Luke Sharrett/Getty Images News

British American Tobacco (NYSE:BTI) offers shareholders a safe 6.7% dividend yield, which is becoming more valuable now that we are slouching towards a potentially severe global recession. British American Tobacco is growing alternative tobacco product categories aggressively, and the firm targets 138% revenue growth in the non-combustible category between FY 2021 and FY 2025. Growth at the tobacco firm will continue to be driven by alternative tobacco categories, especially vaping products, in the U.S.!

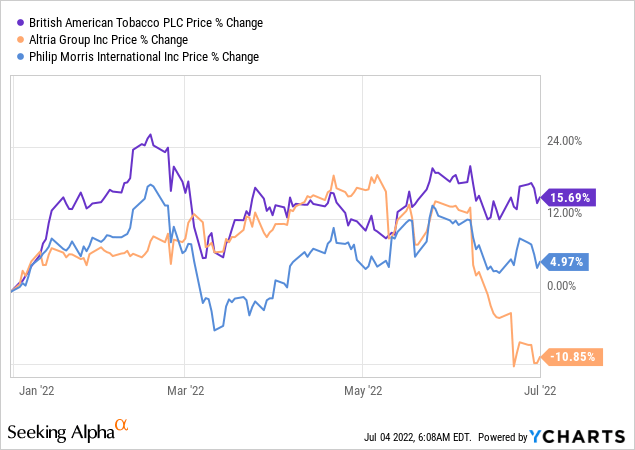

Shares of British American Tobacco gained 15.7% year to date in 2022 while the market had its worst first half in more than half a century. Big rival tobacco brands like Philip Morris International (PM) and Altria Group (MO) did not nearly as well as British American Tobacco, which may in part be related to expectations about a U.S. recession as well as a recent FDA ruling on e-cigarettes.

British American Tobacco: Doubling Down On Alternative Tobacco Products

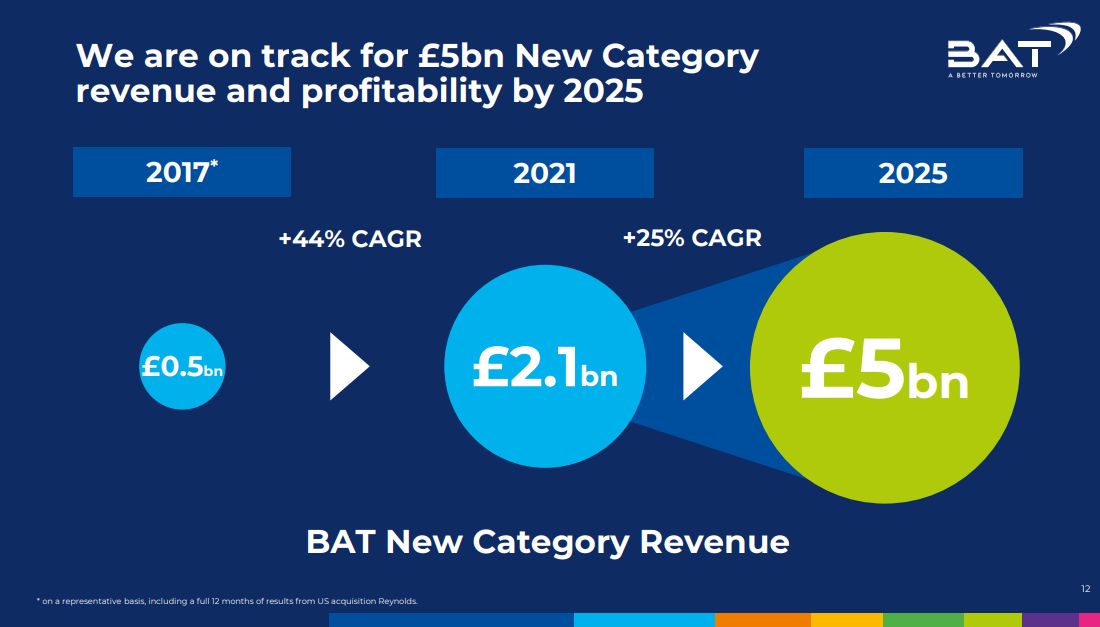

Three distinct brands make up British American Tobacco’s non-combustible category: Vuse, which produces and markets vaping products to chiefly younger consumers, glo, which markets heated tobacco products, and Velo, which is a brand that consolidates British American Tobacco’s oral nicotine products. These brands have seen strong customer adoption and volume growth in recent years as especially younger smokers migrated to innovations such as vaping products. British American Tobacco is doubling down on the successes it achieved in the alternative product category, especially in vaping, and plans to grow its total non-combustible revenues from £2.1B in FY 2021 to £5.0B in FY 2025. The FY 2025 revenue goal implies total expected top line growth of 138% over a four-year period.

British American Tobacco

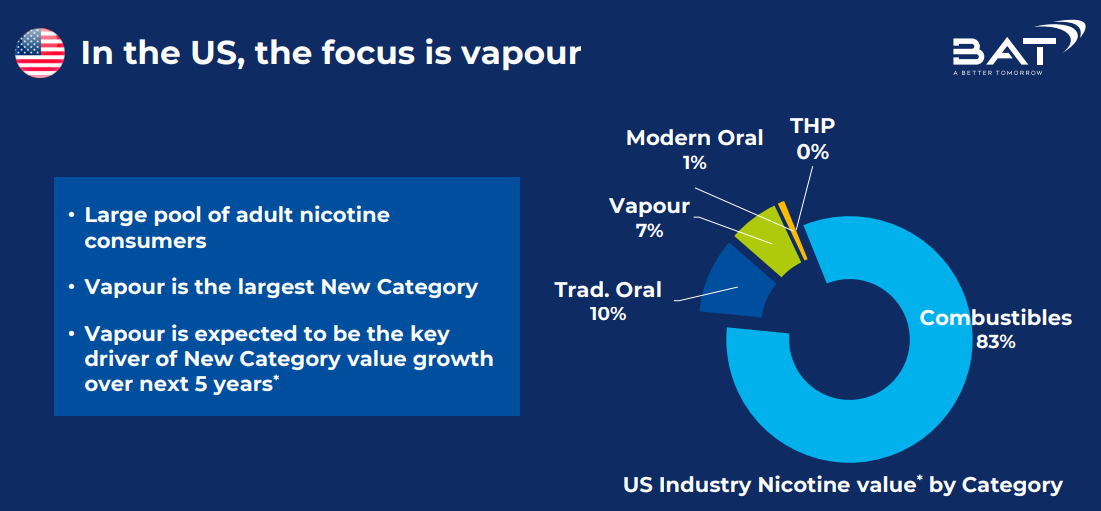

The long term outlook for vapor products is very attractive, especially in the U.S. which is seeing rapid adoption of vape products. The American market represents the biggest growth opportunity for British American Tobacco, in part because vapor products have a low market penetration rate of only 7%.

British American Tobacco

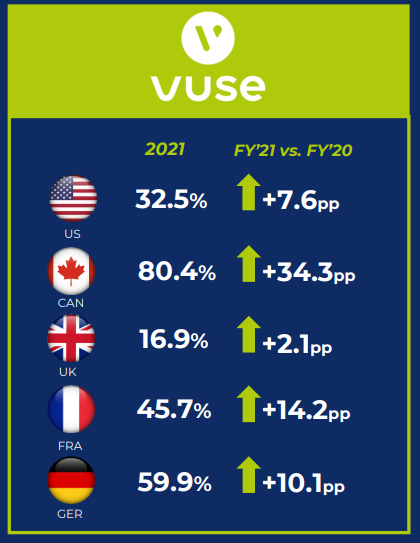

The low penetration rate in the U.S. creates an opportunity for British American Tobacco’s Vuse brand to achieve volume growth and gain market share. Vuse is already seeing strong demand for its products in the U.S. as well as in other markets around the world.

British American Tobacco

Recent JUUL Lab’s E-Cigarette Ban

The Food And Drug Administration, which is tasked with regulating the U.S. tobacco market, last week banned Juul Labs from selling its products in the U.S. According to an FDA release from June 23, 2022, Juul Labs has been ordered to stop selling and distributing the Juul device and four types of JUULpods. British American Tobacco’s Vuse brand competes with Juul Labs’ vape products and has achieved significant success in recent years by closing in on its rival regarding market share. While Juul Labs is appealing the decision, a permanent ban, as unlikely as I believe it is, would severely cut into British American Tobacco’s revenue growth prospects and could lead to a serious revaluation to the down-side.

BTI: Strong Dividend Value, Cheap P-E

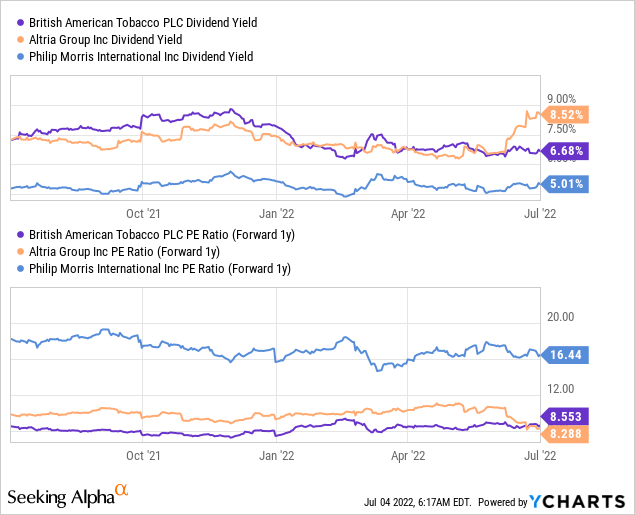

Tobacco companies may be underrated regarding their dividend yields. British American Tobacco currently serves up a 6.7% dividend yield while trading only at a P-E ratio of 8.6 X. Philip Morris is possibly the most unattractive investment in the tobacco industry right now since it has the lowest yield (5.0%) and the highest P-E ratio (16.4 X).

Risks With British American Tobacco

The tobacco industry does not have a reputation for being a regulation-light industry. Tobacco regulations and increasing restrictions on nicotine advertisements represent top line challenges for British American Tobacco as well as the entire tobacco industry. There is also a considerable risk of costly litigation in the industry, and long term trends indicate a consistent decline in the share of smokers. While British American Tobacco’s non-combustible products are seeing increasing customer adoption, the general societal trend towards not smoking is a long term challenge for British American Tobacco and its stock. A ban of vaping products would likely be a seriously negative development for BTI.

Final Thoughts

With a recession all but certain to impact investment values and growth prospects in the near future, British American Tobacco offers investors a solid 6.7% dividend that could grow if the tobacco company executes well against its medium term growth and revenue targets in the non-combustible product category. I believe that British American Tobacco has a very attractive risk profile, especially with markets getting more unstable, and both the high dividend yield and the low P-E ratio make BTI a buy!

Be the first to comment