naphtalina/iStock via Getty Images

Thesis

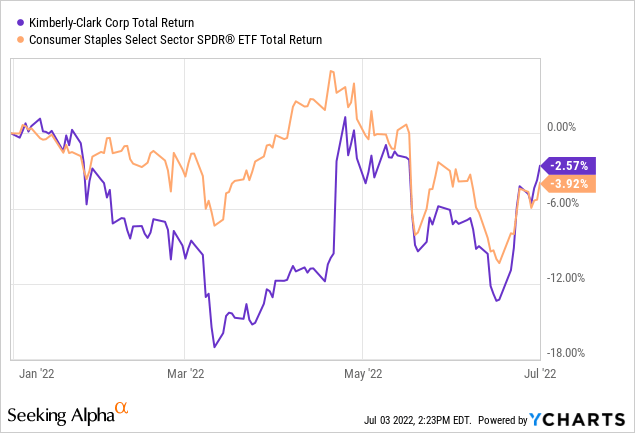

In an unforgiving stock market, that has just marked its worst first six months in 40+ years, many investors seek to find shelter in consumer defensive stocks. Kimberly-Clark (NYSE:KMB) is one of the largest in the sector, with a $45B market cap and almost $20B in sales. The 3.4% dividend yield also grabs investors’ attention in today’s inflationary environment.

While consumer staples stocks, including KMB, have significantly outperformed the broader market over the last six months, in this analysis a more long-term oriented examination of Kimberly-Clark is attempted, outlining some of the company’s strong and weak financial areas. A brief examination of the stock’s current valuation is also available.

Brief Business Overview

Kimberly-Clark is a global manufacturer and marketer of personal care, tissue, and other hygiene-related products. The company’s product range includes child and feminine care products, as well as general use personal care solutions. Products are distributed to supermarkets, drugstores, department stores, other retailers, and online through e-commerce. As of December 31, 2021, Kimberly-Clark had 45,000 employees worldwide.

In 2021, KMB also concluded its global restructuring program that was initiated in 2018, aiming to implement cost-saving changes to the supply chain and overhead organization. Savings from this initiative in 2021 were $140M ($560M cumulative savings since 2018). The program did positively affect profitability margins up until 2022, where inflation headwinds became more evident. As the demand for personal care products is relatively stable over time, cost management and operational efficiency will be the key drivers for the business over the next few years.

Financial Strengths And Struggles

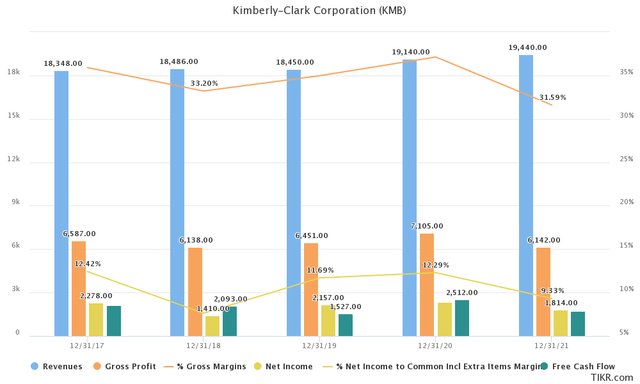

Stagnation has been the story for sales over the past 5 years, with KMB recording a 5-year CAGR of 4.85% versus the consumer staples sector median of 11.26%. Profitability on the other hand displays strong potential, with most metrics surpassing sector benchmarks. A 30.5% gross and 8.9% net margin are deemed sufficient in a highly-competitive industry, that faces inflationary and supply chain headwinds at the moment.

Focusing on 2021, revenue increased 2% to reach $19.44B, with organic sales decreasing, however, by 1%. The firm’s largest geographic segment, North American, proved to be the more problematic, with sales decreasing 5%, compared to increases of 5% in revenue outside North America.

Despite respectable margin capacity, inflationary pressures have taken a toll on KMB’s profitability. Despite the inelastic nature of the company’s products, price increases haven’t been able to offset input cost inflation, therefore hurting profit margins. In 2021, KMB’s gross margin decreased from 37.10% to 31.59%, with net margins followed a similar trajectory, down from 12.29% to 9.33%.

This significant retreat has also affected free cash flow generation. FCF decreased from $2.5B to $1.7B, while on a 5-year basis, a lot of fluctuations and inconsistency are observed in the CF aspect of the business. For a company that relies heavily on its ability to increase dividends and buybacks over time to attract more conservative, long-term investors, inability to produce ample amounts of cash flow can damage the attractiveness of the stock.

During the most recent earnings call, management reiterated that price increases should mitigate inflationary cost pressures over time, as supply chain disruptions ease. That said, they foresee an uptick of $375M in inflation-related costs for the 2022 fiscal year. They also emphasized the necessity of deploying additional cost-saving measures to that end.

As the demand for personal care products is relatively stable over time, cost management and operational efficiency will be the key drivers over the next few years. On a more macro level, child and baby care products’ demand is highly correlated with the statistical trends in childbirths. In recent years, birth rate declines in key markets like China and the U.S. have pressured sales volume growth downwards. It is becoming clear that Kimberly-Clark is going to have to expand its market share in order to see sustainable revenue growth return. In a market that is highly competitive on a global scale, this attempt might prove hurtful to the company’s profitability margins.

Dividend Investing

Given its dividend aristocrat status and the mature nature of Kimberly-Clark’s business, dividend payments have been a significant part of investors’ return equation for many years. KMB offers a generous 3.39% FWD yield, compared to the consumer staples’ average yield of 2.30%. Income distributions can provide some comfort during market downturns, salvaging total returns for investors. For investors closer to retirement, they can also provide a steady income source through their portfolio.

Despite a relatively high payout ratio, KMB’s dividend is considered safe, receiving a B+ score for safety by Seeking Alpha. Consistency and dividend growth also receive A+ and A scores, respectively. Over the past 10, 5, and 3-year periods, dividend payments have grown at 5.24%, 4.00%, and 4.25%. Analyst estimates are looking for dividend growth between 3% and 4% for the next few years. Inconsistencies and recent declines in Cash flow generation (explored in a previous segment), however, raise the level of concern regarding long-term dividend sustainability.

Insisting On Buybacks

Major points for Kimberly-Clark are scored in the area of share repurchases, especially in the eyes of long-term investors. The company has been steadily reducing its share count over the past two decades. Since 2012 basic average shares outstanding have decreased from 393M to 337M. In 2021, the company repurchased 3.0 million shares. Again, however, we should point out that declining FCF capacity could hurt the company’s ability to fund future share repurchases, just like it could affect dividend payouts.

Valuation

While given its below sector average growth records, someone could expect the company to be less expensively valued compared to its peers, in fact, the opposite is true. KMB is trading at 23.9x P/E and 2.3x P/S, compared to sector average respective multiples of 18.6x and 1.2x. Even though the sizable dividend yield can perhaps justify some difference, still given the current state of the market and the downward pressure on valuations, KMB should be considered expensive. EV/EBITDA and EV/Sales multiples also point to the same conclusion. Kimberly-Clark also trades at a premium compared to its 5-year average P/E multiple of around 20.0x.

Final Thoughts

After all things are considered, at current price levels and given some financial struggles KMB is facing, in my view, the stock has more downside than upside potential. Cash flow generation is facing pressures and the personal care market seems mature with little room for top-line growth. Unless fundamental changes are made, inflationary and supply chain headwinds fade or growth improves, I would be hesitant to assign a buy rating to the stock for the time being.

Be the first to comment