Marina_Skoropadskaya/iStock via Getty Images

Co-produced with Treading Softly

One frequent question that flows into my inbox as an author on investing and retirement is along the line of “I have $X to invest, where would you put it today?” or “I am just starting and have $X saved, where do I begin?”

I know I am likely getting these types of questions, because High Dividend Opportunities is designed to help retirees, income investors, and anyone looking to make income from the market, to get their portfolios up and running to start pumping out dividends. As such, I am in a unique situation to receive this question often as many new members get their feet on the starting blocks and look forward to beginning their income investing journey in earnest.

So, if I was just starting out, where would I put $100,000 to work? I’m so glad you asked! Let’s talk about it.

Got Debt? High-Interest Debt Specifically?

Before putting that money to work in the market, the biggest question to tackle is the other end of your equation, debt. High-interest debt is a killer to savings and income. Think of it this way, if your investment is yielding 7% but your credit card carries 18% interest (many store-brand credit cards have interest rates over 20%!) then you’re fighting a losing battle.

So before getting excited about those dividends rolling in and the potential benefit of compounding your income over the years, let’s defeat an equally powerful enemy – compounding interest on your debt.

Refinance revolving debt – like credit cards or lines of credit – into fixed-rate debt like a personal loan or debt consolidation loan. Or even better, pay it off entirely. If you can’t wipe it out, refinancing can reduce the rate exponentially making it easier to pay down and service.

As rates are rising, it means that mortgages, loans, and other debt is getting more expensive, and less likely to benefit from refinancing. If you have a low-rate mortgage, paying it off early may not be the best mathematical choice but the mental benefit of being debt-free is worth it for many people.

Have A Reserve Account or Top it Off

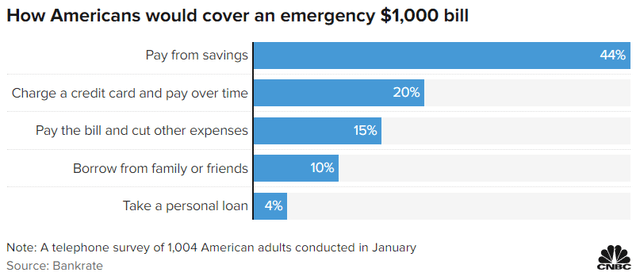

A shocking number of us cannot afford an unexpected expense. According to a telephone survey conducted in 2022, 56% of Americans couldn’t cover an unexpected $1000 expense.

This means one thing, so many of us don’t have the proper emergency savings fund that we should. Many of my frequent readers will remember I have repeatedly stated that in this market and inflationary environment that “your cash is trash.” I stand by that for an investment portfolio. I have also repeatedly said that it does not apply to your emergency liquid savings.

You need it. If you don’t have it, take some of your $100,000 and set it aside in that account. Inflation doesn’t matter when you cannot afford to fix your AC or your car. Many suggest a year’s worth of expenses be set aside, or 6 months’ worth. I would aim to start with $1,000 if you have nothing and grow it from there.

Put It To Work Earning Income

Once you’ve covered those other two massively important areas to consider, now it is time to put these dollars to work. I would like to believe many of my readers are able to say they have a reserve account and debt covered, but if not, don’t skip those steps on your trail to developing long-term personal wealth.

When it comes to the United States Stock Market, we have been blessed to have access to the single largest generator of wealth in known history. Consistently and repeatedly the stock market has generated wealth in the United States economy for decades into centuries.

I like to imagine my financial health as the foundation for my entire lifestyle. To touch on a mental picture, my financial health is the foundation of my home while my lifestyle is the frame and boards. If your foundation is cracked, crumbling, or broken, then your home may survive a brief time without it before it all comes crashing down.

This is why those who are swimming in debt and approaching the edge of bankruptcy can keep up appearances for a brief period of time before the facade crashes around them.

So what would I use in my foundation?

Fixed Income and Lots of It

I would first invest heavily in fixed-income securities and funds. 40% of your portfolio at least, higher for those who are more risk-averse. Why? Fixed income comes with multiple benefits:

- Priority in dividends or coupon payments vs. common shares.

- More price stability due to fixed maturities and PAR values working as anchors.

- Lower price volatility in normal conditions.

When it comes to fixed income, I personally look for “set and forget” type of investments. I know many investors or services like to trade in and out of preferreds or baby bonds and make good money doing so, but that’s not my flair or focus. I look to buy and hold until maturity or until my shares are called away. I buy fixed income to know what my income is going to be for my entire holding period. It makes budgeting easier and my expectations are easier to forecast.

A Focus on Value and Middle Market

Next, I would pass over lower-yielding mega-cap investments like Coca-Cola (KO) or Kellogg (K) and focus on the middle market and value investments. These investments not only generate 40% of the U.S. GDP (gross domestic product) annually but they also are often undervalued compared to the rest of the market. I am looking to make my dollars work hard for me, and get the most income possible from my portfolio. This means I am buying into premier and blue chip-style BDCs (business development companies) such as Ares Capital (ARCC), and individual companies generating high levels of cash flow now without the burden of large sums of debt.

Don’t Skip over Real Estate or Commodities

Lastly, I would look to inflation-resistant and recession-resistant holdings. As such, my eyes turn to REITs for their real estate holdings and long-term rental agreements or agency MBS holdings. Both can be leaned upon to benefit from steady income and actually see it grow with inflation for equity REITs. My personal portfolio has seen multiple increases from mortgage REITs and property REITs alike.

We also cannot forget the all-important commodity or energy-focused investments. MLPs (master limited partnerships), often operate like toll bridges on the path from oil or other commodities being extracted and reaching your front door. I have heavily invested in Natural Gas focused investments like Enterprise Products Partners (EPD) and Antero Midstream (AM) which both have large exposure to moving natural gas.

Dreamstime

Conclusion

Where would I put $100,000 to work? I’m so glad you asked.

To put it simply:

- Clear your high-cost debt

- Ensure you have an emergency fund

- Get it working in the market.

I personally like to invest in opportunities yielding above 7%. In the market, as we have recently, the opportunities are bountiful to exceed my goal and still be buying quality investments.

Your retirement will benefit from having strong income-producing powerhouses stored in the foundation of your lifestyle. They will provide income, stability, and a level of comfort you will enjoy for decades to come.

On an aside, I also often get asked if this is a good time to be buying in the market, and my answer is simple. If you can find a yield you’re happy with, then yes.

Be the first to comment