SHansche

In recent quarters, Israel-based ZIM Integrated Shipping Services (NYSE:ZIM) or “ZIM” has been among the most actively discussed container shipping stocks on Seeking Alpha. So far in September, seven articles have been published on the platform with the overwhelming majority of contributors rating the stock a “Buy” or even “Strong Buy“.

Drop In Spot Rates Accelerating

Like all liner companies, ZIM has been enjoying record-high earnings and cash flows for quite some time now but the container shipping party is about to end with investors facing a bad hangover.

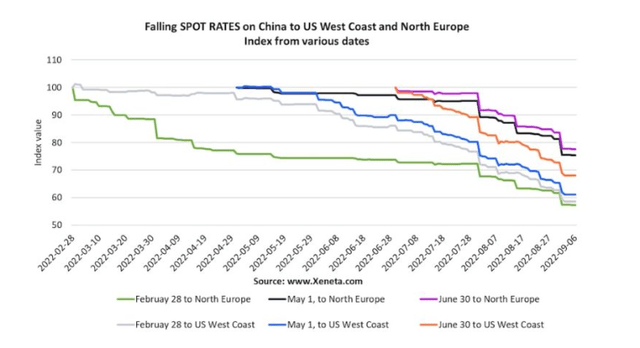

Spot rates have been dropping like a rock in recent weeks and are widely expected to decrease further going into next year with some industry analysts now expecting a hard landing with rates temporarily dropping below the longer-term normal.

Splash247.com

Tightening monetary policy, a shift in consumer spending, elevated U.S. inventories and easing of port congestion are some of the main factors behind the ongoing drop.

Given the high likelihood of a major recession in both Europe and North America, I would consider the above-discussed scenario as reasonable.

While the near-term impact on liner companies will be limited due to high levels of contracted volumes, 2023 is shaping up to be a very different story.

More Dividends To Come But Limited Visibility Going Into 2023

With ZIM being the only liner listed on a major U.S. stock exchange, the company’s stock has attracted outsized retail investor interest mostly due to its eye-catching payout levels.

Since listing on the Big Board in early 2021, ZIM has distributed almost $30 per share in dividends with another $10-15 per share being anticipated as a result of the company’s projected second half earnings.

Unfortunately, there’s not much visibility going into next year as customers are widely expected to successfully renegotiate rates on previously agreed long-term contracts while the spot market is likely to plummet even further, particularly with a host of newbuildings scheduled to enter the market starting in the second half of 2023.

Given the severe plunge in spot rates and the level of uncertainty in the market, the recent sell-off in liner companies’ shares can hardly be considered a surprise.

Even with the industry still being expected to generate tens of billions of free cash flow for the remainder of the year, the sheer possibility of liners starting to lose money in the not-too-distant future is alienating investors.

Decent Financial Condition

My expectation is for ZIM’s cash, bank deposits and investment instruments to increase well beyond the $3.9 billion level reached at the end of Q2.

Quite frankly, I wouldn’t be surprised to see the company finish the year with at least $45 in cash per common share and no real debt other than the companies’ lease obligations which amounted to approximately $4.3 billion at the end of the second quarter.

Please note that the company has agreed to charter in 46 newbuildings until the end of 2024 but with 62 vessels coming up for renewal over the same time frame, ZIM has plenty of optionality to adjust its fleet size to market requirements.

Bottom Line

While the company appears like a screaming buy from a fundamental perspective, I expect shares to remain under pressure mostly as a result of persistent, negative news flow.

Even a material stock buyback announcement isn’t likely to change the direction of the shares for more than a couple of sessions as I would expect investors to remain focused on the company’s diminishing dividend capacity going into 2023.

Under a worst-case scenario, I wouldn’t rule out ZIM starting to lose money in the second half of next year and beyond.

As the hefty payout has attracted a large number of retail investors to the shares, I would expect news of the company’s dividend being reduced to a tiny fraction of today’s levels or even cancelled altogether to result in additional selling pressure.

When I started work on this article in late August with ZIM’s shares still trading above $40, I wouldn’t have hesitated to assign a “Sell” or even “Strong Sell” rating to the stock but at $27, the call is obviously getting much tougher, particularly when considering the company’s outsized cash position and another $10+ dollars in dividends per share anticipated over the next few quarters.

Anyway, with plenty of negative catalysts still ahead, I firmly expect liner companies’ shares to underperform the market regardless of vastly improved balance sheets and plenty of liquidity to weather the gathering storm.

With dividends likely to evaporate next year and the industry potentially facing losses going into 2024, I still expect ZIM’s shares to fall even further.

Admittedly, this is an aggressive call given the company’s outstanding financial condition, but I wouldn’t be surprised to see the shares trading below $20 going into 2023 should rates continue to drop at the current pace.

Be the first to comment