Knowledge Workforce |

|---|---|---|---|

| Software Developer | 50% | 2x | 4.6% |

| Office and Admin Support | 75% | 4x | 35.0% |

| Bookkeeper | 50% | 2x | 4.6% |

| Accountants | 10% | 1.11x | 4.0% |

| Lawyer | 10% | 1.11x | 1.2% |

| Paralegal | 75% | 4x | 0.4% |

Source: ARK Investment Management LLC, 2022, based on data sourced from the US Bureau of Labor Statistics. “Occupational Employment and Wage Statistics.” www.bls.gov/oes/current/oes_stru.htm., and McKinsey Global Institute. “A Future That Works: Automation, Employment, and Productivity. mckinsey.com/~/media/mckinsey/featured%20insights/digital%20disruption/harnessing%20automation%20for%20a%20future%20that%20works/mgi-a-future-that-works_full-report.pdf

Forecasts are inherently unpredictable and cannot be relied upon.

McKinsey’s mid-point scenario suggests that AI could automate 15% of labor tasks by 2030. According to our research, however, the displacement could be much higher for two reasons: technological advancement and the adoption curve.

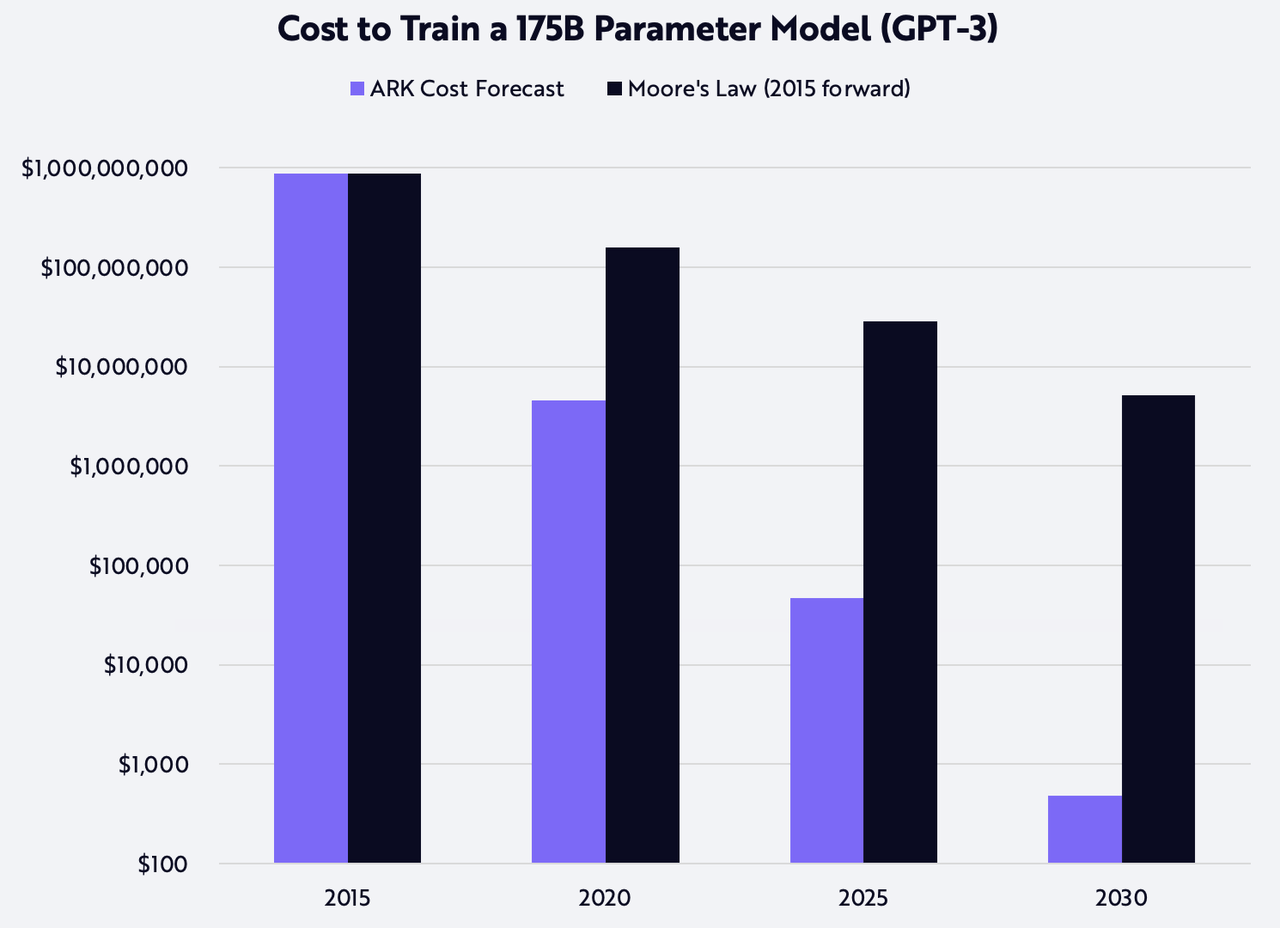

The current slope of AI advancement is steep because innovations in hardware, training methods, and neural network architecture are compounding to accelerate progress beyond Moore’s Law. OpenAI, DeepMind, and other organizations have demonstrated that AI models should be able to achieve near human-level proficiency in many narrow knowledge worker tasks. Our research also suggests that AI training costs are dropping at a rate of ~60% per year, potentially breaking down barriers to many exciting large model projects. In our view, higher allocations of human and financial capital to AI projects will continue to accelerate the rate of innovation, as shown below.

Source: ARK Investment Management LLC, 2022, based on data sourced from Hernandez, Danny, and Tom Brown. “AI and Efficiency.” OpenAI, May 2020, openai.com/blog/ai-and-efficiency/, NVIDIA., “Demystifying GPT-3.” lambdalabs.com/blog/demystifying-gpt-3/., and “Brain Facts and Figures.” faculty.washington.edu/chudler/facts.html.

Forecasts are inherently unpredictable and cannot be relied upon.

Accelerating the adoption of AI software offers a clear return on investment, particularly because of the acute shortage of specialized knowledge workers. An AI tool that doubles the productivity of engineers is a compelling value proposition for software companies struggling with recruitment. Failure to adopt this technology is likely to put many companies in harm’s way.

Technological advances and accelerated adoption call into question the consensus forecast for technology spending. According to Gartner, global IT spend as a percent of GDP was ~4-5% from 2012 to 2021. Consensus estimates for future IT spend relative to GDP are the same. In our view, the productivity potential associated with AI will upend that forecast.

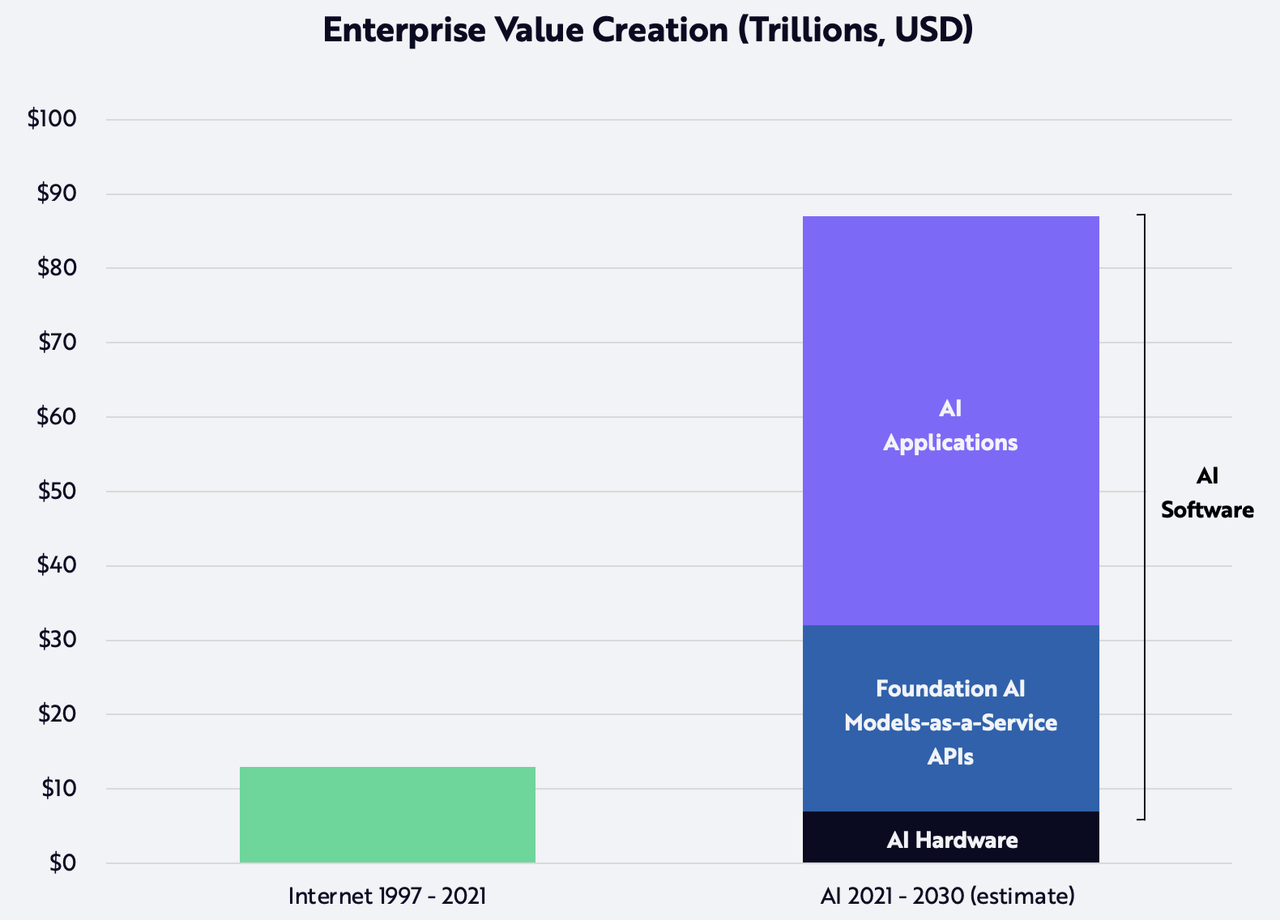

If AI software companies were to generate revenue at a $14 trillion annual rate and a cash flow yield of roughly 30%, AI software could create more than $80 trillion in enterprise value, more than six times the $13 trillion in enterprise value created by the Internet since 1997, as shown below.

Source: ARK Investment Management LLC, 2022.

Forecasts are inherently unpredictable and cannot be relied upon.

©2021-2026, ARK Investment Management LLC (“ARK” ® “ARK Invest”). All content is original and has been researched and produced by ARK unless otherwise stated. No part of ARK’s original content may be reproduced in any form, or referred to in any other publication, without the express written permission of ARK. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence.

Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice. All statements made regarding companies or securities or other financial information on this site or any sites relating to ARK are strictly beliefs and points of view held by ARK or the third party making such statement and are not endorsements by ARK of any company or security or recommendations by ARK to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that ARK’s objectives will be achieved. Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. For full disclosures, please go to our Terms & Conditions page.

The Adviser did not pay a fee to be considered for or granted the awards. The Adviser did not pay any fee to the grantor of the awards for the right to promote the Adviser’s receipt of the awards, nor was the Adviser required to be a member of an organization to be eligible for the awards. For full Award Disclosure, please go to our Terms & Conditions page. Past performance is not indicative of future performance.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment