Ja’Crispy

Thesis

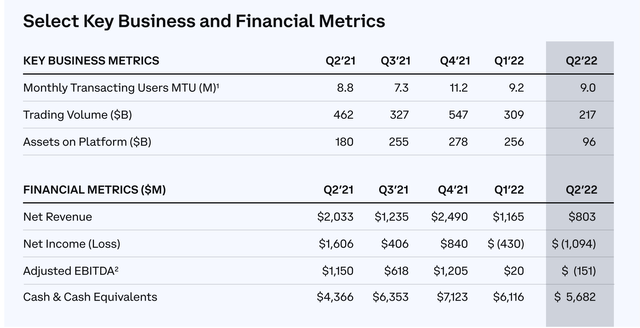

On August 9th after market hours, Coinbase (NASDAQ:COIN) reported earnings for the second quarter 2022 and greatly disappointed against analyst consensus estimates, both with regards to revenues and earnings. Crashing crypto prices caused Coinbase’s revenues to plummet by more than 60% as compared to the same quarter in 2021 and net-income dropped by almost $3 billion to a loss of $1.6 billion for the quarter. Unsurprisingly, following the announcement, Coinbase stock crashed by as much as 10% (reference extended trading hours).

Reflecting on the very challenging macro environment, especially for Crypto-related assets, I believe investors should avoid investing in Coinbase.

Coinbase June Quarter

During the period from April to end of June, Coinbase generated total revenues of $802 million, versus $832 million expected by analyst consensus. The company’s net income crashed to a loss of about $1.1 billion, compared to a gain of $1.6 billion in the June quarter 2021. Coinbase’s loss was driven by an operating loss of $647 million and a (hopefully) one-time impairment charge of $446 million. Management commented as follows:

Q2 was a tough quarter, with trading volume and transaction revenue each down by 30% and 35% sequentially, respectively. Both metrics were influenced by a shift in customer and market activity, driven by macroeconomic and crypto credit factors alike

Coinbase quarterly results suffered badly as the platform’s trading volume decreased by about 30%, paired with a drop of about 50%-80% for popular crypto assets (e.g., Bitcoin (BTC-USD) is down 59%). Coinbase’s total customers were 9 million, up from 8.8 million last year, but down from 9.2 million in the last quarter.

How Coinbase Thinks About Q2 2022

Reflecting on deteriorating financials, Coinbase blamed the ‘fast and furious’ crypto downturn (crypto winter) and said that the company will focus on building great and innovative products for customers. CEO Brian Armstrong said on a conference call with analysts:

Of course, we don’t control the macroeconomic factors or downturn. We don’t really even control the crypto market more broadly, right? So what do we control?

Well, obviously we can focus on building great products for our customers. We can focus on staying on the forefront of crypto technology to make sure that we’re creating compelling use cases and making those available to our customers. We can focus on our expense management in down markets, and, frankly, we can ensure that we just don’t get distracted or disillusioned by short-term thinking.

After bankruptcy filings from leading crypto companies such as Voyager Digital (OTCPK:VYGVQ), COIN investors might appreciate that Coinbase’s balance sheet appears healthy. At the end of the June quarter, Coinbase recorded about $6.2 billion in ‘total US-Dollar resources’ and an additional $428 million of crypto assets. Alesia Haas, the company’s CFO, said that Coinbase plans to use these funds to invest during the downturn.

The company provided an adjusted outlook for the full year: Coinbase expects between 7 and 9 million monthly transacting users and average transaction revenue per user in the low $20 range. Only three months ago, management expected monthly transactions to be between 5 and 15 million. The company’s earnings outlook remains robust, although skewed towards a net-loss:

… we did set a guardrail that if we went into a winter that we would operate to a $500 million loss.

Valuation Remains Difficult

Personally, I am neutral on Coinbase. And one of the key reasons is that it is very difficult, if not impossible, to value the company. First, investors should consider that there are arguably no publicly listed comparable firms that could indicate a relative valuation. Secondly, Coinbase’s valuation is deeply correlated to the price of crypto, which is highly volatile and no ‘intrinsic worth’ (not saying worthless). Thirdly, multiples are not helpful either. True, COIN is trading at a one-year forward valuation of x4 Price to Book and x5 Price to Sale, but without a comparison against the company’s fundamentals, which are difficult to analyze, these numbers don’t tell an investor much. Finally, investors cannot structure a discounted earnings analysis, because there is little evidence to predict the company’s long-term revenue and margin potential. And Q2 has highlighted Coinbase’s earnings volatility.

Implications For Investors

Coinbase shares dropped by as much as 8% after the earnings announcement (reference extended trading hours August 9th) and I believe the market’s first reaction was correct. The crypto industry is clearly in a down-cycle. And Coinbase’s June quarter results highlighted that the company doesn’t perform in a down-cycle. While Coinbase CEO Brian Armstrong sees a ‘disproportionate share in the next up cycle’, and I personally do not doubt the claim, there is no visibility about when the next ‘up-cycle’ begins. And I personally do not see this upcycle with the next 6-12 months. Accordingly, as long as the macro environment or crypto assets remains challenging, in my opinion, there is little justification to own COIN stock. A Hold recommendation is the best I can do.

Be the first to comment